Ansoff Matrix Presentation 733g62

This document was ed by and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this report form. Report 3b7i

Overview 3e4r5l

& View Ansoff Matrix Presentation as PDF for free.

More details w3441

- Words: 2,186

- Pages: 25

Strategy – Ansoff’s Matrix

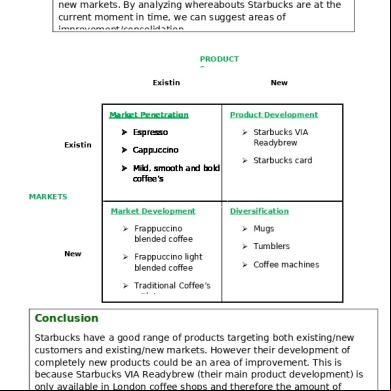

Ansoff’s Matrix • This matrix was developed by Igor Ansoff • It is a framework for identifying corporate growth opportunities • Two dimensions determine the scope of options,namely products and markets • Four generic growth strategies are identified: – Market penetration: more of the same to the same customers – Market development: new customers for existing products – Product development: new products for existing customers – Diversification: new products and new customers Strategy – Ansoff’s Matrix

Ansoff’s Matrix Existing product

New product

Existing market

Market penetration Increase sales to the existing market Penetrate more deeply into the existing market

Product development New product developed for existing markets

New market

Market development Existing products sold to new markets

Diversification New products sold in new markets

Strategy – Ansoff’s Matrix

Ansoff’s matrix and risk • The greater the degree of newness the greater the risk • Hence: • Market penetration - little risk involved • Market development - moderate risk • Product development - moderate risk • Diversification - high risk because both product and market are new and unknown Strategy – Ansoff’s Matrix

Example 1 - Growth of Tesco • Market penetration – Increase in its share of the grocery business at the expense of Sainsbury’s and Asda

• Market development – Movement into the convenience store market – Expansion abroad

• Product development – Expansion into petrol sales – Development of financial services

• Diversification – Today Tesco is so all embracing that diversification would have to involve something entirely outside Tesco’s current range of activities and sold in foreign markets or to business customers

Strategy – Ansoff’s Matrix

Example 2: Growth of Scottish Banks • In recent years both Royal Bank of Scotland and Bank of Scotland have grown rapidly through: • Market penetration – Increased sales of banking financial services in Scotland

• Market development – Growing presence south of the border following acquisitions. – Bank of Scotland and the Halifax Bank merge to create HBOS – RBS took over Williams and Glyn in 1970 and also runs Tesco’s banking operation

• Product development – Growing involvement in insurance – RBS subsidiary Direct line revolutionised motor insurance

• Diversification – Selling insurance in England might be seen as new markets and new products Strategy – Ansoff’s Matrix

Market Penetration • Aim of the strategy: – To maintain or increase share of the current market with current products – To secure dominance of a growth market or restructure a mature market by driving out competition

• Market penetration involves an increase in sales of existing products to existing markets - selling more of the same to the same people • But it is difficult to achieve growth through increased market penetration if the market is saturated • In a stagnating market increase in sales is only possible by grabbing market share from rivals. Hence competition will be intense in such markets • Risks are low but the prospects of success are low unless there is strong growth in the market Strategy – Ansoff’s Matrix

Market penetration strategies • How is increased market penetration achieved? – Increase usage by existing customers – Attract customers away from rivals – Gain market. share at the expense of rivals – Encourage increase in frequency of use – Devise and encourage new applications – Encourage non buyers to buy

• Market penetration requires realignment of the marketing mix Strategy – Ansoff’s Matrix

Use market penetration when... • • • •

The market is not saturated There is growth in the market Competitors’ share of the market is falling Increased volumes lead to economies of scale • There is scope for selling more to existing customers

Strategy – Ansoff’s Matrix

Market development • This involves – Selling the same product to different people – Entering new markets or segments with existing products – Gaining new customers,new segments,new markets – Entering overseas markets

• Market development will require changes to marketing strategy e.g. new distribution channels, different pricing policy, now promotional strategy to attract different types of customers Strategy – Ansoff’s Matrix

Market development • Market development is used when… – Untapped markets are beckoning – The firm has excess capacity – There are attractive channels to access new market

• Market development involves moderate risk - there is a lack of familiarity with customers but at least the product is familiar

Strategy – Ansoff’s Matrix

Product development • This is the development of new products for the existing market • New products come in the form of: – New products to replace current products – New innovative products – Product improvements – Product line extensions – New products to complement existing products – Products at a different quality level to existing products Strategy – Ansoff’s Matrix

Product development • Product development is used when: – The Firm has strong R&D capabilities – The market is growing – There is rapid change – The firm can build on existing brands – Competitors have better products

• But new product development is costly and there are moderate risks associated with this strategy Strategy – Ansoff’s Matrix

Diversification • Diversification in the Ansoff Matrix means: – New products sold to new markets – New products for new customers

• It is a risky strategy because it involves two unknowns • Therefore new products and new markets should be selected which offer the prospect for growth which the exiting product market mix does not • One problem is to identify real life examples of firms developing new products for genuinely new groups of customers • Diversification can be sub-divided into related and unrelated

Strategy – Ansoff’s Matrix

Related diversification • This is development beyond present product market but still within the broad confines of the industry • Markets and products share some commonality with existing products • Therefore it builds on assets or activities which the firm has developed • Related diversification can also be seen as synergistic diversification since it involves harnessing exiting product market knowledge • This closeness can reduce the risks associated with diversification • Example: banks developing insurance products Strategy – Ansoff’s Matrix

Example: Product mix at PC World • PC World (part of the Dixons/ Curry’s group) has grown through market penetration (new stores), product development (new products) and related diversification • In the early days, the stock consisted of PCs and accessories • Then space was devoted to digital photographic products. • After that, iPods and similar products became major an important part of the product range • Now with flat screen and high definition TV they are expanding into this market • All these products are linked in that they involve digital technology. These developments could be classed as product development or, especially if they bring new people into the store, it could be seen as related diversification Strategy – Ansoff’s Matrix

Related diversification • Horizontal diversification: when new products are introduced to current markets • Vertical diversification: when an organisation decides to move into its suppliers or customer’s business to secure supply or to firm up the use of products in end products • Concentric diversification: when new products closely related to current products are introduced into new markets • The product might be new but is it genuinely diversification into new markets? Strategy – Ansoff’s Matrix

Unrelated diversification • Features of unrelated diversification – Growth in products and markets that are completely new – Development beyond the present industry into products and markets which bear little relation to the present product market mix – No commonality with existing products and markets

• It is also known as conglomerate diversification: When completely new, technologically unrelated products are introduced into new markets • As it represents a departure from existing products and markets it does represent considerable risk Strategy – Ansoff’s Matrix

Examples of unrelated diversification • In each case consider whether it is genuinely unrelated or whether there is some link be with existing products or markets • Water supply companies acquiring or developing hotel businesses • Granada TV group developed motorway service areas (now sold off since the merger of ITV) • The involvement of Pearson Group (a publisher) in television production companies and running an exam board (Edexcel) • British Gas offers home emergency services covering plumbing and electrical problems • Hollywood film studios own hotels, casinos and cruise liners Strategy – Ansoff’s Matrix

Uses of the Ansoff Matrix • The matrix is a framework to explore directions for strategic growth • It is the most commonly used model for analysing the possible strategic direction that a business should take • It not only identifies and analyses different growth opportunities it also encourages planners to consider both expected returns and risks • But, as we have seen, real world examples do not fit neatly into the four cells of the Ansoff’s Matrix Strategy – Ansoff’s Matrix

Market Penetration Aim

Risks

Contents

How is it Achieved

When to use it

Examples

Increase a share in the current market with current products and secure dominance In a growing market, or change an existing market by driving out competition.

There are minimal risks in market penetration. Market penetration is the strategy involving the least risk out of the four. However because risk is low, so is success. Penetration includes an increase of existing goods to an already existing market. You are essentially selling more of the same thing to the same people. Difficult if market is saturated. Success is achieved through multiple things. Increased sales to customers, attract customers from rivals, gaining market share at the expense of rivals and encouraging non buyers to buy.

There are certain times to use it. Some are, when the market is NOT saturated, when there is growth in the market, competitors share in the market is falling and increased volumes lead to economies of scale.

An example of market penetration is when Tesco increased its share of the grocery business during its competitors struggles.

Strategy – Ansoff’s Matrix

Market Development Aim

Risks

Contents

How is it Achieved

When to use it

Examples

The aim of market development is basically to expand the market and customer base of a firm or company.

Moderate risks come with Market Development. There is also a lack of familiarity with customers, but the product stays familiar. Selling the same product to a newer, expanding customer base or entering new markets with the same base. Basically gaining new customers with the same product. This will include changes to many different aspects of a firm, such as marketing strategies, new distribution channels, a different pricing policy and many others. Market Development is best used when untapped markets are beckoning, the firm has excess capacity and there are attractive channels to access a new market. An example of Market Development is when Tesco expanded into the convenience store market.

Strategy – Ansoff’s Matrix

Product Development Aim

Risks

Contents

How is it Achieved

When to use it

Examples

The aim of Product Development is to create new products for an already existing market. The creation of new products is usually quite costly and there are moderate risk levels associated. Probably the biggest risk is will this new product be successful. This could be new products to replace current older ones, new innovative products, product improvements or product line extensions. What makes Product Development easiest, is a strong Research and Development program, also known as R&D. Without this, it is very risky and has a lower success rate. Companies usually utilize product development when they have strong Resource and Development capabilities, the market is growing and there is rapid change. Two examples are Tesco expanding petrol sales and the development of financial services.

Strategy – Ansoff’s Matrix

Market Diversification Aim

Risks

Contents

The aim of this is to successfully sell new products to a new market, which means new products for new customers. Market Diversification is the riskiest of the four strategies because you’re dealing with two unknowns here; a new market and new customers. There are two main types of Market Diversification. Related and Unrelated. Related stays within confines of the industry but beyond the present market. Unrelated is a growth in products and markets that are completely new.

It is achieved by putting new products into a new market to new customers. How is it Achieved

When to use it

Examples

Market diversification, like product development is best used when your firm have good R&D capabilities for the least risk possible.

For Scottish Banks, selling insurance in England, could be seen as expanding its market with new products to new customers.

Strategy – Ansoff’s Matrix

Advantages and Disadvantages The Ansoff matrix is the most commonly used model for analyzing business strategies for a reason. Because it works and has been successful.

AdvantageThe main advantage is it takes very complex business scenarios and allows for rapid assessment and expansion.

Strategy – Ansoff’s Matrix

DisadvantageThe Ansoff Matrix is so simplistic that real world business problems don’t fit very well onto the model. It is a good starting model but further detail needs to be put in afterwards.

Ansoff’s Matrix • This matrix was developed by Igor Ansoff • It is a framework for identifying corporate growth opportunities • Two dimensions determine the scope of options,namely products and markets • Four generic growth strategies are identified: – Market penetration: more of the same to the same customers – Market development: new customers for existing products – Product development: new products for existing customers – Diversification: new products and new customers Strategy – Ansoff’s Matrix

Ansoff’s Matrix Existing product

New product

Existing market

Market penetration Increase sales to the existing market Penetrate more deeply into the existing market

Product development New product developed for existing markets

New market

Market development Existing products sold to new markets

Diversification New products sold in new markets

Strategy – Ansoff’s Matrix

Ansoff’s matrix and risk • The greater the degree of newness the greater the risk • Hence: • Market penetration - little risk involved • Market development - moderate risk • Product development - moderate risk • Diversification - high risk because both product and market are new and unknown Strategy – Ansoff’s Matrix

Example 1 - Growth of Tesco • Market penetration – Increase in its share of the grocery business at the expense of Sainsbury’s and Asda

• Market development – Movement into the convenience store market – Expansion abroad

• Product development – Expansion into petrol sales – Development of financial services

• Diversification – Today Tesco is so all embracing that diversification would have to involve something entirely outside Tesco’s current range of activities and sold in foreign markets or to business customers

Strategy – Ansoff’s Matrix

Example 2: Growth of Scottish Banks • In recent years both Royal Bank of Scotland and Bank of Scotland have grown rapidly through: • Market penetration – Increased sales of banking financial services in Scotland

• Market development – Growing presence south of the border following acquisitions. – Bank of Scotland and the Halifax Bank merge to create HBOS – RBS took over Williams and Glyn in 1970 and also runs Tesco’s banking operation

• Product development – Growing involvement in insurance – RBS subsidiary Direct line revolutionised motor insurance

• Diversification – Selling insurance in England might be seen as new markets and new products Strategy – Ansoff’s Matrix

Market Penetration • Aim of the strategy: – To maintain or increase share of the current market with current products – To secure dominance of a growth market or restructure a mature market by driving out competition

• Market penetration involves an increase in sales of existing products to existing markets - selling more of the same to the same people • But it is difficult to achieve growth through increased market penetration if the market is saturated • In a stagnating market increase in sales is only possible by grabbing market share from rivals. Hence competition will be intense in such markets • Risks are low but the prospects of success are low unless there is strong growth in the market Strategy – Ansoff’s Matrix

Market penetration strategies • How is increased market penetration achieved? – Increase usage by existing customers – Attract customers away from rivals – Gain market. share at the expense of rivals – Encourage increase in frequency of use – Devise and encourage new applications – Encourage non buyers to buy

• Market penetration requires realignment of the marketing mix Strategy – Ansoff’s Matrix

Use market penetration when... • • • •

The market is not saturated There is growth in the market Competitors’ share of the market is falling Increased volumes lead to economies of scale • There is scope for selling more to existing customers

Strategy – Ansoff’s Matrix

Market development • This involves – Selling the same product to different people – Entering new markets or segments with existing products – Gaining new customers,new segments,new markets – Entering overseas markets

• Market development will require changes to marketing strategy e.g. new distribution channels, different pricing policy, now promotional strategy to attract different types of customers Strategy – Ansoff’s Matrix

Market development • Market development is used when… – Untapped markets are beckoning – The firm has excess capacity – There are attractive channels to access new market

• Market development involves moderate risk - there is a lack of familiarity with customers but at least the product is familiar

Strategy – Ansoff’s Matrix

Product development • This is the development of new products for the existing market • New products come in the form of: – New products to replace current products – New innovative products – Product improvements – Product line extensions – New products to complement existing products – Products at a different quality level to existing products Strategy – Ansoff’s Matrix

Product development • Product development is used when: – The Firm has strong R&D capabilities – The market is growing – There is rapid change – The firm can build on existing brands – Competitors have better products

• But new product development is costly and there are moderate risks associated with this strategy Strategy – Ansoff’s Matrix

Diversification • Diversification in the Ansoff Matrix means: – New products sold to new markets – New products for new customers

• It is a risky strategy because it involves two unknowns • Therefore new products and new markets should be selected which offer the prospect for growth which the exiting product market mix does not • One problem is to identify real life examples of firms developing new products for genuinely new groups of customers • Diversification can be sub-divided into related and unrelated

Strategy – Ansoff’s Matrix

Related diversification • This is development beyond present product market but still within the broad confines of the industry • Markets and products share some commonality with existing products • Therefore it builds on assets or activities which the firm has developed • Related diversification can also be seen as synergistic diversification since it involves harnessing exiting product market knowledge • This closeness can reduce the risks associated with diversification • Example: banks developing insurance products Strategy – Ansoff’s Matrix

Example: Product mix at PC World • PC World (part of the Dixons/ Curry’s group) has grown through market penetration (new stores), product development (new products) and related diversification • In the early days, the stock consisted of PCs and accessories • Then space was devoted to digital photographic products. • After that, iPods and similar products became major an important part of the product range • Now with flat screen and high definition TV they are expanding into this market • All these products are linked in that they involve digital technology. These developments could be classed as product development or, especially if they bring new people into the store, it could be seen as related diversification Strategy – Ansoff’s Matrix

Related diversification • Horizontal diversification: when new products are introduced to current markets • Vertical diversification: when an organisation decides to move into its suppliers or customer’s business to secure supply or to firm up the use of products in end products • Concentric diversification: when new products closely related to current products are introduced into new markets • The product might be new but is it genuinely diversification into new markets? Strategy – Ansoff’s Matrix

Unrelated diversification • Features of unrelated diversification – Growth in products and markets that are completely new – Development beyond the present industry into products and markets which bear little relation to the present product market mix – No commonality with existing products and markets

• It is also known as conglomerate diversification: When completely new, technologically unrelated products are introduced into new markets • As it represents a departure from existing products and markets it does represent considerable risk Strategy – Ansoff’s Matrix

Examples of unrelated diversification • In each case consider whether it is genuinely unrelated or whether there is some link be with existing products or markets • Water supply companies acquiring or developing hotel businesses • Granada TV group developed motorway service areas (now sold off since the merger of ITV) • The involvement of Pearson Group (a publisher) in television production companies and running an exam board (Edexcel) • British Gas offers home emergency services covering plumbing and electrical problems • Hollywood film studios own hotels, casinos and cruise liners Strategy – Ansoff’s Matrix

Uses of the Ansoff Matrix • The matrix is a framework to explore directions for strategic growth • It is the most commonly used model for analysing the possible strategic direction that a business should take • It not only identifies and analyses different growth opportunities it also encourages planners to consider both expected returns and risks • But, as we have seen, real world examples do not fit neatly into the four cells of the Ansoff’s Matrix Strategy – Ansoff’s Matrix

Market Penetration Aim

Risks

Contents

How is it Achieved

When to use it

Examples

Increase a share in the current market with current products and secure dominance In a growing market, or change an existing market by driving out competition.

There are minimal risks in market penetration. Market penetration is the strategy involving the least risk out of the four. However because risk is low, so is success. Penetration includes an increase of existing goods to an already existing market. You are essentially selling more of the same thing to the same people. Difficult if market is saturated. Success is achieved through multiple things. Increased sales to customers, attract customers from rivals, gaining market share at the expense of rivals and encouraging non buyers to buy.

There are certain times to use it. Some are, when the market is NOT saturated, when there is growth in the market, competitors share in the market is falling and increased volumes lead to economies of scale.

An example of market penetration is when Tesco increased its share of the grocery business during its competitors struggles.

Strategy – Ansoff’s Matrix

Market Development Aim

Risks

Contents

How is it Achieved

When to use it

Examples

The aim of market development is basically to expand the market and customer base of a firm or company.

Moderate risks come with Market Development. There is also a lack of familiarity with customers, but the product stays familiar. Selling the same product to a newer, expanding customer base or entering new markets with the same base. Basically gaining new customers with the same product. This will include changes to many different aspects of a firm, such as marketing strategies, new distribution channels, a different pricing policy and many others. Market Development is best used when untapped markets are beckoning, the firm has excess capacity and there are attractive channels to access a new market. An example of Market Development is when Tesco expanded into the convenience store market.

Strategy – Ansoff’s Matrix

Product Development Aim

Risks

Contents

How is it Achieved

When to use it

Examples

The aim of Product Development is to create new products for an already existing market. The creation of new products is usually quite costly and there are moderate risk levels associated. Probably the biggest risk is will this new product be successful. This could be new products to replace current older ones, new innovative products, product improvements or product line extensions. What makes Product Development easiest, is a strong Research and Development program, also known as R&D. Without this, it is very risky and has a lower success rate. Companies usually utilize product development when they have strong Resource and Development capabilities, the market is growing and there is rapid change. Two examples are Tesco expanding petrol sales and the development of financial services.

Strategy – Ansoff’s Matrix

Market Diversification Aim

Risks

Contents

The aim of this is to successfully sell new products to a new market, which means new products for new customers. Market Diversification is the riskiest of the four strategies because you’re dealing with two unknowns here; a new market and new customers. There are two main types of Market Diversification. Related and Unrelated. Related stays within confines of the industry but beyond the present market. Unrelated is a growth in products and markets that are completely new.

It is achieved by putting new products into a new market to new customers. How is it Achieved

When to use it

Examples

Market diversification, like product development is best used when your firm have good R&D capabilities for the least risk possible.

For Scottish Banks, selling insurance in England, could be seen as expanding its market with new products to new customers.

Strategy – Ansoff’s Matrix

Advantages and Disadvantages The Ansoff matrix is the most commonly used model for analyzing business strategies for a reason. Because it works and has been successful.

AdvantageThe main advantage is it takes very complex business scenarios and allows for rapid assessment and expansion.

Strategy – Ansoff’s Matrix

DisadvantageThe Ansoff Matrix is so simplistic that real world business problems don’t fit very well onto the model. It is a good starting model but further detail needs to be put in afterwards.