Consumer Rights And Responsibilities 3t685a

This document was ed by and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this report form. Report 3b7i

Overview 3e4r5l

& View Consumer Rights And Responsibilities as PDF for free.

More details w3441

- Words: 1,244

- Pages: 4

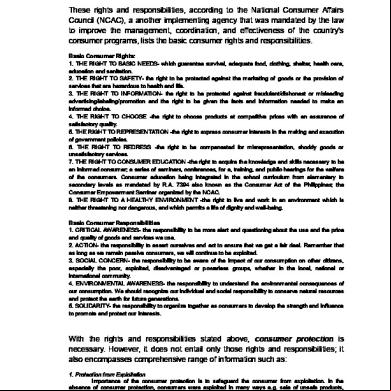

Consumer Rights and Responsibilities These rights and responsibilities, according to the National Consumer Affairs Council (NCAC), a another implementing agency that was mandated by the law to improve the management, coordination, and effectiveness of the country’s consumer programs, lists the basic consumer rights and responsibilities. Basic Consumer Rights: 1. THE RIGHT TO BASIC NEEDS- which guarantee survival, adequate food, clothing, shelter, health care, education and sanitation. 2. THE RIGHT TO SAFETY- the right to be protected against the marketing of goods or the provision of services that are hazardous to health and life. 3. THE RIGHT TO INFORMATION- the right to be protected against fraudulent/dishonest or misleading advertising/labeling/promotion and the right to be given the facts and information needed to make an informed choice. 4. THE RIGHT TO CHOOSE -the right to choose products at competitive prices with an assurance of satisfactory quality. 5. THE RIGHT TO REPRESENTATION -the right to express consumer interests in the making and execution of government policies. 6. THE RIGHT TO REDRESS -the right to be compensated for misrepresentation, shoddy goods or unsatisfactory services. 7. THE RIGHT TO CONSUMER EDUCATION -the right to acquire the knowledge and skills necessary to be an informed consumer; a series of seminars, conferences, for a, training, and public hearings for the welfare of the consumers. Consumer education being integrated in the school curriculum from elementary to secondary levels as mandated by R.A. 7394 also known as the Consumer Act of the Philippines; the Consumer Empowerment Seminar organized by the NCAC. 8. THE RIGHT TO A HEALTHY ENVIRONMENT -the right to live and work in an environment which is neither threatening nor dangerous, and which permits a life of dignity and well-being. Basic Consumer Responsibilities 1. CRITICAL AWARENESS- the responsibility to be more alert and questioning about the use and the price and quality of goods and services we use. 2. ACTION- the responsibility to assert ourselves and act to ensure that we get a fair deal. that as long as we remain ive consumers, we will continue to be exploited. 3. SOCIAL CONCERN- the responsibility to be aware of the impact of our consumption on other citizens, especially the poor, exploited, disadvantaged or powerless groups, whether in the local, national or international community. 4. ENVIRONMENTAL AWARENESS- the responsibility to understand the environmental consequences of our consumption. We should recognize our individual and social responsibility to conserve natural resources and protect the earth for future generations. 5. SOLIDARITY- the responsibility to organize together as consumers to develop the strength and influence to promote and protect our interests.

With the rights and responsibilities stated above, consumer protection is necessary. However, it does not entail only those rights and responsibilities; it also encomes comprehensive range of information such as: 1. Protection from Exploitation Importance of the consumer protection is to safeguard the consumer from exploitation. In the absence of consumer protection, consumers were exploited in many ways e.g. sale of unsafe products, adulteration and hoarding of goods, using wrong weights and measures, charging excessive prices and sale

of inferior quality goods, etc. Through various Consumer Protection Acts; business organizations are under pressure to keep away from exploiting consumers. 2. Consumer Education Importance of consumer protection is to create awareness among consumers about their rights and responsibilities by organizing workshops and seminars and gives them confidence to take legal action against companies who have defaulted. 3. Redressal of Complaints Importance of Consumer Protection is to present the consumer complaints in appropriate consumer courts and make sure that justice is done to consumers. 4. Bulletins and Periodicals Importance of consumer protection organization is to issue various journals and periodicals in which wide publicity is given to the unfair trade practices adopted by business organizations so that they are pressured to give fair treatment to consumers. 5. Encouraging Honest Businessmen Importance of consumer protection is to encourage the honest businessmen. Organizations give the credit to the business organizations which aims at consumer satisfaction by publishing favorable reports in their periodical's about them. This helps in building goodwill for such organizations. 6. Connecting Link Importance of consumer protection is they play connecting link between the consumers. Consumer Protection organizations act as a link between consumers wanting to file complaints on one side and the business organizations that have defaulted on other sides and make sure that justice is done to final consumers. 7. Unity Consumer Protection aims at bringing unity among consumers to fight collectively against the business organizations which indulge in unfair trade practices. Consumers are encouraged to form cooperative societies so that the focus is on providing services to rather than earning profit on the cost of customers. 8. Quality life for Consumer Importance of Consumer Protection is to aim at redressal of consumer complaints in an effective manner but also on giving good-quality life to consumers by business organizations that have defaulted on the other side and make sure that justice is done to final consumers. 9. Ethical Obligations Importance of consumer protection, today ethics play a prominent role in business. Business without ethical values is nothing but a criminal activity. Protecting the interests of the consumer includes absence of unfair business practices such as black marketing, profiteering, creating an artificial shortage, using wrong weights and measures, publishing false ment, etc. It is necessary for a businessman not to practice such uneven means thereby protect the interest of consumers. 10. Getting Public Importance of consumer protection does not isolate the business. Financial institutions and banks provide finance to business. Government provides and incentives. Employees contribute their time, skill and labour. Consumers are ready to pay for value. The businessmen can get the best of all these parties only when it stops exploiting its customers.

The Philippine law for consumers was known as Consumer Code of the Philippines – Republic Act 7394. This law entails: 1. The rights and responsibilities of consumers; 2. The sanctions and penalties in regards of conduct of prohibited acts;

3. Policies on regulation of food, drugs, cosmetics and devices, hazardous substance; 4. Protection against deceptive, unfair, and unconscionable sales acts or practices; 5. Regarding the labeling and fair packaging; 6. Liability for product and service; 7. In of consumer credit transaction; 8. The establishment of National Consumer Affairs Council; and 9. Transitory and final provisions.

In line with this, agencies of the government serve as main implementing agents for the law. These agencies include: 1. 2. 3. 4. 5. 6.

Department of Trade and Industry Department of Agriculture Department of Education Department of Health Bangko Sentral ng Pilipinas Securities and Exchange Commission

For respective implementing agencies, their some concerns include: Department of Trade and Industry a) Consumer Products and Service Warranties b) Consumer Product Quality and Safety c) Deceptive, unfair and unconscionable sales acts and practices d) Price Tag e) Weights and measures (metrication) f) Labeling and Packaging g) Advertising and sales promotion h) Liability for Products and Services i) Service and repair shops Department of Agriculture (DA) a) Agricultural Products b) Quality and Safety c) Labelling and Packaging Department of Education (DepEd) a)

Consumer education and information

Department of Health (DOH) a.) Food, drugs, cosmetics and devices and hazardous substances Quality and safety Price Tag Labelling and Packaging Advertising & Sales Promotion

Bangko Sentral ng Pilipinas (BSP) a.) Consumer credit transactions extended by banks and other financial intermediaries Securities and Exchange Commission (SEC) a.) Credit facilities extended to consumers by financing companies

With the rights and responsibilities stated above, consumer protection is necessary. However, it does not entail only those rights and responsibilities; it also encomes comprehensive range of information such as: 1. Protection from Exploitation Importance of the consumer protection is to safeguard the consumer from exploitation. In the absence of consumer protection, consumers were exploited in many ways e.g. sale of unsafe products, adulteration and hoarding of goods, using wrong weights and measures, charging excessive prices and sale

of inferior quality goods, etc. Through various Consumer Protection Acts; business organizations are under pressure to keep away from exploiting consumers. 2. Consumer Education Importance of consumer protection is to create awareness among consumers about their rights and responsibilities by organizing workshops and seminars and gives them confidence to take legal action against companies who have defaulted. 3. Redressal of Complaints Importance of Consumer Protection is to present the consumer complaints in appropriate consumer courts and make sure that justice is done to consumers. 4. Bulletins and Periodicals Importance of consumer protection organization is to issue various journals and periodicals in which wide publicity is given to the unfair trade practices adopted by business organizations so that they are pressured to give fair treatment to consumers. 5. Encouraging Honest Businessmen Importance of consumer protection is to encourage the honest businessmen. Organizations give the credit to the business organizations which aims at consumer satisfaction by publishing favorable reports in their periodical's about them. This helps in building goodwill for such organizations. 6. Connecting Link Importance of consumer protection is they play connecting link between the consumers. Consumer Protection organizations act as a link between consumers wanting to file complaints on one side and the business organizations that have defaulted on other sides and make sure that justice is done to final consumers. 7. Unity Consumer Protection aims at bringing unity among consumers to fight collectively against the business organizations which indulge in unfair trade practices. Consumers are encouraged to form cooperative societies so that the focus is on providing services to rather than earning profit on the cost of customers. 8. Quality life for Consumer Importance of Consumer Protection is to aim at redressal of consumer complaints in an effective manner but also on giving good-quality life to consumers by business organizations that have defaulted on the other side and make sure that justice is done to final consumers. 9. Ethical Obligations Importance of consumer protection, today ethics play a prominent role in business. Business without ethical values is nothing but a criminal activity. Protecting the interests of the consumer includes absence of unfair business practices such as black marketing, profiteering, creating an artificial shortage, using wrong weights and measures, publishing false ment, etc. It is necessary for a businessman not to practice such uneven means thereby protect the interest of consumers. 10. Getting Public Importance of consumer protection does not isolate the business. Financial institutions and banks provide finance to business. Government provides and incentives. Employees contribute their time, skill and labour. Consumers are ready to pay for value. The businessmen can get the best of all these parties only when it stops exploiting its customers.

The Philippine law for consumers was known as Consumer Code of the Philippines – Republic Act 7394. This law entails: 1. The rights and responsibilities of consumers; 2. The sanctions and penalties in regards of conduct of prohibited acts;

3. Policies on regulation of food, drugs, cosmetics and devices, hazardous substance; 4. Protection against deceptive, unfair, and unconscionable sales acts or practices; 5. Regarding the labeling and fair packaging; 6. Liability for product and service; 7. In of consumer credit transaction; 8. The establishment of National Consumer Affairs Council; and 9. Transitory and final provisions.

In line with this, agencies of the government serve as main implementing agents for the law. These agencies include: 1. 2. 3. 4. 5. 6.

Department of Trade and Industry Department of Agriculture Department of Education Department of Health Bangko Sentral ng Pilipinas Securities and Exchange Commission

For respective implementing agencies, their some concerns include: Department of Trade and Industry a) Consumer Products and Service Warranties b) Consumer Product Quality and Safety c) Deceptive, unfair and unconscionable sales acts and practices d) Price Tag e) Weights and measures (metrication) f) Labeling and Packaging g) Advertising and sales promotion h) Liability for Products and Services i) Service and repair shops Department of Agriculture (DA) a) Agricultural Products b) Quality and Safety c) Labelling and Packaging Department of Education (DepEd) a)

Consumer education and information

Department of Health (DOH) a.) Food, drugs, cosmetics and devices and hazardous substances Quality and safety Price Tag Labelling and Packaging Advertising & Sales Promotion

Bangko Sentral ng Pilipinas (BSP) a.) Consumer credit transactions extended by banks and other financial intermediaries Securities and Exchange Commission (SEC) a.) Credit facilities extended to consumers by financing companies