ing Theory Summary Conceptual Framework 5k3ik

This document was ed by and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this report form. Report 3b7i

Overview 3e4r5l

& View ing Theory Summary Conceptual Framework as PDF for free.

More details w3441

- Words: 2,736

- Pages: 9

CHAPTER 1 THEORETICAL BACKGROUND 1.1 THE ROLE OF A CONCEPTUAL FRAMEWORK A conceptual framework of ing aims to provide a structured theory of ing. At its highest theoretical levels, it states the scope and objective of financial reporting. At the next fundamental conceptual level, it identifies and defines the qualitative characteristics of financial instruments (such as relevance, reliability, comparability, timeliness and understandability. At the lower operational levels, the conceptual framework deals with principles and rules of recognition and measurement of the basic elements, and report disclosures. The FASB has defined the conceptual framework as: “…a coherent system of interrelated objectives and fundamentals that is expected to lead to consistent standards and that prescribes the nature, function and limits of financial ing and reporting.” Such words as ‘coherent system’ and ‘consistent’ indicate that the FASB advocates a theoretical and non-arbitrary framework, and the word ‘prescribes’ s a normative approach. Some ants ask whether a conceptual framework is necessary. They argue that formulating a general theory of ing through a conceptual framework is not necessary. Some people hold the view that ing practices is overly permissive because it permits alternatives ing practices to be applied to similar circumstances. The inconsistency of practices has also been seen as a problem. There are many sources of authority in ing that regulate, such as the inventory calculation, differently. Business managers and executives sometimes persuade ants to devise ‘acceptable’ ing schemes for the purpose of minimizing their tax expense or increasing their reported profit. There is an argument that the conceptual framework as a defence against political interference in the neutrality of ing reports. The benefits of a conceptual framework have been summarized by Australian standard setters as follows: a) Reporting requirements will be more consistent and logical because they will stem from an orderly set of concepts. b) Avoidance of reporting requirements will be much more difficult because of the existence of all-embracing provisions.

c) The boards that establish the requirements will be more able for their actions in that the thinking behind specific requirements will be more explicit, as will any compromises that may be included in particular ing standards. d) The need for specific ing standards will be reduced to those circumstances in which the appropriate application of concepts is not clear-out, thus minimizing the risk over-regulation. e) Preparers and auditors will be able to better understand the financial reporting requirements they face. f) More economical standard setting because issues should not need to be re-debated from differing viewpoints.

1.2 OBJECTIVES OF CONCEPTUAL FRAMEWORK The FASB statement of Financial ing Concepts (SFAC) No 1 (paragraph 34) stated the basic objectives of external financial reporting for business entities: “Financial reporting should provide information that is useful to present and potential investors and creditors and other s in making rational investment, credit and similar decisions.” Both the IASB and FASB frameworks consider the main objective of financial reporting is to communicate financial information to s. This objectives is seen to be achieved by reporting information that is: Useful in making economic decisions Useful in assessing cash flow prospects About enterprise resources, claims to those resources and changes in them SFAC

No

2

and

IASB

framework

explain

the

qualitative

characteristics.

Understandability refers to the ability of information to be understood by s, s are assumed to have reasonable knowledge of business and economic activities and ing, and a willingness to study the information with reasonable diligence. Information has the quality of relevance when it influences the economic decisions of s by helping them evaluate past, present or future or confirming or correcting their past evaluations. To be reliable, financial information should faithfully represent transactions and events without material bias or error (IASB Framework, paragraph 2442).

The FASB issued seven concept statements covering the following topics:

Objectives of financial reporting by business enterprises and non-profit

organizations Qualitative characteristics of useful ing information Elements of financial statements Criteria for recognizing and measuring the elements Use of cash flow and present value information in ing measurements

The IASB has just one concept statements, the Framework for the Preparation and Presentation of Financial Statements, which:

Defines the objectives of financial statements Identifies qualitative characteristics that make information in financial statements

useful Defines the basic elements of financial statements and the concept for recognizing and measuring them in financial statements.

1.3 DEVELOPING A CONCEPTUAL FRAMEWORK The development of conceptual frameworks is influenced by two key issues: principles versus rules-based approaches to standard setting information for decision making and the decision-theory approach Principles-based and rule-based standard setting The IASB aims to produce principle-based standards and thus it looks to the conceptual framework for guidance. It represents the basic ideas which underpin the development of the standard and assist s in their interpretation of the standards. While the IASB aims

to be principle-based standard setter, standards such as IAS 39 have been criticized as being overly rule-based. Nobes suggests that the reasons standards become rules-based is that they are inconsistent with the conceptual frameworks of standard setters. He argues that the need for rules results from lack of principles or use of an inappropriate principle. However, rule-based standards have some advantages which explain their popularity. These include increased comparability and increased verifiability for auditors and regulators. Rule-based standards may reduce the opportunities for earnings management; however they allow for the specific structuring of transactions to work around the rules. The study recommended that ing standards be developed using a principles-based approach and that standard should have the following characteristics.

Be based on an improved and consistently applied conceptual framework. Clearly state the objective of the standard. Provide sufficient detail and structure that the standard can be operationalized and

applied on a consistent basis. Minimize the use of exceptions from the standards. Avoid use of percentage tests that allow financial engineers to achieve technical compliance with the standards while evading the intent of the standard.

The greater emphasis on the conceptual framework, principles and objectives arises from events of the corporate collapses at Enron and WorldCom. The Sarbanes-Oxley act 2002 introduced many changes to improve the quality of financial reporting and auditing. Establishing a principle-based approach as a FASB objective is timely in of the IASB/FASB convergence program. A lack of the same underlying approach would make converging standards and producing standards for use in both jurisdictions more difficult. Information for decision making and decision-theory approach ing data are for decision making or evaluative purposes in relation to a specific entity. ing information for decision making begins with the stewardship functions. The information on how managers have discharged their stewardship responsibility is used by the equityholders to evaluate the performances of the managers and the firm. Information for decision making, however, is not seen to replace information relating to stewardship or ability. Information for decision making implies more than

information on stewardship. First, the s of financial information are greatly expanded to include all resources providers, recipients of goods and services and parties performing a review or oversight function. Second, ing information is seen as input data for the prediction models of s The decision-theory approach to ing is helpful to test whether ing achieves its purposes. The theory should serve as a standard by which ing practices are judged. The model is presented in figure below. The arrows indicate the output of the theory, system or model.

The model maps the process by which the outputs of the ing system provide inputs to the decision model of a . Financial information may have a wider range of s, includes investors, employees, lenders, suppliers and trade creditors, customers, governments and their agencies, and the public as potential s. International developments: the IASB and FASB Conceptual Framework In October 2004, the FASB and IASB added a t project to their agendas to develop an improved, common conceptual framework. The revised framework will build on the existing IASB’s and FASB’s frameworks and consider developments subsequent to the issuance of those frameworks. The FASB states that the project will do the following: 1. Focus on changes in the environment since the original frameworks were issued, as well as the omissions in the original frameworks, in order to efficiently and effectively improve, complete, and converge the existing frameworks. 2. Give priority to addressing and deliberating those issues within each phase that are likely to yield benefits to the Boards in the short term; that is, cross-cutting issues that affect a number of their projects for new or revised standards.

3. Initially consider concepts applicable to private sector business entities. Controversial matters include the perspective underlying financial reporting (entity vs proprietorship), the primary group and the objective of financial reporting, and the qualitative characteristics of financial reporting.

1.3 A CRITIQUE OF CONCEPTUAL FRAMEWORK PROJECTS The development of conceptual frameworks met with criticisms. An analysis of the criticisms will help explain reasons for the previous slow development of the frameworks and highlight issues relevant to achieving progress in the current IASB/FASB project. There are two approaches use in the analysis: – Scientific, which recourse to logic and empiricism or both – Professional, which prescribes the best course of action by recourse to professional values Scientific criticisms for the conceptual framework project includes,

prescriptive unspecified rules and conventions do not resolve contemporary disclosure issues vague definitions do not address measurement issues risk of mechanical decision making framework may become an end in itself overreliance on definitions

Further criticisms focus on the ontological and epistemological assumptions. ing can never be neutral and unbiased. ing as a social science is two-way and does not have an objective and separate existence from ants. In measuring and communicating reality, ants play a critical role in creating that reality. Particular methods and methodological assumptions also dominate ing, which leads to generalized and large-scale empirical research. This type of research ignores the micro level of practicing ants who may require a situation-specific problem-solving approach. There are also arguments that view the conceptual framework as policy documents based on professional values and self-interest. Therefore they are seen to be a reflection of the political will of the dominant group, which is dominated by professional values. One

motivation is to increase economic power through monopoly-seeking behavior. The conceptual frameworks, as a response, testify to the presumed existence of a coherent theoretical core which underlies practice, thus alleviating criticism. There is some evidence, however, that the existence of the conceptual framework project has increased the level of conceptual debate in the standard setting lobbying process. Furthermore, it provides guidance for dealing with issues that are not yet the subject of an ing standards.

1.5 CONCEPTUAL FRAMEWORK FOR AUDITING STANDARD Early auditing theory emphasized the role of logic and key concepts such as auditor independence and evidence gathering. By the 1990s the formalized auditing processes and structures were under pressure from clients for lower audit fees and greater value. There was a swift away from substantive testing towards a greater emphasis on consideration of audit risk, in particular the role of client business risk. Business risk auditing emphasized the impact of threats to the clients’ business model from external factors and the resulting risk of fraud and error in the financial statements. Critics believed that business risk auditing was an attempt to justify less audit work and greater consulting. Legislative changes since the early 2000s have restricted the opportunity for consulting to audit clients but also increased the focus on auditing clients’ internal controls.

CHAPTER II CASE STUDY Case Study 4.3 Revisiting the conceptual framework Questions 1. Explain why principles-based standards require a conceptual framework. 2. Why is it important that the IASB and FASB share a common conceptual framework? 3. It is suggested that several parties can benefit from a conceptual framework. Do you consider that a conceptual framework is more important for some parties than others? Explain your reasoning.

4. What is meant by a 'cross-cutting' issue? Suggest some possible examples of crosscutting issues Answers 1. Principle-based standards require a conceptual framework because of following reasons: a. A conceptual framework makes the standards to be deep rooted in fundamental concepts rather than just being a collection of conventions b. Conceptual framework helps FASB and IASB to achieve coherent ing and reporting c. Conceptual framework ensures that there is consistent between standards and between the past and future decisions. This prevents reaching different conclusions on similar events. d. Conceptual framework ensures that standards are not based on the individual concepts of the standard-setting board . e. Conceptual framework brings consistence between financial statement preparation, financial reporting and interpretation of the information contained in the financial statements. f. A conceptual framework acts a written constitution for financial ing and reporting and all references are made from it. 2. It is important to share a common conceptual framework in order to enable the refinement, updating, completion and convergence between the current IASB framework, and FASB concept statements. This is because these frameworks were developed in the 70s and 80s and therefore refining and updating them is necessary. 3. There are arguments (including a securities regulator and many ing firms) agreed that the primary of the Conceptual Framework should be the IASB. They cited the following reason: a) Because the IASB has developed more comprehensive guidance since the original Framework, there are fewer instances when parties other than the IASB will use the Conceptual Framework to interpret Standards. b) It reinforces the position that the Conceptual Framework is not a Standard and does not override Standards. c) It will ensure that the IASB focuses on conceptual issues when developing the Conceptual Framework and does not merely codify current practice. Others cited reasons why the Conceptual Framework is important to parties other than the IASB: a) The Conceptual Framework facilitates a common understanding of basic principles or concepts of financial reporting among all those who use the Standards. b) Focusing on the IASB as the primary of the Conceptual Framework is likely to reduce the prominence or importance of this document to other parties. For example:

a. auditors and regulators consider the Conceptual Framework when assessing the judgements made by preparers; and b. the IFRS Interpretations Committee uses the Conceptual Framework when developing Interpretations. c) A Conceptual Framework should contain high-level principles that stakeholders can understand to fulfil the IFRS Foundation’s objective of promoting and facilitating the adoption of IFRS. d) The Conceptual Framework is a ‘behavioral code’ that all parties should follow. Based on all those reasons, we concluded that everyone might use the conceptual framework as point of references in the ing application. The IASB might be use the conceptual framework the most, but that doesn’t mean that other parties are not important enough to use these. 4. OECD (2014) reviewed that cross cutting issues are defined as that immensely effects

the operations of a given field due to their nature, therefore, special attention is provided to such issues. Some of the examples of cross cutting issues in the contemporary business include sustainability of the environment, gender equality and health related issues. Hollander, Kim, Braun, Simeon, and Zohar (2009) added that issues such as environment and gender equality are crucial from all the perspectives of development, most of the societies and business consider environment and the development to be a similar thing. Since, the business as well as societal development is affected adversely if the rivers are contaminated, subtle changes in the weather, and due to depletion in the soil. In the same manner, Narrow, Clarke, Kuramoto, Kraemer, Kupfer, Greiner, Regier (2013) stated that people cannot take care of the environment if they are financially unstable. Thus gender equality has also emerged out as a goal in its self. However, according to Hák, Moldan, and Dahl (2012), countries cannot reach their potential without utilising 50% of their labour force and talent. Moser and Ekstrom (2010) stated that if women are provided with the similar resources financial services and technological equipments as men, the production of agriculture across the world will increase which will eventually decrease the hungry people by 100 million. Therefore, Narrow, Clarke, Kuramoto, Kraemer, Kupfer, Greiner, Regier (2013) stated that the mainstream cross cutting issue suggest that the developmental initiatives shall have a positive effect on the consideration that are termed as mainstream cross cutting issues.

c) The boards that establish the requirements will be more able for their actions in that the thinking behind specific requirements will be more explicit, as will any compromises that may be included in particular ing standards. d) The need for specific ing standards will be reduced to those circumstances in which the appropriate application of concepts is not clear-out, thus minimizing the risk over-regulation. e) Preparers and auditors will be able to better understand the financial reporting requirements they face. f) More economical standard setting because issues should not need to be re-debated from differing viewpoints.

1.2 OBJECTIVES OF CONCEPTUAL FRAMEWORK The FASB statement of Financial ing Concepts (SFAC) No 1 (paragraph 34) stated the basic objectives of external financial reporting for business entities: “Financial reporting should provide information that is useful to present and potential investors and creditors and other s in making rational investment, credit and similar decisions.” Both the IASB and FASB frameworks consider the main objective of financial reporting is to communicate financial information to s. This objectives is seen to be achieved by reporting information that is: Useful in making economic decisions Useful in assessing cash flow prospects About enterprise resources, claims to those resources and changes in them SFAC

No

2

and

IASB

framework

explain

the

qualitative

characteristics.

Understandability refers to the ability of information to be understood by s, s are assumed to have reasonable knowledge of business and economic activities and ing, and a willingness to study the information with reasonable diligence. Information has the quality of relevance when it influences the economic decisions of s by helping them evaluate past, present or future or confirming or correcting their past evaluations. To be reliable, financial information should faithfully represent transactions and events without material bias or error (IASB Framework, paragraph 2442).

The FASB issued seven concept statements covering the following topics:

Objectives of financial reporting by business enterprises and non-profit

organizations Qualitative characteristics of useful ing information Elements of financial statements Criteria for recognizing and measuring the elements Use of cash flow and present value information in ing measurements

The IASB has just one concept statements, the Framework for the Preparation and Presentation of Financial Statements, which:

Defines the objectives of financial statements Identifies qualitative characteristics that make information in financial statements

useful Defines the basic elements of financial statements and the concept for recognizing and measuring them in financial statements.

1.3 DEVELOPING A CONCEPTUAL FRAMEWORK The development of conceptual frameworks is influenced by two key issues: principles versus rules-based approaches to standard setting information for decision making and the decision-theory approach Principles-based and rule-based standard setting The IASB aims to produce principle-based standards and thus it looks to the conceptual framework for guidance. It represents the basic ideas which underpin the development of the standard and assist s in their interpretation of the standards. While the IASB aims

to be principle-based standard setter, standards such as IAS 39 have been criticized as being overly rule-based. Nobes suggests that the reasons standards become rules-based is that they are inconsistent with the conceptual frameworks of standard setters. He argues that the need for rules results from lack of principles or use of an inappropriate principle. However, rule-based standards have some advantages which explain their popularity. These include increased comparability and increased verifiability for auditors and regulators. Rule-based standards may reduce the opportunities for earnings management; however they allow for the specific structuring of transactions to work around the rules. The study recommended that ing standards be developed using a principles-based approach and that standard should have the following characteristics.

Be based on an improved and consistently applied conceptual framework. Clearly state the objective of the standard. Provide sufficient detail and structure that the standard can be operationalized and

applied on a consistent basis. Minimize the use of exceptions from the standards. Avoid use of percentage tests that allow financial engineers to achieve technical compliance with the standards while evading the intent of the standard.

The greater emphasis on the conceptual framework, principles and objectives arises from events of the corporate collapses at Enron and WorldCom. The Sarbanes-Oxley act 2002 introduced many changes to improve the quality of financial reporting and auditing. Establishing a principle-based approach as a FASB objective is timely in of the IASB/FASB convergence program. A lack of the same underlying approach would make converging standards and producing standards for use in both jurisdictions more difficult. Information for decision making and decision-theory approach ing data are for decision making or evaluative purposes in relation to a specific entity. ing information for decision making begins with the stewardship functions. The information on how managers have discharged their stewardship responsibility is used by the equityholders to evaluate the performances of the managers and the firm. Information for decision making, however, is not seen to replace information relating to stewardship or ability. Information for decision making implies more than

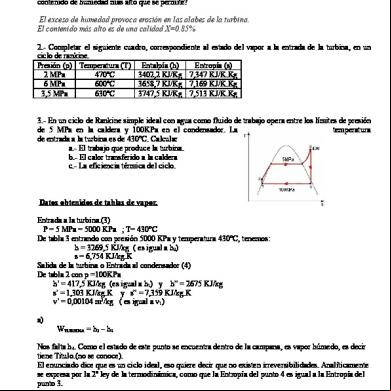

information on stewardship. First, the s of financial information are greatly expanded to include all resources providers, recipients of goods and services and parties performing a review or oversight function. Second, ing information is seen as input data for the prediction models of s The decision-theory approach to ing is helpful to test whether ing achieves its purposes. The theory should serve as a standard by which ing practices are judged. The model is presented in figure below. The arrows indicate the output of the theory, system or model.

The model maps the process by which the outputs of the ing system provide inputs to the decision model of a . Financial information may have a wider range of s, includes investors, employees, lenders, suppliers and trade creditors, customers, governments and their agencies, and the public as potential s. International developments: the IASB and FASB Conceptual Framework In October 2004, the FASB and IASB added a t project to their agendas to develop an improved, common conceptual framework. The revised framework will build on the existing IASB’s and FASB’s frameworks and consider developments subsequent to the issuance of those frameworks. The FASB states that the project will do the following: 1. Focus on changes in the environment since the original frameworks were issued, as well as the omissions in the original frameworks, in order to efficiently and effectively improve, complete, and converge the existing frameworks. 2. Give priority to addressing and deliberating those issues within each phase that are likely to yield benefits to the Boards in the short term; that is, cross-cutting issues that affect a number of their projects for new or revised standards.

3. Initially consider concepts applicable to private sector business entities. Controversial matters include the perspective underlying financial reporting (entity vs proprietorship), the primary group and the objective of financial reporting, and the qualitative characteristics of financial reporting.

1.3 A CRITIQUE OF CONCEPTUAL FRAMEWORK PROJECTS The development of conceptual frameworks met with criticisms. An analysis of the criticisms will help explain reasons for the previous slow development of the frameworks and highlight issues relevant to achieving progress in the current IASB/FASB project. There are two approaches use in the analysis: – Scientific, which recourse to logic and empiricism or both – Professional, which prescribes the best course of action by recourse to professional values Scientific criticisms for the conceptual framework project includes,

prescriptive unspecified rules and conventions do not resolve contemporary disclosure issues vague definitions do not address measurement issues risk of mechanical decision making framework may become an end in itself overreliance on definitions

Further criticisms focus on the ontological and epistemological assumptions. ing can never be neutral and unbiased. ing as a social science is two-way and does not have an objective and separate existence from ants. In measuring and communicating reality, ants play a critical role in creating that reality. Particular methods and methodological assumptions also dominate ing, which leads to generalized and large-scale empirical research. This type of research ignores the micro level of practicing ants who may require a situation-specific problem-solving approach. There are also arguments that view the conceptual framework as policy documents based on professional values and self-interest. Therefore they are seen to be a reflection of the political will of the dominant group, which is dominated by professional values. One

motivation is to increase economic power through monopoly-seeking behavior. The conceptual frameworks, as a response, testify to the presumed existence of a coherent theoretical core which underlies practice, thus alleviating criticism. There is some evidence, however, that the existence of the conceptual framework project has increased the level of conceptual debate in the standard setting lobbying process. Furthermore, it provides guidance for dealing with issues that are not yet the subject of an ing standards.

1.5 CONCEPTUAL FRAMEWORK FOR AUDITING STANDARD Early auditing theory emphasized the role of logic and key concepts such as auditor independence and evidence gathering. By the 1990s the formalized auditing processes and structures were under pressure from clients for lower audit fees and greater value. There was a swift away from substantive testing towards a greater emphasis on consideration of audit risk, in particular the role of client business risk. Business risk auditing emphasized the impact of threats to the clients’ business model from external factors and the resulting risk of fraud and error in the financial statements. Critics believed that business risk auditing was an attempt to justify less audit work and greater consulting. Legislative changes since the early 2000s have restricted the opportunity for consulting to audit clients but also increased the focus on auditing clients’ internal controls.

CHAPTER II CASE STUDY Case Study 4.3 Revisiting the conceptual framework Questions 1. Explain why principles-based standards require a conceptual framework. 2. Why is it important that the IASB and FASB share a common conceptual framework? 3. It is suggested that several parties can benefit from a conceptual framework. Do you consider that a conceptual framework is more important for some parties than others? Explain your reasoning.

4. What is meant by a 'cross-cutting' issue? Suggest some possible examples of crosscutting issues Answers 1. Principle-based standards require a conceptual framework because of following reasons: a. A conceptual framework makes the standards to be deep rooted in fundamental concepts rather than just being a collection of conventions b. Conceptual framework helps FASB and IASB to achieve coherent ing and reporting c. Conceptual framework ensures that there is consistent between standards and between the past and future decisions. This prevents reaching different conclusions on similar events. d. Conceptual framework ensures that standards are not based on the individual concepts of the standard-setting board . e. Conceptual framework brings consistence between financial statement preparation, financial reporting and interpretation of the information contained in the financial statements. f. A conceptual framework acts a written constitution for financial ing and reporting and all references are made from it. 2. It is important to share a common conceptual framework in order to enable the refinement, updating, completion and convergence between the current IASB framework, and FASB concept statements. This is because these frameworks were developed in the 70s and 80s and therefore refining and updating them is necessary. 3. There are arguments (including a securities regulator and many ing firms) agreed that the primary of the Conceptual Framework should be the IASB. They cited the following reason: a) Because the IASB has developed more comprehensive guidance since the original Framework, there are fewer instances when parties other than the IASB will use the Conceptual Framework to interpret Standards. b) It reinforces the position that the Conceptual Framework is not a Standard and does not override Standards. c) It will ensure that the IASB focuses on conceptual issues when developing the Conceptual Framework and does not merely codify current practice. Others cited reasons why the Conceptual Framework is important to parties other than the IASB: a) The Conceptual Framework facilitates a common understanding of basic principles or concepts of financial reporting among all those who use the Standards. b) Focusing on the IASB as the primary of the Conceptual Framework is likely to reduce the prominence or importance of this document to other parties. For example:

a. auditors and regulators consider the Conceptual Framework when assessing the judgements made by preparers; and b. the IFRS Interpretations Committee uses the Conceptual Framework when developing Interpretations. c) A Conceptual Framework should contain high-level principles that stakeholders can understand to fulfil the IFRS Foundation’s objective of promoting and facilitating the adoption of IFRS. d) The Conceptual Framework is a ‘behavioral code’ that all parties should follow. Based on all those reasons, we concluded that everyone might use the conceptual framework as point of references in the ing application. The IASB might be use the conceptual framework the most, but that doesn’t mean that other parties are not important enough to use these. 4. OECD (2014) reviewed that cross cutting issues are defined as that immensely effects

the operations of a given field due to their nature, therefore, special attention is provided to such issues. Some of the examples of cross cutting issues in the contemporary business include sustainability of the environment, gender equality and health related issues. Hollander, Kim, Braun, Simeon, and Zohar (2009) added that issues such as environment and gender equality are crucial from all the perspectives of development, most of the societies and business consider environment and the development to be a similar thing. Since, the business as well as societal development is affected adversely if the rivers are contaminated, subtle changes in the weather, and due to depletion in the soil. In the same manner, Narrow, Clarke, Kuramoto, Kraemer, Kupfer, Greiner, Regier (2013) stated that people cannot take care of the environment if they are financially unstable. Thus gender equality has also emerged out as a goal in its self. However, according to Hák, Moldan, and Dahl (2012), countries cannot reach their potential without utilising 50% of their labour force and talent. Moser and Ekstrom (2010) stated that if women are provided with the similar resources financial services and technological equipments as men, the production of agriculture across the world will increase which will eventually decrease the hungry people by 100 million. Therefore, Narrow, Clarke, Kuramoto, Kraemer, Kupfer, Greiner, Regier (2013) stated that the mainstream cross cutting issue suggest that the developmental initiatives shall have a positive effect on the consideration that are termed as mainstream cross cutting issues.