Manpower Required In The Hotel 3u1p4t

This document was ed by and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this report form. Report 3b7i

Overview 3e4r5l

& View Manpower Required In The Hotel as PDF for free.

More details w3441

- Words: 18,168

- Pages: 146

MINISTRY OF TOURISM DEPARTMENT OF TOURISM GOVERNMENT OF INDIA

MANPOWER REQUIREMENT IN HOTEL INDUSTRY, TOUR OPERATORS & TRAVEL SECTOR MANPOWER TRAINED BY DIFFERENT INSTITUTES & PLACEMENT SCENARIO

A MARKET PULSE Report February 05, 2004 Market Pulse: H-20, 1st Floor, Green Park Extension, New Delhi 110 016 Ph: 2618 7043/45, 2616 5305/10 Fax: 2618 9486, E-mail: [email protected]

TABLE OF CONTENTS Chapters

Page Nos.

BACKGROUND

1

OF REFERENCE

2

1.0

PROJECT METHODOLOGY

03-06

2.1

TOURISM IN INDIA : A SNAPSHOT

07-9

3.0

HOTELS IN INDIA

10-18

4.0

EMPLOYMENT IN HOTELS

19-26

5.0

PROFILE OF HOTEL EMPLOYEES

27-34

6.0

RESTAURANTS IN INDIA

35-41

7.0

EMPLOYMENT IN RESTAURANTS

42-54

8.0

PROFILE OF RESTAURANT EMPLOYEES

55-59

9.0

PROJECTED DEMAND FOR TRAINED MANPOWER

60-68

10.0

TRAVEL & TOUR OPERATORS

69-73

11.0

HOTEL MANAGEMENT INSTITUTES

74-77

12.0

TRAVEL & TOUR INSTITUTES

78-82

APPENDIX 1 APPENDIX 2 APPENDIX 3

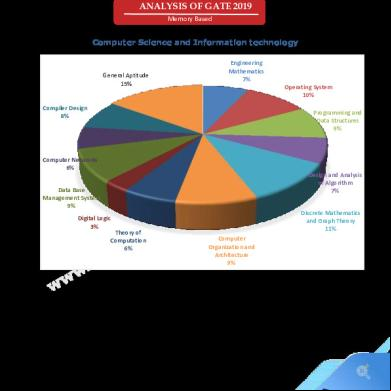

EXECUTIVE SUMMARY Recent tourism statistics reveal that both domestic and foreign tourism are on a robust growth path. This growth will need to be serviced by a substantial increase in infrastructure, including air-road, rail connectivity as well as hotels and restaurants. In this context, Department of Tourism (MR Division), Ministry of Tourism & Culture, Government of India, commissioned our firm– Market Pulse, to assess the manpower requirement in the hotels and restaurants sector as well as tour & travel operation. This study is based on an extensive primary field survey in 27 important tourist destinations. More than 900 questionnaire-based face-to-face interviews with personnel in hotels, restaurants, tour & travel operators, hotel and travel/ tourism management institutes, tourism offices and municipalities have been carried out by our field research team. In addition, physical scanning of cities and sections of highways has been done to estimate the number of hotels, motels and restaurants in the unorganized sector (refers to small businesses that are not of any trade body). Analysis of secondary data from municipal corporations, trade directories, hotel and restaurant associations has also been used in this estimation. Some of the key findings of this study are mentioned subsequently. Hotels in India There are an estimated 1.2 million hotel rooms in the country. However, the star category hotels for a mere 7% (approximately 80000 rooms). Our forecast is that there will be a total of 2.9 million and 6.6 million hotel rooms in 2010 and 2020 respectively. The larger four & five star hotels (along with the heritage hotels) employ on an average 162 people per 100 rooms, compared to 122 in the One, Two & Three Star Hotels and 58 in the unorganized sector.

There are almost 750,000 people working in hotels across India. In addition, there are more than 1 lakh employees working in motels on state & national highways. Employment is forecast to increase to 3.5 million by the year 2020. A bulk of the employees (approximately 60%) are working in F&B service, Kitchen and housekeeping. Almost 80% of the employees in key hotel functions such as F&B, front office and housekeeping are young; they are less than 40 years old. Most employees in the management/supervisory cadres in the front office, F&B service, kitchen and housekeeping function of the larger four & five star hotels have a formal hotel management qualification. Almost half the managers and supervisors of the one – three star hotels have either a hotel management degree/diploma or a Food Crafts Institute Certificate. Hotels in the unorganized sector employ largely untrained manpower. Restaurants in India Our estimate is that there are at least 140,000 restaurants in urban India. Delhi and Mumbai for nearly 15% of these restaurants. Conventional restaurants for the largest population (30%), followed by sweet shops (16%), fast food outlets (16%) and dhabas (13%). While the number of conventional restaurants ranges between 10-20 numbers per lakh of population, the total number of eating places could be as high as 86 per lakh of population (as in the North). The total number of restaurants could touch 200,000 in year 2010 and 240,000 in year 2020. There are almost 1.85 million people working in restaurants across India. Employment is forecast to increase to 2.73 million by the year 2020. In addition, there are more than 1.3 million people employed in small restaurants and dhabas on the state and national highways.

Almost 70% of the employees in key functions of F& B service and kitchen are less than 30 years old. Almost 20% of those employed in F & B of conventional restaurants, cafes and fast food outlets are diploma holders either from private hotel management institutions or Food Craft Institutes. Dhabas, largely, employ untrained manpower. Travel Trade Business in India There are approximately 6000 travel trade companies/ firms in the country. The population of these agencies could be growing at 7.5 - 10% annually. On an average, each of these travel trade agencies employ 14 – 15 people. This sector employs almost 83,500 people. Of them, a significant proportion are in functions such as ticketing, tour operations and s/ istration. Our forecast is that the employment in this sector will touch 242,000 by year 2020. Almost 44% of the employees in ticketing have a formal IATA/ UTA certificate or a diploma in travel & tour management; 17% of those in istration also have a formal education in travel & tour management. Overall, 17.5% of the employees have formal training in tour and travel management. Annual Demand for Trained Manpower: A Forecast The annual demand for trained manpower in hotels and restaurants is likely to touch 29,000 by the year 2010; this is likely to increase to approximately 39,000 by the year 2020. The demand for trained manpower in hotels and restaurants is likely to be boosted by aggressive expansion of fast food restaurants/ cafe, an increase in 1 – 3 star budget hotels, golden quadrilateral of national highways as well as the preference for youth in this sector. The annual demand for trained manpower in the travel and tour sector is likely to be 1275 and 2075 in 2010 and 2020, respectively.

Training Institutes in Hotel Management/ Food Craft There are approximately 175 training institutes engaged in hotel management and food craft; 50 of them are government sponsored/ owned. Of the 125 private institutes, only 47 are ed with AICTE. A total of 18000 students are graduating with a degree/ diploma in hotel management or food craft. Of them, only 20% are obtaining training in government sponsored institutes. Only 3800 students (21%) are completing diploma/ certificate courses; a majority of them are completing 3-year degree courses. These institutes claim 100% placement for the graduating class. However, 35 – 40% of the graduates are ing other emerging sectors such as call centers because of the following reasons: • Better salaries in alternative careers • Poor perceived image of work in hotels • Reluctance to take up job in the service function of hotels & restaurants In this scenario, there is likely to be a shortage of trained manpower in this sector. Training Institutes in Travel & Tourism Management There are 172 training institutes engaged in travel and tour management education; only 11 of them are government sponsored institutes, 78 are d to universities while the balance are privately owned ones. Approximately, 17,500 students are completing IATA/ UFTA certified diploma courses, graduate and post-graduate degree courses.

Strategic Recommendations The present and new hotel management institutes have to train a substantially larger number of students to cater to the increasing demand in hotels and restaurants. In our opinion, the student throughput of diploma and certificate courses needs to be increased substantially; this could be done by altering the mix of students in favour of the short-term courses. Since trained manpower is scarce in the smaller hotels, a training module in the form of audio and video CDs can be explored. The existing training infrastructure for the travel and tour sector appears to be adequate. A t sector campaign has to be undertaken to generate pride in a hotel management career. This will help attract and retain trained manpower in this sector.

KEY RESEARCH FINDINGS HOTELS IN INDIA: Present Infrastructure There is an estimated 1.2 million hotel rooms in the country. However, the star category hotels for a mere 7% (approximately 80000 rooms); most of the rooms are contributed by budget hotels, guesthouses and inns, that cater primarily to domestic tourism. The metropolitan cities of Delhi, Mumbai, Chennai, Hyderabad and Kolkata, along with Goa for 62% of the rooms in the five & four star category. The other smaller hotels are more geographically dispersed; this results from a strong correlation between hotels in the unorganized sector and domestic tourism statistics. Places of pilgrimage such as Tirupati and Haridwar have significantly lower availability of rooms – 28 & 150 rooms per lakh of tourists, respectively. Our forecast is that there will be a total of 2.5 million and 5.8 million hotel rooms in 2010 and 2020 respectively. This assumes that the infrastructure growth will keep pace with the anticipated growth in tourism. The other assumption is that the mix of hotels will remain the same; however, this might change in favour of the organized sector, if government initiatives take shape. Geographical spread might also change in favour of North-eastern states, J&K, West Bengal, Andhra Pradesh, Madhya Pradesh & Uttar Pradesh.

HOTELS IN INDIA: Employment Pattern & Forecast Employment intensity increases with the size of hotel. The larger Four & Five star hotels (along with the heritage hotels) employ on an average 174 people per 100 rooms, compared to 122 in the One, Two & Three Star Hotels and 58 in the unorganized sector. Total Employment 2002

Total Employment 2010

Total Employment 2020

5/4 star Hotels

Employment Intensity (Employees per 100 rooms) 174

57,000

83,000

1,10,400

1-3 star Hotels

122

52,500

63,000

83,000

Smaller hotels

58

638,000

14,05,000

32,61,500

Total

NA

7,47,500

15,51,000

34,54,900

In addition, there are more than one lakh employees working in motels on state and national highways. A bulk of the employees approximately 60% are working in F&B service, Kitchen and housekeeping. Front offices of the larger hotels for nearly 7% of the employees.

Hotel Employee Profile

Five/Four Star Hotels: Most employees in the management/supervisory cadres in the front office, F&B service and housekeeping have hotel management backgrounds. Almost 90% of the chefs are having a hotel management degree/diploma or a certificate from a Food Crafts Institute.

Three, Two & One Star Hotels: Almost half the managers and supervisors have either a hotel management degree/diploma or a Food Crafts Institute Certificate. A majority of those at junior levels are just graduates or even SSC .

Unorganized Sector: Only a few of the managers have a hotel management degree/diploma. Most of the employees consist of untrained manpower. Almost 80% of the employees in key hotel functions such as F&B, front office and housekeeping are young; they are less than 40 years old. In the smaller hotels, more than 50% are less than 30 years old.

RESTAURANTS IN INDIA: Infrastructure The burgeoning middle class and evolving lifestyle is driving the demand for quality restaurants – both conventional ones as well as fast food outlets and cafes. Our estimate is that there are at least 140,000 restaurants in urban India. Delhi and Mumbai for nearly 15% of the restaurants. Conventional restaurants for the largest population (30%), followed by sweet shops (16%), fast food outlets (16%) and dhabas (13%). Northern region already has over 10000 fast food outlets serving Chinese, Western and Indian food. While the number of conventional restaurants ranges between 10-20 numbers per lakh of population, the total number of eating places could be as high as 80 per lakh of population (as in the North).

Employment Pattern & Forecast: The total number of restaurants could touch 200,000 in year 2010 and 240,000 in year 2020. The mix is likely to remain largely the same; however, fast food outlets and cafes in the organized sector are likely to grow much faster than the others if one goes by the stated expansion plan of large chains. Employment Intensity (Employees per 100 chairs)

Total Employment 2002

Total Employment 2010

Total Employment 2020

26

926000

1226000

1436000

Cafes/Coffee/ Tea Vendors Fast food Outlets

31

270000

406700

504500

32

284000

401600

487800

Dhabas/Bhojanalays

26

179000

253900

306300

Total

NA

1659000

2288200

2734600

Conventional Restaurants

In addition, there are more than 1.3 million people employed in small restaurants and dhabas on the state and national highways. By 2020, even a 10% share for the organized sector will generate nearly 130,000 jobs for trained manpower. More than half the employees are in key functions of F& B service and kitchen and are less than 30 years old. Almost 60% of these employed in kitchens of conventional restaurants, cafes and fast food outlets are diploma holders either from private hotel management institutions or Food Craft Institutes. Only 20% of people in F&B Service are hotel management degree/diploma holders. Restaurants, employ largely untrained manpower.

PROJECTED ANNUAL DEMAND FOR TRAINED MANPOWER

Year 2010

Year 2020

Hotels

7000

10000

Restaurants

45000

45000

Total

52000

55,000

Key drivers of demand for trained manpower are likely to be the expansion of the organized sector, golden quadrilateral and preference for youth in the hospitality sector. Presently, 16850 students are being trained in hotel management, annually. Only 22% are graduating from the Government promoted institutes. Nearly 40% of them are pursuing alternative careers in other emerging service sectors (such as call centres). These statistics indicate that there could be a severe shortage for trained manpower by the year 2010.

PROJECT TEAM Chief Technical Advisor: Ejaz Hoda (38 years) A graduate of IIT, Delhi and a post-graduate from IIM, Bangalore, has over 15 years of experience in the area of market research. Brings to the team a marketing focus as well as experience of diverse products and services. Specializes in consumer research, statistics and market entry strategy. Has pioneered the use of databases in marketing, spearheads the research and development

of

new

research

methodologies

and

techniques

such

as

mpEVOLUTION & intelliPROBE, has co-authored iConsumer, a comprehensive research publication on Indian consumer markets and MACCESS 2002 – a unique report on Indian Men’s Accessories. Has been the chief research advisor on important assignments for multinational corporations such as Frito Lay (a PepsiCo), Hyundai Motor, Nestle India, Pillsbury India and Spice Telecom. Has also been on the Young Business Committee of Confederation of Indian Industry (CII). Chief of Project:

Makarand Chaurey (40 years)

A graduate of IIT, Kanpur and a post-graduate from IIM, Ahmedabad, has over 10 years of experience in the areas of industrial research, project appraisals and financial services. Has established cutting edge quality systems and specializes in demand forecasting and advanced statistical analysis for the industrial & automotive sectors. Has co-authored iConsumer, a comprehensive research publication on Indian consumer markets and worked on important assignments for Honda Cars, DCM group and PVR.

Head of Data Processing & Analysis: Dominic Sebastian (33 years): Heads the data processing team and specializes in computer-aided statistical analysis. Has 8 years of hands-on experience with specialized software (SPSS, XLSTAT & STATS) that enables statistical analyses such as correspondence analysis, multiple discriminant analysis, significant testing and database management. He is assisted by a team of 5 data processing executives. Program Coordinator:

Akhtar Siddiqui (28 years)

Heads the field function and is responsible for field briefing, accurate implementation of sampling plans and quality control in relation to field research. Has played a key role in mapping different cities and rural areas in of consumer demographics, on an al-India basis. He is assisted by a team of 12 field officers and research associates. Research Executives/Associates:

Qammar Naseem Ahmad,

Prabhat

Kumar, Deepak Raj, Kaushal Kishore and Rajendra Prasad Have been instrumental in collection of all primary data as well as compilation of secondary data.

BACKGROUND India offers diverse opportunities for tourism, be it for leisure or business. Over 2.5 million foreign tourists (including NRI’s & PIO’s) visit India every year. By comparison, domestic tourism is significantly greater. Statistics reveal that we are likely to witness a sharp increase in both domestic and international tourist traffic. The rapid increase in tourism is being fuelled by a wide range of contributory factors as outlined in the table below. Tourism Segment

Growth Drivers

Domestic tourism

Rapidly increasing purchasing power of the middle class. Better road connectivity Evolving lifestyle

International tourism

Development of internationally acclaimed destinations such as Kerala & Rajasthan Favourable perception of Brand India Attractive market that motivates foreign business travelers

The growth in tourism will have to be serviced by a substantial increase in infrastructure, including air-road-rail connectivity, hotels and restaurants. It is in this context that Department of Tourism, Ministry of Tourism & Culture, Government of India, has decided to undertake a study to assess the manpower requirement in the hotel and restaurant sector as well as the tour and travel operation business. Our firm Market Pulse has been commissioned to conduct this study. This document presents the findings of the study.

1

OF REFERENCE 1. To analyze the job opportunities in the hotel sector by assessing : Current manpower requirement and the requirement by 2010 & 2020 of different categories of personnel in star category, heritage hotels, un-approved hotels, restaurants and cafeterias (both region-wise and state-wise) The manpower available in the hotel industry and a comparison of the same with the total workforce. 2. To make an estimate of trained manpower by assessing the number of personnel (category-wise) trained presently and in 2010 & 2020. The institutes to be considered are as follows: National Council for Hotel Management and Catering Technology (NCHMCT) Private sector and other agencies related to travel and tourism 3. To analyze the placement scenario (category-wise) of the students and quantify the number of students ing out from various institutes, offering courses related to travel and tourism. The institutes to be considered would be IHMs/ FCIs under NCHMCT as well as private institutions and other agencies related to travel and tourism. 4. To assess the current manpower requirement as well as for 2010 & 2020, in the tour operation and travel sector.

2

CHAPTER 1

PROJECT METHODOLOGY

3

This study is based on an extensive primary field survey, analysis of secondary data as well as physical scanning of cities. The primary field survey has been carried out in 27 important tourist destinations. These have been selected from different destination categories on the basis of their tourist traffic. More than 900 interviews have been conducted by our field research team, comprising 3 field officers, 2 research associates and a team of 5 field interviewers. The sample composition is detailed in table 1.1. below. The interviewee in each of the segments comprised of middle – senior level managers in the Human Resource departments of large organizations as well as the ownersmanagers of smaller organizations. Secretaries and director level officials of state tourism offices, municipal bodies and relevant hotel associations have also been interviewed. The sample has been randomly selected so as to be representative of a cross-section of that segment. 1.1. Sample composition (Number of Interviews) Region

Cities

Hotels Restaurants

Travel &Tour operators

Hotel Mgmt. Institutes

Tourism offices & Municipalities

Total

North

Delhi

42

59

2

11

3

117

Agra

14

18

2

0

3

37

Haridwar

3

10

0

0

3

16

Shimla

3

5

3

1

2

14

Varanasi

5

13

1

1

4

24

Amritsar

5

10

2

0

2

19

4

Region

Cities

Travel &Tour operators

Hotel Mgmt. Institutes

Tourism offices & Municipalities

Total

South

Trivandrum

11

21

2

1

4

39

Cochin

6

15

2

1

4

28

Ooty

6

14

1

1

0

22

Mysore

3

4

1

1

2

11

Bangalore

8

7

3

3

8

29

Chennai

8

6

1

3

4

22

Tirupati

2

5

2

0

1

10

Hyderabad

2

11

2

3

8

26

Kokata

17

33

4

2

7

63

Bhubanesh

8

11

2

1

6

28

Puri

3

1

1

0

2

7

North

Guwahati

5

12

1

1

9

28

East

Shillong

3

9

0

0

2

14

West & Mumbai

31

77

7

11

7

133

Central

Ahmedabad

10

24

2

2

6

44

Pune

9

20

3

3

3

38

Aurangabad

8

9

1

0

4

22

Goa

15

36

4

2

5

62

Udaipur

10

4

2

1

3

20

Jaipur

7

6

1

2

11

27

Khajuraho

5

6

1

0

2

14

249

446

53

51

115

914

East

Hotels Restaurants

war

All India

5

Project Coverage Hotels

All star category & heritage hotels Others ed with municipal bodies or hotel associations. Various small hotels/ guest houses/ inns scattered in residential areas or located in pockets near the railway station, inter-state bus depots, etc.

Restaurants

All conventional restaurants (AC /non AC) ed with municipal bodies or listed in telephone/trade directories Fast Food chains Dhabas/hawkers/ juice corners Cafeterias, etc.

Travel & Tour

Organized sector players ed with TAAI

Operators

Other small and medium sized travel agencies Ticketing agents

Hotel

Those ed with NCHMCT

Management

Private sector institutes

and Travel & Tour Institutes The states of Jammu & Kashmir and Bihar have not been directly covered in addition to some union territories such as Andaman & Nicobar, Pondicherry and Lakshwadeep. The states covered by our research for 88% and 94% of domestic and foreign tourist visits, respectively. Hence, for purposes of estimating national statistics these contribution ratios have been used.

6

Information Areas Structured questionnaires (refer Appendix 1) were developed for each of the segments under study. The information areas addressed by the questionnaires are briefly mentioned subsequently.

Hotel/ Restaurants/ Travel & Tour Operators Employment pattern across functions Age profile of employees Business particulars Proportion of temporary employees across functions

Institutes of Hotel Management (both private and NCHMCT) Batch size, i.e number of students graduating annually Courses/ Subjects offered Tenure of the course Interviews with the officials of municipal bodies and hotel associations were used to estimate the number of hotels and restaurants in each of the cities under study. Additionally, comprehensive physical scanning of each of the destinations under study was carried out to estimate the proportion of hotels (guest houses, inns and small hotels) and restaurants (including dhabas) in the unorganized sector. A study of the local telephone and trade directories as well as ed Internet websites was also used to estimate the number of travel and tour operators as well as private institutes of hotel management and travel management institutes.

7

CHAPTER 2

TOURISM IN INDIA : A SNAPSHOT

8

Attractiveness of diverse destinations and increased levels of marketing are transforming India into a thriving tourist centre of the world. Although, India’s shape of world tourist arrivals is a mere 0.37%, recent statistics indicate a robust growth of more than 15%. In addition, growth in the disposable income of more than 200 million people belonging to the middle class is changing the profile of domestic tourism. Statistics from Ministry of Tourism and Culture reveal that domestic tourist visits have increased from 191 million in 1999 to an estimated 272 million in 2002. This represents a compounded annual growth rate of 17%. Domestic tourism in both North and North-Eastern regions have ed high growth rates (20% and 63% CAGR, respectively). While Southern India experienced a 6% growth, West/ Central and Eastern regions experienced a marginal decline. The growth rates point towards relative needs for infrastructure development in these regions.

2.1 Geographic Contribution of Domestic Tourism

6%

2.2 Geographic Contribution of Foreign Tourism

13%

35%

1%

8%

41% 39%

North

South

East

West & Central

0%

34% 23%

North East

North

South

East

West & Central

North East

9

2.3. Tourist Traffic in Important Destinations (covered by research) State

City

AP

Hyderabad Tirupati Chennai Ootty Bangalore Mysore Cochin Trivandrum Agra Varanasi Shimla Delhi Haridwar Amritsar Bhubaneshwar Puri Kolkata Guwahati Shillong Mumbai Pune Aurangabad Ahmedabad Goa Jaipur Udaipur Khajuraho

Tamilnadu

Karnataka Kerala UP HP Delhi Uttaranchal Punjab Orissa WB Assam Meghalaya Maharashtra

Gujarat Goa Rajasthan MP

Domestic

Foreign

Total

7099871 7967264 4635278 1806969 5181381 1373637 961820 775225 1543988 3027277 1227710 1228059 5316980 172404 373122 1014449 5280530 1953915 268609 8599938

475131 718325 310198 67014 172880 45832 87357 65240 682737 272938 37860 543036 5859 5057 9611 9691 529366 6409 3146 749206

7575002 8685589 4945476 1873983 5354261 1419469 1049177 840465 2226725 3300215 1265570 1771095 5322839 177461 382733 1024140 5809896 1960324 271755 9349144

584874 1077971 1325296 589414 471576 122616

50953 13179 271645 81451 101303 24093

635827 1091150 1596941 670865 572879 146709

10

2.4. State-Wise Tourist Traffic –2002 (covered by research) Domestic

Foreign

Total

Andhra Pradesh

60487370

210310

60697680

Tamil Nadu

41274392

804641

42079033

Karnataka

8678170

59545

8737715

Kerala

5568256

232564

5800820

MP

6487773

111813

6599586

UP

73067000

109464

73176464

HP

4958917

144383

5103300

Orissa

3289205

23279

3312484

Assam

2833042

4262

2837304

Meghalaya

268609

3146

271755

Rajasthan

8300190

428437

8728627

WB

8503573

531335

9034908

Delhi

1228059

543036

1771095

Utranchal

11818221

55762

11873983

Maharashtra

10896408

949269

11845677

Gujarat

5735286

34187

5769473

Goa

1325296

271645

1596941

Punjab

305977

8975

314952

237874638

4526231

242400869

88

94

88

271840337

4828624

276668961

Total Contribution % All India

11

CHAPTER 3

HOTELS IN INDIA

12

One of the pillars of tourism infrastructure is made up of the places of lodging. Given the disparate socio-economic profile of domestic tourists, hotels exist in both the organized and the unorganized sector. In addition to the star category hotels, there are smaller hotels, guesthouses and inns that cater largely to domestic tourists. The pilgrimage destinations also have a large number of dharmashalas to the seasonal increase in the number of tourists. In this study, we have carried out the required analyses for the following 3 segments: 5star, 4 star and heritage hotels Three, two & one star hotels Small budget hotels, guesthouses & inns in the unorganized sector. 3.1. A Hotel Map There is an estimated 1171000 hotel rooms in the country in both the organized and unorganized sectors combined. The star category and heritage hotels for 7% of the hotel rooms; the balance is contributed by other places of lodging such as budget hotels, guesthouses and inns.

13

3.1 % Contribution of Hotel Segments to Total Rooms 3% 4%

93%

5star/4star/Heritage Hotels

1-3 star Hotels

Others

3.1.1. Five & Four Star/ Heritage Hotels These hotels have a total of almost 36000 rooms. The metropolitan cities of Delhi (21%), Mumbai (17%), Chennai (7%), Hyderabad (5%) and Kolkata (5%) for 55% of the rooms in this category. Goa s for 7% of the rooms. 3.1.2. Three, Two & One Star Hotels These hotels have 43000 rooms and are more extensively spread than their larger counterparts. They are not concentrated in the metropolitan cities. Both Mumbai and Goa have a significantly higher presence of these hotels; they together for 5939 rooms (14%). The states of Andhra Pradesh (5045 rooms), Tamil Nadu (6213 rooms) and Maharashtra (6588 rooms) together for almost 42% of the rooms in this category.

14

3.1.3. Other Hotels in the Unorganized Sector These hotels are also well spread throughout India; their presence is correlated with the number of domestic tourists visiting different tourist destinations. The 3 states of U.P, Rajasthan and Tamil Nadu for almost 45% of the total availability in the country. 3.2. State-wise Rooms Availability 2002 State

Total rooms

5 & 4 Star Hotel rooms

Other Hotels

2007

1, 2 & 3 Star Hotel rooms 5045

Andhra Pradesh

58362

Tamilnadu

89293

2431

6213

80649

Karnataka

71897

1875

1967

68055

Kerala

44049

1464

3694

38891

MP

39181

547

922

37712

UP

295436

2504

1739

291193

HP

53236

262

372

52602

Orissa

46683

389

703

45591

Assam

10900

160

414

10326

Meghalaya

2115

50

115

1950

Rajasthan

128823

3351

2798

122674

WB

17278

1797

1428

14053

Delhi

27272

7677

1507

18088

Uttaranchal

17846

323

1013

16510

Maharashtra

51893

7561

6588

37744

Gujarat

60468

712

1629

58127

Goa

11924

1819

1099

8952

Punjab

8975

499

1508

6968

1171121

35574

42991

1092556

All India

51310

15

3.2. Total Rooms Availability per Lakh Tourists Places of pilgrimage such as Tirupati and Haridwar have significantly lower availability of rooms – 28 and 150 rooms per lakh of tourists, respectively. Even Agra’s availability of rooms is substantially lower (175) than the national average. However, this could be attributed to the fact that a large number of Agra tourists stay in Delhi. By comparison, states such as Delhi, Karnataka, Himachal Pradesh, Orissa, Rajasthan and Gujarat have substantially higher availability of rooms for tourists. 3.3. State-wise Availability of Rooms State

City

58362

Rooms per lakh Tourists 96

Hyderabad

13183

174

Tirupati

2452

28

89293

351

Chennai

17577

355

Ooty

6334

338

71897

823

Bangalore

51507

962

Mysore

4230

298

44049

759

Cochin

5861

559

Trivandrum

8488

1010

39181

594

871

594

Andhra Pradesh Tamilnadu

Karnataka

Kerala

M.P Khajuraho

Total Rooms

16

State

City

295436

Rooms per lakh Tourists 404

Agra

3891

175

Varanasi

18423 53236 13202 46683 3467 16360 10900 10900 2115 2115 128823 12874 5482 17278 10709 27272 17846 8000 51893 28682 2935 15060 60468 11436 11924 8975 5057 1171121

558 1043 1043 1409 906 1597 556 556 778 778 1476 1919 957 184 184 1540 150 150 438 307 NA 2369 1048 1048 747 2850 2850 423

U.P

H.P Shimla Orissa Bhubaneshwar Puri Assam Guwahati Meghalaya Shillong Rajasthan Jaipur Udaipur W.B Kolkata Delhi Uttaranchal Haridwar Maharashtra Mumbai Pune Aurangabad Gujarat Goa Punjab

Ahmedabad Goa Amritsar

All India

Total Rooms

17

3.3. Growth in Tourist Traffic 2003-10 (Projected Growth)

1999-2002

Andhra Pradesh

12.7

10.0

Tamilnadu

5.0

-18.5

Karnataka

5.0

4.5

Kerala

5.0

6.4

Madhya Pradesh

14.7 4.7

Himachal Pradesh

5.0

Orissa

5.0

6.8 408.0 18.9

Assam

20.0

Meghalaya

20.0

Rajasthan

6.4 24.2 -14.1

5.0

West Bengal Delhi

16.3

10.0

10.0 5.0 10.0

Uttar Pradesh

10.0

Uttaranchal

5.0

11.4

Maharashtra

5.0

Gujarat

-20.7

5.0

8.7

Goa

5.0

9.7

Punjab

5.0

Growth statistics pertaining to tourist traffic are based on statistics of Ministry of Tourism. For the period 2003-10, we have assumed that growth in tourist traffic will follow more or less the same trend as in the past. Thus, some (north-eastern state are likely to experience very quick annual growth of approximately 20%, others like Delhi, U.P, Tamul Nadu and Karnataka, where growth has already slowed down, will experience a 5% growth annually. Still others like W.B, A.P and M.P are likely to grow at 10% annually, since they have displayed robust statistics in the recent past.

18

3.4. Rooms Availability: A Forecast (2010 – 2020) In order to arrive at an estimate of hotel rooms in different states, the following bases have been assumed. The growth in star category hotels will follow the same trend as in the last 4 years. This trend has been obtained from the projects approved by the Ministry of Tourism in the last 4 years. If growth rate in tourism accelerates, this estimate can be treated as a conservative estimate. The growth in hotels in the unorganized sector will depend on the growth in tourism (domestic and foreign combined). The other assumption is that the 18 important states covered in the primary research will continue to represent 88% of hotel rooms in the unorganized sector. In 2010, there will be a total of 2.9 million hotel rooms, more than twice the numbers in 2002. Star category hotels will have almost 100,000 hotel rooms, while the balance will be present in the unorganized sector. The states of Andhra Pradesh, Madhya Pradesh, Uttar Pradesh, Assam/Meghalaya and West Bengal will the quickest growth trends. The states of Delhi, Karnataka and Gujarat might experience a stagnant phase. These are also those states that already have a high availability of hotel rooms. In the year 2020, there should be approximately 6.6 million hotel rooms, if the full potential of tourism is tapped. We feel that the contribution of North-eastern states as well as J&K, would be substantially higher than the present levels.

19

3.5. Rooms Availability in 2010 (A Forecast) State Andhra Pradesh

141312

4/5 star Hotels 1802

Tamilnadu

144250

3609

8327

132314

Karnataka

76034

2875

3159

70000

Kerala

64595

2396

7102

55097

Madhya Pradesh

114919

857

1360

112702

Uttar Pradesh

978216

3340

1779

973097

Himachal Pradesh

76769

342

372

76055

Orissa

78758

589

879

77290

Assam

45068

154

514

44400

Meghalaya

7950

50

115

7785

Rajasthan

209019

3815

3106

202098

West Bengal

83336

2421

1576

79339

Delhi

31528

9807

1721

20000

Uttaranchal

36727

323

1013

35391

Maharashtra

107952

10333

8324

89295

Gujarat

12281

732

2501

9048

Goa

21989

3035

1545

17409

Punjab

17372

975

1822

14575

2877168

46690

54867

2775611

All India

Total rooms

1-3 star Hotels 5973

Other 133537

20

3.6. Rooms Availability in 2020 (A Forecast) State Andhra Pradesh

355296

4/5 star Hotels 1802

Tamilnadu

231577

5082

10970

215526

Karnataka

122797

4125

4649

114023

Kerala

104671

3561

11362

89748

Madhya Pradesh

295471

1245

1908

292319

Uttar Pradesh

2530177

4385

1829

2523963

Himachal Pradesh

124699

442

372

123885

Orissa

127836

839

1099

125898

Assam

275706

154

639

274913

Meghalaya

48369

50

115

48204

Rajasthan

337082

4395

3491

329196

West Bengal

210746

3201

1761

205784

Delhi

47036

12470

1989

32578

Uttaranchal

58984

323

1013

57648

Maharashtra

169744

13798

10494

145452

Gujarat

19087

757

3591

14739

Goa

35016

4555

2103

28358

Punjab

27526

1570

2215

23741

6554019

49469

57836

6446714

All India

Total rooms

1-3 star Hotels 7133

Other 346361

21

CHAPTER 4

EMPLOYMENT IN HOTELS

22

4.1. Employment Pattern

4.1.1. Five, Four Star/Heritage Hotels: A single five star hotel could employ more than 400 employees. A total of 57508 people are employed to service about 36000 rooms in this category. On an average, there are approximately 162 employees per 100 rooms in these hotels. The employment pattern is the across geographic regions. The major employing functions are F&B Service, F&B Kitchen and Housekeeping. They, together, for 56% of the total employment in these hotels.

4.1. % Contribution of Key Functions to Employment

7%

15%

7%

21%

8% 7% 15%

F&B service Housekeeping Management Purchase/stores & s

20%

F&B kitchen Front office Engineering Others

23

4.1.2. Three, Two & One Star Hotels A total of 52,577 employees are present in these hotels to service almost 42,991 rooms nationally. On an average, there are 122 employees per 100 rooms in this category. The key employing functions are F&B and housekeeping. They together for 62% of the total employment in these hotels. To a large extent, the employment across geographic regions depends on the 4.2. % Contribution of Key Functions to Employment

7%

12%

8%

20%

9%

22%

22% Management F&B service Housekeeping Others

Front office F&B kitchen Purchase & s

presence of hotels; however, there are some differences in the employment intensity across regions. 4.3. Regional Employment Intensity 149

North

123

South

170

East West Overall

77 122

24

4.1.3. Other Hotels in the Unorganized Sector : There are approximately 638,000 employees working in hotels in the unorganized sector. These almost 58 employees for every 100 rooms in this sector, substantially less than in the star category hotels. 4.4. % Contribution of Key Functions to Employment

23% 6% 13%

21%

23%

14%

F&B service

F&B kitchen

Housekeeping

Management

Purchase & s

Others

Although employment pattern across geographic regions depends on the presence of hotels, there are some minor differences in the employment intensity across regions.

4.5. Regional Employment Intensity 63

North

South

East

West

North East

59 48 61

67

25

4.2.1 Employment in Five, Four Star/ Heritage Hotels State

Manage ment team

Front office

Andhra Pradesh

284

237

Tamilnadu

343

Karnataka

F&B kitchen

House keeping

s

Total

727

683

520

259

3493

287

880

827

630

314

4231

265

221

679

638

486

242

3263

Kerala

206

173

530

498

379

189

2548

M.P

78

64

198

186

142

71

952

U.P

353

295

907

852

648

323

4358

H.P

37

31

95

89

68

34

456

Orissa

55

46

141

132

101

50

677

Assam

22

19

58

54

41

21

278

Meghalaya

6

6

18

17

13

7

87

Rajasthan

473

395

1213

1141

868

432

5832

W.B

254

212

651

612

465

232

3127

Delhi

1083

905

2780

2613

1988

991

13361

Uttaranchal

45

38

117

110

84

42

562

Maharashtra

1067

891

2738

2573

1958

976

13159

Gujarat

99

84

258

242

184

92

1239

Goa

257

214

659

619

471

234

3166

Punjab

70

59

181

170

129

64

868

4661

3896

11965

11247

8557

4267

57508

All India

F&B service

26

4.2.2 Employment in Three, Two & One Star Hotels State

Manage ment team

Front office

F&B service

F&B kitchen

House keeping

s

Total

Andhra Pradesh

252

397

1346

1685

1607

522

6188

Tamilnadu

311

489

1658

2075

1980

644

7620

Karnataka

99

155

525

657

627

204

2413

Kerala

184

291

986

1234

1177

383

4531

M.P

137

91

156

189

134

78

710

U.P

191

251

584

416

399

120

2591

H.P

42

54

125

89

85

25

554

Orissa

35

70

316

328

246

71

1195

Assam

21

41

186

193

145

42

704

Meghalaya

6

12

52

54

40

12

196

Rajasthan

413

275

474

573

405

237

2156

W.B

72

143

643

666

500

143

2428

Delhi

167

217

506

360

345

104

2246

Uttaranchal

112

146

340

242

232

70

1509

Maharashtra

972

648

1116

1350

954

558

5076

Gujarat

240

160

276

334

236

138

1255

Goa

162

108

186

225

159

93

847

Punjab

167

218

507

361

346

105

2247

All India

4114

4616

11776

11776

10533

3728

52577

27

4.2.3 Employment in Hotels in Unorganized Sector State

Manage

Front

F&B

F&B

House

ment

office

service

kitchen

keeping

s

Total

team

Andhra Pradesh

1779

2386

2022

1941

5499

1011

30446

Tamilnadu

2797

3750

3178

3051

8643

1589

47856

Karnataka

2360

3164

2681

2574

7294

1341

40383

Kerala

1349

1808

1532

1471

4168

766

23077

M.P

2788

3307

4452

2896

5360

1491

23016

U.P

18864

22980

36356

25381

43902

10633

184182

H.P

3408

4151

6568

4585

7931

1921

33271

Orissa

4115

863

5509

2987

5045

1128

21904

Assam

500

318

1638

1365

1410

454

6869

Meghalaya

94

60

309

258

266

86

1297

Rajasthan

9070

10756

14482

9420

17434

4850

74870

W.B

1266

266

1695

919

1552

347

6741

Delhi

1171

1427

2258

1577

2727

660

11441

Uttaranchal

1069

1303

2061

1439

2489

603

10443

Maharashtra

2790

3309

4456

2898

5364

1492

23036

Gujarat

4298

5097

6862

4464

8261

2299

35476

Goa

665

790

1063

692

1280

356

5496

Punjab

451

550

870

607

1051

254

4407

84309

66866

135847

86688

147740

38058

637739

All India

28

4.3. Employment Forecast (2010 – 2020) The employment forecast has been computed on the basis of the forecast of hotel rooms in different categories. Employment intensity per room has been assumed to be the same as the present level. The employment potential in different states is in direct proportion to the number of hotel rooms in future.

4.6. 4.6. Employment Employment Forecast Forecast 3455144 3455144

3261666 3261666

1551333 1551333

1405080 1405080

83077 83077

110434 110434

5star/4star/Heritage 5star/4star/Heritage

63176 63176

83044 83044

1-3 1-3stars stars

2010 2010

Others Others

Total Total

2020 2020

In the years 2010 and 2020, there will be more than 1.5 million and 3.4 million people employed in hotels, respectively. However, given the trend in the growth of star category hotels and the higher employment intensity in these hotels, we expect a substantially higher numbers of employees in the five & four star/heritage hotels.

29

4.4. Employment in Motels The national and state highways have a substantial number of motels along their length. In this study, we have estimated the number of motels for every 100 km of road covered, via physical counting on a sample of highways. The results of this scan are mentioned in the table below. National Highway Delhi-Agra

Road Length 203

# Motels 21

# Motel Rooms 315

Delhi-Jaipur

258

58

870

Mumbai-Pune

163

63

945

Agra-Fathepur Sikri

42

3

45

Fathepur-Bharatpur

22

17

255

Cochin-Trivandrum

220

60

900

Total

908

222

3330

Road Length 139

# Motels 10

# Motel Rooms 100

Mysore-Ooty

140

2

20

Total

279

12

120

State Highway Bangalore-Mysore

The average number of rooms in the motels on national highways and state highway have been assumed as 15 and 10, respectively. Total Length

# Rooms

Employment Total Intensity per Employment Room 0.575 72820

National highway

34508

126644

State highway

135187

59482

0.575

34202

Total

169695

186126

0.575

107022

The highways have more than 107,000 employees working in motels throughout the country.

30

CHAPTER 5

PROFILE OF HOTEL EMPLOYEES

31

5.1. Educational Background of Personnel in Key Functions 5.1.1. Front Office Five, Four Star/ Heritage Hotels: Our survey reveals that the pre-requisite for the managerial and supervisory positions is a hotel management degree; a few of the office assistants in the front office are graduates from other disciplines. Three, Two & One Star Hotels: 44% of the positions are occupied by graduates without training in hotel management. A majority of the office associates (more than 60%) are either graduates from other fields or SSC -outs. Hotels in the Unorganized Sector: Only one in every eight managers is having a hotel management degree or an MBA. A majority of them are graduates while almost 35% have just completed their SSC level school education. On the other hand, almost 72% of the office assistants have a school level certificate only. 5.1.2. F&B Service Five, Four Star/ Heritage Hotels: Most managers and captains are having a hotel management degree. A few captains (30%) are having a certificate in cookery from the food craft institutes. The stewards and waiters have either a hotel management degree or a Food Craft Institute Certificate. Three, Two & One Star Hotels: Almost half the managers and captains have a hotel management degree/diploma or a Food Craft Institute Certificate. Most stewards and waiters possess an SSC level school certificate only. Hotels in the Unorganized Sector: While one-third of the managers are hotel management students, the rest are either plain graduates or SSC . The stewards and particularly the waiters predominantly have a SSC level school certificate only.

32

5.1.3. F&B Kitchen Five, Four Star/ Heritage Hotels: Almost 90% of the chefs are hotel management graduates, while 80% of the cooks are either hotel management graduates or food craft diploma certificate holders. While most helpers in the kitchen possess an SSC level school education, a few (20%) have a cookery certificate as well. Three, Two & One Star Hotels: While ¾ of the chefs are hotel management graduates, 1/6 of them and half of the cooks are merely SSC . Most helpers are school and are not expected to have any special qualification. Hotels in the Unorganized Sector: A majority of those presently employed in the kitchens are SSC ; only 1/3 of them are either hotel management graduates or food craft certificate holders. 5.1.4. Housekeeping Five, Four Star/ Heritage Hotels: Almost 80-90% of the managers and supervisors are hotel management graduates. Half the room attendants are hotel management graduates while the balance are mostly SSC . Three, Two & One Star Hotels: While 60% of the managers are hotel management graduates, the balance are equally either graduates or SSC . Approx. ¾ of the supervisors are either college graduates or SSC ; 30% of them are hotel management graduates. Most room attendants are just SSC . Hotels in the Unorganized Sector: A majority of the supervisors and room attendants are SSC ; 1/3 of the managers are hotel management graduates.

33

5.1.5. Other Functions Purchase, HRD and Sales & Marketing in both 1-3 star and small hotels have graduates while the bigger hotels prefer MBAs. The engineering functions have employees with an engineering degree or an ITI diploma. The proportion of degree holders increases with the size of the hotel. Function-wise summary of Educational Qualification Functions Front Office

5/4 star 1-3 Star Hotels Hotels/Heritage

All are Hotel A number of Management managers & Degree supervisors have a hotel management degree F&B Service All are Hotel 50% have a Hotel Management Management Degree/ Food Degree or Food Certificate holders Craft certificate F&B Kitchen Most are Hotel Chefs are Hotel Management degree Management degree or Food craft holders certificate holders Housekeeping Most supervisors/ Managers & are managers are Hotel supervisors Management degree Hotel management graduates holders Purchase, HR MBAs Graduates

Unorganized sector

1/8 managers are post-graduates in hotel management

1/3 managers are Hotel Management degree holders Largely trained on the job

A few managers are Hotel Management graduates, largely SSC Graduates

and Sales & Marketing

34

5.2. Age Profile of Employees 5.2.1. Five, Four Star/ Heritage Hotels: None of the employees are more than 50 years old. Bulk of them are less than 40 years of age; particularly in the key functions of front office, F&B and housekeeping. A majority of them are less than 30 year of age.

5.1. % Contribution of Age Segments to Employment 21% 0% 15% 37%

27% 18-25 years 41-50 years

25-30 years >50 years

31-40 years

5.2. % Age Profile of Workforce in Key Functions

F&B kitchen

F&B service

Front office

<30 years

21

67

Housekeeping

12

31

56

5

27

68

59

31-40 years

13

23

41-50 years

19

>50 years

35

5.2.2. Three, Two & One Star Hotels: A majority of the people (52%) employed in these hotels are less than 30 years of age. A negligible proportion is more than 50 years of age. More than 60% of the workforce employed in the front office, F&B service and housekeeping are less than 30 years of age.

5.3. % Contribution of Age Segments to Employment 15% 2% 31%

26%

26% 18-25 years 41-50 years

25-30 years >50 years

31-40 years

36

5.2.3. Hotels in the Unorganized Sector: By comparison to hotels in the star category, a significantly higher proportion (59%) of employees in these hotels are less than 30 years of age. Only 8% of the workforce is more than 50 years of age. The age profile of the workforce in these hotels is young. More than 80% of those employed in the key hotel functions are less than 40 years of age.

5.5. % Contribution of Age Segments to Employment 13%

8%

20% 22%

37% 18-25 years 41-50 years

25-30 years >50 years

31-40 years

5.6. % Age Profile of Workforce in Key Functions 86

Housekeeping

F&B kitchen

71

<30 years

24

6

84

F&B service

Front office

10 31

15

64 31-40 years

16 41-50 years

13

1

8

>50 years

37

5.3. Organizational Structure in Key Hotel Functions 5.3.1. Front Office : The principal tiers in the front office comprise of managers, supervisors and office assistants. Bulk of the employees in the front office of star category hotel are office assistants. In smaller hotels, the front office has a larger proportion of managers; there are fewer supervisors.

5.7 % Contribution of Organizational Tiers to Employment

5Star/4Star/Heritage Hotels

23

1-3 Stars Hotels

23

24

30 40

Other Hotels

Managers

54

47 16

Supervisors

44

Office Assistants

5.3.2. F&B Service: In the unorganized sector, most of the workforce consists of waiters/stewards. The proportion of managers, captains and stewards increases with the size of the hotel. 5.8. % Contribution of Organizational Tiers to Employment

5Star/4Star/Heritage Hotels

8

1-3 Stars Hotels

7

Other Hotels

24

14

4 6

Managers

49

19

37

42

68

21

Captains

Stewards

Waiters

38

5.3.3. F&B Kitchen : In the larger hotels, almost 15% of the workforce comprises of chefs. However, a bulk of the employees are cooks. 5.9. % Contribution of Organizational Tiers to Employment

15

5Star/4Star/Heritage Hotels

1-3Stars Hotels

6

Other Hotels

5

52

33

33

60

51

Chefs

44

Cooks

Helpers

5.3.4. Housekeeping : Managers and supervisors for 10-20% of the workforce in housekeeping. A bulk of the employees are room attendants.

5.10. % Contribution of Organizational Tiers to Employment

5Star/4Star/Heritage Hotels

1-3Star Hotels

Other Hotels

Manager

3

11

5

14

2 8

Supervisors

51

35

54

26

22

68 Room Attendants

House-men

39

CHAPTER 6

RESTAURANTS IN INDIA

40

The burgeoning middle class and evolving lifestyle is driving the demand for quality restaurants - both conventional ones as well as new ones such as fast food outlets, cafés and pubs. These restaurants will cater to both the foreign and domestic tourists travelling to key tourist destinations. The low cost mobile food vans, sweet shops, dhabas and juice corner cater primarily to the lower and middle-income population segment. Since the presence of restaurants is largely dependent on the resident population, the computations are based on sample statistics and population data obtained form the Census of India. 6.1. A Map of Restaurants On this basis, our estimate is that there are more than 140, 000 restaurants in urban India. The 18 states covered by our primary research have 124,000 restaurants. These states for 88% of the urban Indian population. Conventional restaurants for the largest population (30%) followed by sweet shops (16%), fast food outlets (16%) and dhabas (13%). Northern region has over 10,000 fast food outlets, serving Chinese, Western and Indian food. 6.1. Estimated Number of Restaurants Conventional Restaurant Café

42261 8433

Fast food

21940

Sweet shop

22451

Dhaba

18162

Juice Corner

12329

Others

15446

141022

Total

41

6.2. % Contribution of Restaurant Categories to Total

13% 16%

8%

30%

16% 6% Restaurant Fast food Corner

11% Pubs/Bars Sweet shop

Café Dhaba

42

6.2. Geographic Spread The northern region s for 34% of the outlets followed by the west (26%). The metropolitan cities of Delhi & Mumbai for almost 15% of the restaurants. Almost 35% of the café/ tea & coffee vendors are in South India; however sweet shops are fewer. Mobile food vans are few in numbers and are located in the larger cities of North and South India only. 6.3. % Contribution of Regions to Total Restaurants 26% 12% 16%

1% 13% 32% North West & Central

East Others

North East State total

6.3. Restaurant Penetration While the number of conventional restaurants ranges between 10-20 per lakh of population, the total number of eating places could be as high as 86 per lakh of population (as in the Northern Region). This is on of higher penetration of fast food outlets, sweet shops, dhabas and juice corners.

43

6.4. Restaurants Penetration (Numbers per Lakh Population) Region Conven tional ones

Pubs/ Bars

Café

Fast food

Sweet shop

Dhaba

Corner

All Outlets

South

12

1

3

4

2

5

3

31

North

13

8

7

19

15

12

11

86

East

19

6

1

8

15

4

5

59

North

15

2

1

3

0

3

1

25

17

8

0

4

6

5

1

41

East West & Central

44

6.5. State-wise Estimate of Restaurants State

Conven tional one s

Café

Fast food

Sweet shop

Dhaba

Juice Corner

All Outlets

2552

714

726

491

962

678

6319

Tamilnadu

3386

948

963

651

1276

899

8384

Karnataka

2228

624

634

428

840

592

5518

Kerala

1033

289

294

199

389

274

2558

Uttar

4468

2508

6548

5152

4226

3772

29349

78

44

114

90

73

66

510

Delhi

1657

930

2428

1910

1567

1399

10881

Punjab

1062

596

1556

1224

1004

897

6976

Orissa

1067

65

450

822

220

296

3251

West

4367

267

1841

3361

899

1211

13299

Assam

526

29

102

0

102

44

862

Maharashtra

6924

197

1699

2459

2050

348

16779

Gujarat

3192

91

783

1133

945

160

7735

Goa

227

6

56

81

67

11

550

Rajasthan

2229

64

547

792

660

112

5402

Madhya

2719

77

667

965

805

136

6589

42261

8433

21940

22451

18162

12329

141022

Andhra Pradesh

Pradesh Himachal Pradesh

Bengal

Pradesh All India

45

6.4. Restaurants Forecast : 2010 - 2020 We estimate that there would be almost 196,000 restaurants in 2010 and then 237,000 in 2020. The increase is based on expected population growth and does not take into new developments and evolution of restaurants. The mix of restaurants is definitely going to change; however, the future mix is difficult to forecast. The shares of the north and east are likely to increase in future, because of expected differential in population growth rates. The penetration of restaurants in of numbers per lakh of population has been assumed as the same as the present one.

6.6. Estimated Number of Restaurants (2010)

56781 Café

11985 31510

Sweet shop

31542 25516

Juice Corner Total

17621 21501

196456

46

6.7. Estimated Number of Restaurants (2020)

67661

Restaurant Café Fast food Sweet shop Dhaba Juice Corner Others Total

14552 38477 38226 30915 21450 26016

237297

47

CHAPTER 7

EMPLOYMENT IN RESTAURANTS

48

7.1.1. Conventional Restaurants There is an average of 26 people employed (both permanent and temporary) for every 100 chairs in restaurants. Almost 80% are employed in the kitchen and service functions, while the balance are almost equally distributed between management, store, security, maintenance and delivery. 7.1. % Contribution of Key Functions to Employment 18% 2%

42% 38% Management

Kitchen

Service

Others

There are some geographic differences in the employment intensity of restaurants. While the restaurants in the east have 31 employees per 100 chairs, in the north east, there are only 19 per 100 chairs.

7.2. Regional Employment Intensity 26

North

22

South

31

East North east West Overall

19 28 26

49

7.1.2. Café/Coffee Tea Shops There are an average of 31 people employed for every 100 chairs in cafes. The employment pattern is the same as in traditional restaurants, with 74% of the employees in the kitchen/service functions. 7.3. % Contribution of Key Functions to Employment 16% 10%

35%

39% Management

Kitchen

Service

Others

There is some geographic difference in the employment intensity of restaurants. While the restaurants in the north have 56 employees per 100 chairs, in the south, there are only 16 per 100 chairs. 7.4. Regional Employment Intensity 56

North South

16

East/North east

23

West

23

Overall

31

50

7.1.3. Fast Food restaurants There are an average of 32 employees for every 100 chairs. This is on of the higher number of employees in the delivery function, which is a recent trend. fast food restaurants have more people for management of outlets. 7.5. % Contribution of Key Functions to Employment 16%

12% 13%

28%

31% Management Delivery

Kitchen Others

Service

There is one significant difference across the various geographic regions. While fast food restaurants generally have 24-28 employees per 100 chairs, in the West, there are 36 for every 100 chairs. 7.6. Regional Employment Intensity North

28

South

26

East

24 36

West Overall

32

51

7.1.4. Dhabas/Bhojanalaya Even Dhabas employ 26 people for every 100 chairs. However, the functions are limited to management and predominantly kitchen and service. 7.7. % Contribution of Key Functions to Employment 46%

12%

42% Management

Kitchen

Service

There is not much geographical difference in the employment intensity. Only the north east has significantly less number of employees (18 per 100 chairs).

7.8. Regional Employment Intensity North

29 22

South

31

East North east

18

West

27

Overall

26

52

7.2. Employment Potential 7.2.1. Employment Potential of Conventional Restaurants There are almost 926,000 people employed in conventional restaurants across the country. The employment potential of different regions is different from the spread of restaurants because of the difference in employment intensity.

926073

7.9. Employment Potential

383663

352543

76957 Total

Service

Kitchen

Management

7.2.2. Employment Potential of Fast Food Outlets There are already more than 280,000 people employed in fast food restaurants across the country. Almost 47% of them are in the North which has the highest member of fast food outlets as well as a high employment intensity. The West s for 21% of employees in fast food outlets.

53

7.10. Employment Potential

284296

85059

103684 36524

27439 Total

Delivery

Service

Kitchen

Management

7.2.3 Employment Potential of Cafes There are more than 270,000 people employed in cafes across the country. Almost 72% of them are in the north, which has the highest employment intensity.

270108

7.11. Employment Potential

106034

125645

15042 Total

Service

Kitchen

Management

54

7.2.4. Employment Potential of Dhabas/Bhojanalayas There are almost 1.8 lakh people employed in Dhabas and Bhojanalayas. 7.12. Employment Potential

179342

76980

76822

17635

Total

Service

Kitchen

Management

7.3. Total Employment in Restaurants

7.13. Total Employment

1852859

926073

Conventional Restaurants

284296 Fast food

270108

Café

179342 Dhabas

Sweet shops

Juice corner

Total

24658

168382

55

7.4. State-wise Employment in Different Restaurant Categories 7.4.1. Conventional Restaurants States Management Kitchen Service Total AP

3757

21972

24774

55980

Tamil Nadu

4985

29152

32870

74275

Karnataka

3280

19182

21629

48873

Kerala

1521

8894

10028

22660

UP

7428

41814

39838

98066

HP

130

730

695

1712

Delhi

2755

15507

14774

36369

Punjab

2253

12681

12081

29740

Orissa

1349

5735

5510

14337

WB

5523

23472

22552

58680

Maharashtra

15448

57771

67706

165733

Rajasthan

4973

18598

21796

53353

MP

6066

22686

26588

65082

Gujarat

7121

26633

31213

76404

Goa

506

1894

2220

5433

Assam

625

3516

3350

8246

76957

352543

383663

926073

All India

56

7.4.2. Cafe States

Management

Kitchen

Service

Total

U.P

5852

56848

47652

120384

Delhi

2170

21080

17670

44640

Punjab

1391

13509

11324

28608

H.P

103

997

836

2112

0

116

58

174

A.P

714

4284

3570

9282

Tamilnadu

948

5688

4740

12324

Karnataka

624

3744

3120

8112

Kerala

289

1734

1445

3757

Maharashtra

519

1163

1311

3760

Rajasthan

169

378

426

1221

M.P

203

454

512

1470

Gujarat

240

537

606

1737

Goa

16

35

40

115

15042

125645

106034

270108

Assam

All India

57

7.4.3. Fast Food States Management

Kitchen

Service

Total

Orissa

446

893

2381

4465

West Bengal

1827

3653

9741

18265

Uttar Pradesh

9957

28210

19913

68036

Delhi

3692

10460

7384

25228

Punjab

2366

6704

4732

16167

H.P

173

491

347

1185

A.P

1089

5082

2904

10346

Tamilnadu

1445

6741

3852

13723

Karnataka

951

4438

2536

9035

Kerala

441

2058

1176

4190

Maharashtra

4417

10194

9005

36019

Rajasthan

1422

3282

2899

11596

M.P

1734

4002

3535

14140

Gujarat

2036

4698

4150

16600

Goa

146

336

297

1187

36524

103684

85059

284296

All India

58

7.4.4. Dhaba/Bhojanalayas States Management

Kitchen

Service

Total

AP

556

3751

3751

8127

Tamilnadu

1025

6917

6917

14986

Karnataka

675

4553

4553

9865

Kerala

312

2109

2109

4569

U.P

3210

15513

14978

36376

Delhi

1190

5752

5554

13488

Punjab

763

3686

3558

8642

HP

55

268

259

628

Orissa

283

585

777

1685

WB

1155

2392

3175

6887

Maharashtra

2828

9899

9742

23412

Rajasthan

911

3187

3136

7538

M.P

1111

3887

3826

9194

Gujarat

1304

4563

4491

10793

Goa

92

324

318

765

Assam

51

357

459

867

17635

76980

76822

179342

All India

59

7.5 All India Employment Forecast 2010

2020

Conventional Restaurants Kitchen

1226307

1436196

467249

546542

Service

507467

594100

253947

306377

Kitchen

109037

131475

Service

108504

130688

406768

504563

Kitchen

189566

235289

Service

159872

198390

Fast Food

401608

487809

Kitchen

147692

179824

Service

119581

144927

Dhabas

Cafe

7.6. All India Restaurant Employment Forecast for Key Functions

2288630

2734945

913594

Total

1093130

895424

Kitchen 2010

1068105

Service 2020

60

7.7. Employment in Highway Restaurants The national and state highways have a substantial number of eating places, to cater to both the commercial as well as leisure road travelers. These eating-places comprise mainly of conventional restaurants, fast food outlets, tea/ coffee vendors and dhabas. Physical scanning of the highways revealed the following penetration of restaurants and dhabas. Outlet Type

Numbers per 100 km

100 # per km on State Highways

Highways (NH)

(SH)

Restaurants

39

16

Dhabas

80

29

Outlet Type

Employment Intensity

Employment

per on NH

Employment

Total

on SH

100 chairs

Restaurants

26

175,000

280,000

455,000

Dhabas

26

360,000

510,000

870,000

535,000

790,000

1,325,000

Total

There are more than 1.3 million people already employed on the national and state highways. Presently, these restaurants and dhabas employ untrained people in their kitchens and service functions. By 2020, progressively higher proportions will belong to the organized sector. Even a 10% share for the organized sector, at present levels of employment intensity, could create almost 130,000 jobs for trained manpower.

61

CHAPTER 8

PROFILE OF RESTAURANT EMPLOYEES

62

8.1. Structure of Different Departments 8.1.1 F&B Kitchen

Conventional Restaurants: While 9% of the employees are chefs, the balance are either cooks or helpers in almost equal proportion. 8.1. % Contribution of Organizational Tiers to Employment 9

Conventional Restaurants

Dhaba

Fast food

Café

48

1

43

57

43

22 11

Chefs

49 44 Cooks

29

46

Helpers

Dhaba: The proportion of helpers is comparatively small (43%); bulk of the employees are cooks (57%).

Fast Food Outlets: The fast food restaurants have a sizeable proportion of chefs

(22%), thereby indicating a preference for qualified and trained manpower.

Café: These outlets have an employment structure similar to that of restaurants.

63

8.1.2. F&B Service A bulk of the people (more than 80%) employed in the service function are either stewards or waiters. The definition of different designations is flexible and varies across outlet category. Both conventional restaurants and cafes have a sizeable proportion of captains (approx. 12%). Dhabas have waiters only. 8.2. % Contribution of Organizational Tiers to Employment Conventional Restaurants

Dhaba

4

2

83

1

99

14

Fast food

Café

12

2

4

82

12

Hall incharge

86

Captains

Butlers

Stewards & Waiters

64

8.1.3. Store A bulk of the employees in the stores of restaurants are designated store keepers. A majority of those in the store of fast food restaurants are helpers. 8.3. % Contribution of Organizational Tiers to Employment

Conventional Restaurants

13

20

54

Dhaba

Fast food

66

19

Café

Store managers

46 25

56

71 Store keepers

29

Helpers

65

8.2. Age Profile of Employees A majority of those employed in the kitchen, service, maintenance and home delivery functions are less than 30 years of age. Only the store and restaurant management have a majority of people aged more than 30 years.

8.4. % Contribution of Age Segments to Employment in Key Functions 34

Management

39

22

68

Kitchen

71

Service

35

Store

5

26

51

21

7

60

41