(questionnaire) Bikes 63351i

This document was ed by and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this report form. Report 3b7i

Overview 3e4r5l

& View (questionnaire) Bikes as PDF for free.

More details w3441

- Words: 4,527

- Pages: 21

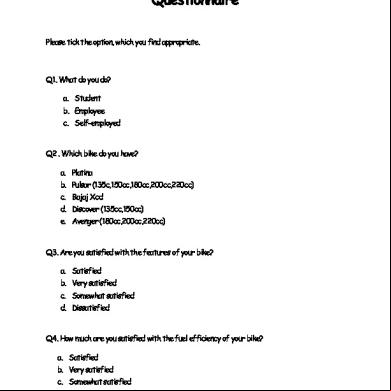

(Questionnaire) BIKES Name

:

Date of Birth

:

Address

:

Telephone/Mobile

:

Occupation

:

Marital Status

Q1-

:

Which two wheeler you own currently?

i)

Geared bike

ii)

Gearless Motor Bike.

( (

iii) Gearless Moppets (Honda, Scooty, Bike).

Q2i) iii)

)

(

) )

Average Distance Covered in a Month? 0-100

km ( )

200-300 km ( )

ii ) 100-200 km ( ) iv)

Q3- Which price slot your bike belongs?

300-400 km ( )

i)

Less than 30000. (

)

ii)

30000 – 40000.

)

iii)

40001 – 50000. (

)

iv)

50001 – 60000. (

)

v)

I don’t know

(

(

)

Q4- What is engine capacity of your bike? i)

Less than 100cc

ii)

100cc to 125cc

iii)

126cc to 150cc

iv)

151cc to 180cc

v)

Above 180cc I don’t know

Q5- Which was the last bike used by you? (i) Hero Honda

( )

(ii) Bajaj Discover ( )

(iii) TVS Apache

( )

(iv) Honda Stunner ( )

(v) Others

( )

Q6 - What is the ranking you would give to the following features of the bike?

Fuel Consumption ( ) Engine Capacity

( )

Average

( )

Mileage

( )

Q7- You have collected information about the particular brand from which source. i)

Newspaper

( )`

ii)

T.V. or Radio

( )

iii)

Family, Friends ( )

iv)

Others

( )

Q8- Do you have faith on the Brand? i) Yes ( )

ii) No ( )

Q9- Experience with your bike:Worse Very sfied

Not Satisfied

Good

Q11- Features you want to prefer in the bike? (1) Tyre

- (a) Broad ( )

(b) Narrow ( )

Satisfied

(2) Ignition

- (a) Kick Start ( )

(3) Breaks

-

(a) Disk Break ( )

(b) Self Start ( )

(b)Normal ( )

Q12- For what purpose you want to have bike (a) Status

Symbol

( )

(b) Utility

Vehicle

( )

(c)

Long Journey Vehicle ( )

(d) Style.

( )

Q13- Which kind of two wheeler would you buy in future? (a)

Motor bike

( )

(b)

Scooter

( )

(c) Electric bike

( )

(e) Can’t (f)

say

( )

I don’t want to buy one

( )

Q14- Which is the most preferred bike liked by you?

(Ans) _________________________________________

Q15- How often you take your bike for servicing? (Ans) _________________________________________ Pension Plan: Riders •

FAQs on Life Insurance Basics Do you need insurance if your not the breadwinner of the family? Not really. ...... • Sudden hospitalization? Solution; Hospital Cash Benefit Rider This benefit rider coupled with your life insurance will ensure that monetary issues do not bother you in event of unfortunate hospitalization for an ailment. ...... • Guaranteed Insurability Option Rider; insurance without medical check-up Get additional whole life insurance at different stages in your life without medical tests. ...... Read More >

Pension Plan: Exculsions •

Insurance is null and void if suicide is committed within a Death claims are not payable under certain circumstances in case of life insurance. ......

year

Read More >

Pension Plan: Claims •

Insurance is null and void if suicide is committed within a year Death claims are not payable under certain circumstances in case of life insurance. ...... • How to collect maturity amount from insurer? Getting maturity amount made easy , here's how .The insurer sends a discharge/claims form more than a month in advance of the policy maturity- here's your maturity claim. ...... • The death claim process is simple and the benefit is tax free Make life easy after death . Fill in a form to file a death claim . It will be about four months before you can get the claim amount. ...... Read More >

Pension Plan: Tax Implications •

Money-back Life Insurance Plan Get back the s you have paid for the insurance , Puzzled! The money-back plans provides life insurance cover for a specified period. The insured gets back fixed, tax-free proportions from the ...... • The death claim process is simple and the benefit is tax free Make life easy after death . Fill in a form to file a death claim . It will be about four months before you can get the claim amount. ...... Read More >

Types of Pension Plans Pension plans can vary greatly in of their structure and the benefits they provide. The two most common types of pension plans are the defined benefit plan and the defined contribution (or money purchase) plan. Some employers offer a combination of the two types of plans - known as "hybrid" or "combination" plans. Defined Benefit Pension Plans Defined benefit plans are designed to provide you with a specified amount of pension benefit when you retire based on a formula. Generally, this formula depends on factors like years of service and earnings and is described in the pension plan documents provided to . of this type of plan are advised annually of the amount of pension benefit they have earned or "accrued" up to that point. There are three types of benefit formulae commonly used to determine a member's pension:

final or best average earnings formula:

For each year of service, the formula provides a fixed percentage of your final earnings from employment or of an average of your earnings over a fixed period of time. In other words your pension adjusts in step with your wages. For example: 1.6% of your average earnings over the best 5 years of earnings x your total years of service

career average earnings formula:

Your annual pension benefit is a fixed percentage of your annual earnings while a member of the plan. For example: 1.2% of your annual earnings

flat benefit formula:

Your annual pension benefit is a fixed dollar amount per year of service. For example: $32 per month per year of service Defined Contribution Pension Plans In a defined contribution or money purchase pension plan, a specified amount of money is contributed regularly for you. This money is placed in an investment in your name. At retirement, these contributions - plus interest - are used to purchase a pension. You will not know the amount of pension you will receive until you retire. Some defined contribution plans permit employees to make their own investment choices, while others provide that the employer or a board of trustees is responsible for all investment decisions. Ultimately, the size of your pension depends on the amount of the contributions made by, or on behalf of you. It will also vary due to the return on the investment of those contributions. Annuity rates (i.e., longterm interest rates) at the time of retirement also may be a factor.

The traditional form of pension is the life annuity. Typically with a life annuity, your locked-in pension money is paid to a life insurance company that guarantees the payment of a fixed amount for your lifetime. Pension legislation has introduced the following alternatives to the life annuity: •

A ed Retirement Income Fund (RRIF) will allow you to determine your level of income, as well as manage your pension capital to take advantage of continued capital growth from investment earnings, and to have more flexibility for tax and income planning purposes.

•

A Variable Benefit, which is similar in nature to the above RRIF may be offered by a defined contribution plan. Check with the of your plan to see if this is a retirement option under your plan. TOP OF PAGE

Pension plans vary greatly in of the benefits that they provide and their structure. The two most common types of pension plans are the defined contribution or the money purchase plan and the defined benefit plan. Sometimes these two plans are combined and the combination is thus known as hybrid plans or combination plans. Designed Benefit Pension Plans The designed benefit pension plans are designed to provide a fixed amount of pension benefit after you retire from your job based on some formula. This formula, which his used to, calculate the pension benefits, depends upon various factors like the amount that you pay and years of your service. It is described in the documents of the pension plans that are provided to . who avail this type of pension plans are advised annually about the pension benefit that they have earned up to that point. The company mainly uses three types of formulae to determine the pension benefits of the member. Flat benefit formulae- The annual pension benefits that you will get will be a fixed amount per year of your service. For example 50$ per month per year of service. Final or best average earning formula- In this formula, the pension will adjust as per your wages. For each year of your service, this formula provides a specified percentage of your final earnings or average of your earnings over a specified period. For example, 2% of your average earnings over the best 6 years of earnings X year of service. Career average-earning formula- In this, the annual pension benefit, which you will receive, is a fixed percentage of your annual earnings. For example-1.5% of your annual earnings. Defined contribution pension plans. This is also known as money purchase plan. In this, a fixed amount is regularly contributed for you. The money is placed by your name in an investment . After you retire, these investments along with interest are used to buy pension. However, in this you will not have any idea about the amount of pension until you retire.

Some plans of this category allow employees to make their own investment choices. Whereas other require that the investments decision should be left with board of trustees or other senior people in the organization. Ultimately, the pension benefit that you are going to receive after your retirement will depend upon the contributions made on your behalf or by you. It will also depend upon the return on the investments on the contributions made by you and the annuity factor. Both defined contribution and the defined benefit plan are ed pension plans, but apart from them there are few pension plans that are not ed, these are Deferred profit sharing plan (DPSP), Employee stock purchase plan (ESPP), Individual pension plan (IPP). These do not generally follow the same rule that ed pension plans follows. These plans heavily depend upon the performance of the company in which you are working. Thus, it will be difficult for you to estimate the amount that you are going to receive post retirement. Individual pension plan is mainly designed for people with higher incomes. This plan allows bigger tax-deductible contributions. Employee stock purchase plan allows an employee to buy the shares of the company at a lower price, less than what you pay at the stock market. Deferred profit sharing plan is a plan that the employers use to build retirement fund for its employees. The company also contributes a portion of its profits to these funds. However, an employee cannot put his own money in a DPSP. Anzer Article Source: http://EzineArticles.com/?expert=Anzer_Khan

Birla SunLife Dream Plan – Review December 17th, 2009 Amar Ranu Leave a comment Go to comments

Birla SunLife Dream Plan is a unit-linked insurance plan (ULIP) that provides the double benefit of higher sum assured and guaranteed maturity benefit at a cost lower than the traditional term plan. In addition, it does not carry any allocation charges (PAC), probably the only plan in the market with a no-load structure, albeit there is a 2 per cent PAC on top-up . Product highlights

• •

A ULIP with a term ranging from 5 to 25 years for an individual between 18 to 60 years of age at entry; the maximum age at maturity is 75 years. Option to choose Guaranteed Maturity Benefit (GMB) with an upside potential based on the performance of funds chosen. This assures that you will receive no less than the GMB when the plan matures. Highlights o

This is a good alternative

o

for a traditional term plan, and also carries features of a ULIP This is one of the cheapest ULIPs in the market

o

Though it comes with lots of benefits, the charges are a little higher

•

• • • •

Option to choose Guaranteed Maturity Options (GMO), i.e., 100 per cent, 200 per cent and 300 per cent with three separate maturity amount payout schedules A minimum guaranteed return of 3 per cent p.a. on the paid less other charges Partial withdrawals allowed after 3 policy years; it does not affect the GMB. Policy surrender allowed after 3 policy years, with maximum payout up to the fund value at that time The cheapest ULIP product, with no allocation charges

Investment fund options •

The investor has an option to choose from three investment funds – Protector, Builder and Enhancer – as shown in Table 1.

The (minus charges) can be invested in any of the fund options or a combination of all three. The three funds follow a balanced approach to investment, and hence can be an ideal choice for investors with low to medium risk appetite. Charges you pay

•

allocation charge

No allocation charge is deducted from your , except for the 2 per cent charge that is levied on the top-up . •

Fund management charge (FMC)

FMC varies from 1 per cent to 1.25 per cent per year with a maximum cap of 1.5 per cent (Table 1). •

Policy istration charge and mortality charge

Policy istration charges are on the higher side. For example, in case of a 20-year policy with a basic sum assured of Rs. 590, the charges will be Rs. 12.91 for the first three years and Rs. 13.23 for the remaining years, compared to the normal charge of Rs. 2 to Rs. 3. Mortality charge is also high as compared to other ULIP plans. •

Surrender and revival charge

Policy revival charge is Rs. 100, which can go up to Rs. 1,000 at the company’s discretion. A surrender charge will be applicable if the policy is returned in the first 3 policy years. •

Other policy charges

Two fund switches, two partial withdrawals and two redirections are allowed free per year at an additional cost of Rs. 100, with a maximum cap of Rs. 500 per additional request. Incentives 1. Maturity benefit • Guaranteed maturity amount depending upon GMO along with the fund value is paid at the time of maturity. • A guaranteed return of 3 per cent per annum on net is applicable. 2. Death benefit The nominee will receive basic sum assured, enhanced sum assured plus the higher of Fund Value and Guaranteed Fund Value. 3. The plan offers discounts at higher guaranteed maturity benefit amounts based on different bands. Performance

Let us find out how this plan fares from its cost-benefit analysis, which is based on certain assumptions. For a 26-year-old male individual with the guaranteed maturity benefit (GMB) of Rs. 75,000, guaranteed maturity option of 300 per cent on GMB and enhanced sum assured of Rs. 50 lakh for a period of 25 years, the net return (gross of mortality charges) comes to 4.25 per cent and 8.24 per cent at an assumed growth rate of 6 per cent and 10 per cent, respectively. These returns are well above the minimum return prescribed by the regulator (i.e., 2.25 per cent for a policy with maturity period of more than 10 years). However, if we exclude the mortality charges, the net return will be negative. •

Table 2 sums up the performance of the three funds as on Sept. 30, 2009.

•

In Enhancer fund, 28.44 per cent investment is made in equities. Out of this investment, 25.40 per cent, 13.21 per cent and 11.17 per cent go to banking, oil & gas and capital goods, respectively as the top 3 sectors. All three funds (Protector, Builder and Enhancer) have cash allocation, including money market instruments, in the ratio of 18.98 per cent to 11.20 per cent to 17.38 per cent, which may prove to be a boon for the funds in months to come as the market may see some correction in the near term. However, the average maturity of debt holdings is 5.14 to 6.72 years which can be fatal in the near term as the market can see unwinding of the monetary policies which will shoot up debt yields, leading to devaluation of the portfolio. Higher the interest rate, lower will be the average duration and debt value, and vice versa.

•

•

Equating with other products A comparative analysis of BSLI Dream Plan with other investment products (Table 3) throws up some interesting facts. •

In case of Dream Plan, for a 30-year-old male individual opting for a GMB of Rs. 75,000 (100 per cent GMO) with an enhanced sum assurance of Rs. 50 lakh, the annual comes to Rs. 13,378 for 20 years with a maturity benefit of Rs. 1.82 lakh. The total paid in a span of 20 years exceeds the maturity benefit at both assumed interest level of 6 per cent and 10 per cent, thus, giving a net negative return. It happens because most of the amount goes in providing insurance cover of Rs 50 lakh. But if he invests in a combination product of PPF and a normal term plan for the

•

same insurance cover of Rs. 50 lakh, his annual comes to Rs. 5,200 and the return is 3.39 per cent. In BSLI Back Term Plan, the same benefits come at an annual of Rs. 42,422 with a maturity benefit of Rs. 8.4 lakh. But the net return is zero.

Tax benefits • •

payable under BSLI Dream Plan up to Rs. 1 lakh is eligible for tax benefits under Section 80C. Maturity or death proceeds are tax free under Sec 10(10D).

Things to look into • • •

The plan is preferably for an individual looking for an enhanced basic sum assured. The policy istration charge and mortality charge are exorbitantly high. Opting for riders will further reduce your return as units will be reduced in proportion to cover the monthly rider charge.

Recommendations • • • • • • •

For whom – Conservative investors willing to put money for a longer period Risk – Safe capital; maturity benefits linked to market returns Investment horizon – 5-25 years Returns – More in comparison to customised investment product providing same benefit Beats inflation – No, it won’t be able to beat inflation at an assumed growth rate of 6 per cent Tax bracket – Preferable for all tax brackets Alternatives – Term plan with the return of option, PPF with term plan

Summing it up

BSLI Dream Plan is ideal for those who are looking for an enhanced sum assured with moderate maturity benefits (in case of 100 per cent GMO). The other GMOs, i.e., 200 per cent and 300 per cent provide increased maturity benefits but come with high policy istration charges and mortality charges. In our opinion, the overheads are abrupt and the guaranteed 3 per cent return also does not look exciting enough. Moreover, investors can lose the trivial 3 per cent return if s are not paid in time.

Related posts: 1. 2. 3. 4. 5.

ICICI Prudential Pinnacle Guaranteed NAV- Review LIC Jeevan Anand – Review MetLife’s Monthly Income Plan – Review LIC Jeevan Saral – Review Best of 2009 – ULIP Funds

Categories: Banking, Insurance, Life insurance, Money management, Mutual Fund, Personal Finance, Rupeetalk Tags: Birla Sunlife, Birla Sunlife Dream Plan, Birla Sunlife Dream Plan Review, BSLI Dream Plan, Dream Plan, GMB, GMO, Guaranteed Maturity Benefits, Guaranteed Maturity Options, ULIP Comments (25) Trackbacks (0) Leave a comment Trackback

1. Anand December 18th, 2009 at 17:43 | #1 Reply | Quote

It is indeed surprising that this is the cheapest ULIP! perhaps you should make a distinction between small ticket size and cheap. One wonders who are the people who buy such products and how these products are sold. Our Country may end up with a generation of under insured and under invested retirees by the time the regulators do something. 2. khadar December 19th, 2009 at 13:46 | #2

Reply | Quote

very good policy……………….. 3. khadar December 19th, 2009 at 13:47 | #3 Reply | Quote

good ……………………………….. 4. Rajan m nair December 22nd, 2009 at 05:28 | #4 Reply | Quote

Interested to know and invest in Birla SunLife Dream Plan 5. Rajan m nair December 22nd, 2009 at 05:31 | #5 Reply | Quote

Shorterm investment like 5 yrs are available. 6. Saravanan December 22nd, 2009 at 14:32 | #6 Reply | Quote

Rajan m nair : Shorterm investment like 5 yrs are available. 7. Sandesh Khanivadekar December 26th, 2009 at 13:17 | #7 Reply | Quote

Its a very intresting and usefull site for review…….still not reviewed 100% but all is best… 8. SANDEEP December 28th, 2009 at 13:17 | #8 Reply | Quote

BIRLA SUN LIFE TAXAVING MUTAUAL FUND OR THIS DREAM PLAN……..CAN SOMEONE TELL THE DIFFERENCE BW THE RETURNS AND RISK? ON ESHOULD INVEST IN WHICH SCHEME? 9. Prasoon Gupta December 28th, 2009 at 15:17 | #9 Reply | Quote

@SANDEEP Answer: All the things you have to consider first is… 1. what is the need for you about Insurance factor Insurance in available in Dream Plan.. where is taxsaving in available in both the schemes 2. in case of Market Uncertainity, in Dream Plan – Have option to switch to safer option without withdrawl during the Policy Term. In TaxSaver Mutual Fund you have only option to get dividend or redeem after 3 yrs.

10. Vivek December 28th, 2009 at 15:38 | #10 Reply | Quote

I purchased Agone Religare iTerm. This way I get to pay less and then can use it the way I want. Even to fulfill my othr current needs. 11. praveen December 28th, 2009 at 16:44 | #11 Reply | Quote

guys all of you thinking that its a good as well as great policy only because the allocatin chrgs are zero and high coverage. but noone is looking at the istration chrgs its very high. coz it is charging on the sumassured and the sum assure is minimum 12times. allocation chrgs are charged only once in the year on ur but istration chrged on sum assured and its monthly and its equal to 30% yearly every year 12. Kavita December 28th, 2009 at 18:39 | #12 Reply | Quote

@Rajan m nair Hi Rajan let me know if u want to invest in Birla… but hope u r in pune:-) Reply back ASAP coz the dream plan is closing on 31st of dec.09 13. Anant

December 28th, 2009 at 21:03 | #13 Reply | Quote

i dont understand why you compare Birla dream plan with aegon i term + ppf . please comare as like apple to apple. please compare it with aegon i term + aegon invest maximiser . waiting for your replay………. 14. Gopal Agrawal December 28th, 2009 at 22:37 | #14 Reply | Quote

@Rajan m nair pl me I will be able to help you about this plan 15. Amar Ranu December 29th, 2009 at 10:56 | #15 Reply | Quote

@ Anant We at Rupeetalk try to provide the best risk-free alternative to the product under analysis. Since PPF is a risk-free investment avenue, it is an ideal choice for all risk-averse investors. 16. Anjali December 30th, 2009 at 15:37 | #16 Reply | Quote

Need to invest in BSLI. Can u help?

17. mahesh poddar December 30th, 2009 at 17:03 | #17 Reply | Quote

Anjali :Need to invest in BSLI. Can u help? yes pls on my mail address 18. manish December 30th, 2009 at 23:36 | #18 Reply | Quote

provide me more about term plan 19. Umesh December 31st, 2009 at 17:48 | #19 Reply | Quote

@Rajan m nair Hi Mr. Nair! I may surely help you with personal financial plannins. Do write me on my e-mail i/d as furbished in this mail. Regards. Umesh 20. VIKAS January 1st, 2010 at 10:53 | #20

Reply | Quote

WHAT ABOUT HDFC SLIC YOUNGSTAR SUPER?? 21. sanjay sharma January 3rd, 2010 at 19:46 | #21 Reply | Quote

I hv taken a housing loan but it is not insured kindly let me know how can i get it insured at a minimum and from which insurance company 22. Vivek G January 17th, 2010 at 19:17 | #22 Reply | Quote

Hi, I had opted for GMO – 100%, Guaranteed maturity benefit – 173000, basic sum assured 102000 and Enhanced sum assured – 300000, The term period is 20 years, The is 8000 per year. I was just looking into the statement and found that Rs.240 is taken as istrative charge every month. It’s really very high. When I see the fund value it is 7100 from 8000 in just 6 months. Could anyone please help me with following questions - how much I will get at end of maturity (after 20 yrs) if I pay all the s. - Will I get (basic sum assured + enhanced sum assured = 402000) – If yes, it looks attractive, but, the istrative charges scares me. - Is there a way to reduce the term to 5 years and decrease the basic sum assured, so that I will be losing less money on istrative charges. If yes, how much is the charge for that switching. Thanks, Vivek G 23.

KAMAL N T January 18th, 2010 at 21:48 | #23 Reply | Quote

Mr. Vivek G Your answers are 1 You will get GMB = 173000 minimum at the end of term else the fund value ok 2 In cae of your death in policy term your nominee will get Total sum assured ie. 402000 plus fund value at that time ok and 3 You may surrender policy after three year any time without paying any surrender charges in DP You can’t change sum assured ok 24. rishabh parakh January 18th, 2010 at 22:46 | #24 Reply | Quote

hi, how can thiese all kind of ULIP products are good and specially like this one where you are saying that there are no allocaton charges but in reality they are charging 100% for the first year by stating that the amt is set aside to guarntee your frst and the guarntee is like peanuts 3 or 5 times i.e. 300 % over a period Of 25 yrs and also all the other charges are also very high, when it comes to insurance buying a term plan and invest the balance in equity or pther options is the only best option rather than buying ulips 25. riteish January 19th, 2010 at 00:14 | #25 Reply | Quote

@Anjali yes i can help u out u can me on my mail id [email protected]

:

Date of Birth

:

Address

:

Telephone/Mobile

:

Occupation

:

Marital Status

Q1-

:

Which two wheeler you own currently?

i)

Geared bike

ii)

Gearless Motor Bike.

( (

iii) Gearless Moppets (Honda, Scooty, Bike).

Q2i) iii)

)

(

) )

Average Distance Covered in a Month? 0-100

km ( )

200-300 km ( )

ii ) 100-200 km ( ) iv)

Q3- Which price slot your bike belongs?

300-400 km ( )

i)

Less than 30000. (

)

ii)

30000 – 40000.

)

iii)

40001 – 50000. (

)

iv)

50001 – 60000. (

)

v)

I don’t know

(

(

)

Q4- What is engine capacity of your bike? i)

Less than 100cc

ii)

100cc to 125cc

iii)

126cc to 150cc

iv)

151cc to 180cc

v)

Above 180cc I don’t know

Q5- Which was the last bike used by you? (i) Hero Honda

( )

(ii) Bajaj Discover ( )

(iii) TVS Apache

( )

(iv) Honda Stunner ( )

(v) Others

( )

Q6 - What is the ranking you would give to the following features of the bike?

Fuel Consumption ( ) Engine Capacity

( )

Average

( )

Mileage

( )

Q7- You have collected information about the particular brand from which source. i)

Newspaper

( )`

ii)

T.V. or Radio

( )

iii)

Family, Friends ( )

iv)

Others

( )

Q8- Do you have faith on the Brand? i) Yes ( )

ii) No ( )

Q9- Experience with your bike:Worse Very sfied

Not Satisfied

Good

Q11- Features you want to prefer in the bike? (1) Tyre

- (a) Broad ( )

(b) Narrow ( )

Satisfied

(2) Ignition

- (a) Kick Start ( )

(3) Breaks

-

(a) Disk Break ( )

(b) Self Start ( )

(b)Normal ( )

Q12- For what purpose you want to have bike (a) Status

Symbol

( )

(b) Utility

Vehicle

( )

(c)

Long Journey Vehicle ( )

(d) Style.

( )

Q13- Which kind of two wheeler would you buy in future? (a)

Motor bike

( )

(b)

Scooter

( )

(c) Electric bike

( )

(e) Can’t (f)

say

( )

I don’t want to buy one

( )

Q14- Which is the most preferred bike liked by you?

(Ans) _________________________________________

Q15- How often you take your bike for servicing? (Ans) _________________________________________ Pension Plan: Riders •

FAQs on Life Insurance Basics Do you need insurance if your not the breadwinner of the family? Not really. ...... • Sudden hospitalization? Solution; Hospital Cash Benefit Rider This benefit rider coupled with your life insurance will ensure that monetary issues do not bother you in event of unfortunate hospitalization for an ailment. ...... • Guaranteed Insurability Option Rider; insurance without medical check-up Get additional whole life insurance at different stages in your life without medical tests. ...... Read More >

Pension Plan: Exculsions •

Insurance is null and void if suicide is committed within a Death claims are not payable under certain circumstances in case of life insurance. ......

year

Read More >

Pension Plan: Claims •

Insurance is null and void if suicide is committed within a year Death claims are not payable under certain circumstances in case of life insurance. ...... • How to collect maturity amount from insurer? Getting maturity amount made easy , here's how .The insurer sends a discharge/claims form more than a month in advance of the policy maturity- here's your maturity claim. ...... • The death claim process is simple and the benefit is tax free Make life easy after death . Fill in a form to file a death claim . It will be about four months before you can get the claim amount. ...... Read More >

Pension Plan: Tax Implications •

Money-back Life Insurance Plan Get back the s you have paid for the insurance , Puzzled! The money-back plans provides life insurance cover for a specified period. The insured gets back fixed, tax-free proportions from the ...... • The death claim process is simple and the benefit is tax free Make life easy after death . Fill in a form to file a death claim . It will be about four months before you can get the claim amount. ...... Read More >

Types of Pension Plans Pension plans can vary greatly in of their structure and the benefits they provide. The two most common types of pension plans are the defined benefit plan and the defined contribution (or money purchase) plan. Some employers offer a combination of the two types of plans - known as "hybrid" or "combination" plans. Defined Benefit Pension Plans Defined benefit plans are designed to provide you with a specified amount of pension benefit when you retire based on a formula. Generally, this formula depends on factors like years of service and earnings and is described in the pension plan documents provided to . of this type of plan are advised annually of the amount of pension benefit they have earned or "accrued" up to that point. There are three types of benefit formulae commonly used to determine a member's pension:

final or best average earnings formula:

For each year of service, the formula provides a fixed percentage of your final earnings from employment or of an average of your earnings over a fixed period of time. In other words your pension adjusts in step with your wages. For example: 1.6% of your average earnings over the best 5 years of earnings x your total years of service

career average earnings formula:

Your annual pension benefit is a fixed percentage of your annual earnings while a member of the plan. For example: 1.2% of your annual earnings

flat benefit formula:

Your annual pension benefit is a fixed dollar amount per year of service. For example: $32 per month per year of service Defined Contribution Pension Plans In a defined contribution or money purchase pension plan, a specified amount of money is contributed regularly for you. This money is placed in an investment in your name. At retirement, these contributions - plus interest - are used to purchase a pension. You will not know the amount of pension you will receive until you retire. Some defined contribution plans permit employees to make their own investment choices, while others provide that the employer or a board of trustees is responsible for all investment decisions. Ultimately, the size of your pension depends on the amount of the contributions made by, or on behalf of you. It will also vary due to the return on the investment of those contributions. Annuity rates (i.e., longterm interest rates) at the time of retirement also may be a factor.

The traditional form of pension is the life annuity. Typically with a life annuity, your locked-in pension money is paid to a life insurance company that guarantees the payment of a fixed amount for your lifetime. Pension legislation has introduced the following alternatives to the life annuity: •

A ed Retirement Income Fund (RRIF) will allow you to determine your level of income, as well as manage your pension capital to take advantage of continued capital growth from investment earnings, and to have more flexibility for tax and income planning purposes.

•

A Variable Benefit, which is similar in nature to the above RRIF may be offered by a defined contribution plan. Check with the of your plan to see if this is a retirement option under your plan. TOP OF PAGE

Pension plans vary greatly in of the benefits that they provide and their structure. The two most common types of pension plans are the defined contribution or the money purchase plan and the defined benefit plan. Sometimes these two plans are combined and the combination is thus known as hybrid plans or combination plans. Designed Benefit Pension Plans The designed benefit pension plans are designed to provide a fixed amount of pension benefit after you retire from your job based on some formula. This formula, which his used to, calculate the pension benefits, depends upon various factors like the amount that you pay and years of your service. It is described in the documents of the pension plans that are provided to . who avail this type of pension plans are advised annually about the pension benefit that they have earned up to that point. The company mainly uses three types of formulae to determine the pension benefits of the member. Flat benefit formulae- The annual pension benefits that you will get will be a fixed amount per year of your service. For example 50$ per month per year of service. Final or best average earning formula- In this formula, the pension will adjust as per your wages. For each year of your service, this formula provides a specified percentage of your final earnings or average of your earnings over a specified period. For example, 2% of your average earnings over the best 6 years of earnings X year of service. Career average-earning formula- In this, the annual pension benefit, which you will receive, is a fixed percentage of your annual earnings. For example-1.5% of your annual earnings. Defined contribution pension plans. This is also known as money purchase plan. In this, a fixed amount is regularly contributed for you. The money is placed by your name in an investment . After you retire, these investments along with interest are used to buy pension. However, in this you will not have any idea about the amount of pension until you retire.

Some plans of this category allow employees to make their own investment choices. Whereas other require that the investments decision should be left with board of trustees or other senior people in the organization. Ultimately, the pension benefit that you are going to receive after your retirement will depend upon the contributions made on your behalf or by you. It will also depend upon the return on the investments on the contributions made by you and the annuity factor. Both defined contribution and the defined benefit plan are ed pension plans, but apart from them there are few pension plans that are not ed, these are Deferred profit sharing plan (DPSP), Employee stock purchase plan (ESPP), Individual pension plan (IPP). These do not generally follow the same rule that ed pension plans follows. These plans heavily depend upon the performance of the company in which you are working. Thus, it will be difficult for you to estimate the amount that you are going to receive post retirement. Individual pension plan is mainly designed for people with higher incomes. This plan allows bigger tax-deductible contributions. Employee stock purchase plan allows an employee to buy the shares of the company at a lower price, less than what you pay at the stock market. Deferred profit sharing plan is a plan that the employers use to build retirement fund for its employees. The company also contributes a portion of its profits to these funds. However, an employee cannot put his own money in a DPSP. Anzer Article Source: http://EzineArticles.com/?expert=Anzer_Khan

Birla SunLife Dream Plan – Review December 17th, 2009 Amar Ranu Leave a comment Go to comments

Birla SunLife Dream Plan is a unit-linked insurance plan (ULIP) that provides the double benefit of higher sum assured and guaranteed maturity benefit at a cost lower than the traditional term plan. In addition, it does not carry any allocation charges (PAC), probably the only plan in the market with a no-load structure, albeit there is a 2 per cent PAC on top-up . Product highlights

• •

A ULIP with a term ranging from 5 to 25 years for an individual between 18 to 60 years of age at entry; the maximum age at maturity is 75 years. Option to choose Guaranteed Maturity Benefit (GMB) with an upside potential based on the performance of funds chosen. This assures that you will receive no less than the GMB when the plan matures. Highlights o

This is a good alternative

o

for a traditional term plan, and also carries features of a ULIP This is one of the cheapest ULIPs in the market

o

Though it comes with lots of benefits, the charges are a little higher

•

• • • •

Option to choose Guaranteed Maturity Options (GMO), i.e., 100 per cent, 200 per cent and 300 per cent with three separate maturity amount payout schedules A minimum guaranteed return of 3 per cent p.a. on the paid less other charges Partial withdrawals allowed after 3 policy years; it does not affect the GMB. Policy surrender allowed after 3 policy years, with maximum payout up to the fund value at that time The cheapest ULIP product, with no allocation charges

Investment fund options •

The investor has an option to choose from three investment funds – Protector, Builder and Enhancer – as shown in Table 1.

The (minus charges) can be invested in any of the fund options or a combination of all three. The three funds follow a balanced approach to investment, and hence can be an ideal choice for investors with low to medium risk appetite. Charges you pay

•

allocation charge

No allocation charge is deducted from your , except for the 2 per cent charge that is levied on the top-up . •

Fund management charge (FMC)

FMC varies from 1 per cent to 1.25 per cent per year with a maximum cap of 1.5 per cent (Table 1). •

Policy istration charge and mortality charge

Policy istration charges are on the higher side. For example, in case of a 20-year policy with a basic sum assured of Rs. 590, the charges will be Rs. 12.91 for the first three years and Rs. 13.23 for the remaining years, compared to the normal charge of Rs. 2 to Rs. 3. Mortality charge is also high as compared to other ULIP plans. •

Surrender and revival charge

Policy revival charge is Rs. 100, which can go up to Rs. 1,000 at the company’s discretion. A surrender charge will be applicable if the policy is returned in the first 3 policy years. •

Other policy charges

Two fund switches, two partial withdrawals and two redirections are allowed free per year at an additional cost of Rs. 100, with a maximum cap of Rs. 500 per additional request. Incentives 1. Maturity benefit • Guaranteed maturity amount depending upon GMO along with the fund value is paid at the time of maturity. • A guaranteed return of 3 per cent per annum on net is applicable. 2. Death benefit The nominee will receive basic sum assured, enhanced sum assured plus the higher of Fund Value and Guaranteed Fund Value. 3. The plan offers discounts at higher guaranteed maturity benefit amounts based on different bands. Performance

Let us find out how this plan fares from its cost-benefit analysis, which is based on certain assumptions. For a 26-year-old male individual with the guaranteed maturity benefit (GMB) of Rs. 75,000, guaranteed maturity option of 300 per cent on GMB and enhanced sum assured of Rs. 50 lakh for a period of 25 years, the net return (gross of mortality charges) comes to 4.25 per cent and 8.24 per cent at an assumed growth rate of 6 per cent and 10 per cent, respectively. These returns are well above the minimum return prescribed by the regulator (i.e., 2.25 per cent for a policy with maturity period of more than 10 years). However, if we exclude the mortality charges, the net return will be negative. •

Table 2 sums up the performance of the three funds as on Sept. 30, 2009.

•

In Enhancer fund, 28.44 per cent investment is made in equities. Out of this investment, 25.40 per cent, 13.21 per cent and 11.17 per cent go to banking, oil & gas and capital goods, respectively as the top 3 sectors. All three funds (Protector, Builder and Enhancer) have cash allocation, including money market instruments, in the ratio of 18.98 per cent to 11.20 per cent to 17.38 per cent, which may prove to be a boon for the funds in months to come as the market may see some correction in the near term. However, the average maturity of debt holdings is 5.14 to 6.72 years which can be fatal in the near term as the market can see unwinding of the monetary policies which will shoot up debt yields, leading to devaluation of the portfolio. Higher the interest rate, lower will be the average duration and debt value, and vice versa.

•

•

Equating with other products A comparative analysis of BSLI Dream Plan with other investment products (Table 3) throws up some interesting facts. •

In case of Dream Plan, for a 30-year-old male individual opting for a GMB of Rs. 75,000 (100 per cent GMO) with an enhanced sum assurance of Rs. 50 lakh, the annual comes to Rs. 13,378 for 20 years with a maturity benefit of Rs. 1.82 lakh. The total paid in a span of 20 years exceeds the maturity benefit at both assumed interest level of 6 per cent and 10 per cent, thus, giving a net negative return. It happens because most of the amount goes in providing insurance cover of Rs 50 lakh. But if he invests in a combination product of PPF and a normal term plan for the

•

same insurance cover of Rs. 50 lakh, his annual comes to Rs. 5,200 and the return is 3.39 per cent. In BSLI Back Term Plan, the same benefits come at an annual of Rs. 42,422 with a maturity benefit of Rs. 8.4 lakh. But the net return is zero.

Tax benefits • •

payable under BSLI Dream Plan up to Rs. 1 lakh is eligible for tax benefits under Section 80C. Maturity or death proceeds are tax free under Sec 10(10D).

Things to look into • • •

The plan is preferably for an individual looking for an enhanced basic sum assured. The policy istration charge and mortality charge are exorbitantly high. Opting for riders will further reduce your return as units will be reduced in proportion to cover the monthly rider charge.

Recommendations • • • • • • •

For whom – Conservative investors willing to put money for a longer period Risk – Safe capital; maturity benefits linked to market returns Investment horizon – 5-25 years Returns – More in comparison to customised investment product providing same benefit Beats inflation – No, it won’t be able to beat inflation at an assumed growth rate of 6 per cent Tax bracket – Preferable for all tax brackets Alternatives – Term plan with the return of option, PPF with term plan

Summing it up

BSLI Dream Plan is ideal for those who are looking for an enhanced sum assured with moderate maturity benefits (in case of 100 per cent GMO). The other GMOs, i.e., 200 per cent and 300 per cent provide increased maturity benefits but come with high policy istration charges and mortality charges. In our opinion, the overheads are abrupt and the guaranteed 3 per cent return also does not look exciting enough. Moreover, investors can lose the trivial 3 per cent return if s are not paid in time.

Related posts: 1. 2. 3. 4. 5.

ICICI Prudential Pinnacle Guaranteed NAV- Review LIC Jeevan Anand – Review MetLife’s Monthly Income Plan – Review LIC Jeevan Saral – Review Best of 2009 – ULIP Funds

Categories: Banking, Insurance, Life insurance, Money management, Mutual Fund, Personal Finance, Rupeetalk Tags: Birla Sunlife, Birla Sunlife Dream Plan, Birla Sunlife Dream Plan Review, BSLI Dream Plan, Dream Plan, GMB, GMO, Guaranteed Maturity Benefits, Guaranteed Maturity Options, ULIP Comments (25) Trackbacks (0) Leave a comment Trackback

1. Anand December 18th, 2009 at 17:43 | #1 Reply | Quote

It is indeed surprising that this is the cheapest ULIP! perhaps you should make a distinction between small ticket size and cheap. One wonders who are the people who buy such products and how these products are sold. Our Country may end up with a generation of under insured and under invested retirees by the time the regulators do something. 2. khadar December 19th, 2009 at 13:46 | #2

Reply | Quote

very good policy……………….. 3. khadar December 19th, 2009 at 13:47 | #3 Reply | Quote

good ……………………………….. 4. Rajan m nair December 22nd, 2009 at 05:28 | #4 Reply | Quote

Interested to know and invest in Birla SunLife Dream Plan 5. Rajan m nair December 22nd, 2009 at 05:31 | #5 Reply | Quote

Shorterm investment like 5 yrs are available. 6. Saravanan December 22nd, 2009 at 14:32 | #6 Reply | Quote

Rajan m nair : Shorterm investment like 5 yrs are available. 7. Sandesh Khanivadekar December 26th, 2009 at 13:17 | #7 Reply | Quote

Its a very intresting and usefull site for review…….still not reviewed 100% but all is best… 8. SANDEEP December 28th, 2009 at 13:17 | #8 Reply | Quote

BIRLA SUN LIFE TAXAVING MUTAUAL FUND OR THIS DREAM PLAN……..CAN SOMEONE TELL THE DIFFERENCE BW THE RETURNS AND RISK? ON ESHOULD INVEST IN WHICH SCHEME? 9. Prasoon Gupta December 28th, 2009 at 15:17 | #9 Reply | Quote

@SANDEEP Answer: All the things you have to consider first is… 1. what is the need for you about Insurance factor Insurance in available in Dream Plan.. where is taxsaving in available in both the schemes 2. in case of Market Uncertainity, in Dream Plan – Have option to switch to safer option without withdrawl during the Policy Term. In TaxSaver Mutual Fund you have only option to get dividend or redeem after 3 yrs.

10. Vivek December 28th, 2009 at 15:38 | #10 Reply | Quote

I purchased Agone Religare iTerm. This way I get to pay less and then can use it the way I want. Even to fulfill my othr current needs. 11. praveen December 28th, 2009 at 16:44 | #11 Reply | Quote

guys all of you thinking that its a good as well as great policy only because the allocatin chrgs are zero and high coverage. but noone is looking at the istration chrgs its very high. coz it is charging on the sumassured and the sum assure is minimum 12times. allocation chrgs are charged only once in the year on ur but istration chrged on sum assured and its monthly and its equal to 30% yearly every year 12. Kavita December 28th, 2009 at 18:39 | #12 Reply | Quote

@Rajan m nair Hi Rajan let me know if u want to invest in Birla… but hope u r in pune:-) Reply back ASAP coz the dream plan is closing on 31st of dec.09 13. Anant

December 28th, 2009 at 21:03 | #13 Reply | Quote

i dont understand why you compare Birla dream plan with aegon i term + ppf . please comare as like apple to apple. please compare it with aegon i term + aegon invest maximiser . waiting for your replay………. 14. Gopal Agrawal December 28th, 2009 at 22:37 | #14 Reply | Quote

@Rajan m nair pl me I will be able to help you about this plan 15. Amar Ranu December 29th, 2009 at 10:56 | #15 Reply | Quote

@ Anant We at Rupeetalk try to provide the best risk-free alternative to the product under analysis. Since PPF is a risk-free investment avenue, it is an ideal choice for all risk-averse investors. 16. Anjali December 30th, 2009 at 15:37 | #16 Reply | Quote

Need to invest in BSLI. Can u help?

17. mahesh poddar December 30th, 2009 at 17:03 | #17 Reply | Quote

Anjali :Need to invest in BSLI. Can u help? yes pls on my mail address 18. manish December 30th, 2009 at 23:36 | #18 Reply | Quote

provide me more about term plan 19. Umesh December 31st, 2009 at 17:48 | #19 Reply | Quote

@Rajan m nair Hi Mr. Nair! I may surely help you with personal financial plannins. Do write me on my e-mail i/d as furbished in this mail. Regards. Umesh 20. VIKAS January 1st, 2010 at 10:53 | #20

Reply | Quote

WHAT ABOUT HDFC SLIC YOUNGSTAR SUPER?? 21. sanjay sharma January 3rd, 2010 at 19:46 | #21 Reply | Quote

I hv taken a housing loan but it is not insured kindly let me know how can i get it insured at a minimum and from which insurance company 22. Vivek G January 17th, 2010 at 19:17 | #22 Reply | Quote

Hi, I had opted for GMO – 100%, Guaranteed maturity benefit – 173000, basic sum assured 102000 and Enhanced sum assured – 300000, The term period is 20 years, The is 8000 per year. I was just looking into the statement and found that Rs.240 is taken as istrative charge every month. It’s really very high. When I see the fund value it is 7100 from 8000 in just 6 months. Could anyone please help me with following questions - how much I will get at end of maturity (after 20 yrs) if I pay all the s. - Will I get (basic sum assured + enhanced sum assured = 402000) – If yes, it looks attractive, but, the istrative charges scares me. - Is there a way to reduce the term to 5 years and decrease the basic sum assured, so that I will be losing less money on istrative charges. If yes, how much is the charge for that switching. Thanks, Vivek G 23.

KAMAL N T January 18th, 2010 at 21:48 | #23 Reply | Quote

Mr. Vivek G Your answers are 1 You will get GMB = 173000 minimum at the end of term else the fund value ok 2 In cae of your death in policy term your nominee will get Total sum assured ie. 402000 plus fund value at that time ok and 3 You may surrender policy after three year any time without paying any surrender charges in DP You can’t change sum assured ok 24. rishabh parakh January 18th, 2010 at 22:46 | #24 Reply | Quote

hi, how can thiese all kind of ULIP products are good and specially like this one where you are saying that there are no allocaton charges but in reality they are charging 100% for the first year by stating that the amt is set aside to guarntee your frst and the guarntee is like peanuts 3 or 5 times i.e. 300 % over a period Of 25 yrs and also all the other charges are also very high, when it comes to insurance buying a term plan and invest the balance in equity or pther options is the only best option rather than buying ulips 25. riteish January 19th, 2010 at 00:14 | #25 Reply | Quote

@Anjali yes i can help u out u can me on my mail id [email protected]