Rajesh Tambe 4f1x7

This document was ed by and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this report form. Report 3b7i

Overview 3e4r5l

& View Rajesh Tambe as PDF for free.

More details w3441

- Words: 455

- Pages: 1

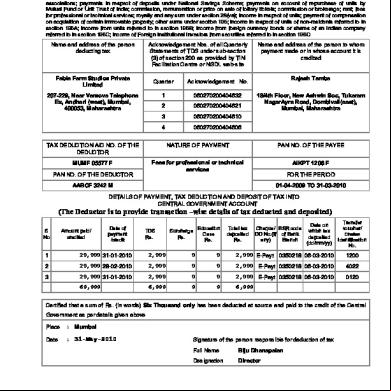

FORM NO. 16A

TDS\194J\24

[See Rule 31(1)(b)]

Certificate of deduction of tax at source under section 203 of the Income-tax Act, 1961 For interest on securities; dividends; interest other than “interest on securities”; winnings from lottery or crossword puzzle; winnings from horse race; payments to contractors and sub-contractors; insurance commission; payments to non-resident sportsmen/sports associations; payments in respect of deposits under National Savings Scheme; payments on of repurchase of units by Mutual Fund or Unit Trust of India; commission, remuneration or prize on sale of lottery tickets; commission or brokerage; rent; fees for professional or technical services; royalty and any sum under section 28(va); income in respect of units; payment of compensation on acquisition of certain immovable property; other sums under section 195; income in respect of units of non-residents referred to in section 196A; income from units referred to in section 196B; income from foreign currency bonds or shares of an Indian company referred to in section 196C; income of Foreign Institutional Investors from securities referred to in section 196D

Name and address of the person deducting tax

Acknowledgement Nos. of all Quarterly Statements of TDS under sub-section (3) of section 200 as provided by TIN Facilitation Centre or NSDL web-site

Fable Farm Studios Private Limited

Quarter

Acknowledgement No.

1

060270200404632

2

060270200404621

3

060270200404610

4

060270200404606

207-229, Near Versova Telephone Ex, Andheri (west), Mumbai, 400053, Maharashtra

Name and address of the person to whom payment made or in whose it is credited Rajesh Tambe 18/4th Floor, New Ashwin Soc, Tukaram NagarAyre Road, Dombivali(east), Mumbai, Maharashtra

TAX DEDUCTION A/C NO. OF THE DEDUCTOR

NATURE OF PAYMENT

PAN NO. OF THE PAYEE

MUMF 05577 F

Fees for professional or technical services

AIKPT 1206 F

PAN NO. OF THE DEDUCTOR

FOR THE PERIOD

AABCF 3242 M

01-04-2009 TO 31-03-2010

DETAILS OF PAYMENT, TAX DEDUCTION AND DEPOSIT OF TAX INTO CENTRAL GOVERNMENT

(The Deductor is to provide transaction –wise details of tax deducted and deposited) S No

Amount paid/ credited

Date of payment /credit

TDS Rs.

Surcharge Rs.

Education Cess Rs.

Total tax deposited Rs.

Cheque/ BSR code DD No.(if of Bank any) Branch

Date on which tax deposited (dd/mm/yy)

Transfer voucher/ Challan

Identification No.

1

20,000 31-01-2010

2,000

0

0

2,000 E-Payt 0350218 06-03-2010

1200

2

20,000 28-02-2010

2,000

0

0

2,000 E-Payt 0350218 06-03-2010

4022

3

20,000 31-01-2010

2,000

0

0

2,000 E-Payt 0350218 06-03-2010

0120

60,000

6,000

0

0

6,000

Certified that a sum of Rs. (in words) Six Thousand only has been deducted at source and paid to the credit of the Central Government as per details given above Place

:

Mumbai

Date

:

31-May-2010

Signature of the person responsible for deduction of tax Full Name

Biju Dhanapalan

Designation

Director

TDS\194J\24

[See Rule 31(1)(b)]

Certificate of deduction of tax at source under section 203 of the Income-tax Act, 1961 For interest on securities; dividends; interest other than “interest on securities”; winnings from lottery or crossword puzzle; winnings from horse race; payments to contractors and sub-contractors; insurance commission; payments to non-resident sportsmen/sports associations; payments in respect of deposits under National Savings Scheme; payments on of repurchase of units by Mutual Fund or Unit Trust of India; commission, remuneration or prize on sale of lottery tickets; commission or brokerage; rent; fees for professional or technical services; royalty and any sum under section 28(va); income in respect of units; payment of compensation on acquisition of certain immovable property; other sums under section 195; income in respect of units of non-residents referred to in section 196A; income from units referred to in section 196B; income from foreign currency bonds or shares of an Indian company referred to in section 196C; income of Foreign Institutional Investors from securities referred to in section 196D

Name and address of the person deducting tax

Acknowledgement Nos. of all Quarterly Statements of TDS under sub-section (3) of section 200 as provided by TIN Facilitation Centre or NSDL web-site

Fable Farm Studios Private Limited

Quarter

Acknowledgement No.

1

060270200404632

2

060270200404621

3

060270200404610

4

060270200404606

207-229, Near Versova Telephone Ex, Andheri (west), Mumbai, 400053, Maharashtra

Name and address of the person to whom payment made or in whose it is credited Rajesh Tambe 18/4th Floor, New Ashwin Soc, Tukaram NagarAyre Road, Dombivali(east), Mumbai, Maharashtra

TAX DEDUCTION A/C NO. OF THE DEDUCTOR

NATURE OF PAYMENT

PAN NO. OF THE PAYEE

MUMF 05577 F

Fees for professional or technical services

AIKPT 1206 F

PAN NO. OF THE DEDUCTOR

FOR THE PERIOD

AABCF 3242 M

01-04-2009 TO 31-03-2010

DETAILS OF PAYMENT, TAX DEDUCTION AND DEPOSIT OF TAX INTO CENTRAL GOVERNMENT

(The Deductor is to provide transaction –wise details of tax deducted and deposited) S No

Amount paid/ credited

Date of payment /credit

TDS Rs.

Surcharge Rs.

Education Cess Rs.

Total tax deposited Rs.

Cheque/ BSR code DD No.(if of Bank any) Branch

Date on which tax deposited (dd/mm/yy)

Transfer voucher/ Challan

Identification No.

1

20,000 31-01-2010

2,000

0

0

2,000 E-Payt 0350218 06-03-2010

1200

2

20,000 28-02-2010

2,000

0

0

2,000 E-Payt 0350218 06-03-2010

4022

3

20,000 31-01-2010

2,000

0

0

2,000 E-Payt 0350218 06-03-2010

0120

60,000

6,000

0

0

6,000

Certified that a sum of Rs. (in words) Six Thousand only has been deducted at source and paid to the credit of the Central Government as per details given above Place

:

Mumbai

Date

:

31-May-2010

Signature of the person responsible for deduction of tax Full Name

Biju Dhanapalan

Designation

Director