Consignment ing Journal Entries 54g3a

This document was ed by and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this report form. Report 3b7i

Overview 3e4r5l

& View Consignment ing Journal Entries as PDF for free.

More details w3441

- Words: 697

- Pages: 2

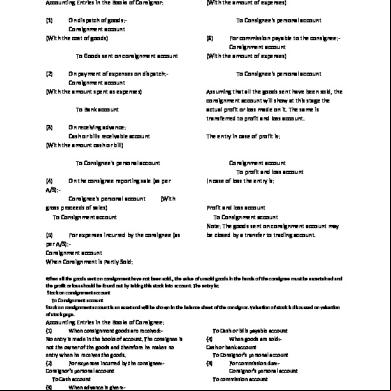

Consignment ing Journal Entries: ing Entries in the Books of Consignor: On dispatch of goods:Consignment (With the cost of goods)

(With the amount of expenses)

(1)

To Consignee's personal (6)

To Goods sent on consignment (2)

On payment of expenses on dispatch:Consignment (With the amount spent as expenses) To Bank On receiving advance: Cash or bills receivable (With the amount cash or bill)

For commission payable to the consignee:Consignment (With the amount of expenses) To Consignee's personal Assuming that all the goods sent have been sold, the consignment will show at this stage the actual profit or loss made on it. The same is transferred to profit and loss .

(3)

The entry in case of profit is:

To Consignee's personal (4) A/S):-

On the consignee reporting sale (as per

Consignee's personal gross proceeds of sales) To Consignment

Consignment To profit and loss In case of loss the entry is:

(With

(5) For expenses incurred by the consignee (as per A/S):Consignment When Consignment is Partly Sold:

Profit and loss To Consignment Note: The goods sent on consignment may be closed by a transfer to trading .

When all the goods sent on consignment have not been sold., the value of unsold goods in the hands of the consignee must be ascertained and the profit or loss should be found out by taking this stock into . The entry is: Stock on consignment To Consignment Stock on consignment is an asset and will be shown in the balance sheet of the consignor. Valuation of stock is discussed on valuation of stock page.

ing Entries in the Books of Consignee: (1) When consignment goods are received:No entry is made in the books of . The consignee is not the owner of the goods and therefore he makes no entry when he receives the goods. (2) For expenses incurred by the consignee:Consignor's personal To Cash (3) When advance is given:Consignor's personal

To Cash or bills payable (4) When goods are sold:Cash or bank To Consignor's personal (5) For commission due:Consignor's personal To commission

Valuation of Unsold Stock Or Closing Stock in Consignment ing: How is the closing stock or unsold stock laying with the consignee valued?. The valuation of stock laying with the consignee at the time of final closing of the of the consignor is generally made at cost or market price whichever is less. The meaning of cost, however, should be properly understood. Cost should not mean merely the cost at which the consignor invoices the goods. If such expenses as normally increase the value of goods have been incurred, a proportionate of such expenses should be included in the cost. In other words, all the expenses incurred to move the goods from the consignor's premises to the premises of consignee should be included. Expenses which are incurred up to the moment the goods are received into the godown of the consignee are treated as part of the cost. But expenses incurred after the goods have been put into the godown should not be included into the cost because such expenses do not increase the value of goods. Examples of such expenses are godown rent, insurance godown, ment, salaries of salesmen, etc. It does not matter who pays the expenses (consignor or consignee). Example: Suppose, 1000 units are dispatched at a cost of $20 each. The consignor pay $100 for insurance in transit and $200 for packing. The consignee pays 700 for freight, $100 as octroi duty and $100 as cartage. He also pays $200 as godown rent and $150 as insurance . The last two items will be excluded while calculating the cost. The total cost will be $20,000 + $100 + 200 + 700 + $100 + $100 = $21,200. The cost per unit, therefore, comes to $21.20. If 100 units remain unsold, the value of stock will be: 100 × 21.20, i.e., $2,300. If the market price is less than this figure, then the value of stock will be on the basis of market price.

(With the amount of expenses)

(1)

To Consignee's personal (6)

To Goods sent on consignment (2)

On payment of expenses on dispatch:Consignment (With the amount spent as expenses) To Bank On receiving advance: Cash or bills receivable (With the amount cash or bill)

For commission payable to the consignee:Consignment (With the amount of expenses) To Consignee's personal Assuming that all the goods sent have been sold, the consignment will show at this stage the actual profit or loss made on it. The same is transferred to profit and loss .

(3)

The entry in case of profit is:

To Consignee's personal (4) A/S):-

On the consignee reporting sale (as per

Consignee's personal gross proceeds of sales) To Consignment

Consignment To profit and loss In case of loss the entry is:

(With

(5) For expenses incurred by the consignee (as per A/S):Consignment When Consignment is Partly Sold:

Profit and loss To Consignment Note: The goods sent on consignment may be closed by a transfer to trading .

When all the goods sent on consignment have not been sold., the value of unsold goods in the hands of the consignee must be ascertained and the profit or loss should be found out by taking this stock into . The entry is: Stock on consignment To Consignment Stock on consignment is an asset and will be shown in the balance sheet of the consignor. Valuation of stock is discussed on valuation of stock page.

ing Entries in the Books of Consignee: (1) When consignment goods are received:No entry is made in the books of . The consignee is not the owner of the goods and therefore he makes no entry when he receives the goods. (2) For expenses incurred by the consignee:Consignor's personal To Cash (3) When advance is given:Consignor's personal

To Cash or bills payable (4) When goods are sold:Cash or bank To Consignor's personal (5) For commission due:Consignor's personal To commission

Valuation of Unsold Stock Or Closing Stock in Consignment ing: How is the closing stock or unsold stock laying with the consignee valued?. The valuation of stock laying with the consignee at the time of final closing of the of the consignor is generally made at cost or market price whichever is less. The meaning of cost, however, should be properly understood. Cost should not mean merely the cost at which the consignor invoices the goods. If such expenses as normally increase the value of goods have been incurred, a proportionate of such expenses should be included in the cost. In other words, all the expenses incurred to move the goods from the consignor's premises to the premises of consignee should be included. Expenses which are incurred up to the moment the goods are received into the godown of the consignee are treated as part of the cost. But expenses incurred after the goods have been put into the godown should not be included into the cost because such expenses do not increase the value of goods. Examples of such expenses are godown rent, insurance godown, ment, salaries of salesmen, etc. It does not matter who pays the expenses (consignor or consignee). Example: Suppose, 1000 units are dispatched at a cost of $20 each. The consignor pay $100 for insurance in transit and $200 for packing. The consignee pays 700 for freight, $100 as octroi duty and $100 as cartage. He also pays $200 as godown rent and $150 as insurance . The last two items will be excluded while calculating the cost. The total cost will be $20,000 + $100 + 200 + 700 + $100 + $100 = $21,200. The cost per unit, therefore, comes to $21.20. If 100 units remain unsold, the value of stock will be: 100 × 21.20, i.e., $2,300. If the market price is less than this figure, then the value of stock will be on the basis of market price.