Hdfc Life Click 2 Invest - Ulip_harvinder_s100000287062.pdf 503m11

This document was ed by and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this report form. Report 3b7i

Overview 3e4r5l

& View Hdfc Life Click 2 Invest - Ulip_harvinder_s100000287062.pdf as PDF for free.

More details w3441

- Words: 7,786

- Pages: 17

UNIT LINKED PROPOSAL FORM Full Underwriting ALL UNIT LINKED POLICIES ARE DIFFERENT FROM TRADITIONAL INSURANCE POLICIES AND ARE SUBJECT TO DIFFERENT RISK FACTORS. IN THIS POLICY THE INVESTMENT RISK IN YOUR CHOSEN INVESTMENT PORTFOLIO IS BORNE BY YOU. * The entire form is to be filled in black ink only. Use CAPITAL letters for information required in boxes with a space between words. Use separate proposal forms for each plan. Any cancellation/alteration is to be signed by the proposed policyholder or life to be assured as appropriate. * All relevant ing documents are to be provided. Nomination should be done when proposal is on own life. * All information provided here shall be relied on and should be accurate, complete and true in all respects for processing the proposal quickly. In case you have any doubt whether the particular information is material or not, please disclose the information. * Where the proposed policyholder has not filled up the application form or where he/she has affixed the thumb impression, the corresponding declarations are to be completed. * Section B (questions 9, 10,12 and 13) and Section C (questions 2 and 3) are mandatory only where the life to be assured and the proposed policyholder are the same. Email, Pin code and numbers are mandatory. details mentioned herein will be used for future communication. * The plans mentioned in this proposal form have been approved by IRDAI (Insurance Regulatory and Development Authority of India) and have been allotted an Unique Identification Number (UIN). This number is available in our sales literature and also on IRDAI’s website for verification.

Notes: a) For any additional forms, annexes, questionnaires or drafts of declarations and affidavits, please your financial consultant.

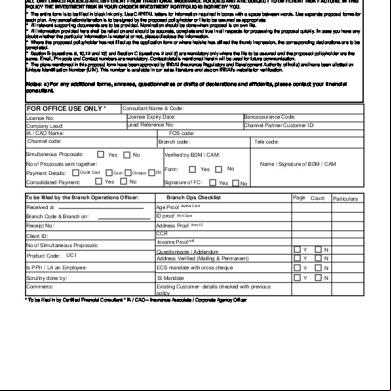

FOR OFFICE USE ONLY *

Consultant Name & Code: License Expiry Date: Lead Reference No:

License No: Company Lead: IA / CAO Name: Channel code:

Bancassurance Code: Channel Partner Customer ID:

FOS code: Branch code:

Simultaneous Proposals:

Yes

No

Tele code:

Verified by BDM / CAM:

No of Proposals sent together: Credit Card

Payment Details:

Consolidated Payment:

Cash

Yes

Cheque

No

To be filled by the Branch Operations Officer:

DD

Form:

Signature of FC:

No Page

Count

Aadhar Card

Age Proof

Branch Code & Branch on:

ID proof

Receipt No:

Address Proof Voter ID CCR

No of Simultaneous Proposals:

Yes

Branch Ops Checklist

Received at

Client ID:

Name / Signature of BDM / CAM

No

Yes

PAN Card

Income Proof null Questionnaire / Addendum Address Verified (Mailing & Permanent)

Y

N

Y

N

ECS mandate with cross cheque

Y

N

Scrutiny done by:

SI Mandate

Y

N

Comments:

Existing Customer- details checked with previous policy

Product Code:

UC1

Is PPH / LA an Employee:

* To be filled in by Certified Financial Consultant * IA / CAO – Insurance Associate / Corporate Agency Officer

Particulars

Plan Selection: Please update the desired plan and Plan Options in Section A (plan details) of the application form. The table below indicates the Plans and various features available with the plan. You are requested to study it thoroughly before indicating the plan / benefits that you desire. Plans

ProGrowth Super

Frequency

Annual

Plan/ Benefit Options (a) Life Option (b) Extra Life Option (c) Life & Health Option (d) Extra Life &Health Option (e) Life & Disability Option* (f) Extra Life & Disability Option * (g) Life & Health & Disability Option* (h) Extra Life & Health & Disability Option*

Annual

Save Benefit : (a) Life Option (b) Life & Health Option Save-n-Gain Benefit : (a) Life Option (b) Life & Health Option

Annual Half Yearly Monthly**

(a) Life Option (b) Extra Life Option

ProGrowth Plus

Annual Half Yearly Monthly**

(a) Life Option (b) Extra Life Option

Crest

Annual

None

Single

None

YoungStar Super

ProGrowth Flexi

ProGrowth Maximiser

Invest Wise

Single

None

Smart Woman

Single

(a) Classic (b) Premier (c) Elite

Sampoorn Nivesh

Click 2 Invest - ULIP

Annual Half-Yearly Quaterly Monthly** Single

Annual Half-Yearly Quaterly Monthly** Single

Plan Options: (a) Life Option (b) Extra Life Option Additionaly, also choose one of the following Benefit options: (a) Classic Benefit (b) Classic Plus Benefit (c) Classic Waiver Benefit

Investment Fund Options(SFIN)

Choice of 4 funds (Free Asset Allocation) * Income Fund(ULIF03401/01/10IncomeFund101) * Balanced Fund(ULIF03901/09/10BalancedFd101) * Blue chip Fund(ULIF03501/01/10BlueChipFd101) * Opportunities Fund (ULIF03601/01/10OpprtntyFd101)

Choice of 8 funds (Self Managed) * Income Fund(ULIF03401/01/10IncomeFund101) * Balanced Fund(ULIF03901/09/10BalancedFd101) * Blue chip Fund(ULIF03501/01/10BlueChipFd101) * Opportunities Fund (ULIF03601/01/10OpprtntyFd101) * Equity Plus Fund (ULIF05301/08/13EquityPlus101) * Diversified Equity Fund (ULIF05501/08/13DivrEqtyFd101) * Bond Fund (ULIF05601/08/13Bond Funds101) * Conservative Fund(ULIF05801/08/13ConsertvFd101)

None

Single Top - Ups are available with HDFC SL ProGrowth Maximiser and HDFC Life Sampoorn Nivesh *Not available to housewives and student ***Life to be Assured should be female life. Spouse cover on life of spouse only in Elite option of the plan. Life Assured should be married on date of proposal to opt for Elite option. **Subject to our prevailing operational rules, it may be required for Monthly Frequency to be taken with ECS/SI & and to pay first 3 months in advance along with the Proposal Form.

SECTION A - PLAN DETAILS HDFC Life Click 2 Invest - ULIP UC1

Plan Name: Plan Option: Benefit Option:

Paying Term (Yrs): Policy Term (Yrs): 10

Frequency of Payment:

Regular 10

Installment Amount (Rs):

Quarterly

7500.00

Sum Assured on Installment (Rs.):

300000.00

Single Top-Ups Amount (Rs.):

Sum Assured on Single Top-Ups (Rs.):

For availability of Single Top-Ups refer to Page 2

Total Sum Assured (Rs.):

300000.00

Amount: 7500.00

Payment Details: DEBIT_CARD Drawn on (Bank name):

Date: 18-Dec-2015

Cheque/DD No:

Bank Number Investment Allocation Option: Self Managed/Free Asset Allocation

Life Stage Asset Allocation (applicable only for Sampoorn Nivesh)

Kindly indicate % of allocation in below mentioned funds as applicable ( not applicable if Life Stage Asset Allocation is chosen)

Fund Income Fund Balanced Fund

Allocation in % 60

Fund Equity Plus Fund

Allocation in % 0

0 0 20

Diversified Equity Fund Bond Fund Conservative Fund

0

Blue chip Fund Opportunities Fund

20 0

In case the life to be assured is the guardian of a disabled person, is this insurance policy being taken primarily to protect the disabled person? UID Number: Do you want the policy in Demat form? Yes No If yes,insurance number If a policy is requested in demat format, it will not be given in physical form if policy is given in physical format. It will not be given in demat form.

SECTION B – PERSONAL DETAILS OF LIFE TO BE ASSURED 1. Title:

MR

Client Code (Office use only)

First Name:

Harvinder

Middle Name: Last Name:

Singh

Maiden Name: (Only for married females)

Father’s / Spouse’s Name: Employee of HDFC Life:

Paramjeet Kaur

If Yes, Employee Code & Location

No

KARNAL

* Proposer/policy holder other than individual please mention 'Legal name' in the Name column

2. DOB (DD/MM/YYYY)

4. Marital Status

3. Gender

27-Oct-1985

Male

6. Nature of Age Proof attached: 7. Educational Qualification:

5. Nationality Indian

Married

Aadhar Card Graduation

8. Are you a Non Resident Indian (NRI)?

NO

9. Visible Identification

.If yes , name of resident country and attach NRI questionnaire

10. PAN:

Applied For

CSVPS1996N

11. Aadhar card

Not Applicable

*PAN is mandatory for all applications where as on date of application, the cumulative amount of

13. If you are our existing life assured, assignee, nominee, 14. Proof of Identity

(Document submitted):

12. Place of Birth:

PAN Card

Serial No:

Name of Issuing Authority: Date of Issue of Document:

15. Proof of Residence (must for mailing & permanent)

Mailing :

Voter ID

Permanent :

If residential proof provided other than of self / spouse / father, then please specify the name of owner of residence: 16. Where would you like to receive all your communication? SMS

Email

Tele Calls

Mail

Residence

Office

Preferred Language of Communication

Permanent

17. Correspondence Address: House / Flat No:

H.no-703

Street / Area:

Sector-6

Landmark:

Near Tagore Baal Niketan scho

City/Distri Karnal State:

Pin Code:

132001

Haryana

18. Permanent Address: (If different from correspondence address) House / Flat No: Street / Area: Landmark: City/Distri

Pin Code:

State: Mobile:

9416166122

Telephone No (R):

Telephone No (O):

-

Fax No:

E-mail Address:

[email protected]

SECTION C – PERSONAL AND FAMILY HISTORY OF LIFE TO BE ASSURED 1. Present Occupation Details: Designation:

Salaried

JE

Gross Yearly Income from all Sources (Rs): Office Address :

500000.00

BSNL KARNAL

Please provide in detail the exact nature of work performed by you in connection with your present employment or business. (For e.g. clerical, mechanical, supervisory job, etc.)

Maintenance

Please provide details, if any, regarding your occupation or business, which may render you No susceptible to injury or illness. (e.g. exposure to chemical substances/hazardous materials/harmful dust or gases/ explosives/ working at heights/ handling heavy machinery etc.) Electronics and Telecommunications

Industry to which your company or business belongs (cement, banking etc.) Nature of Occupation: (e.g. architect, garment dealer, etc.) 2. Sources of Funds : income e.g. ITR salaries 100

Maintenance

If & Single Top-Ups, wherever relevant is equal to or more than Rs. 1 Lakh, please enclose proof of

Business 0

House Property 0

Capital Gains

Investments

0

3. Are you a “Politically Exposed Person”?

0

Agriculture 0

Others 0

Total 100%

NO

Definition of a Politically Exposed Person: Politically exposed persons are individuals who are or have been entrusted with prominent public functions in a foreign country, their family and close relatives such as Heads of States or of Governments, Senior politicians, Senior government/judicial/military officers, Senior executives of state-owned corporations, Important political party officials, etc.

4. Do you take part in any hobbies/activities that could be considered dangerous in any way? e.g. aviation (other than as a fare-paying No enger), mountaineering, deep sea diving or any form of racing? If ‘Yes’, please provide details HOUSEWIFE – kindly submit Housewife Addendum *STUDENTS – kindly state 1. The course being pursued 2. Name and address of college/institution (excluding coaching classes) 3. Duration of the course 4. Year/semester/standard Address of present employer or business premises if self employed and address of ed office/main place of business in case of other entities) 9Proposer/policy owner is other than individual please mention Designation & fill Legal Form , 10Address of present employer or business premises if self employed and address of ed office/main place of business in case of other entities

5. Have you resided overseas for more than 6 months continuously during the last five years, or do you intend to travel overseas in the No next six months? If you have answered ‘‘Yes’’ to the question, please give the names of the countries and duration of stay:

Yes / No

Countries

Duration

Past Travel

No

Months

Future Travel

No

Months

6. Do you have any existing insurance cover of paying and/or paid up policies (excluding group term insurance plan taken by No your employer)? If ‘‘Yes’’ please provide the following details: (All amounts in Rupees) A.

Sum Assured payable on death

B

Sum payable on accidental death (excluding A)

C.

Benefits payable on disability/critical illness

D.

How much of this cover i.e. (i+ii+iii) was taken out in the last 1 Year?

E.

How much of the cover in (A) was taken out during the last five years?

7. Have you submitted any simultaneous applications for life insurance at any of our offices or to another life insurance company, which is still pending OR are you likely to revive lapsed policies? No If ‘‘Yes’’ please give details of those proposals (All amounts in Rupees) To be Revived

Already Proposed A. Sum Assured payable on death B. Name of the company/ies C. Types of products D. Purpose of cover 8. Has any application for insurance on your life been: Yes Postponed?

No

Accepted with Extra

No

Accepted on other special ?

No

Declined?

No

Withdrawn by yourself?

No

9. Height

Cms (or)

5

Feet

No

Policy Number

11 Inches

Name of Insurance Co.

10. Weight

Reason

75

Kgs.

11. Please give the following details: Substance Consumed

Yes

No

Consumed As

Quantity

a. Alcohol

No

Units* Per Week

b. Tobacco

No

Units* Per Day

c. Are you currently consuming or have you ever consumed narcotics or any such other substance whether prescribed or not?(for example ganja, hashish, heroin, cocaine, charas, marijuana, etc.) No * 1 unit equivalent to 330 ml of beer / 125 ml of wine / 30 ml of spirits ** 1 unit equivalent to 1 cigar / 1 cigarette / 1 bidi. If chewing tobacco please specify how many grams per day. 12. State the name and address of your usual doctor who attends you in the event of illness, OR if you have been consulting with this doctor for less than 3 months, the name and address of your previous doctor. Name: House / Flat No: Street / Area: City: State: Telephone No Email :

Pin Code: Mobile:

13. Personal medical details: (If answered ‘Yes’ in sub-question Ia (a to j) please fill the relevant questionnaire)

Ia. Have you EVER suffered from any of the following conditions?

Indicate Yes or No by Questionnaire ticking in relevant box attached Yes

No

Ib. Have you EVER suffered from any of Indicate Yes or No the following conditions? by ticking in relevant box

Please tick if “Yes”

Yes

(a) Diabetes

No

(k) Stroke

No

(b) High blood pressure

No

(l) Liver disorder

No

(c) Respiratory disorders

No

(m) Kidney disorder

No

(d) Epilepsy

No

(n) Disorder of the digestive system

No

(e) Back problems

No

(o) Paralysis or multiple sclerosis

No

(f) Arthritis

No

(p) Blood disorder

No

(g) Any nervous disorder or mental condition

No

(q) Heart Disease

(h) Abnormality of thyroid

No

(r) Any recurrent medical condition /disability (including eye/ear disorder)?

No

(i) Tuberculosis

No

(s) Cancer or a tumour

No

(j) Depression or psychiatric disorder

No

II. Do you have any physical disability? III. Are you currently suffering from any illness, impairment, or taking any medication or pills or drugs? IV. Have you ever tested positive for HIV/AIDS or Hepatitis B or C, or have you been tested/treated for other sexually transmitted diseases or are you awaiting the results of such a test? V. Do you have / had any recurrent medical condition or physical disability or deformity or illness or injury that has kept you from working for more than one week in the last 5 years? VI. During the last 5 years, have you undergone or been recommended to undergo: a. Hospitalisation? b. An operation? c. X ray or any other investigation (excluding check-ups for employment/insurance/foreign visit)?

No

No

No No No No No No No

If you have answered ''Yes'' to any of the sub questions [I (a to s), II, III, IV, V and VI] asked under question 14 of this section, please answer the following Nature of Illness/Accident Date of Name and Address of Details of Investigations Under Fully Diagnosis the Doctor Done Medication recovered /Event (Yes/No) (Yes/No)

14. To be answered by the female life to be assured: Please tick the appropriate answer to all of the questions below. (a) Are you presently pregnant? (b) If ‘‘Yes’’, how many weeks? Kindly attach the Pregnancy Questionnaire (c) Do you have a history of past an abortion, miscarriage, Caesarian section or complications during pregnancy? Special Woman Plan Questionnaire to be completed if answer is Yes (d) Have you ever had any disease of uterus, cervix, or ovaries? (e) Have you given birth to a child with any congenital disorder like Down syndrome? Special Woman Plan Questionnaire to be completed if answer is (f) Have you ever undergone hysterectomy? * * Please attach hysterectomy questionnaire and histopathology reports if answered as ‘Yes’

If you have answered ‘‘Yes’’ to (d), please give details below (If required please attach separate sheet):

15. We may require you to undergo medical examinations/tests. Some of the medical tests may require you to observe fasting. Please indicate your preference of location, near which the medical tests can be conducted. 16. Family history of the life to be assured. Please tick the appropriate answer to all of the questions below: Have any of your parents, brothers or sisters died or suffered prior to the age of 65 years from:

No

a) Heart disease? b) High blood pressure? c) Stroke? d) Diabetes? e) Kidney disease? f) Cancer? g) Any form of paralysis, any hereditary disorder (such as Huntington’s disease, Polycystic disease of the kidney or familial polyposis of the colon)? If you have answered ‘‘Yes’’ to any of the questions above, please give details: Relation to the life to be assured

Disease

Age of Diagnosis

Alive/Deceased

Current Age/ Age at death

SECTION D (I) - PERSONAL DETAILS OF NOMINEE / BENEFICIARY / PROPOSED POLICYHOLDER Nomination facility is available only when the proposed policyholder is taking a policy on his/her own life. Hence if you are proposing to apply on your OWN life please use this section to furnish the personal details of the nominee else please use this section to fill in your personal details. Nominee is the person to whom the money secured by the policy shall be paid in the event of death of the life to be assured. The beneficiary facility is currently available only for the HDFC SL YoungStar Super II & HDFC SL YoungStar Super . The beneficiary to be the sole person entitled to the benefits and payments (except any refund payable on cancellation in the free-look period) under the policy. For other products if the beneficiary is indicated, the same will be considered as a nominee. In any event where the benefits revert to the life to be assured under the provisions of the policy and the life to be assured does not intend to appoint any other beneficiary under the policy, the life to be assured can at that time appoint a nominee to receive the proceeds of the policy and give a valid discharge to the Insurance Company. Note: It is advisable to appoint nearest blood relative as nominee / beneficiary. Mandatory: Please also fill in the KYC form if you have selected proposed policyholder Section C, point 3 to be included(incase of beneficiary only)

NOMINEE SECTION Nominee 1 : Title:

100% allocated

Client Code (Office use only):

MRS

First Name:

Gender:

Female

DOB :

Paramjeet

Middle Name: Last Name:

Kaur

Relationship of nominee / beneficiary / proposed policyholder to life to be assured: Residential Address:

Wife

Same as stated on page 4, if different then please fill the fields below

House / Flat No:

H.no-703

Street / Area:

Sector-6

City/District :

Karnal

Pin Code:

State:

Haryana

Mobile:

Telephone No. (R):

-

132001

Telephone No. (O):

E-mail Address: Nominee 2 : Title:

Date of Birth:

Gender:

First Name: Middle Name: Last Name: Relationship of nominee / beneficiary/proposed policyholder to life to be assured: Correspondence Address:

Same as stated on page 3, if different then please fill the fields below

House / Flat No: Street / Area: City:

Pin Code:

State/District:

Mobile:

Telephone No. (R): E-mail Address:

-

Telephone No. (O):

27-Dec-1989

Nominee 3 : Title:

Date of Birth:

Gender:

First Name: Middle Name: Last Name: Relationship of nominee / beneficiary/proposed policyholder to life to be assured: Correspondence Address:

Same as stated on page 3, if different then please fill the fields below

House / Flat No: Street / Area: City:

Pin Code:

State/District:

Mobile:

Telephone No. (R):

-

Telephone No. (O):

E-mail Address: Nominee 4 : Title:

Date of Birth:

Gender:

First Name: Middle Name: Last Name: Relationship of nominee / beneficiary/proposed policyholder to life to be assured: Correspondence Address:

Same as stated on page 3, if different then please fill the fields below

House / Flat No: Street / Area: City:

Pin Code:

State/District:

Mobile:

Telephone No. (R):

-

Telephone No. (O):

E-mail Address:

SECTION D (II) – APPOINTEE DETAILS Title:

(To be filled only if nominee/beneficiary is minor. The Appointee must not be life to be assured) Gender: Client Code (Office use only):

First Name: Middle Name: Last Name: DOB : correspondence Address:

Same as stated on page 4, if different then please fill the fields below

House / Flat No: Street / Area: City:

Pin Code:

State:

Mobile:

Telephone No. (R):

-

E-mail Address: Signature of appointee accepting the appointment: (appointee cannot affix thumb impression)

Telephone No. (O):

SECTION E - DECLARATION OF THE LIFE TO BE ASSURED AND PROPOSED I declare that: i. I have received the Product Brochure and Benefit Illustration of the Plan of Insurance under which I have applied for a policy of insurance on the Life to be Assured and specified by me in Section A of this Proposal Form and I have applied for the policy after being fully satisfied of the features and benefits of the said Plan of insurance; ii. I have replied to the questions, and have made the statements in respect of the matters sought for, in the Proposal Form and I understand and agree that the replies given and statements made in the Proposal Form together with any documents submitted by me for processing my application for insurance shall be the basis of the contract between me and HDFC Standard Life Insurance Company Limited ("the Company"). iii. I understand and agree that in case of any fraud or misrepresentation, the policy shall be cancelled immediately by paying the surrender value, if any, in accordance with Section 45 of the Insurance Act, 1938. iv. I shall be bound and I undertake to notify the Company forthwith , in writing ,of any change in my health , occupation and income during the period between the date of this proposal and the date of acceptance of my proposal for insurance , as communicated in writing to me by the Company ; v. The first deposit made by me along with this proposal for insurance has been made, and the s payable under the policy that may be issued in pursuance of this proposal, will be paid, strictly in accordance with the law of the land. Amounts paid, otherwise than from my shall be permitted only if an insurable interest can be established. vi. I confirm that the s have not been and will not be generated from proceeds of any criminal activities/offenses listed in the Prevention of Money Laundering Act 2002 or under any other applicable laws. vii. I confirm that I have understood the Benefit Illustration and accept that the investment rates assumed therein are not guaranteed.

I agree and authorize : i. I understand and I agree that the Company will be on risk in pursuance of this proposal only after the risk under the proposal is accepted by the Company and such acceptance is communicated to me in writing by the Company. ii. I understand and agree that the Company shall be entitled to retain the paid along with the proposal form as an interest free initial deposit to be adjusted against payable upon issuance of the Policy. In the event the proposal is not accepted by the Company the aforesaid deposit shall be refunded without any interest subject to deductions for medical costs and processing charges, if any, incurred by the Company under the proposal. iii. My employers / business associates, present and past, to disclose to and to furnish such documents to the Company as it may require either for the purpose of processing my proposal for insurance or at any time thereafter for any other purpose in relation to the policy that may be issued in pursuance of this proposal ; iv. Any doctor/medical examiner/hospital/laboratory/clinic/insurance company to disclose and to furnish to the Company such documents regarding my health and habits or health and habits of the Life to be Assured, as the Company may require either for the purpose of processing this proposal for insurance or for any other purpose at any time thereafter in relation to the policy that may be issued in pursuance of this proposal, not withstanding any usage or custom or rules/ regulations of such hospital or laboratory or clinic prohibiting such disclosure or furnishing of such documents , or on such disclosure or furnishing of documents being done without my consent or the consent of my family or of any member thereof ; v. That the Company may, without any reference to me or to my family or to any member thereof, furnish any details or any information furnished in this proposal for insurance to any judicial or statutory or other authority or to any insurer or reinsurer in connection with the processing of this proposal for insurance or for any other purpose, as for instance, settlement of a claim under the policy and the like that may be issued in pursuance of this proposal; vi. That in addition to such mode of communication as the postal or courier service , the Company may, at its discretion use any electronic media, for communication in relation to this proposal for insurance or the policy that may be issued in pursuance of this proposal. vii. I hereby voluntarily give my consent to collect, process, receive, possess, store, deal or handle my/our sensitive personal data or information [as defined in the Information Technology (Reasonable security practices and procedures and sensitive personal data or information) Rules 2011 as amended from time to time] (“Data”) with third parties/ vendors associated with the Company for various purposes and outsourced activities exclusively related to issuance/servicing/settlement of claim as required under the insurance policy. viii. All documents submitted by me along with this Proposal Form are authentic, valid, and where relevant true copies of originals for the purpose of this Proposal Form. Signature/Thumb impression of Witness Name & Address

Occupation

Signature/Thumb impression of life to be assured Signature should match with signature on ECS/SI

Signature/Thumb impression of proposed policyholder (Only if different from life to be assured) Signature should match with signature on ESI/SI mandate

Place:

Place:

Date: 18/12/2015

Date: Mobile:

Mobile:

Above signature and Mobile number will be used for all future interactions and verification. Please provide your in-use mobile no and sign as per

DECLARATION OF GOOD HEALTH FOR SPOUSE Name:

TO BE FILED ONLY FOR ELITE OPTION OF SMART WOMAN PLAN

DOB :

Amount of Insurance :

Within the last 5 years, I have neither been hospitalized for, required medication or treatment for, nor consulted a physician (to include a follow-up visit) due to,or as a result of, any of the following: alcohol or drug abuse, heart or circulatory disorder, stroke, cancer or leukemia, diabetes, high blood pressure, chronic kidney or liver disease, mental, nervous or neurological disorders, lung disorders, AIDS (acquired immune deficiency syndrome), ARC (aids related complex),or had tests indicating exposure to the aids virus.

Signature of the spouse:

Date:

Note: 1.You may withdraw the consent till anytime before the proposal is logged into our systems. In that case, your proposal shall stand withdrawn by you. 2. The data provided by you/LA and if subsequently found to be inaccurate, can be rectified upon a written request by you and as per our process except such data which is the basis of this contract / policy unless agreed to by Company. Please us on any of the following touch points in case of non receipt of your HDFC Life policy document after 1month from date of application. Call us toll free on 1860 267 9999(do not pre fix any country code e.g. +91 or 00), SMS SERVICE to 5676727 for call back request or email us at service @ hdfclife.com

Note: Please retain your copy of the acknowledgement slip for future references Declaration to be made by a 3rd person where: —The life to be assured/proposed policyholder has affixed his/her thumb impression; OR —The life to be assured/proposed policyholder has signed in vernacular; OR —The life to be assured/proposed policyholder has not filled the application. I hereby declare that I have explained the contents of this application form to the life to be assured in ________________language and have truthfully recorded the answers provided to me. I further declare that the life to be assured/proposed policyholder has signed/affixed his/ her thumb impression in my presence.

Name and Address of declarant

Signature

Declaration made by life to be assured/proposed policyholder I hereby declare that the content of the form and document has been fully explained to me and I have fully understood the significance of the proposed contract.

Signature/Thumb impression of life to be assured/proposed policyholder

Section 45 – Disclosure of material information: 1.No policy of life insurance shall be called in question on any ground whatsoever after the expiry of three years from the date of the policy, i.e., from the date of issuance of the policy or the date of commencement of risk or the date of revival of the policy or the date of the rider to the policy, whichever is later. 2.A policy of life insurance may be called in question at any time within three years from the date of issuance of the policy or the date of commencement of risk or the date of revival of the policy or the date of the rider to the policy, whichever is later, on the ground of fraud: Provided that the insurer shall have to communicate in writing to the insured or the legal representatives or nominees or assignees of the insured the grounds and materials on which such decision is based. 3.Notwithstanding anything contained in sub-section (2), no insurer shall repudiate a life insurance policy on the ground of fraud if the insured can prove that the misstatement of or suppression of a material fact was true to the best of his knowledge and belief or that there was no deliberate intention to suppress the fact or that such mis-statement of or suppression of a material fact are within the knowledge of the insurer: Provided that in case of fraud, the onus of disproving lies upon the beneficiaries, in case the policyholder is not alive. 4.A policy of life insurance may be called in question at any time within three years from the date of issuance of the policy or the date of commencement of risk or the date of revival of the policy or the date of the rider to the policy, whichever is later, on the ground that any statement of or suppression of a fact material to the expectancy of the life of the insured was incorrectly made in the proposal or other document on the basis of which the policy was issued or revived or rider issued: Provided that the insurer shall have to communicate in writing to the insured or the legal representatives or nominees or assignees of the insured the grounds and materials on which such decision to repudiate the policy of life insurance is based: Provided further that in case of repudiation of the policy on the ground of misstatement or suppression of a material fact, and not on the ground of fraud, the s collected on the policy till the date of repudiation shall be paid to the insured or the legal representatives or nominees or assignees of the insured within a period of ninety days from the date of such repudiation. 5.Nothing in this section shall prevent the insurer from calling for proof of age at any time if he is entitled to do so, and no policy shall be deemed to be called in question merely because the of the policy are adjusted on subsequent proof that the age of the life insured was incorrectly stated in the proposal.

Section 41 – Prohibition of rebates: (1) No person shall allow or offer to allow, either directly or indirectly, as an inducement to any person to take or renew or continue an insurance in respect of any kind of risk relating to lives or property in India, any rebate of the whole or part of the commission payable or any rebate of the shown on the policy, nor shall any person taking out or renewing or continuing a policy accept any rebate, except such rebate as may be allowed in accordance with the published prospectuses or tables of the insurer: Provided that acceptance by an insurance agent of commission in connection with a policy of life insurance taken out by himself on his own life shall not be deemed to be acceptance of a rebate of within the meaning of this sub-section if at the time of such acceptance the insurance agent satisfies the prescribed conditions establishing that he is a bona fide insurance agent employed by the insurer. (2) Any person making default in complying with the provisions of this section shall be liable for a penalty which may extend to ten lakh rupees.

FC Code No:

NRI Q - 6.6

Non Resident Indian/ Person of Indian Origin Questionnaire. We thank you for applying for an HDFC standard Life Insurance Policy. To enable us to assess your application, kindly send this NRI/ Person of Indian Origin Questionnaire answered by the Life to be Assured and duly signed by the Life to be Assured and Proposed Policy Holder, if any. Name of Life to be Assured

Harvinder

Application No./Proposal No.

S100000287062

1. Address of foreign residence.

2. The name of your regular medical physician while abroad, with full information. -Telephone No, Address, E-mail address, etc. 3. Permanent address in India.

4. Nationality

INDIAN

5. a) Date of first leaving India. 5. b) Date when you intend to leave from India after your current visit. 6. a) Duration of your stay abroad. 6. b) Date of return if known. 7. Purpose of your stay abroad. 8. Name and address of person to whom the policy document is to be sent in India?

9. Please state your NRI Bank number and the name of the bank. 10. The source from which the s will be paid? 11. a) port / PIO Card Number. 11. b) Date and place of issue.

*

An incomplete Questionnaire will not be considered valid.

I agree and understand the following: 1.The information given herein is true and complete in all respects and will form an integral part of the proposal made by me for an Insurance policy from HDFC Standard Life Insurance Co. Ltd. 2.The policy as and when issued will be delivered to the address specified in Question No 8. 3.Similarly, the claim proceeds under such policies will be paid in India in Indian Currency. 4.The product has been sold to me in India and the proposal from is being signed by me in Indian territory.

MANDATE FORM FOR DIRECT DEBIT (Please use a separate request form for each policy) To, The Manager I/We, the undersigned, hereby: {Tick whichever is applicable}

Date:

18/12/2015

Request for maintenance of standing instruction for payment to HDFC Standard Life Insurance Co. Ltd. (with select banks only) Request to remit bill amount for payment to HDFC Standard Life Insurance Co. Ltd. through Electronic Clearing Service (for select X cities only). Request for direct debit from my bank (non ECS location) for payment to HDFC Standard Life Insurance Co. Ltd. (with select banks only*) Preferred billing date:

(DD/MM) *

Policy No. :

S100000287062

Name of proposed policyholder: Harvinder Singh Name of holder (if different from above): amount to be debited: Rs. 7500.00 Amount in words: Rs. Rupees Seven Thousand Five Hundred Only Bank A/c no (from where will be debited): 3989000400107272 Bank name & address: PNB-PUNJAB NATIONAL BANK,null 9 Digit MICR no. (not required for SI to HDFC Bank Ltd / Direct Debit from bank of non ECS location): Frequency (Please tick): Quarterly Type of : Saving holder signature: Date: Place: Proposed policyholder signature*: Date: Place: (*If different from Relationship with holder (If proposed policyholder is different from holder): Reason for payment (If proposed policyholder is different from holder): *Kindly check overleaf for the & conditions, Kindly submit this mandate 30 days prior to the due (Please refer point 8 of the declaration)

For office use only * Next due date:

Last due date:

Policy number

number of the beneficiary (with HDFC Bank Ltd):

---------------------------------------------------------------------------------------------------------------------------------CUSTOMER ACKNOWLEDGEMENT Date: Plan Name Cheque / DD

Frequency of Payment Amount (Rs.)

Term Bank

Other requirements (LIST) 1.

2.

3.

I, have collected the above documents and will be submitting it tothe nearest HDFC Standard Life branch for further processing. (Signature of Financial Consultant) (Financial Consultant number) Financial Consultant Code) > This is NOT A PAYMENT RECEIPT but only a proof of the documents received from you. > All cheques/DD should be crossed and drawn in favour of HDFCSLIC. > If payment is not made by way of Cheque/DD, Kindly make cash payment at an HDFC Standard Life branch and collect your initial deposit receipt. > This acknowledgement does not in any way constitute acceptance or commencement of risk. Easy Connect: If you have any queries or clarifications regarding your policy, kindly us at any of the following service touch points accessible from 9 am to 9 pm all 7 days, alternatively you may e-mail us at [email protected] @ Call 1800 266 0315 tol free SMS ‘service’ to 5676727 Dear _______________, we acknowledge the receipt of your SI/ECS mandate and it will be processed within 30 days from today. After attaching the same in our system, we will forward it to your bank for further processing. In case of rejection, the same would be communicated to you; or else it would mean that your mandate is lodged in successfully. Effective the next due date the would be debited from your bank . Thank you for choosing direct debit as your payment option.

Branch Stamp

Acknowledgement received (Signature of the Customer) Continued Overleaf

DECLARATIONS FOR DIRECT DEBIT 1. I/We undertake to keep sufficient funds in the funding on the date of execution of standing instruction. 2. I/We hereby authorise the bank / Bill Junction to communicate my/our funding number and any other details (as may be necessary) to HDFC Standard Life Insurance Company Ltd. for the specific purpose of recovering my/our HDFC Standard Life Insurance Company Ltd. payments through a standing instruction of my/our . 3. I/We hereby authorise HDFC Standard Life Insurance Company Ltd., in the instance of the Standing Instruction / ECS debit failing for any reason, to authorise the bank / Bill Junction to recover the payable through a direct debit to my/out with the mentioned bank. 4. I/We agree that for changing the amount as per my requirement, I/We will furnish a fresh mandate for such change in the amount, which will supercede all other mandates previously given.. 5. I/We agree that in the event of any violation by me/us of any undertaking confirmed in the agreement herein shall amount to an event of default in the of the Insurance Policy and HDFC Standard Life shall be entitled to invoke the remedies available to it in of the policy agreement. 6. ‘I/We agree that in the event of the bank being unable to debit my for want of sufficient funds or for any other reason, HDFC Standard Life shall be entitled to deal with my policy in the manner as described in the policy provisions, unless the payment is received by any alternate mode on or before the specified date.’ 7. I/We undertake to revoke the Standing Instruction in the event of the policy being ‘withdrawn/surrendered/lapsed/terminated’, where any subsequent amount is debited to my due to the reason that the SI not being revoked, I/We shall only be entitled to a refund of such amount on my/our demand and no interest or compensation is payable on the same. 8. I/We agree that the will be debited starting from the due date / preferred billing date which occurs after the date of this mandate, till the last due date unless the mandate is revoked. a. I/We agree and understand that “Preferred Billing Date” should be within 30 days of the PTD and will always bebefore the PTD. b. I/We agree that the will be debited on the “Preferred Billing Date”, if opted and this date will not be revised till the last due date unless the mandate is revoked. c. I/We agree and understand that in cases where the Preferred Billing Date is opted for, and if the payment of by such mode amounts to advance payment of , then such amount will remain as an interest-free deposit with us and will

Note: * can be paid out of your own or out of your Spouse, Parent or Children’s only. * Any cancellation, correction, alteration etc. should be countersigned by the Holder. * Kindly ensure that the SI mandate form is signed by the holder, even if the holder is different from the policy holder. * If the bank is unable to debit the of the Policy Holder due to want of sufficient funds, the policy holder will have to pay the by cheque/DD or cash at any of the branches of HDFC Standard Life Insurance Co. Ltd. before the grace period ends, failing which the policy will lapse with/without a surrender value as applicable. * HDFC SL has the right to revoke the Standing Instruction on event of the Instruction or change in the amount due to any alteration. * Direct debit facility (non ECS location) is offered by ICICI Bank, Citibank, Corporation Bank, Union Bank of India, Bank of Baroda and Axis Bank only. To be filled in by the holder’s bank

Bank Stamp

Date

Authorised Signatory of the Bank

---------------------------------------------------------------------------------------------------------------------------------Introducing you to our wide range of value added services. Track and Trace: You can track your proposal status online: 1. Log on to www.hdfcinsurance.com 2. Click on ‘My ’ 3. Click on Track Your Application 4. Enter the 16 digit application number (on the bar code)

Hassle Free Options: Your policy portfolio now available at your fingertips! ‘My ’- your very own customer portal

‘On the Move’ - avail of policy details on your mobile, just call our center or sms REG<space><policy number> to 5676727 or call our center to for this service payments made easy: Standing Instructions (SI) - a direct debit facility for all HDFC Bank holders. Electronic Clearing Service (ECS) - an auto debit facility available in more than 50 cities across India* Online payments - available to all policyholders ed with billjunction.com or have net banking facility. * *Kindly check with your financial consultant to see if these services are available in your city.In case you wish to avail of any of these services kindly fill in the service request form in the proposal document. If you opt for electronic clearing service kindly Correspondence Address: Customer Service, HDFC Standard Life Insurance Co. Ltd, 5th Floor, “B” Wing, Eureka Towers,Mindspace complex, Link Road, Malad (West)

Know Your Customer - Addendum Instructions: 1. Details required to be provided are of the proposer 2. All points are mandatory 3. Any cancellation or overwriting needs to be countersigned by the proposer

Application No.

S100000287062

Plan

HDFC Life Click 2 Invest - ULIP

1. Details Name: Father/Spouse Name: 2. Name and Address of place of work:

3. Proof of Identity: 4. Proof of Residence: 5. PAN details:

(Note: If annual is equal or more than Rs.1 lac, please fill up this point)

6. Current gross total income from all sources is

per annum

7. Source of funds (please state % under each head – totaling upto (Note: If annual is equal or more than Rs.1 lac, please enclose proof of income e.g. Income Tax Return, etc.) Salaries

Business

House Property

Capital Gains

Investments

Agriculture

Others

Total 100 %

8. Occupation : 9. Nature of occupation (e.g. Architect, Garment dealer, etc) 10. Industry to which your company or business belongs (e.g. Banking, Textiles, etc) 11. Details of any previous policies held with HDFC Standard Life where the Proposer is either a Policyholder, Life Assured or Assignee:

12. Are you a Non Resident Indian (NRI)? 13. Are you a “Politically Exposed Person”? Definition of a “Politically Exposed Person”: A "Politically Exposed Person" is a person who performs important functions for the state. This would include individuals who have or have had positions of public trust such as government officials, senior executives of government corporations, politicians, important political party officials, member of parliament, member of legislative assembly, etc. and their families and close associates.

DECLARATIONS: I hereby declare that: • The first has been paid out of legally declared and assessed sources of income and the subsequent s, if any, will continue to be paid out of legally declared and assessed sources of income. In case the is paid out of any other than my own, I shall ensure that such payment is permitted under Section 80C of the Income Tax Act, 1961. • I will provide information as and when required by the company, acting on its own or under any order or instruction received from Statutory Authorities, as regards sources of funds or utilisations or withdrawals. • I agree to the Company providing any information related to me as available to the Company at any time, to any Statutory Authority in relation to the laws governing prevention of money laundering, applicable in the country. • I understand that the Company classifies its customers under various categories of risk for the purposes of complying with the laws governing prevention of money laundering and I confirm that I do not have any objections for the same. • I understand that the Company has the right to peruse my financial profile and also agree that

the Company has right to cancel the Insurance contract in case I have been found guilty of any of the provisions of any Law, directly or indirectly, having relation to the laws governing prevention of money laundering in the country, by any competent court of law. Dated: Place:

Signature of Proposer

Declaration to be made by a third person where: o The life assured has affixed his/her thumb impression; OR o The life assured has signed in vernacular; OR o The life assured has not filled the application. I hereby declare that I have explained the contents of this application form to the life to be assured in ______________________language and have truthfully recorded the answers provided to me. I further declare that the life to be assured has signed/affixed his/her thumb impression in my presence Declarant Signature: ____________________________________________ Date: ___________________ Declarant Address ________________________________________________________________________ _________________________________________________________________________________________

Notes: a) For any additional forms, annexes, questionnaires or drafts of declarations and affidavits, please your financial consultant.

FOR OFFICE USE ONLY *

Consultant Name & Code: License Expiry Date: Lead Reference No:

License No: Company Lead: IA / CAO Name: Channel code:

Bancassurance Code: Channel Partner Customer ID:

FOS code: Branch code:

Simultaneous Proposals:

Yes

No

Tele code:

Verified by BDM / CAM:

No of Proposals sent together: Credit Card

Payment Details:

Consolidated Payment:

Cash

Yes

Cheque

No

To be filled by the Branch Operations Officer:

DD

Form:

Signature of FC:

No Page

Count

Aadhar Card

Age Proof

Branch Code & Branch on:

ID proof

Receipt No:

Address Proof Voter ID CCR

No of Simultaneous Proposals:

Yes

Branch Ops Checklist

Received at

Client ID:

Name / Signature of BDM / CAM

No

Yes

PAN Card

Income Proof null Questionnaire / Addendum Address Verified (Mailing & Permanent)

Y

N

Y

N

ECS mandate with cross cheque

Y

N

Scrutiny done by:

SI Mandate

Y

N

Comments:

Existing Customer- details checked with previous policy

Product Code:

UC1

Is PPH / LA an Employee:

* To be filled in by Certified Financial Consultant * IA / CAO – Insurance Associate / Corporate Agency Officer

Particulars

Plan Selection: Please update the desired plan and Plan Options in Section A (plan details) of the application form. The table below indicates the Plans and various features available with the plan. You are requested to study it thoroughly before indicating the plan / benefits that you desire. Plans

ProGrowth Super

Frequency

Annual

Plan/ Benefit Options (a) Life Option (b) Extra Life Option (c) Life & Health Option (d) Extra Life &Health Option (e) Life & Disability Option* (f) Extra Life & Disability Option * (g) Life & Health & Disability Option* (h) Extra Life & Health & Disability Option*

Annual

Save Benefit : (a) Life Option (b) Life & Health Option Save-n-Gain Benefit : (a) Life Option (b) Life & Health Option

Annual Half Yearly Monthly**

(a) Life Option (b) Extra Life Option

ProGrowth Plus

Annual Half Yearly Monthly**

(a) Life Option (b) Extra Life Option

Crest

Annual

None

Single

None

YoungStar Super

ProGrowth Flexi

ProGrowth Maximiser

Invest Wise

Single

None

Smart Woman

Single

(a) Classic (b) Premier (c) Elite

Sampoorn Nivesh

Click 2 Invest - ULIP

Annual Half-Yearly Quaterly Monthly** Single

Annual Half-Yearly Quaterly Monthly** Single

Plan Options: (a) Life Option (b) Extra Life Option Additionaly, also choose one of the following Benefit options: (a) Classic Benefit (b) Classic Plus Benefit (c) Classic Waiver Benefit

Investment Fund Options(SFIN)

Choice of 4 funds (Free Asset Allocation) * Income Fund(ULIF03401/01/10IncomeFund101) * Balanced Fund(ULIF03901/09/10BalancedFd101) * Blue chip Fund(ULIF03501/01/10BlueChipFd101) * Opportunities Fund (ULIF03601/01/10OpprtntyFd101)

Choice of 8 funds (Self Managed) * Income Fund(ULIF03401/01/10IncomeFund101) * Balanced Fund(ULIF03901/09/10BalancedFd101) * Blue chip Fund(ULIF03501/01/10BlueChipFd101) * Opportunities Fund (ULIF03601/01/10OpprtntyFd101) * Equity Plus Fund (ULIF05301/08/13EquityPlus101) * Diversified Equity Fund (ULIF05501/08/13DivrEqtyFd101) * Bond Fund (ULIF05601/08/13Bond Funds101) * Conservative Fund(ULIF05801/08/13ConsertvFd101)

None

Single Top - Ups are available with HDFC SL ProGrowth Maximiser and HDFC Life Sampoorn Nivesh *Not available to housewives and student ***Life to be Assured should be female life. Spouse cover on life of spouse only in Elite option of the plan. Life Assured should be married on date of proposal to opt for Elite option. **Subject to our prevailing operational rules, it may be required for Monthly Frequency to be taken with ECS/SI & and to pay first 3 months in advance along with the Proposal Form.

SECTION A - PLAN DETAILS HDFC Life Click 2 Invest - ULIP UC1

Plan Name: Plan Option: Benefit Option:

Paying Term (Yrs): Policy Term (Yrs): 10

Frequency of Payment:

Regular 10

Installment Amount (Rs):

Quarterly

7500.00

Sum Assured on Installment (Rs.):

300000.00

Single Top-Ups Amount (Rs.):

Sum Assured on Single Top-Ups (Rs.):

For availability of Single Top-Ups refer to Page 2

Total Sum Assured (Rs.):

300000.00

Amount: 7500.00

Payment Details: DEBIT_CARD Drawn on (Bank name):

Date: 18-Dec-2015

Cheque/DD No:

Bank Number Investment Allocation Option: Self Managed/Free Asset Allocation

Life Stage Asset Allocation (applicable only for Sampoorn Nivesh)

Kindly indicate % of allocation in below mentioned funds as applicable ( not applicable if Life Stage Asset Allocation is chosen)

Fund Income Fund Balanced Fund

Allocation in % 60

Fund Equity Plus Fund

Allocation in % 0

0 0 20

Diversified Equity Fund Bond Fund Conservative Fund

0

Blue chip Fund Opportunities Fund

20 0

In case the life to be assured is the guardian of a disabled person, is this insurance policy being taken primarily to protect the disabled person? UID Number: Do you want the policy in Demat form? Yes No If yes,insurance number If a policy is requested in demat format, it will not be given in physical form if policy is given in physical format. It will not be given in demat form.

SECTION B – PERSONAL DETAILS OF LIFE TO BE ASSURED 1. Title:

MR

Client Code (Office use only)

First Name:

Harvinder

Middle Name: Last Name:

Singh

Maiden Name: (Only for married females)

Father’s / Spouse’s Name: Employee of HDFC Life:

Paramjeet Kaur

If Yes, Employee Code & Location

No

KARNAL

* Proposer/policy holder other than individual please mention 'Legal name' in the Name column

2. DOB (DD/MM/YYYY)

4. Marital Status

3. Gender

27-Oct-1985

Male

6. Nature of Age Proof attached: 7. Educational Qualification:

5. Nationality Indian

Married

Aadhar Card Graduation

8. Are you a Non Resident Indian (NRI)?

NO

9. Visible Identification

.If yes , name of resident country and attach NRI questionnaire

10. PAN:

Applied For

CSVPS1996N

11. Aadhar card

Not Applicable

*PAN is mandatory for all applications where as on date of application, the cumulative amount of

13. If you are our existing life assured, assignee, nominee, 14. Proof of Identity

(Document submitted):

12. Place of Birth:

PAN Card

Serial No:

Name of Issuing Authority: Date of Issue of Document:

15. Proof of Residence (must for mailing & permanent)

Mailing :

Voter ID

Permanent :

If residential proof provided other than of self / spouse / father, then please specify the name of owner of residence: 16. Where would you like to receive all your communication? SMS

Tele Calls

Residence

Office

Preferred Language of Communication

Permanent

17. Correspondence Address: House / Flat No:

H.no-703

Street / Area:

Sector-6

Landmark:

Near Tagore Baal Niketan scho

City/Distri Karnal State:

Pin Code:

132001

Haryana

18. Permanent Address: (If different from correspondence address) House / Flat No: Street / Area: Landmark: City/Distri

Pin Code:

State: Mobile:

9416166122

Telephone No (R):

Telephone No (O):

-

Fax No:

E-mail Address:

[email protected]

SECTION C – PERSONAL AND FAMILY HISTORY OF LIFE TO BE ASSURED 1. Present Occupation Details: Designation:

Salaried

JE

Gross Yearly Income from all Sources (Rs): Office Address :

500000.00

BSNL KARNAL

Please provide in detail the exact nature of work performed by you in connection with your present employment or business. (For e.g. clerical, mechanical, supervisory job, etc.)

Maintenance

Please provide details, if any, regarding your occupation or business, which may render you No susceptible to injury or illness. (e.g. exposure to chemical substances/hazardous materials/harmful dust or gases/ explosives/ working at heights/ handling heavy machinery etc.) Electronics and Telecommunications

Industry to which your company or business belongs (cement, banking etc.) Nature of Occupation: (e.g. architect, garment dealer, etc.) 2. Sources of Funds : income e.g. ITR salaries 100

Maintenance

If & Single Top-Ups, wherever relevant is equal to or more than Rs. 1 Lakh, please enclose proof of

Business 0

House Property 0

Capital Gains

Investments

0

3. Are you a “Politically Exposed Person”?

0

Agriculture 0

Others 0

Total 100%

NO

Definition of a Politically Exposed Person: Politically exposed persons are individuals who are or have been entrusted with prominent public functions in a foreign country, their family and close relatives such as Heads of States or of Governments, Senior politicians, Senior government/judicial/military officers, Senior executives of state-owned corporations, Important political party officials, etc.

4. Do you take part in any hobbies/activities that could be considered dangerous in any way? e.g. aviation (other than as a fare-paying No enger), mountaineering, deep sea diving or any form of racing? If ‘Yes’, please provide details HOUSEWIFE – kindly submit Housewife Addendum *STUDENTS – kindly state 1. The course being pursued 2. Name and address of college/institution (excluding coaching classes) 3. Duration of the course 4. Year/semester/standard Address of present employer or business premises if self employed and address of ed office/main place of business in case of other entities) 9Proposer/policy owner is other than individual please mention Designation & fill Legal Form , 10Address of present employer or business premises if self employed and address of ed office/main place of business in case of other entities

5. Have you resided overseas for more than 6 months continuously during the last five years, or do you intend to travel overseas in the No next six months? If you have answered ‘‘Yes’’ to the question, please give the names of the countries and duration of stay:

Yes / No

Countries

Duration

Past Travel

No

Months

Future Travel

No

Months

6. Do you have any existing insurance cover of paying and/or paid up policies (excluding group term insurance plan taken by No your employer)? If ‘‘Yes’’ please provide the following details: (All amounts in Rupees) A.

Sum Assured payable on death

B

Sum payable on accidental death (excluding A)

C.

Benefits payable on disability/critical illness

D.

How much of this cover i.e. (i+ii+iii) was taken out in the last 1 Year?

E.

How much of the cover in (A) was taken out during the last five years?

7. Have you submitted any simultaneous applications for life insurance at any of our offices or to another life insurance company, which is still pending OR are you likely to revive lapsed policies? No If ‘‘Yes’’ please give details of those proposals (All amounts in Rupees) To be Revived

Already Proposed A. Sum Assured payable on death B. Name of the company/ies C. Types of products D. Purpose of cover 8. Has any application for insurance on your life been: Yes Postponed?

No

Accepted with Extra

No

Accepted on other special ?

No

Declined?

No

Withdrawn by yourself?

No

9. Height

Cms (or)

5

Feet

No

Policy Number

11 Inches

Name of Insurance Co.

10. Weight

Reason

75

Kgs.

11. Please give the following details: Substance Consumed

Yes

No

Consumed As

Quantity

a. Alcohol

No

Units* Per Week

b. Tobacco

No

Units* Per Day

c. Are you currently consuming or have you ever consumed narcotics or any such other substance whether prescribed or not?(for example ganja, hashish, heroin, cocaine, charas, marijuana, etc.) No * 1 unit equivalent to 330 ml of beer / 125 ml of wine / 30 ml of spirits ** 1 unit equivalent to 1 cigar / 1 cigarette / 1 bidi. If chewing tobacco please specify how many grams per day. 12. State the name and address of your usual doctor who attends you in the event of illness, OR if you have been consulting with this doctor for less than 3 months, the name and address of your previous doctor. Name: House / Flat No: Street / Area: City: State: Telephone No Email :

Pin Code: Mobile:

13. Personal medical details: (If answered ‘Yes’ in sub-question Ia (a to j) please fill the relevant questionnaire)

Ia. Have you EVER suffered from any of the following conditions?

Indicate Yes or No by Questionnaire ticking in relevant box attached Yes

No

Ib. Have you EVER suffered from any of Indicate Yes or No the following conditions? by ticking in relevant box

Please tick if “Yes”

Yes

(a) Diabetes

No

(k) Stroke

No

(b) High blood pressure

No

(l) Liver disorder

No

(c) Respiratory disorders

No

(m) Kidney disorder

No

(d) Epilepsy

No

(n) Disorder of the digestive system

No

(e) Back problems

No

(o) Paralysis or multiple sclerosis

No

(f) Arthritis

No

(p) Blood disorder

No

(g) Any nervous disorder or mental condition

No

(q) Heart Disease

(h) Abnormality of thyroid

No

(r) Any recurrent medical condition /disability (including eye/ear disorder)?

No

(i) Tuberculosis

No

(s) Cancer or a tumour

No

(j) Depression or psychiatric disorder

No

II. Do you have any physical disability? III. Are you currently suffering from any illness, impairment, or taking any medication or pills or drugs? IV. Have you ever tested positive for HIV/AIDS or Hepatitis B or C, or have you been tested/treated for other sexually transmitted diseases or are you awaiting the results of such a test? V. Do you have / had any recurrent medical condition or physical disability or deformity or illness or injury that has kept you from working for more than one week in the last 5 years? VI. During the last 5 years, have you undergone or been recommended to undergo: a. Hospitalisation? b. An operation? c. X ray or any other investigation (excluding check-ups for employment/insurance/foreign visit)?

No

No

No No No No No No No

If you have answered ''Yes'' to any of the sub questions [I (a to s), II, III, IV, V and VI] asked under question 14 of this section, please answer the following Nature of Illness/Accident Date of Name and Address of Details of Investigations Under Fully Diagnosis the Doctor Done Medication recovered /Event (Yes/No) (Yes/No)

14. To be answered by the female life to be assured: Please tick the appropriate answer to all of the questions below. (a) Are you presently pregnant? (b) If ‘‘Yes’’, how many weeks? Kindly attach the Pregnancy Questionnaire (c) Do you have a history of past an abortion, miscarriage, Caesarian section or complications during pregnancy? Special Woman Plan Questionnaire to be completed if answer is Yes (d) Have you ever had any disease of uterus, cervix, or ovaries? (e) Have you given birth to a child with any congenital disorder like Down syndrome? Special Woman Plan Questionnaire to be completed if answer is (f) Have you ever undergone hysterectomy? * * Please attach hysterectomy questionnaire and histopathology reports if answered as ‘Yes’

If you have answered ‘‘Yes’’ to (d), please give details below (If required please attach separate sheet):

15. We may require you to undergo medical examinations/tests. Some of the medical tests may require you to observe fasting. Please indicate your preference of location, near which the medical tests can be conducted. 16. Family history of the life to be assured. Please tick the appropriate answer to all of the questions below: Have any of your parents, brothers or sisters died or suffered prior to the age of 65 years from:

No

a) Heart disease? b) High blood pressure? c) Stroke? d) Diabetes? e) Kidney disease? f) Cancer? g) Any form of paralysis, any hereditary disorder (such as Huntington’s disease, Polycystic disease of the kidney or familial polyposis of the colon)? If you have answered ‘‘Yes’’ to any of the questions above, please give details: Relation to the life to be assured

Disease

Age of Diagnosis

Alive/Deceased

Current Age/ Age at death

SECTION D (I) - PERSONAL DETAILS OF NOMINEE / BENEFICIARY / PROPOSED POLICYHOLDER Nomination facility is available only when the proposed policyholder is taking a policy on his/her own life. Hence if you are proposing to apply on your OWN life please use this section to furnish the personal details of the nominee else please use this section to fill in your personal details. Nominee is the person to whom the money secured by the policy shall be paid in the event of death of the life to be assured. The beneficiary facility is currently available only for the HDFC SL YoungStar Super II & HDFC SL YoungStar Super . The beneficiary to be the sole person entitled to the benefits and payments (except any refund payable on cancellation in the free-look period) under the policy. For other products if the beneficiary is indicated, the same will be considered as a nominee. In any event where the benefits revert to the life to be assured under the provisions of the policy and the life to be assured does not intend to appoint any other beneficiary under the policy, the life to be assured can at that time appoint a nominee to receive the proceeds of the policy and give a valid discharge to the Insurance Company. Note: It is advisable to appoint nearest blood relative as nominee / beneficiary. Mandatory: Please also fill in the KYC form if you have selected proposed policyholder Section C, point 3 to be included(incase of beneficiary only)

NOMINEE SECTION Nominee 1 : Title:

100% allocated

Client Code (Office use only):

MRS

First Name:

Gender:

Female

DOB :

Paramjeet

Middle Name: Last Name:

Kaur

Relationship of nominee / beneficiary / proposed policyholder to life to be assured: Residential Address:

Wife

Same as stated on page 4, if different then please fill the fields below

House / Flat No:

H.no-703

Street / Area:

Sector-6

City/District :

Karnal

Pin Code:

State:

Haryana

Mobile:

Telephone No. (R):

-

132001

Telephone No. (O):

E-mail Address: Nominee 2 : Title:

Date of Birth:

Gender:

First Name: Middle Name: Last Name: Relationship of nominee / beneficiary/proposed policyholder to life to be assured: Correspondence Address:

Same as stated on page 3, if different then please fill the fields below

House / Flat No: Street / Area: City:

Pin Code:

State/District:

Mobile:

Telephone No. (R): E-mail Address:

-

Telephone No. (O):

27-Dec-1989

Nominee 3 : Title:

Date of Birth:

Gender:

First Name: Middle Name: Last Name: Relationship of nominee / beneficiary/proposed policyholder to life to be assured: Correspondence Address:

Same as stated on page 3, if different then please fill the fields below

House / Flat No: Street / Area: City:

Pin Code:

State/District:

Mobile:

Telephone No. (R):

-

Telephone No. (O):

E-mail Address: Nominee 4 : Title:

Date of Birth:

Gender:

First Name: Middle Name: Last Name: Relationship of nominee / beneficiary/proposed policyholder to life to be assured: Correspondence Address:

Same as stated on page 3, if different then please fill the fields below

House / Flat No: Street / Area: City:

Pin Code:

State/District:

Mobile:

Telephone No. (R):

-

Telephone No. (O):

E-mail Address:

SECTION D (II) – APPOINTEE DETAILS Title:

(To be filled only if nominee/beneficiary is minor. The Appointee must not be life to be assured) Gender: Client Code (Office use only):

First Name: Middle Name: Last Name: DOB : correspondence Address:

Same as stated on page 4, if different then please fill the fields below

House / Flat No: Street / Area: City:

Pin Code:

State:

Mobile:

Telephone No. (R):

-

E-mail Address: Signature of appointee accepting the appointment: (appointee cannot affix thumb impression)

Telephone No. (O):

SECTION E - DECLARATION OF THE LIFE TO BE ASSURED AND PROPOSED I declare that: i. I have received the Product Brochure and Benefit Illustration of the Plan of Insurance under which I have applied for a policy of insurance on the Life to be Assured and specified by me in Section A of this Proposal Form and I have applied for the policy after being fully satisfied of the features and benefits of the said Plan of insurance; ii. I have replied to the questions, and have made the statements in respect of the matters sought for, in the Proposal Form and I understand and agree that the replies given and statements made in the Proposal Form together with any documents submitted by me for processing my application for insurance shall be the basis of the contract between me and HDFC Standard Life Insurance Company Limited ("the Company"). iii. I understand and agree that in case of any fraud or misrepresentation, the policy shall be cancelled immediately by paying the surrender value, if any, in accordance with Section 45 of the Insurance Act, 1938. iv. I shall be bound and I undertake to notify the Company forthwith , in writing ,of any change in my health , occupation and income during the period between the date of this proposal and the date of acceptance of my proposal for insurance , as communicated in writing to me by the Company ; v. The first deposit made by me along with this proposal for insurance has been made, and the s payable under the policy that may be issued in pursuance of this proposal, will be paid, strictly in accordance with the law of the land. Amounts paid, otherwise than from my shall be permitted only if an insurable interest can be established. vi. I confirm that the s have not been and will not be generated from proceeds of any criminal activities/offenses listed in the Prevention of Money Laundering Act 2002 or under any other applicable laws. vii. I confirm that I have understood the Benefit Illustration and accept that the investment rates assumed therein are not guaranteed.

I agree and authorize : i. I understand and I agree that the Company will be on risk in pursuance of this proposal only after the risk under the proposal is accepted by the Company and such acceptance is communicated to me in writing by the Company. ii. I understand and agree that the Company shall be entitled to retain the paid along with the proposal form as an interest free initial deposit to be adjusted against payable upon issuance of the Policy. In the event the proposal is not accepted by the Company the aforesaid deposit shall be refunded without any interest subject to deductions for medical costs and processing charges, if any, incurred by the Company under the proposal. iii. My employers / business associates, present and past, to disclose to and to furnish such documents to the Company as it may require either for the purpose of processing my proposal for insurance or at any time thereafter for any other purpose in relation to the policy that may be issued in pursuance of this proposal ; iv. Any doctor/medical examiner/hospital/laboratory/clinic/insurance company to disclose and to furnish to the Company such documents regarding my health and habits or health and habits of the Life to be Assured, as the Company may require either for the purpose of processing this proposal for insurance or for any other purpose at any time thereafter in relation to the policy that may be issued in pursuance of this proposal, not withstanding any usage or custom or rules/ regulations of such hospital or laboratory or clinic prohibiting such disclosure or furnishing of such documents , or on such disclosure or furnishing of documents being done without my consent or the consent of my family or of any member thereof ; v. That the Company may, without any reference to me or to my family or to any member thereof, furnish any details or any information furnished in this proposal for insurance to any judicial or statutory or other authority or to any insurer or reinsurer in connection with the processing of this proposal for insurance or for any other purpose, as for instance, settlement of a claim under the policy and the like that may be issued in pursuance of this proposal; vi. That in addition to such mode of communication as the postal or courier service , the Company may, at its discretion use any electronic media, for communication in relation to this proposal for insurance or the policy that may be issued in pursuance of this proposal. vii. I hereby voluntarily give my consent to collect, process, receive, possess, store, deal or handle my/our sensitive personal data or information [as defined in the Information Technology (Reasonable security practices and procedures and sensitive personal data or information) Rules 2011 as amended from time to time] (“Data”) with third parties/ vendors associated with the Company for various purposes and outsourced activities exclusively related to issuance/servicing/settlement of claim as required under the insurance policy. viii. All documents submitted by me along with this Proposal Form are authentic, valid, and where relevant true copies of originals for the purpose of this Proposal Form. Signature/Thumb impression of Witness Name & Address

Occupation

Signature/Thumb impression of life to be assured Signature should match with signature on ECS/SI

Signature/Thumb impression of proposed policyholder (Only if different from life to be assured) Signature should match with signature on ESI/SI mandate

Place:

Place:

Date: 18/12/2015

Date: Mobile:

Mobile:

Above signature and Mobile number will be used for all future interactions and verification. Please provide your in-use mobile no and sign as per

DECLARATION OF GOOD HEALTH FOR SPOUSE Name:

TO BE FILED ONLY FOR ELITE OPTION OF SMART WOMAN PLAN

DOB :

Amount of Insurance :

Within the last 5 years, I have neither been hospitalized for, required medication or treatment for, nor consulted a physician (to include a follow-up visit) due to,or as a result of, any of the following: alcohol or drug abuse, heart or circulatory disorder, stroke, cancer or leukemia, diabetes, high blood pressure, chronic kidney or liver disease, mental, nervous or neurological disorders, lung disorders, AIDS (acquired immune deficiency syndrome), ARC (aids related complex),or had tests indicating exposure to the aids virus.

Signature of the spouse:

Date:

Note: 1.You may withdraw the consent till anytime before the proposal is logged into our systems. In that case, your proposal shall stand withdrawn by you. 2. The data provided by you/LA and if subsequently found to be inaccurate, can be rectified upon a written request by you and as per our process except such data which is the basis of this contract / policy unless agreed to by Company. Please us on any of the following touch points in case of non receipt of your HDFC Life policy document after 1month from date of application. Call us toll free on 1860 267 9999(do not pre fix any country code e.g. +91 or 00), SMS SERVICE to 5676727 for call back request or email us at service @ hdfclife.com

Note: Please retain your copy of the acknowledgement slip for future references Declaration to be made by a 3rd person where: —The life to be assured/proposed policyholder has affixed his/her thumb impression; OR —The life to be assured/proposed policyholder has signed in vernacular; OR —The life to be assured/proposed policyholder has not filled the application. I hereby declare that I have explained the contents of this application form to the life to be assured in ________________language and have truthfully recorded the answers provided to me. I further declare that the life to be assured/proposed policyholder has signed/affixed his/ her thumb impression in my presence.

Name and Address of declarant

Signature

Declaration made by life to be assured/proposed policyholder I hereby declare that the content of the form and document has been fully explained to me and I have fully understood the significance of the proposed contract.

Signature/Thumb impression of life to be assured/proposed policyholder