It Quiz Journal Entries 4153h

This document was ed by and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this report form. Report 3b7i

Overview 3e4r5l

& View It Quiz Journal Entries as PDF for free.

More details w3441

- Words: 750

- Pages: 4

Quiz Principle Financial ing & Reporting, part 1 Name: _______________________________________ Date:____________ Score:_________

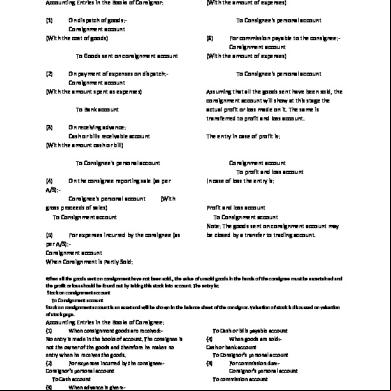

Juan Ted is an experienced events planner. The transactions and s for the business are as follows: Dec. 1 Invested P200,000 in cash to start his Dec. 1 Invested P200,000 in cash to start his own business. own business. Dec. 4 Paid P5,000 for one month’s rent. Dec. 4 Paid P5,000 for one month’s rent. Dec. 5 Bought office furniture for P15,000 in cash. Dec. 5 Bought office furniture for P15,000 in cash. Dec. 6 Received delivery of laptop computer, P54,000. Dec. 6 Received delivery of laptop Paid 50% down, balance due in 30 days. computer, P54,000. Paid 50% down, balance due in Dec. 8 Performed services for P12,000 in cash. 30 days. Dec. 10 Performed services for P10,800 on credit. Dec. 8 Performed services for P12,000 in cash. Dec. 11 Acquired a fax machine for P7,500; paid P3,000 Dec. 10 Performed services for P10,800 on in cash, balance due in 10 days. credit. Dec. 11 Acquired a fax machine for P7,500; Dec. 16 Received P5,400 from clients on . paid P3,000 Dec. 19 Paid P10,000 for salaries. in cash, balance due in 10 days. Dec. 21 Settled in full the P4,500 balance for the fax machine. Dec. 16 Received P5,400 from clients on . Dec. 26 Received P7,000 in cash for services performed. Dec. 19 Paid P10,000 for salaries. Dec. 27 Performed services for P12,000 on credit. Dec. 21 Settled in full the P4,500 balance Dec. 31 Received and paid P1,350 for the monthly telephone bill. for the fax machine. Dec. 26 Received P7,000 in cash for services Dec. 31 Received but did not paid P2,400 for the electric and water performed. bills. Dec. 27 Performed services for P12,000 on Dec. 31 Ted withdrew P7,000 in cash for personal expenses.

Required: Journalize the transactions using s, post them to appropriate s God Bless!

credit. Dec. 31 Received and paid P1,350 for the monthly telephone only the s established inbill.the chart of Dec. 31 Received but did not paid P2,400 in the ledger and finally, prepare a trial balance. for the electric and water bills. Dec. 31 Ted withdrew P7,000 in cash for personal expenses.

ing Cycle 1. Analyzing Transactions and applying rules of Debit and Credit 2. Journalizing 3. Posting 4. Preparation of Unadjusted Trial Balance

1 Corinthians 10:13 “God keeps His promise, and He will not allow you to be tested beyond your power to remain firm; at the time you are put to the test, he will give you the strength to endure it, and so provide you with a way out”

emmanuelgumpalbaccaya

JOURNAL

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62

Date 2012 Dec

Titles & Explanation 1

4

Cash Ted, Capital Invested capital

P.R. 110 310

page

1

Debit

Credit

P200,000 P200,000

page

LEDGER : Cash Date 1

2012

2

Dec

1

No. Explanation

J.R.

Debit

Credit

Balance 1

1

Invested capital

J-1

200,000

200,000

2

3

3

4

4

5

5

6

6

7

7

8

8

9

9

10

10

11

11

12

12

13

13 : s Receivable

No.

1

1

2

2

3

3

4

4 : Office Furniture

No.

1

1

2

2 : Office Equipment

No.

1

1

2

2

3

3 : s Payable

No.

1

1

2

2

3

3

4

4 : Utilities Payable

No.

1

1

2

2 : Ted, capital

1

2012

2

Dec

No. 1

1

Invested capital

: Ted, withdrawals

J-1

200,000

200,000

2

No.

1

1

2

2

page

LEDGER : Consulting Revenues

2

No.

1

1

2

2

3

3

4

4

5

5 : Salaries Expense

No.

1

1

2

2 : Supplies Expense

No.

1

1

2

2

3

3

4

4 : Rent Expense

No.

1

1

2

2 : Utilities Expense

No.

1

1

2

2

3

3

Juan Ted Planners inc. Unadjusted Trial Balance as of December 31, 2012 D.R. Cash s Receivable Office furniture Office equipment s Payable Utilities Payable Ted, capital Ted, withdrawals Consulting Revenues Salaries Expense Rent Expense Utilities Expense Totals

C.R

Juan Ted is an experienced events planner. The transactions and s for the business are as follows: Dec. 1 Invested P200,000 in cash to start his Dec. 1 Invested P200,000 in cash to start his own business. own business. Dec. 4 Paid P5,000 for one month’s rent. Dec. 4 Paid P5,000 for one month’s rent. Dec. 5 Bought office furniture for P15,000 in cash. Dec. 5 Bought office furniture for P15,000 in cash. Dec. 6 Received delivery of laptop computer, P54,000. Dec. 6 Received delivery of laptop Paid 50% down, balance due in 30 days. computer, P54,000. Paid 50% down, balance due in Dec. 8 Performed services for P12,000 in cash. 30 days. Dec. 10 Performed services for P10,800 on credit. Dec. 8 Performed services for P12,000 in cash. Dec. 11 Acquired a fax machine for P7,500; paid P3,000 Dec. 10 Performed services for P10,800 on in cash, balance due in 10 days. credit. Dec. 11 Acquired a fax machine for P7,500; Dec. 16 Received P5,400 from clients on . paid P3,000 Dec. 19 Paid P10,000 for salaries. in cash, balance due in 10 days. Dec. 21 Settled in full the P4,500 balance for the fax machine. Dec. 16 Received P5,400 from clients on . Dec. 26 Received P7,000 in cash for services performed. Dec. 19 Paid P10,000 for salaries. Dec. 27 Performed services for P12,000 on credit. Dec. 21 Settled in full the P4,500 balance Dec. 31 Received and paid P1,350 for the monthly telephone bill. for the fax machine. Dec. 26 Received P7,000 in cash for services Dec. 31 Received but did not paid P2,400 for the electric and water performed. bills. Dec. 27 Performed services for P12,000 on Dec. 31 Ted withdrew P7,000 in cash for personal expenses.

Required: Journalize the transactions using s, post them to appropriate s God Bless!

credit. Dec. 31 Received and paid P1,350 for the monthly telephone only the s established inbill.the chart of Dec. 31 Received but did not paid P2,400 in the ledger and finally, prepare a trial balance. for the electric and water bills. Dec. 31 Ted withdrew P7,000 in cash for personal expenses.

ing Cycle 1. Analyzing Transactions and applying rules of Debit and Credit 2. Journalizing 3. Posting 4. Preparation of Unadjusted Trial Balance

1 Corinthians 10:13 “God keeps His promise, and He will not allow you to be tested beyond your power to remain firm; at the time you are put to the test, he will give you the strength to endure it, and so provide you with a way out”

emmanuelgumpalbaccaya

JOURNAL

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62

Date 2012 Dec

Titles & Explanation 1

4

Cash Ted, Capital Invested capital

P.R. 110 310

page

1

Debit

Credit

P200,000 P200,000

page

LEDGER : Cash Date 1

2012

2

Dec

1

No. Explanation

J.R.

Debit

Credit

Balance 1

1

Invested capital

J-1

200,000

200,000

2

3

3

4

4

5

5

6

6

7

7

8

8

9

9

10

10

11

11

12

12

13

13 : s Receivable

No.

1

1

2

2

3

3

4

4 : Office Furniture

No.

1

1

2

2 : Office Equipment

No.

1

1

2

2

3

3 : s Payable

No.

1

1

2

2

3

3

4

4 : Utilities Payable

No.

1

1

2

2 : Ted, capital

1

2012

2

Dec

No. 1

1

Invested capital

: Ted, withdrawals

J-1

200,000

200,000

2

No.

1

1

2

2

page

LEDGER : Consulting Revenues

2

No.

1

1

2

2

3

3

4

4

5

5 : Salaries Expense

No.

1

1

2

2 : Supplies Expense

No.

1

1

2

2

3

3

4

4 : Rent Expense

No.

1

1

2

2 : Utilities Expense

No.

1

1

2

2

3

3

Juan Ted Planners inc. Unadjusted Trial Balance as of December 31, 2012 D.R. Cash s Receivable Office furniture Office equipment s Payable Utilities Payable Ted, capital Ted, withdrawals Consulting Revenues Salaries Expense Rent Expense Utilities Expense Totals

C.R