Jdw Sugar Mills 5c295s

This document was ed by and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this report form. Report 3b7i

Overview 3e4r5l

& View Jdw Sugar Mills as PDF for free.

More details w3441

- Words: 2,644

- Pages: 19

INDUSTRY PROFILE JDW sugar mills (Jamal Din Wali) company was incorporated in 1990. As a private limited company under the Companies Ordinance, 1984 and was subsequently converted into a public limited Company on 24 August 1991. Shares of the Company are listed on the Karachi and Lahore Stock Exchanges. JDW sugar mills have 3 units and 2 diversifications. The Number of Employees is 942. The revenue of JDW is 28.50bn and the Net income is 835.87mn.

Unit 1 On 31st May 1990 first unit was formed. Crushing capacity of this unit is 2.46 million tons of sugar or 20,500 TCD (tonne sugar cane crushing per day). This Unit is located in District Rahim Yar Khan. The

principal

activity

of

the

Company is production and sale of crystalline sugar with an annual report of 2011.

Unit 2 JDW Unit-II (formerly United Sugar Mills Limited) was acquired by JDWSML in November 2005 and after

four

years

successful

operations this was merged into JDWSML on October 1, 2008. Annual Crushing capacity of this Unit is 1.02 million tons of sugar or

8500 TCD (tonne sugar cane crushing per day) and is located near Sadiqabad at distance of 45 Kms from JDW Unit-I in District Rahim Yar Khan. Unit 3 JDW Unit-III (formerly Ghotki Sugar Mills (pvt) Limited) was incorporated on 02 June 2006 as a Private Limited Company under the Companies Ordinance, 1984. JDW Unit-III started crushing in year 2007-2008. The crushing capacity of this unit is 1.32 million tons of sugar or 11000 TCD (tonne sugar cane crushing per day) and is located in District Ghotki, Sindh Province. It was setup in the record time of 11 months between ground breaking and production and in the first year of production it reached 90,918 Tons with a recovery of 10.55 % which was the highest in the country.

JDW sugar mills have 2 diversifications also Faruki Pulp Mills Ltd and JK Dairies (Pvt) Ltd.

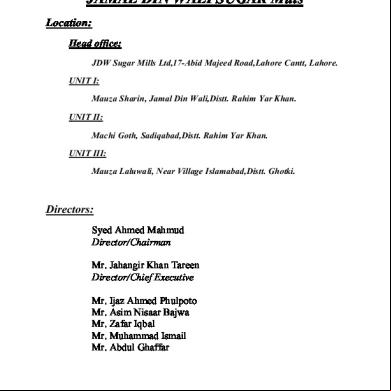

Management Profile Board of Directors

Mr. Jahangir Khan Tareen Director/Chief Executive

Syed Ahmed Mahmud Director/Chairman Mrs. Sameera Mahmud Mr. Ijaz Ahmed Phulpoto Mr. Asim Nisar Bajwa Maj. ® Raheal Masud Mr. Zafar Iqbal

Chief Operating officer Rana NasimAhmed

Group Director Finance Mr. Muhammad Rafique Auditors KPMG Taseer Hadi & Co. Chartered ants Audit Committee Mr. Asim Nisar Bajwa

Mr. Zafar Iqbal Mrs. Sameera Mahmud Banks Faysal Bank Ltd. Habib Bank Ltd. MCB Bank Ltd. United Bank Ltd. Standard Chartered Bank (Pakistan) Ltd. National Bank of Pakistan Allied Bank Ltd. The Bank of Punjab Habib Metropolitan Bank Ltd. Bank Islami (Pakistan) Ltd. Silk Bank Ltd. Location

Email [email protected]

JDW Sugar Mills Ltd 17-Abid Majeed Road, Lahore Cantt, Lahore Pakistan

Registrar Corplink (Pvt.) Ltd.

Phone +92 4 236664891-2, +92 42

Wings Arcade, I-K Commercial,

36602573-4

Model Town, Lahore.

Fax

Legal Advisor

+92 4 236654490

Web http://www.jdw-group.com/

Cornelius, Lane & Mufti

JDW Sugar Mills Limited History

JDW Sugar Mills Limited was incorporated in Pakistan on 31 May 1990 as a private limited company under the Companies Ordinance, 1984 and was subsequently converted into a public limited Company on 24 August 1991. Shares of the Company are listed on the Karachi and Lahore Stock Exchanges.

United Sugar Mills Limited

USML was incorporated in Pakistan on February 5, 1970. United Sugar Mills Limited was acquired by JDWSML in November 2005 and after four years successful operations this was merged into JDWSML on October 1, 2008.

Gohtki Sugar Mills (Pvt) Limited

Ghotki Sugar Mills (pvt) Limited) was incorporated on 02 June 2006 as a Private Limited Company. After that GSM was merged into JDWSML.

JDW is involved in various businesses including: Faruki Pulp mills Ltd Dairy Power Generation

Faruki Pulp Mills Ltd

Faruki Pulp Mills Limited was incorporated as a public limited company on October 20, 1991. The Company is engaged in the manufacturing of wood pulp from Eucalyptus for consumption in local and foreign paper industry. This project was started in early 1990 but due to various reasons could not be completed on time. This will be first of its kind project in Pakistan based on 100% supply of all raw materials locally. Due to its technical and professional viability, JDW Group has chosen this business for strategic investment with an objective of diversification. This is an agro based industry using local raw materials. The company has commenced its commercial production on October 1, 2011.

JK Dairies (Pvt) Ltd This Company was incorporated in Pakistan on 26 February 2007 as a Private Limited Company under the Companies Ordinance, 1984. It is the first modern Dairy Farm in the private sector. At present the herd consists of 1500 Friesian, Jersey & AFS imported cows. It is principally engaged in production and supply of milk.

Company Profile JDW sugar mills (Jamal Din Wali) company was incorporated in 1990. As a private limited company under the Companies Ordinance, 1984 and was subsequently converted into a public limited Company on 24 August 1991. The number of employees is approximately 942 people in all units. Before bringing life to a vision we have to see it first. And for that we need people who specialize in seeing the impossible. Here at JDW, we are proud of the visionary men we have who take up the responsibility of creating opportunities for the future, not only for our company but for the whole community we operate in. We believe life is about the betterment of the human condition; it’s about social awareness, and random acts of kindness that weave the soul of

humanity. Together, we all participate in weaving the social fabric; we should all therefore be patching the fabric when it develops holes. The mission of JDW is to be the market leader and a world-class organization by meeting and proactively anticipating customer needs, to maximize the wealth of stakeholders by optimizing the long term returns and growth of the business, to be amongst the most efficient and lowest cost producers in the industry, to ensure a safe, harmonious and challenging working environment for the employees.

HEAD OFFICE Its head office is situated in 17-Abid Majeed Road, Lahore Cantt, Lahore Pakistan

Market Share: JDW is one of the largest groups in the sugar sector and contributes approximately 9-10% of country sugar production. The current price of per share is 112.06.

Organizational Structure: The JDW is simple structure that each employee can easily understand it very easily and is has centralized structure and on department level is has decentralized structure.

Departments of JDW Mills limited: JDW Sugar Mills Limited has following departments Finance istration Cane Chemical/Production Electrical Management Information System Store Mechanical

Policies: The company has the proper policies and rules to fulfill the vision, mission, objectives and strategies requirement.

LEASING Definition: Leasing is a financial instrument in which the ownership of the leased asset remains with the leasing company while the lessee obtains the right to use the asset by paying lease rentals for the life time of the leasing contract. At the maturity of the leasing contract the ownership of the leased asset is transferred to the lessee at a symbolic cost. In short leasing provides you with alternative business funding.

Leasing Process:

General Benefits Can Be Obtained Through Leasing:

100% financing

Quick approval process

Budgeting is made easy with fixed payments throughout the lease term.

Finance the equipment you need today, without having to wait for the total cash amount to be budgeted.

As a lease is considered a direct expense to your business, there may be advantageous tax benefits.

Help plan equipment acquisitions.

Allows you to upgrade as your needs change.

Monthly, Quarterly, Semi-annual and Annual payments are available.

Lease Proposal of JDW Sugar Mills Statement A company named JDW Sugar Mills LTD approached us for a 5 year lease facility against caterpillar generator for unit 1. After evaluating the data of our customer, we came to know that our customer’s credit history is good and our customer has the potential to repay credit. Our customer is A rated. So, after discussing the and conditions with our customer, we have developed the following lease proposal to be presented to our management. LEASE STRUCTURE Name of Organization:

JDW Sugar Mills Limited

Nature of Organization:

Sugar Mill

Status of Organization:

Public Limited Company

Office:

JDW Sugar Mills Ltd, 17-Abid Majeed Road, Lahore Cantt, Lahore. Phone +92 4 236664891-2, +92 42 36602573-4 Fax

+92 4 236654490

Web http://www.jdw-group.com/ Email [email protected]

Site Offices:

Mauza Sharin, Jamal Din Wali, Distt. Rahim Yar Khan. (Unit 1) Machi Goth, Sadiqabad. (Unit 2) Mauza Laluwali, Near Village Islamabad, Distt. Ghotki. (Unit 3)

Date of Incorporation:

31 May 1990

NTN of Company:

0711003-7

and condition of Lease Type of Lease:

Direct Lease

Description of Asset:

Sugar cane crushing Machinery (4 sets 1 set = 2,500,000)

Lease Amount:

10,000,000 (10 Million)

Security Deposit [35%]:

3,500,000

Residual Value [35%]:

3,500,000

Net lease:

6,500,000

IRR:

12.74% [9.24% 1 month KIBOR (average asks Side) + 350 basis points

Lease Rental Monthly:

($171,718.03)

Lease Term:

4 Year

Payment Term:

Monthly in Advance

Processing fee @ 1%:

Rs-100,000

Documentation charges:

Rs-6,500

Security:

a. personal guarantees of directors. b. 47 postdated Cheques

KIBOR difference will be recovered before disbursement. KIBOR published on 4th January 2013 was 9.74%

REFERENCES CIB Report: CIB report is clear from overdue. No overdue payments have been occur previously means they have good credit history. So a good credit history has been seen so the co is (A rated). Creditors:

Financial Institutions

Suppliers: The statement which is as stated by the supplier that JDW Pay their credit payments on time and we never have a feeling to chances of default. Directors Information: Mr. Jahangir Khan Tareen Director/Chief Executive Syed Ahmed Mahmud Director/Chairman RanaNasim Ahmed Chief Operating Officer Mr. Muhammad Rafique Group Director Finance Mrs. Sameera Mahmud Mr. Ijaz Ahmed Phulpoto Mr. AsimNisarBajwa Maj. ® RahealMasud Mr. ZafarIqbal

FINANCIAL INFORMATION

Following information is extracted from the financial statements of prospect audited by. External Auditors KPMG Taseer Hadi & Co., Chartered ants

PEST ANALYSIS

Political Factors: Since the independence in 1947, Pakistan has continuously faced political instability. The political instability has led to uncertain environment in the country, which is a threat for any business including JDW Mills Limited. Government regulations regarding hygiene, health and food regulations, food standards, etc. The rules and regulations are changed quite frequently due to changes in the government that affects the business flow for any company.

Economic Factors: Economic conditions are not very sound. The rising political instability has led to economic instability as well. Inflation remains the biggest threat to the economy. The surge in global petrol prices and thus local petrol prices hurt the buying power of consumers that reduced the demand for products. Due to inflation the cost of doing business has also gone higher. If Pakistan keeps on getting better grants and loan waivers or if any other economy boosting factors such as controlled inflation rate and economic growth take place, it will benefit the entire industry of Pakistan. Rate of inflation determines the rate of remuneration of employees and directly affects the price of the sugar's products. Again, the proportion between the inflation rate and wages prices is direct. Unemployment rate is going up and up which has increase the level of poverty thus further reducing the buying power of the people.

Social Factors: Eating habits of the people in your chosen business environment may, and certainly will, affect your marketing decisions. Peoples are becoming health curious, they want to avoid sugar’s product.

Technological Factors: Companies have technology with which they can have a competitive advantage in the Pakistani market. Companies are investing in their infrastructure to not only expand but also to upgrade their existing structure. A good technical infrastructure would lead to better production, procurement and distribution logistics, resulting in reduced wastage and lower costs. Sound technology may be a decisive factor for food technology innovation, better presentation, more effective business marketing, etc.

SWOT-ANALYSIS

STRENGTH: JDW is the market leader. There is no union labor in the organization. JDW have wide set up of farms. JDW has experienced qualified and competent employees in each department. They are using latest technology. Latest techniques. Latest fertilizers to increase the capacity of production Most of population lives in rural areas that are why labor is cheap. Cultivatable land is available for the production. Large domestic market is available. WEAKNESS: JDW is using man power on large scale so expenses are high. Salary package of lower staff is low as compared to other sugar mills. JDW have no proper transportation system for their employees.. JDW sugar Mills limited does not have proper recycling system which results in high water. OPPOURTUNITIES: JDW Sugar mills limited can increase per yield production by using further new technologies and fertilizers. The land of vicinity is very fruitful for sugar mills. JDW can shift towards beet production as it is cheaper. JDW can earn foreign exchange by exporting surplus sugar.

THREATS: The production of sugar cane decreases the productivity of land. Competition will increase The advertising campaign may be needed in future. No provision of proper transport to the field staff. As sugar cane crop requires a lot of water, increase in production may create shortage of water for other crops.

Requirement of the regularity bodies

Long-term Debt/Equity ratio is within the prescribed limit of 60/40.

Current ratio is within the prescribed limit.

Borrower’s total facilities are within the limit of 10 times of capital & reserves free of losses.

The prescribed exposure limit is within 20% of equity.

Lease Justification Profitability of the prospect is improving. Existing relationship with one of its group company with satisfactory repayment behavior. Profitability of the prospect is good enough. Their sales are increasing because of new technology. Although current ratio is less than one but this company is cleared from the CIB report and their suppliers and creditors as well. They are taking more Assets and raw material on credit so that is the reason that their Current ratio is less. JDW group has a good name in the market so that is the reason we facilitate them.

Their debt to equity ratio is also good

Ratios Debt to Equity

A company's debt to equity ratio or its gearing ratio is a measure of the level of borrowings a company has used in proportion to stockholders' equity to finance it's assets. It's often used as an indicator of the amount of risk inherent in the shares of a particular corporation.

Debt to Equity = Total Liabilities / Stockholders' Equity

2011

2010

=6,106,431+8,320,707/4,816,905

= 4,396,216+4,365,876/3,417,492

= 2.99 times

= 2.56 times

The company has more debt as compared to previous year. This could be due to the reason that JDW sugar mills issue Rs.500 million loans. Debt to Assets

2011

2010

= 6,106,431+8,320,707/19,244,044

=4,396,216+4,365,876 / 12,179,586

= 74%

= 72%

The ratio has increase from 72% to 74% because of increase in non-current liabilities whereas fixed assets did not increased. The company has not invested loans to enhance its assets

Current ratio An indication of a company's ability to meet debt obligations; the higher the ratio, the more liquid the company is. Current ratio is equal to current assets divided by current liabilities.

Current ratio = Current Assets/ Current Liabilities 2011

2010

= 6,505,191/8,320,707

=3,322,546/4,365,876

= 0.78:1

= 0.76:1

JDW sugar mills has current ratio of 0.78:1 in 2010-11 compare 2009-10 it was 0.76:1. 2011 has more current assets as compared to 2010 but assets are less than liabilities

Unit 1 On 31st May 1990 first unit was formed. Crushing capacity of this unit is 2.46 million tons of sugar or 20,500 TCD (tonne sugar cane crushing per day). This Unit is located in District Rahim Yar Khan. The

principal

activity

of

the

Company is production and sale of crystalline sugar with an annual report of 2011.

Unit 2 JDW Unit-II (formerly United Sugar Mills Limited) was acquired by JDWSML in November 2005 and after

four

years

successful

operations this was merged into JDWSML on October 1, 2008. Annual Crushing capacity of this Unit is 1.02 million tons of sugar or

8500 TCD (tonne sugar cane crushing per day) and is located near Sadiqabad at distance of 45 Kms from JDW Unit-I in District Rahim Yar Khan. Unit 3 JDW Unit-III (formerly Ghotki Sugar Mills (pvt) Limited) was incorporated on 02 June 2006 as a Private Limited Company under the Companies Ordinance, 1984. JDW Unit-III started crushing in year 2007-2008. The crushing capacity of this unit is 1.32 million tons of sugar or 11000 TCD (tonne sugar cane crushing per day) and is located in District Ghotki, Sindh Province. It was setup in the record time of 11 months between ground breaking and production and in the first year of production it reached 90,918 Tons with a recovery of 10.55 % which was the highest in the country.

JDW sugar mills have 2 diversifications also Faruki Pulp Mills Ltd and JK Dairies (Pvt) Ltd.

Management Profile Board of Directors

Mr. Jahangir Khan Tareen Director/Chief Executive

Syed Ahmed Mahmud Director/Chairman Mrs. Sameera Mahmud Mr. Ijaz Ahmed Phulpoto Mr. Asim Nisar Bajwa Maj. ® Raheal Masud Mr. Zafar Iqbal

Chief Operating officer Rana NasimAhmed

Group Director Finance Mr. Muhammad Rafique Auditors KPMG Taseer Hadi & Co. Chartered ants Audit Committee Mr. Asim Nisar Bajwa

Mr. Zafar Iqbal Mrs. Sameera Mahmud Banks Faysal Bank Ltd. Habib Bank Ltd. MCB Bank Ltd. United Bank Ltd. Standard Chartered Bank (Pakistan) Ltd. National Bank of Pakistan Allied Bank Ltd. The Bank of Punjab Habib Metropolitan Bank Ltd. Bank Islami (Pakistan) Ltd. Silk Bank Ltd. Location

Email [email protected]

JDW Sugar Mills Ltd 17-Abid Majeed Road, Lahore Cantt, Lahore Pakistan

Registrar Corplink (Pvt.) Ltd.

Phone +92 4 236664891-2, +92 42

Wings Arcade, I-K Commercial,

36602573-4

Model Town, Lahore.

Fax

Legal Advisor

+92 4 236654490

Web http://www.jdw-group.com/

Cornelius, Lane & Mufti

JDW Sugar Mills Limited History

JDW Sugar Mills Limited was incorporated in Pakistan on 31 May 1990 as a private limited company under the Companies Ordinance, 1984 and was subsequently converted into a public limited Company on 24 August 1991. Shares of the Company are listed on the Karachi and Lahore Stock Exchanges.

United Sugar Mills Limited

USML was incorporated in Pakistan on February 5, 1970. United Sugar Mills Limited was acquired by JDWSML in November 2005 and after four years successful operations this was merged into JDWSML on October 1, 2008.

Gohtki Sugar Mills (Pvt) Limited

Ghotki Sugar Mills (pvt) Limited) was incorporated on 02 June 2006 as a Private Limited Company. After that GSM was merged into JDWSML.

JDW is involved in various businesses including: Faruki Pulp mills Ltd Dairy Power Generation

Faruki Pulp Mills Ltd

Faruki Pulp Mills Limited was incorporated as a public limited company on October 20, 1991. The Company is engaged in the manufacturing of wood pulp from Eucalyptus for consumption in local and foreign paper industry. This project was started in early 1990 but due to various reasons could not be completed on time. This will be first of its kind project in Pakistan based on 100% supply of all raw materials locally. Due to its technical and professional viability, JDW Group has chosen this business for strategic investment with an objective of diversification. This is an agro based industry using local raw materials. The company has commenced its commercial production on October 1, 2011.

JK Dairies (Pvt) Ltd This Company was incorporated in Pakistan on 26 February 2007 as a Private Limited Company under the Companies Ordinance, 1984. It is the first modern Dairy Farm in the private sector. At present the herd consists of 1500 Friesian, Jersey & AFS imported cows. It is principally engaged in production and supply of milk.

Company Profile JDW sugar mills (Jamal Din Wali) company was incorporated in 1990. As a private limited company under the Companies Ordinance, 1984 and was subsequently converted into a public limited Company on 24 August 1991. The number of employees is approximately 942 people in all units. Before bringing life to a vision we have to see it first. And for that we need people who specialize in seeing the impossible. Here at JDW, we are proud of the visionary men we have who take up the responsibility of creating opportunities for the future, not only for our company but for the whole community we operate in. We believe life is about the betterment of the human condition; it’s about social awareness, and random acts of kindness that weave the soul of

humanity. Together, we all participate in weaving the social fabric; we should all therefore be patching the fabric when it develops holes. The mission of JDW is to be the market leader and a world-class organization by meeting and proactively anticipating customer needs, to maximize the wealth of stakeholders by optimizing the long term returns and growth of the business, to be amongst the most efficient and lowest cost producers in the industry, to ensure a safe, harmonious and challenging working environment for the employees.

HEAD OFFICE Its head office is situated in 17-Abid Majeed Road, Lahore Cantt, Lahore Pakistan

Market Share: JDW is one of the largest groups in the sugar sector and contributes approximately 9-10% of country sugar production. The current price of per share is 112.06.

Organizational Structure: The JDW is simple structure that each employee can easily understand it very easily and is has centralized structure and on department level is has decentralized structure.

Departments of JDW Mills limited: JDW Sugar Mills Limited has following departments Finance istration Cane Chemical/Production Electrical Management Information System Store Mechanical

Policies: The company has the proper policies and rules to fulfill the vision, mission, objectives and strategies requirement.

LEASING Definition: Leasing is a financial instrument in which the ownership of the leased asset remains with the leasing company while the lessee obtains the right to use the asset by paying lease rentals for the life time of the leasing contract. At the maturity of the leasing contract the ownership of the leased asset is transferred to the lessee at a symbolic cost. In short leasing provides you with alternative business funding.

Leasing Process:

General Benefits Can Be Obtained Through Leasing:

100% financing

Quick approval process

Budgeting is made easy with fixed payments throughout the lease term.

Finance the equipment you need today, without having to wait for the total cash amount to be budgeted.

As a lease is considered a direct expense to your business, there may be advantageous tax benefits.

Help plan equipment acquisitions.

Allows you to upgrade as your needs change.

Monthly, Quarterly, Semi-annual and Annual payments are available.

Lease Proposal of JDW Sugar Mills Statement A company named JDW Sugar Mills LTD approached us for a 5 year lease facility against caterpillar generator for unit 1. After evaluating the data of our customer, we came to know that our customer’s credit history is good and our customer has the potential to repay credit. Our customer is A rated. So, after discussing the and conditions with our customer, we have developed the following lease proposal to be presented to our management. LEASE STRUCTURE Name of Organization:

JDW Sugar Mills Limited

Nature of Organization:

Sugar Mill

Status of Organization:

Public Limited Company

Office:

JDW Sugar Mills Ltd, 17-Abid Majeed Road, Lahore Cantt, Lahore. Phone +92 4 236664891-2, +92 42 36602573-4 Fax

+92 4 236654490

Web http://www.jdw-group.com/ Email [email protected]

Site Offices:

Mauza Sharin, Jamal Din Wali, Distt. Rahim Yar Khan. (Unit 1) Machi Goth, Sadiqabad. (Unit 2) Mauza Laluwali, Near Village Islamabad, Distt. Ghotki. (Unit 3)

Date of Incorporation:

31 May 1990

NTN of Company:

0711003-7

and condition of Lease Type of Lease:

Direct Lease

Description of Asset:

Sugar cane crushing Machinery (4 sets 1 set = 2,500,000)

Lease Amount:

10,000,000 (10 Million)

Security Deposit [35%]:

3,500,000

Residual Value [35%]:

3,500,000

Net lease:

6,500,000

IRR:

12.74% [9.24% 1 month KIBOR (average asks Side) + 350 basis points

Lease Rental Monthly:

($171,718.03)

Lease Term:

4 Year

Payment Term:

Monthly in Advance

Processing fee @ 1%:

Rs-100,000

Documentation charges:

Rs-6,500

Security:

a. personal guarantees of directors. b. 47 postdated Cheques

KIBOR difference will be recovered before disbursement. KIBOR published on 4th January 2013 was 9.74%

REFERENCES CIB Report: CIB report is clear from overdue. No overdue payments have been occur previously means they have good credit history. So a good credit history has been seen so the co is (A rated). Creditors:

Financial Institutions

Suppliers: The statement which is as stated by the supplier that JDW Pay their credit payments on time and we never have a feeling to chances of default. Directors Information: Mr. Jahangir Khan Tareen Director/Chief Executive Syed Ahmed Mahmud Director/Chairman RanaNasim Ahmed Chief Operating Officer Mr. Muhammad Rafique Group Director Finance Mrs. Sameera Mahmud Mr. Ijaz Ahmed Phulpoto Mr. AsimNisarBajwa Maj. ® RahealMasud Mr. ZafarIqbal

FINANCIAL INFORMATION

Following information is extracted from the financial statements of prospect audited by. External Auditors KPMG Taseer Hadi & Co., Chartered ants

PEST ANALYSIS

Political Factors: Since the independence in 1947, Pakistan has continuously faced political instability. The political instability has led to uncertain environment in the country, which is a threat for any business including JDW Mills Limited. Government regulations regarding hygiene, health and food regulations, food standards, etc. The rules and regulations are changed quite frequently due to changes in the government that affects the business flow for any company.

Economic Factors: Economic conditions are not very sound. The rising political instability has led to economic instability as well. Inflation remains the biggest threat to the economy. The surge in global petrol prices and thus local petrol prices hurt the buying power of consumers that reduced the demand for products. Due to inflation the cost of doing business has also gone higher. If Pakistan keeps on getting better grants and loan waivers or if any other economy boosting factors such as controlled inflation rate and economic growth take place, it will benefit the entire industry of Pakistan. Rate of inflation determines the rate of remuneration of employees and directly affects the price of the sugar's products. Again, the proportion between the inflation rate and wages prices is direct. Unemployment rate is going up and up which has increase the level of poverty thus further reducing the buying power of the people.

Social Factors: Eating habits of the people in your chosen business environment may, and certainly will, affect your marketing decisions. Peoples are becoming health curious, they want to avoid sugar’s product.

Technological Factors: Companies have technology with which they can have a competitive advantage in the Pakistani market. Companies are investing in their infrastructure to not only expand but also to upgrade their existing structure. A good technical infrastructure would lead to better production, procurement and distribution logistics, resulting in reduced wastage and lower costs. Sound technology may be a decisive factor for food technology innovation, better presentation, more effective business marketing, etc.

SWOT-ANALYSIS

STRENGTH: JDW is the market leader. There is no union labor in the organization. JDW have wide set up of farms. JDW has experienced qualified and competent employees in each department. They are using latest technology. Latest techniques. Latest fertilizers to increase the capacity of production Most of population lives in rural areas that are why labor is cheap. Cultivatable land is available for the production. Large domestic market is available. WEAKNESS: JDW is using man power on large scale so expenses are high. Salary package of lower staff is low as compared to other sugar mills. JDW have no proper transportation system for their employees.. JDW sugar Mills limited does not have proper recycling system which results in high water. OPPOURTUNITIES: JDW Sugar mills limited can increase per yield production by using further new technologies and fertilizers. The land of vicinity is very fruitful for sugar mills. JDW can shift towards beet production as it is cheaper. JDW can earn foreign exchange by exporting surplus sugar.

THREATS: The production of sugar cane decreases the productivity of land. Competition will increase The advertising campaign may be needed in future. No provision of proper transport to the field staff. As sugar cane crop requires a lot of water, increase in production may create shortage of water for other crops.

Requirement of the regularity bodies

Long-term Debt/Equity ratio is within the prescribed limit of 60/40.

Current ratio is within the prescribed limit.

Borrower’s total facilities are within the limit of 10 times of capital & reserves free of losses.

The prescribed exposure limit is within 20% of equity.

Lease Justification Profitability of the prospect is improving. Existing relationship with one of its group company with satisfactory repayment behavior. Profitability of the prospect is good enough. Their sales are increasing because of new technology. Although current ratio is less than one but this company is cleared from the CIB report and their suppliers and creditors as well. They are taking more Assets and raw material on credit so that is the reason that their Current ratio is less. JDW group has a good name in the market so that is the reason we facilitate them.

Their debt to equity ratio is also good

Ratios Debt to Equity

A company's debt to equity ratio or its gearing ratio is a measure of the level of borrowings a company has used in proportion to stockholders' equity to finance it's assets. It's often used as an indicator of the amount of risk inherent in the shares of a particular corporation.

Debt to Equity = Total Liabilities / Stockholders' Equity

2011

2010

=6,106,431+8,320,707/4,816,905

= 4,396,216+4,365,876/3,417,492

= 2.99 times

= 2.56 times

The company has more debt as compared to previous year. This could be due to the reason that JDW sugar mills issue Rs.500 million loans. Debt to Assets

2011

2010

= 6,106,431+8,320,707/19,244,044

=4,396,216+4,365,876 / 12,179,586

= 74%

= 72%

The ratio has increase from 72% to 74% because of increase in non-current liabilities whereas fixed assets did not increased. The company has not invested loans to enhance its assets

Current ratio An indication of a company's ability to meet debt obligations; the higher the ratio, the more liquid the company is. Current ratio is equal to current assets divided by current liabilities.

Current ratio = Current Assets/ Current Liabilities 2011

2010

= 6,505,191/8,320,707

=3,322,546/4,365,876

= 0.78:1

= 0.76:1

JDW sugar mills has current ratio of 0.78:1 in 2010-11 compare 2009-10 it was 0.76:1. 2011 has more current assets as compared to 2010 but assets are less than liabilities