Key Financial Ratios Of Icici Bank l2f71

This document was ed by and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this report form. Report 3b7i

Overview 3e4r5l

& View Key Financial Ratios Of Icici Bank as PDF for free.

More details w3441

- Words: 3,081

- Pages: 13

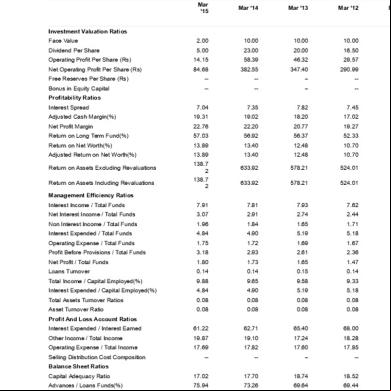

Key Financial Ratios of ICICI Bank

Mar '15

Mar '14

Mar '13

Mar '12

Face Value

2.00

10.00

10.00

10.00

Dividend Per Share

5.00

23.00

20.00

16.50

Investment Valuation Ratios

Operating Profit Per Share (Rs)

14.15

58.39

46.32

29.57

Net Operating Profit Per Share (Rs)

84.68

382.55

347.40

290.99

Free Reserves Per Share (Rs)

--

--

--

--

Bonus in Equity Capital

--

--

--

--

7.04

7.35

7.82

7.45

Adjusted Cash Margin(%)

19.31

19.02

18.20

17.02

Net Profit Margin

22.76

22.20

20.77

19.27

Return on Long Term Fund(%)

57.03

56.92

56.37

52.33

Return on Net Worth(%)

13.89

13.40

12.48

10.70

Adjusted Return on Net Worth(%)

13.89

13.40

12.48

10.70

633.92

578.21

524.01

633.92

578.21

524.01

Profitability Ratios Interest Spread

Return on Assets Excluding Revaluations Return on Assets Including Revaluations

138.7 2 138.7 2

Management Efficiency Ratios Interest Income / Total Funds

7.91

7.81

7.93

7.62

Net Interest Income / Total Funds

3.07

2.91

2.74

2.44

Non Interest Income / Total Funds

1.96

1.84

1.65

1.71

Interest Expended / Total Funds

4.84

4.90

5.19

5.18

Operating Expense / Total Funds

1.75

1.72

1.69

1.67

Profit Before Provisions / Total Funds

3.18

2.93

2.61

2.36

Net Profit / Total Funds

1.80

1.73

1.65

1.47

Loans Turnover

0.14

0.14

0.15

0.14

Total Income / Capital Employed(%)

9.88

9.65

9.58

9.33

Interest Expended / Capital Employed(%)

4.84

4.90

5.19

5.18

Total Assets Turnover Ratios

0.08

0.08

0.08

0.08

Asset Turnover Ratio

0.08

0.08

0.08

0.08

Interest Expended / Interest Earned

61.22

62.71

65.40

68.00

Other Income / Total Income

19.87

19.10

17.24

18.28

Operating Expense / Total Income

17.69

17.82

17.60

17.85

--

--

--

--

Capital Adequacy Ratio

17.02

17.70

18.74

18.52

Advances / Loans Funds(%)

75.94

73.26

69.64

69.44

104.7 2

100.71

99.25

97.71

Profit And Loss Ratios

Selling Distribution Cost Composition Balance Sheet Ratios

Debt Coverage Ratios Credit Deposit Ratio

M

Investment Deposit Ratio

52.43

55.79

60.38

61.16

Cash Deposit Ratio

6.85

6.54

7.21

8.60

Total Debt to Owners Fund

4.50

4.53

4.39

4.23

Financial Charges Coverage Ratio

0.68

0.62

0.52

0.48

Financial Charges Coverage Ratio Post Tax

1.39

1.37

1.34

1.31

0.06

0.09

0.09

0.07

13.81

11.31

10.53

16.71

Dividend Payout Ratio Net Profit

25.93

27.07

27.71

29.41

Dividend Payout Ratio Cash Profit

24.49

25.57

26.17

27.21

Earning Retention Ratio

74.07

72.93

72.29

70.59

Cash Earning Retention Ratio

75.51

74.43

73.83

72.79

AdjustedCash Flow Times

30.55

31.96

33.19

36.55

Mar '15

Mar '14

Mar '13

Mar '12

Earnings Per Share

19.28

84.95

72.17

56.09

Book Value

138.7 2

633.92

578.21

524.01

Mar '15

Mar '14

Mar '13

Mar '12

1.00

10.00

10.00

10.00

Leverage Ratios Current Ratio Quick Ratio Cash Flow Indicator Ratios

M

Source : Dion Global Solutions Limited

Key Financial Ratios of State Bank of India

M

Investment Valuation Ratios Face Value Dividend Per Share

3.50

30.00

41.50

35.00

23.38

199.45

236.63

271.65

204.13

1,826.36

1,749.29

1,587.40

Free Reserves Per Share (Rs)

--

--

--

--

Bonus in Equity Capital

--

--

--

--

Interest Spread

6.26

5.76

5.95

6.87

Adjusted Cash Margin(%)

8.12

7.89

11.23

10.51

Operating Profit Per Share (Rs) Net Operating Profit Per Share (Rs)

Profitability Ratios

Net Profit Margin

8.59

7.98

11.78

10.99

Return on Long Term Fund(%)

90.85

87.28

96.35

97.36

Return on Net Worth(%)

10.20

9.20

14.26

13.94

1,

Adjusted Return on Net Worth(%)

10.20

9.20

14.26

13.94

Return on Assets Excluding Revaluations

172.04

1,584.34

1,445.60

1,251.05

1,

Return on Assets Including Revaluations

172.04

1,584.34

1,445.60

1,251.05

1,

Interest Income / Total Funds

7.94

8.12

8.25

8.32

Net Interest Income / Total Funds

2.87

2.93

3.06

3.38

Non Interest Income / Total Funds

1.18

1.10

1.11

1.12

Interest Expended / Total Funds

5.07

5.19

5.19

4.94

Operating Expense / Total Funds

1.96

2.05

1.94

1.96

Profit Before Provisions / Total Funds

2.03

1.91

2.14

2.47

Net Profit / Total Funds

0.68

0.65

0.97

0.91

Loans Turnover

0.12

0.12

0.13

0.13

Total Income / Capital Employed(%)

9.11

9.22

9.35

9.45

Interest Expended / Capital Employed(%)

5.07

5.19

5.19

4.94

Total Assets Turnover Ratios

0.08

0.08

0.08

0.08

Asset Turnover Ratio

0.08

0.09

0.09

0.09

Interest Expended / Interest Earned

63.90

63.86

62.95

59.36

Other Income / Total Income

12.90

11.98

11.82

11.87

Operating Expense / Total Income

21.47

22.20

20.74

20.73

--

--

--

--

Capital Adequacy Ratio

12.00

12.96

12.92

13.86

Advances / Loans Funds(%)

77.39

82.04

82.25

78.01

Credit Deposit Ratio

84.47

86.84

85.17

82.14

Investment Deposit Ratio

30.07

28.85

29.52

30.73

6.76

5.81

5.34

7.51

Management Efficiency Ratios

Profit And Loss Ratios

Selling Distribution Cost Composition Balance Sheet Ratios

Debt Coverage Ratios

Cash Deposit Ratio Total Debt to Owners Fund

12.28

11.79

12.16

12.43

Financial Charges Coverage Ratio

0.41

0.38

0.43

0.52

Financial Charges Coverage Ratio Post Tax

1.15

1.14

1.20

1.20

0.04

0.03

0.04

0.05

10.78

13.88

12.15

12.05

Dividend Payout Ratio Net Profit

19.51

20.56

20.12

20.06

Dividend Payout Ratio Cash Profit

17.98

18.32

18.62

18.47

Earning Retention Ratio

80.49

79.44

79.88

79.94

Cash Earning Retention Ratio

82.02

81.68

81.38

81.53

110.90

114.06

78.90

82.08

Mar '15

Mar '14

Mar '13

Mar '12

17.55

145.88

206.20

174.46

172.04

1,584.34

1,445.60

1,251.05

Leverage Ratios Current Ratio Quick Ratio Cash Flow Indicator Ratios

AdjustedCash Flow Times

Earnings Per Share Book Value

M

1,

Source : Dion Global Solutions Limited

Balance Sheet of State Bank of India

------------------- in Rs. Cr. ------------------Mar '15

Mar '14

Mar '13

Mar '12

M

12 mths

12 mths

12 mths

12 mths

Total Share Capital

746.57

746.57

684.03

671.04

Equity Share Capital

746.57

746.57

684.03

671.04

Share Application Money

0.00

0.00

0.00

0.00

Preference Share Capital

0.00

0.00

0.00

0.00

127,691.65

117,535.68

98,199.65

83,280.16

64,

Net Worth

128,438.22

118,282.25

98,883.68

83,951.20

64,

Deposits

1,576,793.2 4

1,394,408.51

1,202,739.57

1,043,647.36

933,

Borrowings

205,150.29

183,130.88

169,182.71

127,005.57

119,

Total Debt

1,781,943.5 3

1,577,539.39

1,371,922.28

1,170,652.93

1,053,

Other Liabilities & Provisions

137,698.05

96,412.96

95,455.07

80,915.09

105,

Total Liabilities

2,048,079.8 0

1,792,234.60

1,566,261.03

1,335,519.22

1,223,

Mar '15

Mar '14

Mar '13

Mar '12

M

12 mths

12 mths

12 mths

12 mths

1

115,883.84

84,955.66

65,830.41

54,075.94

94,

1

Capital and Liabilities:

Reserves

Assets Cash & Balances with RBI Balance with Banks, Money at Call

58,977.46

47,593.97

48,989.75

43,087.23

28,

Advances

1,300,026.3 9

1,209,828.72

1,045,616.55

867,578.89

756,

Investments

495,027.40

398,308.19

350,927.27

312,197.61

295,

9,329.16

8,002.16

6,595.71

5,133.87

4,

Revaluation Reserves

0.00

0.00

0.00

0.00

Accumulated Depreciation

0.00

0.00

0.00

0.00

9,329.16

8,002.16

6,595.71

5,133.87

0.00

0.00

409.31

332.68

Other Assets

68,835.55

43,545.90

47,892.03

53,113.02

43,

Total Assets

2,048,079.8 0

1,792,234.60

1,566,261.03

1,335,519.24

1,223,

Contingent Liabilities

1,093,422.5 1

1,091,358.37

993,018.45

899,565.18

790,

Gross Block

Net Block Capital Work In Progress

Bills for collection Book Value (Rs)

0.00

0.00

0.00

0.00

172.04

1,584.34

1,445.60

1,251.05

4,

1,

Profit & Loss of State Bank of India

------------------- in Rs. Cr. ------------------Mar '15

Mar '14

Mar '13

Mar '12

M

12 mths

12 mths

12 mths

12 mths

Interest Earned

152,397.0 7

136,350.80

119,657.10

106,521.45

81,3

Other Income

22,575.89

18,552.92

16,034.84

14,351.45

14,9

Total Income

174,972.9 6

154,903.72

135,691.94

120,872.90

96,3

Interest expended

97,381.82

87,068.63

75,325.80

63,230.37

48,8

Employee Cost

23,537.07

22,504.28

18,380.90

16,974.04

15,

Selling, & Misc Expenses

39,836.01

33,105.70

26,740.65

27,954.03

23,8

1,116.49

1,333.94

1,139.61

1,007.17

9

0.00

0.00

0.00

0.00

Operating Expenses

38,677.64

35,725.85

29,284.42

26,068.99

23,0

Provisions & Contingencies

25,811.93

21,218.07

16,976.74

19,866.25

17,0

Total Expenses

161,871.3 9

144,012.55

121,586.96

109,165.61

88,9

Mar '15

Mar '14

Mar '13

Mar '12

M

12 mths

12 mths

12 mths

12 mths

1

13,101.57

10,891.17

14,104.98

11,707.29

Extraordinary Items

0.00

0.00

0.00

0.00

Profit brought forward

0.32

0.34

0.34

6.05

13,101.89

10,891.51

14,105.32

11,713.34

1

Income

Expenditure

Depreciation Preoperative Exp Capitalised

Net Profit for the Year

Total

7,3

7,3

Preference Dividend Equity Dividend Corporate Dividend Tax

0.00

0.00

0.00

0.00

2,557.28

2,239.71

2,838.74

2,348.66

1,9

520.65

298.45

375.95

296.49

2

Per share data (annualised) Earning Per Share (Rs)

17.55

145.88

206.20

174.46

Equity Dividend (%)

350.00

300.00

415.00

350.00

3

Book Value (Rs)

172.04

1,584.34

1,445.60

1,251.05

1,0

10,023.64

8,353.03

10,890.29

9,067.85

5,2

Appropriations Transfer to Statutory Reserves Transfer to Other Reserves Proposed Dividend/Transfer to Govt Balance c/f to Balance Sheet Total

0.00

0.00

0.00

0.00

3,077.93

2,538.16

3,214.69

2,645.15

0.32

0.32

0.34

0.34

13,101.89

10,891.51

14,105.32

11,713.34

2,1

7,3

Source : Dion Global Solutions Limited

Balance Sheet of Axis Bank

------------------- in Rs. Cr. ------------------Mar '15

Mar '14

Mar '13

Mar '12

12 mths

12 mths

12 mths

12 mths

Total Share Capital

474.10

469.84

467.95

413.20

Equity Share Capital

M

1

Capital and Liabilities: 474.10

469.84

467.95

413.20

Share Application Money

0.00

0.00

0.00

0.00

Preference Share Capital

0.00

0.00

0.00

0.00

Reserves

44,202.41

37,750.64

32,639.91

22,395.34

18,

Net Worth

44,676.51

38,220.48

33,107.86

22,808.54

18,

Deposits

322,441.9 4

280,944.56

252,613.59

220,104.30

189,

Borrowings

79,758.27

50,290.94

43,951.10

34,071.67

26,

Total Debt

402,200.2 1

331,235.50

296,564.69

254,175.97

215,

Other Liabilities & Provisions

15,055.67

13,788.89

10,888.11

8,643.28

8,

Total Liabilities

461,932.3 9

383,244.87

340,560.66

285,627.79

242,

Mar '15

Mar '14

Mar '13

Mar '12

M

12 mths

12 mths

12 mths

12 mths

1

Cash & Balances with RBI

19,818.84

17,041.32

14,792.09

10,702.92

13,

Balance with Banks, Money at Call

16,280.19

11,197.38

5,642.87

3,230.99

7,

230,066.76

196,965.96

169,759.54

142,

113,548.43

113,737.54

93,192.09

71,

Assets

Advances Investments

281,083.0 3 132,342.8

3 Gross Block Revaluation Reserves Accumulated Depreciation

2,413.05

2,310.54

2,230.54

2,188.56

0.00

0.00

0.00

0.00

2,

0.00

0.00

0.00

0.00

2,413.05

2,310.54

2,230.54

2,188.56

101.26

99.67

125.11

70.77

Other Assets

9,893.19

8,980.79

7,066.56

6,482.93

4,

Total Assets

461,932.3 9

383,244.89

340,560.67

285,627.80

242,

Contingent Liabilities

640,183.5 9

608,547.25

574,782.38

514,871.98

477,

0.00

0.00

0.00

0.00

188.47

813.47

707.50

551.99

Net Block Capital Work In Progress

Bills for collection Book Value (Rs)

Profit & Loss of Axis Bank

2,

------------------- in Rs. Cr. ------------------Mar '15

Mar '14

Mar '13

Mar '12

M

12 mths

12 mths

12 mths

12 mths

Interest Earned

35,478.6 0

30,641.16

27,182.57

21,994.65

15,1

Other Income

8,365.05

7,405.22

6,551.11

5,420.22

4,6

Total Income

43,843.6 5

38,046.38

33,733.68

27,414.87

19,7

Interest expended

21,254.4 6

18,689.52

17,516.31

13,976.90

8,5

Employee Cost

3,114.97

2,601.35

2,376.98

2,080.17

1,6

11,710.72

10,173.91

8,309.22

6,773.35

5,9

405.67

363.93

351.73

342.24

2

0.00

0.00

0.00

0.00

Operating Expenses

9,203.74

7,900.77

6,914.23

6,007.10

4,7

Provisions & Contingencies

6,027.62

5,238.42

4,123.70

3,188.66

3,0

Total Expenses

36,485.8 2

31,828.71

28,554.24

23,172.66

16,3

Mar '15

Mar '14

Mar '13

Mar '12

M

12 mths

12 mths

12 mths

12 mths

1

7,357.82

6,217.67

5,179.43

4,242.21

3,3

0.00

0.00

0.00

0.00

10,029.26

7,329.45

4,969.77

3,4

16,246.93

12,508.88

9,211.98

6,8

0.00

0.00

0.00

1

Income

Expenditure

Selling, & Misc Expenses Depreciation Preoperative Exp Capitalised

Net Profit for the Year Extraordinary Items Profit brought forward Total Preference Dividend

13,501.4 5 20,859.2 7 0.00

Equity Dividend

1,087.54

939.69

843.86

658.24

221.42

161.44

143.37

111.83

31.04

132.33

110.68

102.67

Equity Dividend (%)

230.00

200.00

180.00

160.00

1

Book Value (Rs)

188.47

813.47

707.50

551.99

4

1,926.82

1,644.36

1,492.38

1,112.46

8

0.00

-0.01

0.01

0.00

3

1,308.96

1,101.13

987.23

770.07

6

13,501.45

10,029.26

7,329.45

4,9

16,246.93

12,508.88

9,211.98

6,8

Corporate Dividend Tax

5

Per share data (annualised) Earning Per Share (Rs)

Appropriations Transfer to Statutory Reserves Transfer to Other Reserves Proposed Dividend/Transfer to Govt Balance c/f to Balance Sheet Total

17,623.4 9 20,859.2 7

Source : Dion G

Profit & Loss of Axis Bank

------------------- in Rs. Cr. ------------------Mar '15

Mar '14

Mar '13

Mar '12

M

12 mths

12 mths

12 mths

12 mths

1

Interest Earned

35,478.6 0

30,641.16

27,182.57

21,994.65

15,

Other Income

8,365.05

7,405.22

6,551.11

5,420.22

4,

Total Income

43,843.6 5

38,046.38

33,733.68

27,414.87

19,

21,254.4 6

18,689.52

17,516.31

13,976.90

8,

Income

Expenditure Interest expended Employee Cost

3,114.97

2,601.35

2,376.98

2,080.17

1,

11,710.72

10,173.91

8,309.22

6,773.35

5,

405.67

363.93

351.73

342.24

0.00

0.00

0.00

0.00

Operating Expenses

9,203.74

7,900.77

6,914.23

6,007.10

4,

Provisions & Contingencies

6,027.62

5,238.42

4,123.70

3,188.66

3,

Total Expenses

36,485.8 2

31,828.71

28,554.24

23,172.66

16,

Mar '15

Mar '14

Mar '13

Mar '12

Selling, & Misc Expenses Depreciation Preoperative Exp Capitalised

M

Net Profit for the Year Extraordinary Items Profit brought forward Total Preference Dividend

12 mths

12 mths

12 mths

12 mths

1

7,357.82

6,217.67

5,179.43

4,242.21

3,

0.00

0.00

0.00

0.00

10,029.26

7,329.45

4,969.77

3,

16,246.93

12,508.88

9,211.98

6,

13,501.4 5 20,859.2 7 0.00

0.00

0.00

0.00

1,087.54

939.69

843.86

658.24

221.42

161.44

143.37

111.83

31.04

132.33

110.68

102.67

Equity Dividend (%)

230.00

200.00

180.00

160.00

Book Value (Rs)

188.47

813.47

707.50

551.99

1,926.82

1,644.36

1,492.38

1,112.46

0.00

-0.01

0.01

0.00

1,308.96

1,101.13

987.23

770.07

13,501.45

10,029.26

7,329.45

4,

16,246.93

12,508.88

9,211.98

6,

Equity Dividend Corporate Dividend Tax Per share data (annualised) Earning Per Share (Rs)

Appropriations Transfer to Statutory Reserves Transfer to Other Reserves Proposed Dividend/Transfer to Govt Balance c/f to Balance Sheet Total

17,623.4 9 20,859.2 7

Source : Dion G

Balance Sheet of ICICI Bank

------------------- in Rs. Cr. ------------------Mar '15

Mar '14

Mar '13

Mar '12

M

12 mths

12 mths

12 mths

12 mths

1

Total Share Capital

1,159.66

1,155.04

1,153.64

1,152.77

1,

Equity Share Capital

1,

Capital and Liabilities: 1,159.66

1,155.04

1,153.64

1,152.77

Share Application Money

7.44

6.57

4.48

2.39

Preference Share Capital

0.00

0.00

0.00

0.00

Reserves

79,262.26

72,051.71

65,547.84

59,250.09

53,

Net Worth

80,429.36

73,213.32

66,705.96

60,405.25

55,

331,913.66

292,613.63

255,499.96

225,

154,759.05

145,341.49

140,164.91

109,

486,672.71

437,955.12

395,664.87

335,

Deposits Borrowings Total Debt

361,562.7 3 172,417.3 5 533,980.0 8

Other Liabilities & Provisions

31,719.86

34,755.55

32,133.60

17,576.98

15,

Total Liabilities

646,129.3 0

594,641.58

536,794.68

473,647.10

406,

Mar '15

Mar '14

Mar '13

Mar '12

M

12 mths

12 mths

12 mths

12 mths

1

Cash & Balances with RBI

25,652.91

21,821.83

19,052.73

20,461.29

20,

Balance with Banks, Money at Call

16,651.71

19,707.77

22,364.79

15,768.02

13,

338,702.65

290,249.44

253,727.66

216,

177,021.82

171,393.60

159,560.04

134,

4,725.52

4,678.14

4,647.06

4,614.69

4,

0.00

0.00

0.00

0.00

Assets

Advances Investments Gross Block Revaluation Reserves Accumulated Depreciation

387,522.0 7 186,580.0 3

0.00

0.00

0.00

0.00

4,725.52

4,678.14

4,647.06

4,614.69

0.00

0.00

0.00

0.00

Other Assets

24,997.05

32,709.39

29,087.07

19,515.39

16,

Total Assets

646,129.2 9

594,641.60

536,794.69

473,647.09

406,

Contingent Liabilities

868,190.5 8

794,965.35

802,383.84

923,037.16

931,

0.00

0.00

0.00

0.00

138.72

633.92

578.21

524.01

Net Block Capital Work In Progress

Bills for collection Book Value (Rs)

4,

Source : Dion Global Solutions Limited

Profit & Loss of ICICI Bank

------------------- in Rs. Cr. ------------------Mar '15

Mar '14

Mar '13

Mar '12

M

12 mths

12 mths

12 mths

12 mths

44,178.15

40,075.60

33,542.65

25,9

10,427.87

8,345.70

7,502.76

6,6

54,606.02

48,421.30

41,045.41

32,6

1

Income Interest Earned Other Income Total Income

49,091.1 4 12,176.1 3 61,267.2 7

Expenditure Interest expended

30,051.5 3

27,702.59

26,209.18

22,808.50

16,9

Employee Cost

4,749.88

4,220.11

3,893.29

3,515.28

2,8

Selling, & Misc Expenses

14,631.5 6

12,296.88

9,503.20

7,731.85

7,1

Depreciation Preoperative Exp Capitalised

658.95

575.97

490.16

524.53

5

0.00

0.00

0.00

0.00

11,495.83

10,308.86

9,012.89

7,850.44

6,6

Provisions & Contingencies

8,544.56

6,784.10

4,873.76

3,921.22

3,8

Total Expenses

50,091.9 2

44,795.55

40,095.83

34,580.16

27,4

Mar '15

Mar '14

Mar '13

Mar '12

M

12 mths

12 mths

12 mths

12 mths

1

11,175.35

9,810.48

8,325.47

6,465.26

5,1

0.00

0.00

0.00

0.00

9,902.29

7,054.23

5,018.18

3,4

19,712.77

15,379.70

11,483.44

8,6

Operating Expenses

Net Profit for the Year Extraordinary Items Profit brought forward Total Preference Dividend

13,318.5 9 24,493.9 4 0.00

0.00

0.00

0.00

2,898.81

2,656.28

2,307.23

1,902.04

1,6

271.15

231.25

292.16

220.35

2

19.28

84.95

72.17

56.09

Equity Dividend (%)

250.00

230.00

200.00

165.00

1

Book Value (Rs)

138.72

633.92

578.21

524.01

4

4,062.57

3,506.65

2,878.03

2,306.49

1,7

0.00

0.00

0.00

0.33

3,169.96

2,887.53

2,599.39

2,122.39

1,8

13,318.59

9,902.29

7,054.23

5,0

19,712.77

15,379.71

11,483.44

8,6

Mar '15

Mar '14

Mar '13

Mar '12

M

Face Value

2.00

10.00

10.00

10.00

Dividend Per Share

4.60

20.00

18.00

16.00

Operating Profit Per Share (Rs)

22.89

93.96

66.33

56.94

Net Operating Profit Per Share (Rs)

149.6 7

652.16

580.88

532.30

--

--

--

--

Equity Dividend Corporate Dividend Tax Per share data (annualised) Earning Per Share (Rs)

Appropriations Transfer to Statutory Reserves Transfer to Other Reserves Proposed Dividend/Transfer to Govt Balance c/f to Balance Sheet Total

17,261.4 2 24,493.9 5

Source : Dion Global Solutions Limited

Key Financial Ratios of Axis Bank

Investment Valuation Ratios

Free Reserves Per Share (Rs)

Bonus in Equity Capital

--

--

--

--

7.34

7.67

7.90

7.46

Adjusted Cash Margin(%)

17.70

17.29

16.39

16.72

Net Profit Margin

20.73

20.29

19.05

19.28

Return on Long Term Fund(%)

72.32

73.36

75.72

88.84

Return on Net Worth(%)

16.46

16.26

15.64

18.59

Adjusted Return on Net Worth(%)

16.46

16.26

15.64

18.59

813.47

707.50

551.99

813.47

707.50

551.99

Profitability Ratios Interest Spread

Return on Assets Excluding Revaluations Return on Assets Including Revaluations

188.4 7 188.4 7

Management Efficiency Ratios Interest Income / Total Funds

8.40

8.47

8.68

8.33

Net Interest Income / Total Funds

3.37

3.30

3.09

3.04

Non Interest Income / Total Funds

1.98

2.05

2.09

2.05

Interest Expended / Total Funds

5.03

5.16

5.59

5.29

Operating Expense / Total Funds

2.08

2.08

2.10

2.14

Profit Before Provisions / Total Funds

3.17

3.17

2.97

2.81

Net Profit / Total Funds

1.74

1.72

1.65

1.61

Loans Turnover

0.14

0.14

0.15

0.14

Total Income / Capital Employed(%)

10.38

10.51

10.77

10.38

Interest Expended / Capital Employed(%)

5.03

5.16

5.59

5.29

Total Assets Turnover Ratios

0.08

0.08

0.09

0.08

Asset Turnover Ratio

0.09

0.09

0.09

0.09

Interest Expended / Interest Earned

59.91

60.99

64.44

63.55

Other Income / Total Income

19.08

19.46

19.42

19.77

Operating Expense / Total Income

20.07

19.81

19.45

20.66

--

--

--

--

Capital Adequacy Ratio

15.09

16.07

17.00

13.66

Advances / Loans Funds(%)

76.65

73.29

71.53

72.29

Credit Deposit Ratio

84.71

80.03

77.58

76.26

Investment Deposit Ratio

40.75

42.60

43.77

40.35

Cash Deposit Ratio

6.11

5.97

5.39

6.01

Total Debt to Owners Fund

7.22

7.35

7.63

9.65

Financial Charges Coverage Ratio

0.65

0.63

0.55

0.56

Financial Charges Coverage Ratio Post Tax

1.37

1.35

1.32

1.33

0.03

0.03

0.03

0.03

20.64

18.57

20.10

21.63

Dividend Payout Ratio Net Profit

14.78

15.11

16.29

15.51

Dividend Payout Ratio Cash Profit

14.00

14.27

15.25

14.35

Earning Retention Ratio

85.22

84.89

83.71

84.49

Cash Earning Retention Ratio

86.00

85.73

84.75

85.65

Profit And Loss Ratios

Selling Distribution Cost Composition Balance Sheet Ratios

Debt Coverage Ratios

Leverage Ratios Current Ratio Quick Ratio Cash Flow Indicator Ratios

AdjustedCash Flow Times

41.53

42.69

45.67

48.01

Mar '15

Mar '14

Mar '13

Mar '12

Earnings Per Share

31.04

132.33

110.68

102.67

Book Value

188.4 7

813.47

707.50

551.99

Source : Dion Global Solutions Limited

M

Mar '15

Mar '14

Mar '13

Mar '12

Face Value

2.00

10.00

10.00

10.00

Dividend Per Share

5.00

23.00

20.00

16.50

Investment Valuation Ratios

Operating Profit Per Share (Rs)

14.15

58.39

46.32

29.57

Net Operating Profit Per Share (Rs)

84.68

382.55

347.40

290.99

Free Reserves Per Share (Rs)

--

--

--

--

Bonus in Equity Capital

--

--

--

--

7.04

7.35

7.82

7.45

Adjusted Cash Margin(%)

19.31

19.02

18.20

17.02

Net Profit Margin

22.76

22.20

20.77

19.27

Return on Long Term Fund(%)

57.03

56.92

56.37

52.33

Return on Net Worth(%)

13.89

13.40

12.48

10.70

Adjusted Return on Net Worth(%)

13.89

13.40

12.48

10.70

633.92

578.21

524.01

633.92

578.21

524.01

Profitability Ratios Interest Spread

Return on Assets Excluding Revaluations Return on Assets Including Revaluations

138.7 2 138.7 2

Management Efficiency Ratios Interest Income / Total Funds

7.91

7.81

7.93

7.62

Net Interest Income / Total Funds

3.07

2.91

2.74

2.44

Non Interest Income / Total Funds

1.96

1.84

1.65

1.71

Interest Expended / Total Funds

4.84

4.90

5.19

5.18

Operating Expense / Total Funds

1.75

1.72

1.69

1.67

Profit Before Provisions / Total Funds

3.18

2.93

2.61

2.36

Net Profit / Total Funds

1.80

1.73

1.65

1.47

Loans Turnover

0.14

0.14

0.15

0.14

Total Income / Capital Employed(%)

9.88

9.65

9.58

9.33

Interest Expended / Capital Employed(%)

4.84

4.90

5.19

5.18

Total Assets Turnover Ratios

0.08

0.08

0.08

0.08

Asset Turnover Ratio

0.08

0.08

0.08

0.08

Interest Expended / Interest Earned

61.22

62.71

65.40

68.00

Other Income / Total Income

19.87

19.10

17.24

18.28

Operating Expense / Total Income

17.69

17.82

17.60

17.85

--

--

--

--

Capital Adequacy Ratio

17.02

17.70

18.74

18.52

Advances / Loans Funds(%)

75.94

73.26

69.64

69.44

104.7 2

100.71

99.25

97.71

Profit And Loss Ratios

Selling Distribution Cost Composition Balance Sheet Ratios

Debt Coverage Ratios Credit Deposit Ratio

M

Investment Deposit Ratio

52.43

55.79

60.38

61.16

Cash Deposit Ratio

6.85

6.54

7.21

8.60

Total Debt to Owners Fund

4.50

4.53

4.39

4.23

Financial Charges Coverage Ratio

0.68

0.62

0.52

0.48

Financial Charges Coverage Ratio Post Tax

1.39

1.37

1.34

1.31

0.06

0.09

0.09

0.07

13.81

11.31

10.53

16.71

Dividend Payout Ratio Net Profit

25.93

27.07

27.71

29.41

Dividend Payout Ratio Cash Profit

24.49

25.57

26.17

27.21

Earning Retention Ratio

74.07

72.93

72.29

70.59

Cash Earning Retention Ratio

75.51

74.43

73.83

72.79

AdjustedCash Flow Times

30.55

31.96

33.19

36.55

Mar '15

Mar '14

Mar '13

Mar '12

Earnings Per Share

19.28

84.95

72.17

56.09

Book Value

138.7 2

633.92

578.21

524.01

Mar '15

Mar '14

Mar '13

Mar '12

1.00

10.00

10.00

10.00

Leverage Ratios Current Ratio Quick Ratio Cash Flow Indicator Ratios

M

Source : Dion Global Solutions Limited

Key Financial Ratios of State Bank of India

M

Investment Valuation Ratios Face Value Dividend Per Share

3.50

30.00

41.50

35.00

23.38

199.45

236.63

271.65

204.13

1,826.36

1,749.29

1,587.40

Free Reserves Per Share (Rs)

--

--

--

--

Bonus in Equity Capital

--

--

--

--

Interest Spread

6.26

5.76

5.95

6.87

Adjusted Cash Margin(%)

8.12

7.89

11.23

10.51

Operating Profit Per Share (Rs) Net Operating Profit Per Share (Rs)

Profitability Ratios

Net Profit Margin

8.59

7.98

11.78

10.99

Return on Long Term Fund(%)

90.85

87.28

96.35

97.36

Return on Net Worth(%)

10.20

9.20

14.26

13.94

1,

Adjusted Return on Net Worth(%)

10.20

9.20

14.26

13.94

Return on Assets Excluding Revaluations

172.04

1,584.34

1,445.60

1,251.05

1,

Return on Assets Including Revaluations

172.04

1,584.34

1,445.60

1,251.05

1,

Interest Income / Total Funds

7.94

8.12

8.25

8.32

Net Interest Income / Total Funds

2.87

2.93

3.06

3.38

Non Interest Income / Total Funds

1.18

1.10

1.11

1.12

Interest Expended / Total Funds

5.07

5.19

5.19

4.94

Operating Expense / Total Funds

1.96

2.05

1.94

1.96

Profit Before Provisions / Total Funds

2.03

1.91

2.14

2.47

Net Profit / Total Funds

0.68

0.65

0.97

0.91

Loans Turnover

0.12

0.12

0.13

0.13

Total Income / Capital Employed(%)

9.11

9.22

9.35

9.45

Interest Expended / Capital Employed(%)

5.07

5.19

5.19

4.94

Total Assets Turnover Ratios

0.08

0.08

0.08

0.08

Asset Turnover Ratio

0.08

0.09

0.09

0.09

Interest Expended / Interest Earned

63.90

63.86

62.95

59.36

Other Income / Total Income

12.90

11.98

11.82

11.87

Operating Expense / Total Income

21.47

22.20

20.74

20.73

--

--

--

--

Capital Adequacy Ratio

12.00

12.96

12.92

13.86

Advances / Loans Funds(%)

77.39

82.04

82.25

78.01

Credit Deposit Ratio

84.47

86.84

85.17

82.14

Investment Deposit Ratio

30.07

28.85

29.52

30.73

6.76

5.81

5.34

7.51

Management Efficiency Ratios

Profit And Loss Ratios

Selling Distribution Cost Composition Balance Sheet Ratios

Debt Coverage Ratios

Cash Deposit Ratio Total Debt to Owners Fund

12.28

11.79

12.16

12.43

Financial Charges Coverage Ratio

0.41

0.38

0.43

0.52

Financial Charges Coverage Ratio Post Tax

1.15

1.14

1.20

1.20

0.04

0.03

0.04

0.05

10.78

13.88

12.15

12.05

Dividend Payout Ratio Net Profit

19.51

20.56

20.12

20.06

Dividend Payout Ratio Cash Profit

17.98

18.32

18.62

18.47

Earning Retention Ratio

80.49

79.44

79.88

79.94

Cash Earning Retention Ratio

82.02

81.68

81.38

81.53

110.90

114.06

78.90

82.08

Mar '15

Mar '14

Mar '13

Mar '12

17.55

145.88

206.20

174.46

172.04

1,584.34

1,445.60

1,251.05

Leverage Ratios Current Ratio Quick Ratio Cash Flow Indicator Ratios

AdjustedCash Flow Times

Earnings Per Share Book Value

M

1,

Source : Dion Global Solutions Limited

Balance Sheet of State Bank of India

------------------- in Rs. Cr. ------------------Mar '15

Mar '14

Mar '13

Mar '12

M

12 mths

12 mths

12 mths

12 mths

Total Share Capital

746.57

746.57

684.03

671.04

Equity Share Capital

746.57

746.57

684.03

671.04

Share Application Money

0.00

0.00

0.00

0.00

Preference Share Capital

0.00

0.00

0.00

0.00

127,691.65

117,535.68

98,199.65

83,280.16

64,

Net Worth

128,438.22

118,282.25

98,883.68

83,951.20

64,

Deposits

1,576,793.2 4

1,394,408.51

1,202,739.57

1,043,647.36

933,

Borrowings

205,150.29

183,130.88

169,182.71

127,005.57

119,

Total Debt

1,781,943.5 3

1,577,539.39

1,371,922.28

1,170,652.93

1,053,

Other Liabilities & Provisions

137,698.05

96,412.96

95,455.07

80,915.09

105,

Total Liabilities

2,048,079.8 0

1,792,234.60

1,566,261.03

1,335,519.22

1,223,

Mar '15

Mar '14

Mar '13

Mar '12

M

12 mths

12 mths

12 mths

12 mths

1

115,883.84

84,955.66

65,830.41

54,075.94

94,

1

Capital and Liabilities:

Reserves

Assets Cash & Balances with RBI Balance with Banks, Money at Call

58,977.46

47,593.97

48,989.75

43,087.23

28,

Advances

1,300,026.3 9

1,209,828.72

1,045,616.55

867,578.89

756,

Investments

495,027.40

398,308.19

350,927.27

312,197.61

295,

9,329.16

8,002.16

6,595.71

5,133.87

4,

Revaluation Reserves

0.00

0.00

0.00

0.00

Accumulated Depreciation

0.00

0.00

0.00

0.00

9,329.16

8,002.16

6,595.71

5,133.87

0.00

0.00

409.31

332.68

Other Assets

68,835.55

43,545.90

47,892.03

53,113.02

43,

Total Assets

2,048,079.8 0

1,792,234.60

1,566,261.03

1,335,519.24

1,223,

Contingent Liabilities

1,093,422.5 1

1,091,358.37

993,018.45

899,565.18

790,

Gross Block

Net Block Capital Work In Progress

Bills for collection Book Value (Rs)

0.00

0.00

0.00

0.00

172.04

1,584.34

1,445.60

1,251.05

4,

1,

Profit & Loss of State Bank of India

------------------- in Rs. Cr. ------------------Mar '15

Mar '14

Mar '13

Mar '12

M

12 mths

12 mths

12 mths

12 mths

Interest Earned

152,397.0 7

136,350.80

119,657.10

106,521.45

81,3

Other Income

22,575.89

18,552.92

16,034.84

14,351.45

14,9

Total Income

174,972.9 6

154,903.72

135,691.94

120,872.90

96,3

Interest expended

97,381.82

87,068.63

75,325.80

63,230.37

48,8

Employee Cost

23,537.07

22,504.28

18,380.90

16,974.04

15,

Selling, & Misc Expenses

39,836.01

33,105.70

26,740.65

27,954.03

23,8

1,116.49

1,333.94

1,139.61

1,007.17

9

0.00

0.00

0.00

0.00

Operating Expenses

38,677.64

35,725.85

29,284.42

26,068.99

23,0

Provisions & Contingencies

25,811.93

21,218.07

16,976.74

19,866.25

17,0

Total Expenses

161,871.3 9

144,012.55

121,586.96

109,165.61

88,9

Mar '15

Mar '14

Mar '13

Mar '12

M

12 mths

12 mths

12 mths

12 mths

1

13,101.57

10,891.17

14,104.98

11,707.29

Extraordinary Items

0.00

0.00

0.00

0.00

Profit brought forward

0.32

0.34

0.34

6.05

13,101.89

10,891.51

14,105.32

11,713.34

1

Income

Expenditure

Depreciation Preoperative Exp Capitalised

Net Profit for the Year

Total

7,3

7,3

Preference Dividend Equity Dividend Corporate Dividend Tax

0.00

0.00

0.00

0.00

2,557.28

2,239.71

2,838.74

2,348.66

1,9

520.65

298.45

375.95

296.49

2

Per share data (annualised) Earning Per Share (Rs)

17.55

145.88

206.20

174.46

Equity Dividend (%)

350.00

300.00

415.00

350.00

3

Book Value (Rs)

172.04

1,584.34

1,445.60

1,251.05

1,0

10,023.64

8,353.03

10,890.29

9,067.85

5,2

Appropriations Transfer to Statutory Reserves Transfer to Other Reserves Proposed Dividend/Transfer to Govt Balance c/f to Balance Sheet Total

0.00

0.00

0.00

0.00

3,077.93

2,538.16

3,214.69

2,645.15

0.32

0.32

0.34

0.34

13,101.89

10,891.51

14,105.32

11,713.34

2,1

7,3

Source : Dion Global Solutions Limited

Balance Sheet of Axis Bank

------------------- in Rs. Cr. ------------------Mar '15

Mar '14

Mar '13

Mar '12

12 mths

12 mths

12 mths

12 mths

Total Share Capital

474.10

469.84

467.95

413.20

Equity Share Capital

M

1

Capital and Liabilities: 474.10

469.84

467.95

413.20

Share Application Money

0.00

0.00

0.00

0.00

Preference Share Capital

0.00

0.00

0.00

0.00

Reserves

44,202.41

37,750.64

32,639.91

22,395.34

18,

Net Worth

44,676.51

38,220.48

33,107.86

22,808.54

18,

Deposits

322,441.9 4

280,944.56

252,613.59

220,104.30

189,

Borrowings

79,758.27

50,290.94

43,951.10

34,071.67

26,

Total Debt

402,200.2 1

331,235.50

296,564.69

254,175.97

215,

Other Liabilities & Provisions

15,055.67

13,788.89

10,888.11

8,643.28

8,

Total Liabilities

461,932.3 9

383,244.87

340,560.66

285,627.79

242,

Mar '15

Mar '14

Mar '13

Mar '12

M

12 mths

12 mths

12 mths

12 mths

1

Cash & Balances with RBI

19,818.84

17,041.32

14,792.09

10,702.92

13,

Balance with Banks, Money at Call

16,280.19

11,197.38

5,642.87

3,230.99

7,

230,066.76

196,965.96

169,759.54

142,

113,548.43

113,737.54

93,192.09

71,

Assets

Advances Investments

281,083.0 3 132,342.8

3 Gross Block Revaluation Reserves Accumulated Depreciation

2,413.05

2,310.54

2,230.54

2,188.56

0.00

0.00

0.00

0.00

2,

0.00

0.00

0.00

0.00

2,413.05

2,310.54

2,230.54

2,188.56

101.26

99.67

125.11

70.77

Other Assets

9,893.19

8,980.79

7,066.56

6,482.93

4,

Total Assets

461,932.3 9

383,244.89

340,560.67

285,627.80

242,

Contingent Liabilities

640,183.5 9

608,547.25

574,782.38

514,871.98

477,

0.00

0.00

0.00

0.00

188.47

813.47

707.50

551.99

Net Block Capital Work In Progress

Bills for collection Book Value (Rs)

Profit & Loss of Axis Bank

2,

------------------- in Rs. Cr. ------------------Mar '15

Mar '14

Mar '13

Mar '12

M

12 mths

12 mths

12 mths

12 mths

Interest Earned

35,478.6 0

30,641.16

27,182.57

21,994.65

15,1

Other Income

8,365.05

7,405.22

6,551.11

5,420.22

4,6

Total Income

43,843.6 5

38,046.38

33,733.68

27,414.87

19,7

Interest expended

21,254.4 6

18,689.52

17,516.31

13,976.90

8,5

Employee Cost

3,114.97

2,601.35

2,376.98

2,080.17

1,6

11,710.72

10,173.91

8,309.22

6,773.35

5,9

405.67

363.93

351.73

342.24

2

0.00

0.00

0.00

0.00

Operating Expenses

9,203.74

7,900.77

6,914.23

6,007.10

4,7

Provisions & Contingencies

6,027.62

5,238.42

4,123.70

3,188.66

3,0

Total Expenses

36,485.8 2

31,828.71

28,554.24

23,172.66

16,3

Mar '15

Mar '14

Mar '13

Mar '12

M

12 mths

12 mths

12 mths

12 mths

1

7,357.82

6,217.67

5,179.43

4,242.21

3,3

0.00

0.00

0.00

0.00

10,029.26

7,329.45

4,969.77

3,4

16,246.93

12,508.88

9,211.98

6,8

0.00

0.00

0.00

1

Income

Expenditure

Selling, & Misc Expenses Depreciation Preoperative Exp Capitalised

Net Profit for the Year Extraordinary Items Profit brought forward Total Preference Dividend

13,501.4 5 20,859.2 7 0.00

Equity Dividend

1,087.54

939.69

843.86

658.24

221.42

161.44

143.37

111.83

31.04

132.33

110.68

102.67

Equity Dividend (%)

230.00

200.00

180.00

160.00

1

Book Value (Rs)

188.47

813.47

707.50

551.99

4

1,926.82

1,644.36

1,492.38

1,112.46

8

0.00

-0.01

0.01

0.00

3

1,308.96

1,101.13

987.23

770.07

6

13,501.45

10,029.26

7,329.45

4,9

16,246.93

12,508.88

9,211.98

6,8

Corporate Dividend Tax

5

Per share data (annualised) Earning Per Share (Rs)

Appropriations Transfer to Statutory Reserves Transfer to Other Reserves Proposed Dividend/Transfer to Govt Balance c/f to Balance Sheet Total

17,623.4 9 20,859.2 7

Source : Dion G

Profit & Loss of Axis Bank

------------------- in Rs. Cr. ------------------Mar '15

Mar '14

Mar '13

Mar '12

M

12 mths

12 mths

12 mths

12 mths

1

Interest Earned

35,478.6 0

30,641.16

27,182.57

21,994.65

15,

Other Income

8,365.05

7,405.22

6,551.11

5,420.22

4,

Total Income

43,843.6 5

38,046.38

33,733.68

27,414.87

19,

21,254.4 6

18,689.52

17,516.31

13,976.90

8,

Income

Expenditure Interest expended Employee Cost

3,114.97

2,601.35

2,376.98

2,080.17

1,

11,710.72

10,173.91

8,309.22

6,773.35

5,

405.67

363.93

351.73

342.24

0.00

0.00

0.00

0.00

Operating Expenses

9,203.74

7,900.77

6,914.23

6,007.10

4,

Provisions & Contingencies

6,027.62

5,238.42

4,123.70

3,188.66

3,

Total Expenses

36,485.8 2

31,828.71

28,554.24

23,172.66

16,

Mar '15

Mar '14

Mar '13

Mar '12

Selling, & Misc Expenses Depreciation Preoperative Exp Capitalised

M

Net Profit for the Year Extraordinary Items Profit brought forward Total Preference Dividend

12 mths

12 mths

12 mths

12 mths

1

7,357.82

6,217.67

5,179.43

4,242.21

3,

0.00

0.00

0.00

0.00

10,029.26

7,329.45

4,969.77

3,

16,246.93

12,508.88

9,211.98

6,

13,501.4 5 20,859.2 7 0.00

0.00

0.00

0.00

1,087.54

939.69

843.86

658.24

221.42

161.44

143.37

111.83

31.04

132.33

110.68

102.67

Equity Dividend (%)

230.00

200.00

180.00

160.00

Book Value (Rs)

188.47

813.47

707.50

551.99

1,926.82

1,644.36

1,492.38

1,112.46

0.00

-0.01

0.01

0.00

1,308.96

1,101.13

987.23

770.07

13,501.45

10,029.26

7,329.45

4,

16,246.93

12,508.88

9,211.98

6,

Equity Dividend Corporate Dividend Tax Per share data (annualised) Earning Per Share (Rs)

Appropriations Transfer to Statutory Reserves Transfer to Other Reserves Proposed Dividend/Transfer to Govt Balance c/f to Balance Sheet Total

17,623.4 9 20,859.2 7

Source : Dion G

Balance Sheet of ICICI Bank

------------------- in Rs. Cr. ------------------Mar '15

Mar '14

Mar '13

Mar '12

M

12 mths

12 mths

12 mths

12 mths

1

Total Share Capital

1,159.66

1,155.04

1,153.64

1,152.77

1,

Equity Share Capital

1,

Capital and Liabilities: 1,159.66

1,155.04

1,153.64

1,152.77

Share Application Money

7.44

6.57

4.48

2.39

Preference Share Capital

0.00

0.00

0.00

0.00

Reserves

79,262.26

72,051.71

65,547.84

59,250.09

53,

Net Worth

80,429.36

73,213.32

66,705.96

60,405.25

55,

331,913.66

292,613.63

255,499.96

225,

154,759.05

145,341.49

140,164.91

109,

486,672.71

437,955.12

395,664.87

335,

Deposits Borrowings Total Debt

361,562.7 3 172,417.3 5 533,980.0 8

Other Liabilities & Provisions

31,719.86

34,755.55

32,133.60

17,576.98

15,

Total Liabilities

646,129.3 0

594,641.58

536,794.68

473,647.10

406,

Mar '15

Mar '14

Mar '13

Mar '12

M

12 mths

12 mths

12 mths

12 mths

1

Cash & Balances with RBI

25,652.91

21,821.83

19,052.73

20,461.29

20,

Balance with Banks, Money at Call

16,651.71

19,707.77

22,364.79

15,768.02

13,

338,702.65

290,249.44

253,727.66

216,

177,021.82

171,393.60

159,560.04

134,

4,725.52

4,678.14

4,647.06

4,614.69

4,

0.00

0.00

0.00

0.00

Assets

Advances Investments Gross Block Revaluation Reserves Accumulated Depreciation

387,522.0 7 186,580.0 3

0.00

0.00

0.00

0.00

4,725.52

4,678.14

4,647.06

4,614.69

0.00

0.00

0.00

0.00

Other Assets

24,997.05

32,709.39

29,087.07

19,515.39

16,

Total Assets

646,129.2 9

594,641.60

536,794.69

473,647.09

406,

Contingent Liabilities

868,190.5 8

794,965.35

802,383.84

923,037.16

931,

0.00

0.00

0.00

0.00

138.72

633.92

578.21

524.01

Net Block Capital Work In Progress

Bills for collection Book Value (Rs)

4,

Source : Dion Global Solutions Limited

Profit & Loss of ICICI Bank

------------------- in Rs. Cr. ------------------Mar '15

Mar '14

Mar '13

Mar '12

M

12 mths

12 mths

12 mths

12 mths

44,178.15

40,075.60

33,542.65

25,9

10,427.87

8,345.70

7,502.76

6,6

54,606.02

48,421.30

41,045.41

32,6

1

Income Interest Earned Other Income Total Income

49,091.1 4 12,176.1 3 61,267.2 7

Expenditure Interest expended

30,051.5 3

27,702.59

26,209.18

22,808.50

16,9

Employee Cost

4,749.88

4,220.11

3,893.29

3,515.28

2,8

Selling, & Misc Expenses

14,631.5 6

12,296.88

9,503.20

7,731.85

7,1

Depreciation Preoperative Exp Capitalised

658.95

575.97

490.16

524.53

5

0.00

0.00

0.00

0.00

11,495.83

10,308.86

9,012.89

7,850.44

6,6

Provisions & Contingencies

8,544.56

6,784.10

4,873.76

3,921.22

3,8

Total Expenses

50,091.9 2

44,795.55

40,095.83

34,580.16

27,4

Mar '15

Mar '14

Mar '13

Mar '12

M

12 mths

12 mths

12 mths

12 mths

1

11,175.35

9,810.48

8,325.47

6,465.26

5,1

0.00

0.00

0.00

0.00

9,902.29

7,054.23

5,018.18

3,4

19,712.77

15,379.70

11,483.44

8,6

Operating Expenses

Net Profit for the Year Extraordinary Items Profit brought forward Total Preference Dividend

13,318.5 9 24,493.9 4 0.00

0.00

0.00

0.00

2,898.81

2,656.28

2,307.23

1,902.04

1,6

271.15

231.25

292.16

220.35

2

19.28

84.95

72.17

56.09

Equity Dividend (%)

250.00

230.00

200.00

165.00

1

Book Value (Rs)

138.72

633.92

578.21

524.01

4

4,062.57

3,506.65

2,878.03

2,306.49

1,7

0.00

0.00

0.00

0.33

3,169.96

2,887.53

2,599.39

2,122.39

1,8

13,318.59

9,902.29

7,054.23

5,0

19,712.77

15,379.71

11,483.44

8,6

Mar '15

Mar '14

Mar '13

Mar '12

M

Face Value

2.00

10.00

10.00

10.00

Dividend Per Share

4.60

20.00

18.00

16.00

Operating Profit Per Share (Rs)

22.89

93.96

66.33

56.94

Net Operating Profit Per Share (Rs)

149.6 7

652.16

580.88

532.30

--

--

--

--

Equity Dividend Corporate Dividend Tax Per share data (annualised) Earning Per Share (Rs)

Appropriations Transfer to Statutory Reserves Transfer to Other Reserves Proposed Dividend/Transfer to Govt Balance c/f to Balance Sheet Total

17,261.4 2 24,493.9 5

Source : Dion Global Solutions Limited

Key Financial Ratios of Axis Bank

Investment Valuation Ratios

Free Reserves Per Share (Rs)

Bonus in Equity Capital

--

--

--

--

7.34

7.67

7.90

7.46

Adjusted Cash Margin(%)

17.70

17.29

16.39

16.72

Net Profit Margin

20.73

20.29

19.05

19.28

Return on Long Term Fund(%)

72.32

73.36

75.72

88.84

Return on Net Worth(%)

16.46

16.26

15.64

18.59

Adjusted Return on Net Worth(%)

16.46

16.26

15.64

18.59

813.47

707.50

551.99

813.47

707.50

551.99

Profitability Ratios Interest Spread

Return on Assets Excluding Revaluations Return on Assets Including Revaluations

188.4 7 188.4 7

Management Efficiency Ratios Interest Income / Total Funds

8.40

8.47

8.68

8.33

Net Interest Income / Total Funds

3.37

3.30

3.09

3.04

Non Interest Income / Total Funds

1.98

2.05

2.09

2.05

Interest Expended / Total Funds

5.03

5.16

5.59

5.29

Operating Expense / Total Funds

2.08

2.08

2.10

2.14

Profit Before Provisions / Total Funds

3.17

3.17

2.97

2.81

Net Profit / Total Funds

1.74

1.72

1.65

1.61

Loans Turnover

0.14

0.14

0.15

0.14

Total Income / Capital Employed(%)

10.38

10.51

10.77

10.38

Interest Expended / Capital Employed(%)

5.03

5.16

5.59

5.29

Total Assets Turnover Ratios

0.08

0.08

0.09

0.08

Asset Turnover Ratio

0.09

0.09

0.09

0.09

Interest Expended / Interest Earned

59.91

60.99

64.44

63.55

Other Income / Total Income

19.08

19.46

19.42

19.77

Operating Expense / Total Income

20.07

19.81

19.45

20.66

--

--

--

--

Capital Adequacy Ratio

15.09

16.07

17.00

13.66

Advances / Loans Funds(%)

76.65

73.29

71.53

72.29

Credit Deposit Ratio

84.71

80.03

77.58

76.26

Investment Deposit Ratio

40.75

42.60

43.77

40.35

Cash Deposit Ratio

6.11

5.97

5.39

6.01

Total Debt to Owners Fund

7.22

7.35

7.63

9.65

Financial Charges Coverage Ratio

0.65

0.63

0.55

0.56

Financial Charges Coverage Ratio Post Tax

1.37

1.35

1.32

1.33

0.03

0.03

0.03

0.03

20.64

18.57

20.10

21.63

Dividend Payout Ratio Net Profit

14.78

15.11

16.29

15.51

Dividend Payout Ratio Cash Profit

14.00

14.27

15.25

14.35

Earning Retention Ratio

85.22

84.89

83.71

84.49

Cash Earning Retention Ratio

86.00

85.73

84.75

85.65

Profit And Loss Ratios

Selling Distribution Cost Composition Balance Sheet Ratios

Debt Coverage Ratios

Leverage Ratios Current Ratio Quick Ratio Cash Flow Indicator Ratios

AdjustedCash Flow Times

41.53

42.69

45.67

48.01

Mar '15

Mar '14

Mar '13

Mar '12

Earnings Per Share

31.04

132.33

110.68

102.67

Book Value

188.4 7

813.47

707.50

551.99

Source : Dion Global Solutions Limited

M