The Why's Of Economics: How Governments And Central Banks Run The Economy p5767

This document was ed by and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this report form. Report 3b7i

Overview 3e4r5l

& View The Why's Of Economics: How Governments And Central Banks Run The Economy as PDF for free.

More details w3441

- Words: 7,969

- Pages: 33

- Publisher: Pencil

- Released Date: 2021-07-13

- Author: Nirav Shedge

The why's of Economics

How Governments and Central Banks run the economy.

BY

Nirav Shedge

ISBN 9789354581397 © Nirav Shedge 2021 Published in India 2021 by Pencil

A brand of One Point Six Technologies Pvt. Ltd. 123, Building J2, Shram Seva Premises, Wadala Truck Terminal, Wadala (E) Mumbai 400037, Maharashtra, INDIA E [email protected] W www.thepencilapp.com

All rights reserved worldwide

No part of this publication may be reproduced, stored in or introduced into a retrieval system, or transmitted, in any form, or by any means (electronic, mechanical, photocopying, recording or otherwise), without the prior written permission of the Publisher. Any person who commits an unauthorized act in relation to this publication can be liable to criminal prosecution and civil claims for damages.

DISCLAIMER: The opinions expressed in this book are those of the authors and do not purport to reflect the views of the Publisher.

Author biography

Nirav Shedge is an economics student with research interests in macroeconomic policies and international trade. Over the course of two years, he has written several articles on economic issues and frequently publishes research papers in journals. He likes thinking about economic policies and wishes to research more in this area. Nirav is also a sports enthusiast and has represented Maharashtra state for the Netball championship.

Contents

Why study economics-The Importance

The theory of printing money

All about Inflation

Tools to combat economic cycles

China's supremacy in trade

The economics of technology and jobs

Impact of immigration on natives

Government and its fiscal policy

International finance-Currency fluctuation

Commercial Banks

Monetary Authority

Conclusion

Preface

The purpose of studying economics is not to acquire a set of ready-made answers to economic questions, but to learn how to avoid being deceived by economists. - Joan Robinson

What happens when we print too much money, is there a trade-off between human welfare and inflation? How does any economic fallout threaten the nation and put them in jeopardy in short term as well as the long term? Can we simply ask china to produce everything and keep importing from there or we would be reluctant in doing that? The covid19 pandemic has pushed people to operate from homes and considering the demand for technology that has skyrocketed due to it, will in a few years the advanced technology sur human performance at firms? Why are some nations reluctant on immigration, while some are happily allowing people to come and work in their nation and help the economy? How does the government tackle any economic crisis, and from where do they get the money and how do they spend it? Why do we keep reading the news every day about the currency fluctuating, or the dollar going up or falling, what causes the currency to fluctuate and how can the government help in stabilizing the currency value? When we deposit money in the banks, where does it go, or how do the banks give us interest on it after the stipulated time, and how are they able to advance loans to big industries, corporates, and households? And finally, who saves them during times of volatility and adversity? Few of the many questioned which are always raised in economics, are been answered in this book. The knowledge expressed in the book is constructed out of my knowledge that I have gained over the past few years learning, reading a plethora of books, research papers, articles on economics and political governance, reading many blogs. This book will introduce the reader to why governments and central bankers do what they do, and how they do it. We do at times end up criticizing the decisions

taken by the policymakers, and the experts at the finance ministry, but why they do what they do, is what the book will show. Not having practical work experience in the field of economics yet, but still being desperate to share my views, I was a little reluctant on writing this book, but yet I managed, hence I am happy to take any kind of on the views expressed in the book. My deep hope is that you get the most out of the book and understand how the policymakers and the government around the globe run the economy.

Why study economics-The Importance

One of the most common reasons one could think of while talking about the importance of studying economics would be to understand the stock markets and how one can ace in it, i.e., yield more profits. While that may not be completely true, sometimes even the results of stock markets can mislead us into thinking about the performance of the economy, and vice versa. Yes, to an extent understanding the economy can at times help in making better decisions while trading, but it can at times also deceive us. Inflation management and economic policies of the government can move the markets tremendously and eventually fluctuate the economy. A great part of understanding the economy helps the experts to find ways on how to deal with economic crises. Inflation, recession, deflation, booms, stagflation, are all economic cycles if continued for a longer time end up threatening the nation, some of which you will understand as you proceed ahead with the book. Economics helps the government make better decisions which ultimately contribute to the success of a nation, by helping in alleviating poverty, unemployment, and inequality. Many experts argue that schools/ high schools should make it mandatory to teach economics, as it will help the young minds understand not only how the economy works, but also how it affects their daily lives. Understanding economics gives us brief knowledge of other disciplines as well. It helps us understand consumer behavior, a little bit of sociology, mathematics, statistics, and mainly even politics, hence the that we today use ‘economics’ was earlier essentially called ‘political economy.'

The theory of printing money

Everyone in this world likes money and would like to have it more, and if people get an opportunity to get the money without working for it, they like it more. The number one rule of economics, and is something which is taught in the very first lecture of any economics course, i.e. ‘there is nothing called as free lunch’. Today we see many offers that shops and other firms offer, such as, buy one, get one free, or get 50 % off, etc and we fall under the trap of thinking that they are offering that particular product at no cost, forgetting that someone else is paying for that product, or you have already paid for the first product and hence you are getting the second product for free. Printing the money is not a huge task for the central banks, they can do that. However, one of the works of central banks is to combat and control inflation in the country. Inflation is a constant increase in the prices of goods. When the question is raised about why central banks can’t keep printing the money, people answer it by saying, ‘because then people will not work’. There is nothing wrong with this, it is correct that people will stop working, but before that, there are few more problems that will occur. Not working for earning a living is a step beyond what will happen to the economy. Printing more money doesn’t increase the economic output in the economy, it simply increases the money supply that keeps circulating in the country. As Milton Friedman wrote in his book Money Mischief: Episodes in Monetary History ‘Inflation occurs when the quantity of money rises appreciably more rapidly than output, and the more rapid the rise in the quantity of money per unit of output, the greater the rate of inflation.’ When the money supply increases in the economy above a particular percent, it drives the country into inflation. Economists say that inflation above 2% for a developed economy is a cause of concern for that nation, and inflation above 4% for an emerging nation is a cause of concern for that nation. Therefore, one reason central banks can’t simply keep printing the money and

give it away is that it leads to rising inflation in the country. As mentioned above, one-way inflation springs up in an economy is when an excess amount of money supply flows in the country. There are few other ways how inflation surges in the country that we will discuss later in the book. Savings and investment are a crucial part for an economy to grow. Investment helps create new businesses and jobs, that can put money in consumer’s s. But what happens when the money supply increases in the economy? Again, the same thing, we get inflation, savings and investment tend to fall, and hence creates uncertainty among people. Because as inflation rises in the economy everybody gets confused, they don’t want to hold money, because it is losing its value. Here’s another reason why central banks can’t keep printing more and more money is because it discourages savings and investment in the economy. Economists argue that for an emerging country an investment between 25 to 35% is a good sign of growth. When inflation is too high, prices tend to be volatile, that is transactions become tougher because prices change rapidly. For example, think about the hyperinflation that occurred in in 1923. People during that time were getting paid twice during the day, and if they didn’t go and buy any goods right away, the goods would turn out to be very expensive, which ultimately starts affecting the economy. Note that economic stability is the most important factor for a country to grow. Thus, here is another reason why the central bank can’t simply roll out cash and give it away, as it leads to frequent fluctuations in the economy. And then, we finally come to the point where people stop working if they get the money at no cost. , that by simply printing more and more money, it is just the money supply that is increasing and not the production. Once people stop working it will automatically affect the supply chains and the production will plummet, and as production falls inflation occurs. If there is demand, there has to be enough supply. But, if the supply falls, prices go up, because enough goods aren’t available and demand sures the supply. This is where producers see an opportunity to earn more profit. Lower production = Higher inflation Thus, the central banks cannot simply keep on printing the money and give it to the people or even the government, but rather they have to be careful about it,

not to print money too fast, and not to print money too slow.

All about Inflation

With a fair knowledge of inflation management, this chapter will go through further topics and theories on inflation. The excess money supply is simply one way of how an economy experiences rising inflation, but there are other factors also on how inflation springs up in the economy which will be discussed in this part. As we discussed above, as the money supply increases it leads to inflation in the economy but the other reasons that lead to inflation shooting up have to do with the basic economic forces, i.e. supply and demand. One reason for inflation is excess money supply, but another reason for inflation is too much demand, i.e. in other words demand-pull inflation. ‘A demand-pull inflation is referred to as a rapid growth in aggregate demand’ , or as per Wikipedia definition, ‘demand-pull inflation is asserted to arise when aggregate demand in an economy outpaces aggregate supply.’ When the demand is high or increasing, producers see an opportunity to earn more and hence they increase the prices for their goods. (or the supply falls short relative to excess demand). Particularly when it is an inelastic good. An inelastic good is the one that has no impact on consumer consumption when prices change, for example, food. When the prices keep on increasing while the demand is subsequently increasing, or is high, for a longer time it can lead to inflation in the economy. And hence that is when the central banks of the country have to play a role, by making changes in interest rates, etc which we will discuss later in the book. So, this is one reason how an extensive increase in demand can lead to rising inflation in the economy. Now, inflation can also occur due to problems on the supply side. Economists call this a cost-push inflation. Cost-push inflation is due to an increase in wages, the price of commodities, and raw materials. When the supply gets affected the production falls, and hence the prices go up. Take an example here, a drought that destroys food crops will reduce its production and hence it will push the prices up, and overall an inflation will occur. So, when the cost of production increases, producers tend to reduce their supply, and hence that leads to an increase in the prices of goods. And again, when the prices tend to stay higher for a long time, it drives the economy into inflation.

Why is it that countries try harder to combat rising inflation or in other words, why is it not healthy for a country? Firstly, it erodes savings and investment. When inflation increases, the price of commodities also starts increasing. While this happens, the citizens who have already invested their money in banks, and NBFCs (Non-banking financial Organizations) start receiving a negative rate of return. The reason being, when inflation drives the commodity prices up, the return that you receive on savings isn’t equivalent to the rate of increase in inflation. For example, if you had invested 1000 INR (Indian rupee) a year back at an interest rate of 5% this would bring you 1,050 after a year. (also consider that a particular commodity is costing you 1000 INR at the time of investing). Now let’s say that the inflation rate after receiving the rate of return on your deposit has risen to 10%, the commodity which was earlier available at the cost of Rs.1000 will cost you Rs.1,100. Over here what the depositor will experience is a loss of return. Since he only received 1,050 and in reality, due to inflation the price of a commodity has risen to 1,100. In this case, he would have to churn out extra money from his other savings to meet the additional 50 rupees to buy the commodity of 1,100 INR. In conclusion, if people expect that inflation is projected to increase after some time, the depositors and investors would be reluctant to invest as they will be worried about the rate of return on the same. (savings and investment would fall as a result). Secondly, it creates uncertainty. Prices are not stable. Think about the hyperinflation that occurred in in 1923. People during that time were getting paid twice during days, and prices of commodities were rising exponentially. Hence, this leads to the value of money falling and triggers the barter system. (Barter system - not right for any country in today's world). Thirdly, it has an impact on the country’s currency. When domestic prices of the commodities increase it makes them expensive, and hence people start diverting their attention towards foreign country goods. As a result, imports increase. And if imports increase, the demand for exchange rate also increases. This leads to the foreign currency appreciating, while domestic currency depreciating. Additionally, this makes domestic goods less attractive to the world. Since, higher prices divert foreign country's attention, and hence with imports on the rise, trade deficit sets in. (A large and persistent trade deficit can lead to international indebtedness or a financial crisis).

Tools to combat economic cycles

Around the world, central bankers are known as ‘hawkish’ when they are in the of increasing interest rates to combat inflation. On the other hand, is ‘dovish’ when the central banks are in the favour of reducing interest rates. One of the main reasons behind raising interest rates is done to combat inflation in the economy. Here we will discuss the ways central bankers combat inflation. Earlier we discussed inflation occurrence in an economy through the excess money supply and economic forces, i.e., supply and demand. The ways through which the central banks and the government combat inflation in the economy, are the economic policies, i.e., monetary policy instruments, fiscal policy, which is done by controlling the money supply. The monetary policy instruments are Cash reserve ratio (CRR), bank rate, and open market operations (OMO). In India, we also have a Repo rate. These are the interest rates, that the central banks increase to bring inflation in control. By increasing interest rates central banks cause banks to also raise their rates and that is how borrowing falls and inflation target has been achieved. Conversely, the central banks can also cut rates when they feel that the economy is not producing enough goods, or aggregate demand is low. When the economy is giving signs of a slowdown or is experiencing a recessionary period, it cuts rates which makes borrowing inexpensive. By doing this people borrow more money and the economy picks up. Another way to combat inflation is by a tighter fiscal policy, i.e., the government should reduce its expenditure and increase taxes, which can be an easier way of constraining demand, and eventually inflation. Inflation can also occur due to problems on demand as well as supply side, i.e., demand-pull inflation or cost-push inflation . The ways these two cycles can be tackled areTo tackle demand-pull inflation the central banks generally raise the interest rates as we discussed before. This helps them to reduce or constrain demand in

an economy, and eventually lower inflation. The other way to constrain excessive demand is by a contractionary fiscal policy, i.e., the government should spend less, and increase the taxes, which will be an easier way for constraining demand. This is how demand-pull inflation can be combated. As far as cost-push inflation goes, the government would adopt a discretionary fiscal policy, i.e., higher taxes, and lower spending, or at times central bankers would also raise the interest rates. By doing this, the cost of borrowing increases, and people borrow less money (lower aggregate demand). Another way is to raise the indirect taxes. (Indirect taxes are levied on goods and services). This leads consumers to spend more on taxes, and hence some people would be reluctant on spending a higher price. Note- To just get an idea as to what the monetary policy instruments in detail are, I recommend checking them out on search engines to understand them better. This is how central banks and governments around the world combat inflation, but we must not forget that inflation is not the only problem for an economy. There can be cases when the economy can go into severe depression or a recession when the demand is low, wages are falling, jobs are lost, and government borrowings increase. During such times, the job of the government and central banks around the world is to generate demand in the economy. The ways of doing that are by lowering the interest rates so that people borrow and deposit money in the banks, the second way is by lowering the tax rates, and increasing the government expenditure. Amid the slowdown in the economy, we see governments coming up with fiscal and credit stimulus and relief packages to help their citizens. Such stimulus packages help citizens with money and hence this is how many poor people get amid the slowdown when many citizens lose their jobs, and they don’t have anything for a living. Of course, many economists argue about the usefulness of such stimulus in the country. An excess fiscal stimulus leads to government expenditure rising (fiscal deficit rises) and may crowd out private investment.

China's supremacy in trade

Currently, China has the lion's share in producing and selling the most manufacturing goods compared to any other country. If we look at China, it is relatively good at everything, right from technology, fashion, textile, chemicals, toys, etc. So, it easier for other nations to completely rely on china and buy everything from them. According to the data published by the United Nations statistical division, in 2018 China ed for about 28% of the global manufacturing output. This data puts China 10 percentage points ahead of that of the United States who was the world’s largest manufacturer until china took it over in 2010. As David Ricardo argued in 1817 that even if China is relatively good and productive at producing everything, it is not possible for China to sell everything, because then the buyer country will not earn anything and will have no money to buy anything from China or any other country in the future. Secondly, it is also about the deficits, (current deficit). If a country simply keeps on importing everything from China or any other country, it will simply give a rise to current deficits, and eventually debt piles up. And as debts pile up, it ultimately puts pressure on the central banks to monetize the debt or increase taxation to finance the deficits. A large and persistent trade deficit leads to international indebtedness. Owing to this even international organizations such as the International Monetary Fund (IMF), and the World Bank are reluctant to offer financial aid. In 2020 when the Covid19 completely disrupted people’s lives and societies around the world, we quickly saw China’s economy back to normalcy with their supply chains recovering at a faster speed and a surge in exports, mainly medical supplies, and work from home equipment’s. However, China as we know relies extensively on the demand from other countries, and hence china needs to ensure that the other countries are functioning well otherwise, china will simply keep on producing while consumption might stay tepid, which will cause a problem to China since they would be producing excess with no proper consumption. Thus, China needs to make sure that other countries are doing well.

Hence, we cannot simply rely on China as far as trade is concerned, as the nation’s debts keep on piling up, and no new jobs are created in the domestic country.

The economics of technology and jobs

Over the past few years, many research papers have been published, many talks have been going on around the world about what state-of-the-art technologies have to do with replacing humans, or making humans obsolete and redundant. The advancement in new technologies is developing tremendous anxiety among people. Will humans continue to have good jobs to earn a living, or will they have to struggle? The fact of the matter is, we cannot bring a hold to technological advancement, considering the way it has been benefiting the masses. Today, Artificial Intelligence, Machine learning, Robotics have completely changed the way companies have been functioning. Even the labor market. Many computers are being used in construction projects to build products and make the work much more effective and efficient. But the sad news is that many laborers still do not know how to access a computer which has become one of the basic skills in any type of job. If they don’t know how to use a computer, then other advanced tools such as Excel file, or Word file is just a dream for them. So, what happens in such cases, either they lose their employment, or they seek a reduction in wages. Now, this is not the case only in the labor market, but in all the sectors. These new technologies as we all know have been helping us in every possible way. Right from climate change to the healthcare sector. Technology is not only helping us to satisfy our needs but is also helping us satisfy our wants. In the times of the covid19 pandemic which led employees to operate from home, students to attend online classes over video meetings, have surged the demand for technology. Clearly, this is one of the reasons why tech companies (technology companies) are booming today and will boom in the post-covid era as well. This is one of the biggest advantages’ technology brings forth. However, the worry is about the jobs. No matter how captivating these advantages are, they always bring a few disadvantages with them. In this case, are the jobs with basic skills, or the wage earners to be specific. My research and many other professional researchers’ study have found that the jobs of proof-

readers, housemaid/servant, travel agents, courier guys, driver, salespeople can be under threat, considering the way we are going about technology. But all these jobs are the basic jobs that do not demand advanced qualifications to get into. While these may be some basic jobs, we also have highly skilled jobs into . Today, we are seeing a rise in people accessing online study programs, or MOOCs, (Massive open online courses) which have proven their quality and high levels of caliber. These are MOOC courses that are being taught by some highly qualified professors and include various capstone projects, assignments, tests which make the programs much more intriguing and practical. The recent data has shown that the students who enroll in these courses, in reality, complete them. Further, the dropout rates from colleges have increased to 8-10% as many students are moving towards MOOC courses. This might leave a professor out of job, and will essentially have to only be concerned with publishing research papers. Even the ants, financial advisors, and surgeons are under threat. Many countries have been working on building robots which can be helpful even in the health care sector as surgeons. A robot can be taught how to operate a patient, and the robot will be able to do it much more effectively, efficiently, and expeditiously. The job of a financial advisor is to take the client’s information and then come up with a financial plan which is based on the advisor’s knowledge. Now, this is the sort of thing that is easier for Artificial intelligence to do, and do it in a much better way. The job of a financial advisor is to keep up with the economic and market data, but again here the advisor will only be able to read a limited number of newspapers and articles, whereas Artificial Intelligence can easily read all the articles, historical data, trends, and have a better understanding of the market data. Hence, there are chances that Artificial intelligence will sur financial advisors as well. Now, this is where the concern arises. The question is what are we going to do about it. As mentioned earlier, we cannot stop the progress of the technological revolution considering the way it has been benefiting us, but we do have the solution to upgrade ourselves, keep learning, and keep acquiring the skills that are required in a particular field/industry to exist.

Impact of immigration on natives

It is naive to think that, as immigrants move to different countries the labour supply goes up, but since the labour demand is not in equilibrium it drives down the wages, which affects the natives and benefits the immigrants. Immigration is a big thing. Our world has a plethora of poor people and would like to earn a lot more if they get an opportunity, wherever it might be. Indeed, if they get a chance to move out of the country to earn more, they will undisputedly go ahead. But what many politicians and media argue is that immigration makes the immigrant better off while it affects the natives by making them worse off. The question is, is that true? Do immigrants make the natives worse off, or that ultimately leads to a long-term benefit? An article published by IZA World of Labor. The article was about, ‘Do immigrant workers depress the wages of native workers?’ In that article, it stated that 30 years of empirical research provides little ing evidence to this question. Most studies for industrialized countries have found no effect on wages on average and only a modest effect on wage differentials between more and less educated immigrant and native worker. The key finding of their research was, immigration has a very small effect on the average wages of native workers. The article estimates that immigration especially of high skilled workers leads to a long term increase in innovation and positive productivity effects. Below are few points on why immigrants may not depress natives’ wages-

Animmigrantmaytakethosejobswhichthenativesareunwillingtotake.Forexample– flippingburgers,cleaning,sweeping,etc.

Immigrantsbringnewskillsandideasthat maybenefitthecountryinthelongterminofinnovatio

Lowskilledimmigrationmightpushupthedemandforlabour,anditslowsdowntheprocessofmechan

Firmstaketheadvantagetoreducethelabourcostbyhiringimmigrantworkersatlowerpay.So,whenth

Immigrantsarenotsimplyworkerstheyarealsoconsumers.Theywillgoforhaircuts,torestaurants,etc skilledpeople.

The effect of immigrants also depends on who the immigrants are. If they are highly skilled and smarter, then they may start their franchise that may create jobs for natives, but if they are low skilled labours then they may compete with the native low-skilled workers. However, as the article states, immigration has a very small effect on the average wages of native workers. Considering that the wage effects are small, it wouldn't have much effect in taking the advantages of native labourers. In fact, productivity and innovation have positive effects in the long term. And hence, it is important to open immigration policies that focus on attracting immigrants with balanced skills or slightly favouring college educated would not probably change the wages in short term, but will help in of productivity and innovation in the longterm.

Government and its fiscal policy

Policymakers use two main tools to influence the economy. The first is Monetary Policy and the second is Fiscal Policy. Monetary Policy is handled by the central bank of the country, whereas fiscal policy is in the hands of the government. Fiscal policy is one of the most prominent tools that government uses to influence the economy. A textbook definition would define fiscal policy as, ‘government’s decision on how much revenue to collect and how much to spend to achieve economic goals.’ The government uses fiscal policy extensively amid times of crisis. Fiscal policy is used to tackle different economic cycles. Here, we discuss further mechanisms of fiscal policy. The fiscal policy helps the government in many different ways such as, boosting the aggregate demand in the economy (one that we desperately need amid the pandemic) or contracting the demand, achieving economic stability, regulating inflation, etc. Although the new concept of Modern Monetary Theory (MMT) does state that the government uses taxes to make people work for the government. (MMT concept is beyond the scope of the book). Through fiscal policy, governments can influence directly and indirectly the behavior of all the players in an economy. It has a direct impact on the GDP through government spending and taxation. Governments choose to increase or cut their spending or raise or reduce taxation, and accordingly, it affects the economy. There are different ways in how fiscal policy is used, i.e. during the times of recession, and depression and during the times of inflation, and boom. The times of recession or as many people say a slowdown brings a lower consumer demand, which as a result, stabilizes the supply side as well. This further curtails jobs in both the secondary and tertiary sectors. This is when the government adopts deficit financing since its aim is to generate demand in the economy, and hence taxes are reduced and government expenditure increases. This is the time when the government comes up with various stimulus and relief

packages in order to help the people suffering due to this slowdown. These government expenditures help create jobs, stimulate private investment, and lay a foundation for a stronger recovery. In 2020 when the whole world was going through an economic downturn because of the novel coronavirus, the IMF (International Monetary Fund) had estimated that fiscal policy should play a leading role since it helps the economy recover by generating demand, and investment. Amid the crisis, the monetary policy had very limited effect, since the monetary policy was stuck in a liquidity trap. ‘A liquidity trap is when monetary policy becomes ineffective due to a very low rate of interests and that is when people prefer to hold cash, rather than spending in buying assets.' So, this is when the IMF had estimated that fiscal policy should play a leading role. Although there have been countless debates on the use of deficit financing by the government since a large deficit financing by the government crowds out private investment. Recession is one economic cycle among many. There are at times, booms and inflation in the economy, this is when the economy is overheating, or growing too fast and the job of fiscal policy is to control it. An economy should not grow too fast, neither should it grow too slow. Amid this boom or inflation, fiscal policy plays a role somewhat in this way. Government spending is reduced and taxes are increased. This helps the government to control inflation and also stops the economy from overheating. The government adopts a contractionary fiscal policy during these times. Fiscal policy affects the aggregate demand by collecting taxes or by spending which eventually affects private consumption and investment. This is how the government uses its tool (fiscal policy) and changes the structure of the economy that helps in accommodating growth in the economy and achieving economic stability.

International finance-Currency fluctuation

Often when we read the newspapers, in the section of markets or foreign exchange, we come across headlines written as ‘dollar rate fluctuated’ or ‘the domestic currency fluctuated’ and so on. This keeps on happening most of the time since the economic environment keeps changing, which eventually has an impact on the currency rates as well. Exchanges rates keep going up and down, but the question is what causes these fluctuations? The answer to this question in simple is the basic principle of Supply and Demand. The currency fluctuations can also happen due to many external factors such as political or economic conditions in the country, a country’s monetary policy, or the inflation rate. Currency fluctuations are just similar to a seasonal fruit in India, i.e., Mango. As it is the season of mango, people rush and start buying, and so the demand significantly goes up, whereas supply might fall short, or demand is exponentially increasing, and hence the prices tend to keep rising. Similarly, high demand for a currency or a shortage in its currency will cause the prices of the currencies to rise. As mentioned earlier, supply and demand are not the only factors, other environmental situations in a particular nation such as monetary policy, or political circumstances do affect the currency rates. We will discuss a few other conditions as well. Let us see, how interest rates affect currency fluctuations. The money supply is the total amount of currency floating in an economy. If there is a higher amount of money supply in the country, then it is during these times that the currency value decreases against foreign currencies, and the exchange rate will fall down (As higher money supply will cause the price of commodities to surge, and as a result domestic goods become expensive and households start importing goods from other countries). Usually, when there is a lower rate of interest, the money supply in an economy is on a higher side or increases. An increase in money supply is due to lower interest rates and lower interest rates do not attract foreign capital, and hence the demand for domestic currency is low. As a result, due to lower demand, the currency rate starts falling

down. As we discussed earlier, higher inflation destabilizes the economy, but a minimal rate of inflation is healthy for an economy to grow. It must be noted that even the inflation rates have something to do with the exchange rates. When inflation is high, central bankers usually raise the interest rates, which encourages the people to stop or reduce their consumption. However, when the interest rates are high it increases the value of the currency, and similarly a decrease in interest rates in order to boost demand in an economy, the lower interest rates can depress the value of the currency. A contractionary monetary policy (higher interest rates) followed by the central banks attracts foreign capital and causes interest rates to rise. This is how the interest rate and inflation rate affect the value of the currency and keeps fluctuating. Now to consider a few other aspects, i.e., economic or political conditions. If a country is amid some political disturbance, it affects the exchange rate. Take for example Brexit. Such things make the currency less valuable, and hence the demand falls. Due to political uncertainty, foreign investors are careful with their capital before making a decision of investing. Apart from this, the market circumstances also affect the exchange rates to an extent, for example, the interest rate and inflation rate as we discussed above, but also other conditions such as unemployment rate, housing, trade, etc. An overvalued currency and undervalued currency- Here are two scenarios that are susceptible to happen. One is when the currency rate strengthens, i.e., it gets overvalued. When the currency rate appreciates rapidly it lowers the country's exports and imports increase. If exports fall down and imports increase, it leads to a trade deficit and lower exports don't create new jobs for the domestic economy. Hence, a large trade deficit is not healthy for an economy, apart from international indebtedness. Amid such times, the central banks buy the US dollar (since the US dollar is considered as the strongest currency) from the foreign exchange market, and tries to lower the domestic currency value. On the other hand, when the currency is depreciating significantly, it leads to imports becoming expensive. Although a depreciating currency can increase domestic exports and can contribute to economic growth, but yet it is not healthy

for an economy. However, a depreciating currency will increase the price of domestic goods since imports become expensive and as a result, the cost of inputs that are bought from other countries turns out to be expensive. This would lead to prices going up in the domestic economy. All the above-mentioned factors together contribute to the variation of a currency, and hence we keep seeing news every day, about how the currency rate fluctuates in the foreign exchange market. [Note that international finance is a broad topic and comprises many important areas about how currency fluctuations work and differ in the foreign exchange market. The above explanation just briefs out an overview of how currencies fluctuate].

Commercial Banks

A commercial bank is the one, which is a business organization that is concerned with money. The central bank is the head of all the commercial banks. The commercial banks run on the orders given by the central banks of the country. Here what we are going to look at is, how do commercial banks actually work, i.e. how do they give loans, generate deposits, and also how they make their profit. The process of borrowing and lending money is the way banks earn profits. Most human beings tend to save a part of their income or invest in some type of deposit offered by the banks. It is through these processes that the commercial banks raise their deposits while giving the citizens a certain rate of interest on the deposit kept with the bank. (i.e., on the principal amount you have deposited)There are many types of deposits the commercial banks offer such as savings deposits, fixed deposits, and current deposits. When an individual deposits money in a commercial bank, the bank guarantees to pay a certain rate of interest once the deposit that you have kept is matured. Till then, the commercial banks use this money to advance out the loan to other people. Generally, the lending rate of interest is greater than the rate of interest it pays to its depositors because the difference in lending and borrowing is how the banks earn their profits. So, the banks borrow the money from depositors (citizens) and lend that money to other people in of loans. When the loan has been paid back by the borrower, the borrower pays a certain interest rate on it with its principal amount, and that interest rate is been used to pay the interest on the amount the other depositors have kept in the bank, and the difference between the interest rates of borrowing and lending is how the banks make profits. It is important to note that the functioning of banks is not as simple as it sounds. Many people deposit their money in the banks, and many people take loans from the banks. But, at times there are cases when the borrowers are not able to pay back the loans, and this is when the banks start facing problems. When a plethora of people are not able to pay back the amount taken from the banks, it

falls under a problem since during such times the banks don’t get the money and they are not able to recover their money which they had lent in of loans. There are certain ways how the banks acquire the money by selling the mortgages (assets kept by people when taking a loan) when the loans have not been paid by the borrower. However, at times, there are cases when these mortgages are not enough to cover the cost lent by the banks. This is when the banks are forced to take help from the central banks. Or another case is when a large number of depositors come at the same time to withdraw back their money. (This is not likely the case, but can happen during times of recession). It is during these times, that the central banks come to the rescue of the commercial banks. Central bankers at such times lend money to the citizens when the commercial banks are not in a position to pay the depositors. Note that even the central banks charge a certain interest rate on the commercial banks when central banks lend money to them. Bad Loans – One of the rising issues in commercial banks has been the non-performing assets (NPAs) or bad loans as they are famously known. Bad loans are essentially the loans that the borrower has not paid the principal amount or the interest rate for 90 days or more. This is when the banks go under a problem. The commercial banks do not get the money during such times and hence they are forced to take help from the government for that matter. This is when the government has to spend on such bad loans and hence the government’s budget goes into such unproductive purposes wherein it could have been used in a much better way that would promote growth in the economy. Hence, we often see commercials banks getting merged with other banks, or they are going through a very bad condition. Also, it is important to note that the government is trying its best to recognize the bad loans as bad loans through laws such as the Insolvency and Bankruptcy Code (IBC) however the IBC hasn’t proved to be effective in recognizing the bad loans in the recent times. Apart from this, the central bank in India had even taken some effective initiatives to recognize the bad loans by running an Asset Quality Review, yet the bad loans in a few of the public sector banks remain a hot topic to discuss.

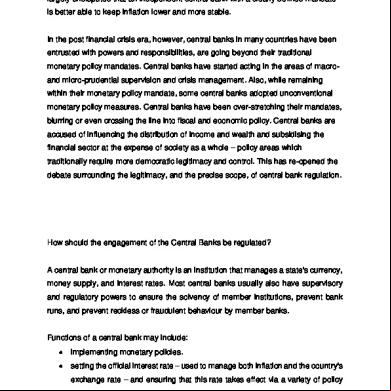

Monetary Authority

The central bank of a country is the head of all the commercial banks. In other words, it regulates them. As far as Public sector banks in India are concerned, they are owned by the finance ministry in India, so here the Reserve bank of India (RBI) has certain limitations as far as the regulation is concerned. For example- The Reserve bank of India doesn’t have the power to remove the Managing director or the Chairman of a public sector bank, or it cannot force mergers of public sector banks. The job of a central bank is not about profitability, rather it is to promote economic development and financial stability of the country. As many experts state, ‘the primary role of the central bank is monetary stability and to sustain confidence in the value of the country’s money. This essentially means that profitability for a central bank should be a secondary consideration, and economic stability should be the priority. Further, the central bank aims to keep inflation low and stable, irrespective of whether inflation is coming from demand or supply constraints or domestic sources. A central bank is the one that handles the monetary policy of a nation. Every day we come across ample news about the changes in the monetary policy. The central bank has many monetary policy instruments that it uses to control the money supply in a country. These instruments are Cash reserve ratio, statutory liquidity ratio (kept with banks on the order of the central bank), bank rate, or engages in Open market operations. In many nations, where the money market is not very well developed, open market operations are very handy for the central banks. Open market operation is the process of buying and selling government bonds and securities. One of the main functions of central banks is to handle inflation in the economy. Inflation for any economy is an extreme headache. It sounds easy to say just give away the money to the public and promote development, but the consequences are diabolical. We did see in the first question the repercussions of rising inflation. So, the central bank controls inflation by using the monetary policy instruments, i.e., by raising their interest rates (Cash reserve ratio, Bank rates, statutory liquidity ratio, or by selling government bonds and securities (Open

market operations). Another main objective of a central bank is to help the banks when in trouble. When the banks are not in a position to pay the depositors their deposited money, the bank can approach the central bank for money and this is how the central bank comes to the rescue of the citizens. Of course, central banks charge interest on the money they lend to the commercial banks when in need. there is nothing called a free lunch in this world. Finally, the other objectives that the central bank's function are promoting development as noted earlier and even managing the national currency's exchange rate. They can do that by providing finance or credit to the sectors that contribute towards the growth of a nation, and as far as exchange rates are concerned, they can do that by buying and selling dollars. As even today, many nations consider the dollar as the dominating currency. If the central bank wishes to appreciate the nation’s currency value it can sell the dollars, and when it wishes to bring down the currency value it can buy dollars. This is how a central bank of a country aims to function, although it is not as easy as it sounds, there are a lot of problems that even the central bankers have to go through such as, any unprecedented circumstances political disturbances, etc.

Conclusion

The book was all about trying to put forward the knowledge on how a nation's economy works, and also how the central banks and governments regulate it. However, I must mention that things are not as easy as they look. Political interference and environmental hindrances may at times add fuel to the fire and exacerbate the economic condition in the country. All this may add as a constrain in decision making and policymaking. I hope this book has served you to the moon and back, and yes there might be some points you (reader) might not agree with, and I am happy to hear the differential sentiments.

How Governments and Central Banks run the economy.

BY

Nirav Shedge

ISBN 9789354581397 © Nirav Shedge 2021 Published in India 2021 by Pencil

A brand of One Point Six Technologies Pvt. Ltd. 123, Building J2, Shram Seva Premises, Wadala Truck Terminal, Wadala (E) Mumbai 400037, Maharashtra, INDIA E [email protected] W www.thepencilapp.com

All rights reserved worldwide

No part of this publication may be reproduced, stored in or introduced into a retrieval system, or transmitted, in any form, or by any means (electronic, mechanical, photocopying, recording or otherwise), without the prior written permission of the Publisher. Any person who commits an unauthorized act in relation to this publication can be liable to criminal prosecution and civil claims for damages.

DISCLAIMER: The opinions expressed in this book are those of the authors and do not purport to reflect the views of the Publisher.

Author biography

Nirav Shedge is an economics student with research interests in macroeconomic policies and international trade. Over the course of two years, he has written several articles on economic issues and frequently publishes research papers in journals. He likes thinking about economic policies and wishes to research more in this area. Nirav is also a sports enthusiast and has represented Maharashtra state for the Netball championship.

Contents

Why study economics-The Importance

The theory of printing money

All about Inflation

Tools to combat economic cycles

China's supremacy in trade

The economics of technology and jobs

Impact of immigration on natives

Government and its fiscal policy

International finance-Currency fluctuation

Commercial Banks

Monetary Authority

Conclusion

Preface

The purpose of studying economics is not to acquire a set of ready-made answers to economic questions, but to learn how to avoid being deceived by economists. - Joan Robinson

What happens when we print too much money, is there a trade-off between human welfare and inflation? How does any economic fallout threaten the nation and put them in jeopardy in short term as well as the long term? Can we simply ask china to produce everything and keep importing from there or we would be reluctant in doing that? The covid19 pandemic has pushed people to operate from homes and considering the demand for technology that has skyrocketed due to it, will in a few years the advanced technology sur human performance at firms? Why are some nations reluctant on immigration, while some are happily allowing people to come and work in their nation and help the economy? How does the government tackle any economic crisis, and from where do they get the money and how do they spend it? Why do we keep reading the news every day about the currency fluctuating, or the dollar going up or falling, what causes the currency to fluctuate and how can the government help in stabilizing the currency value? When we deposit money in the banks, where does it go, or how do the banks give us interest on it after the stipulated time, and how are they able to advance loans to big industries, corporates, and households? And finally, who saves them during times of volatility and adversity? Few of the many questioned which are always raised in economics, are been answered in this book. The knowledge expressed in the book is constructed out of my knowledge that I have gained over the past few years learning, reading a plethora of books, research papers, articles on economics and political governance, reading many blogs. This book will introduce the reader to why governments and central bankers do what they do, and how they do it. We do at times end up criticizing the decisions

taken by the policymakers, and the experts at the finance ministry, but why they do what they do, is what the book will show. Not having practical work experience in the field of economics yet, but still being desperate to share my views, I was a little reluctant on writing this book, but yet I managed, hence I am happy to take any kind of on the views expressed in the book. My deep hope is that you get the most out of the book and understand how the policymakers and the government around the globe run the economy.

Why study economics-The Importance

One of the most common reasons one could think of while talking about the importance of studying economics would be to understand the stock markets and how one can ace in it, i.e., yield more profits. While that may not be completely true, sometimes even the results of stock markets can mislead us into thinking about the performance of the economy, and vice versa. Yes, to an extent understanding the economy can at times help in making better decisions while trading, but it can at times also deceive us. Inflation management and economic policies of the government can move the markets tremendously and eventually fluctuate the economy. A great part of understanding the economy helps the experts to find ways on how to deal with economic crises. Inflation, recession, deflation, booms, stagflation, are all economic cycles if continued for a longer time end up threatening the nation, some of which you will understand as you proceed ahead with the book. Economics helps the government make better decisions which ultimately contribute to the success of a nation, by helping in alleviating poverty, unemployment, and inequality. Many experts argue that schools/ high schools should make it mandatory to teach economics, as it will help the young minds understand not only how the economy works, but also how it affects their daily lives. Understanding economics gives us brief knowledge of other disciplines as well. It helps us understand consumer behavior, a little bit of sociology, mathematics, statistics, and mainly even politics, hence the that we today use ‘economics’ was earlier essentially called ‘political economy.'

The theory of printing money

Everyone in this world likes money and would like to have it more, and if people get an opportunity to get the money without working for it, they like it more. The number one rule of economics, and is something which is taught in the very first lecture of any economics course, i.e. ‘there is nothing called as free lunch’. Today we see many offers that shops and other firms offer, such as, buy one, get one free, or get 50 % off, etc and we fall under the trap of thinking that they are offering that particular product at no cost, forgetting that someone else is paying for that product, or you have already paid for the first product and hence you are getting the second product for free. Printing the money is not a huge task for the central banks, they can do that. However, one of the works of central banks is to combat and control inflation in the country. Inflation is a constant increase in the prices of goods. When the question is raised about why central banks can’t keep printing the money, people answer it by saying, ‘because then people will not work’. There is nothing wrong with this, it is correct that people will stop working, but before that, there are few more problems that will occur. Not working for earning a living is a step beyond what will happen to the economy. Printing more money doesn’t increase the economic output in the economy, it simply increases the money supply that keeps circulating in the country. As Milton Friedman wrote in his book Money Mischief: Episodes in Monetary History ‘Inflation occurs when the quantity of money rises appreciably more rapidly than output, and the more rapid the rise in the quantity of money per unit of output, the greater the rate of inflation.’ When the money supply increases in the economy above a particular percent, it drives the country into inflation. Economists say that inflation above 2% for a developed economy is a cause of concern for that nation, and inflation above 4% for an emerging nation is a cause of concern for that nation. Therefore, one reason central banks can’t simply keep printing the money and

give it away is that it leads to rising inflation in the country. As mentioned above, one-way inflation springs up in an economy is when an excess amount of money supply flows in the country. There are few other ways how inflation surges in the country that we will discuss later in the book. Savings and investment are a crucial part for an economy to grow. Investment helps create new businesses and jobs, that can put money in consumer’s s. But what happens when the money supply increases in the economy? Again, the same thing, we get inflation, savings and investment tend to fall, and hence creates uncertainty among people. Because as inflation rises in the economy everybody gets confused, they don’t want to hold money, because it is losing its value. Here’s another reason why central banks can’t keep printing more and more money is because it discourages savings and investment in the economy. Economists argue that for an emerging country an investment between 25 to 35% is a good sign of growth. When inflation is too high, prices tend to be volatile, that is transactions become tougher because prices change rapidly. For example, think about the hyperinflation that occurred in in 1923. People during that time were getting paid twice during the day, and if they didn’t go and buy any goods right away, the goods would turn out to be very expensive, which ultimately starts affecting the economy. Note that economic stability is the most important factor for a country to grow. Thus, here is another reason why the central bank can’t simply roll out cash and give it away, as it leads to frequent fluctuations in the economy. And then, we finally come to the point where people stop working if they get the money at no cost. , that by simply printing more and more money, it is just the money supply that is increasing and not the production. Once people stop working it will automatically affect the supply chains and the production will plummet, and as production falls inflation occurs. If there is demand, there has to be enough supply. But, if the supply falls, prices go up, because enough goods aren’t available and demand sures the supply. This is where producers see an opportunity to earn more profit. Lower production = Higher inflation Thus, the central banks cannot simply keep on printing the money and give it to the people or even the government, but rather they have to be careful about it,

not to print money too fast, and not to print money too slow.

All about Inflation

With a fair knowledge of inflation management, this chapter will go through further topics and theories on inflation. The excess money supply is simply one way of how an economy experiences rising inflation, but there are other factors also on how inflation springs up in the economy which will be discussed in this part. As we discussed above, as the money supply increases it leads to inflation in the economy but the other reasons that lead to inflation shooting up have to do with the basic economic forces, i.e. supply and demand. One reason for inflation is excess money supply, but another reason for inflation is too much demand, i.e. in other words demand-pull inflation. ‘A demand-pull inflation is referred to as a rapid growth in aggregate demand’ , or as per Wikipedia definition, ‘demand-pull inflation is asserted to arise when aggregate demand in an economy outpaces aggregate supply.’ When the demand is high or increasing, producers see an opportunity to earn more and hence they increase the prices for their goods. (or the supply falls short relative to excess demand). Particularly when it is an inelastic good. An inelastic good is the one that has no impact on consumer consumption when prices change, for example, food. When the prices keep on increasing while the demand is subsequently increasing, or is high, for a longer time it can lead to inflation in the economy. And hence that is when the central banks of the country have to play a role, by making changes in interest rates, etc which we will discuss later in the book. So, this is one reason how an extensive increase in demand can lead to rising inflation in the economy. Now, inflation can also occur due to problems on the supply side. Economists call this a cost-push inflation. Cost-push inflation is due to an increase in wages, the price of commodities, and raw materials. When the supply gets affected the production falls, and hence the prices go up. Take an example here, a drought that destroys food crops will reduce its production and hence it will push the prices up, and overall an inflation will occur. So, when the cost of production increases, producers tend to reduce their supply, and hence that leads to an increase in the prices of goods. And again, when the prices tend to stay higher for a long time, it drives the economy into inflation.

Why is it that countries try harder to combat rising inflation or in other words, why is it not healthy for a country? Firstly, it erodes savings and investment. When inflation increases, the price of commodities also starts increasing. While this happens, the citizens who have already invested their money in banks, and NBFCs (Non-banking financial Organizations) start receiving a negative rate of return. The reason being, when inflation drives the commodity prices up, the return that you receive on savings isn’t equivalent to the rate of increase in inflation. For example, if you had invested 1000 INR (Indian rupee) a year back at an interest rate of 5% this would bring you 1,050 after a year. (also consider that a particular commodity is costing you 1000 INR at the time of investing). Now let’s say that the inflation rate after receiving the rate of return on your deposit has risen to 10%, the commodity which was earlier available at the cost of Rs.1000 will cost you Rs.1,100. Over here what the depositor will experience is a loss of return. Since he only received 1,050 and in reality, due to inflation the price of a commodity has risen to 1,100. In this case, he would have to churn out extra money from his other savings to meet the additional 50 rupees to buy the commodity of 1,100 INR. In conclusion, if people expect that inflation is projected to increase after some time, the depositors and investors would be reluctant to invest as they will be worried about the rate of return on the same. (savings and investment would fall as a result). Secondly, it creates uncertainty. Prices are not stable. Think about the hyperinflation that occurred in in 1923. People during that time were getting paid twice during days, and prices of commodities were rising exponentially. Hence, this leads to the value of money falling and triggers the barter system. (Barter system - not right for any country in today's world). Thirdly, it has an impact on the country’s currency. When domestic prices of the commodities increase it makes them expensive, and hence people start diverting their attention towards foreign country goods. As a result, imports increase. And if imports increase, the demand for exchange rate also increases. This leads to the foreign currency appreciating, while domestic currency depreciating. Additionally, this makes domestic goods less attractive to the world. Since, higher prices divert foreign country's attention, and hence with imports on the rise, trade deficit sets in. (A large and persistent trade deficit can lead to international indebtedness or a financial crisis).

Tools to combat economic cycles

Around the world, central bankers are known as ‘hawkish’ when they are in the of increasing interest rates to combat inflation. On the other hand, is ‘dovish’ when the central banks are in the favour of reducing interest rates. One of the main reasons behind raising interest rates is done to combat inflation in the economy. Here we will discuss the ways central bankers combat inflation. Earlier we discussed inflation occurrence in an economy through the excess money supply and economic forces, i.e., supply and demand. The ways through which the central banks and the government combat inflation in the economy, are the economic policies, i.e., monetary policy instruments, fiscal policy, which is done by controlling the money supply. The monetary policy instruments are Cash reserve ratio (CRR), bank rate, and open market operations (OMO). In India, we also have a Repo rate. These are the interest rates, that the central banks increase to bring inflation in control. By increasing interest rates central banks cause banks to also raise their rates and that is how borrowing falls and inflation target has been achieved. Conversely, the central banks can also cut rates when they feel that the economy is not producing enough goods, or aggregate demand is low. When the economy is giving signs of a slowdown or is experiencing a recessionary period, it cuts rates which makes borrowing inexpensive. By doing this people borrow more money and the economy picks up. Another way to combat inflation is by a tighter fiscal policy, i.e., the government should reduce its expenditure and increase taxes, which can be an easier way of constraining demand, and eventually inflation. Inflation can also occur due to problems on demand as well as supply side, i.e., demand-pull inflation or cost-push inflation . The ways these two cycles can be tackled areTo tackle demand-pull inflation the central banks generally raise the interest rates as we discussed before. This helps them to reduce or constrain demand in

an economy, and eventually lower inflation. The other way to constrain excessive demand is by a contractionary fiscal policy, i.e., the government should spend less, and increase the taxes, which will be an easier way for constraining demand. This is how demand-pull inflation can be combated. As far as cost-push inflation goes, the government would adopt a discretionary fiscal policy, i.e., higher taxes, and lower spending, or at times central bankers would also raise the interest rates. By doing this, the cost of borrowing increases, and people borrow less money (lower aggregate demand). Another way is to raise the indirect taxes. (Indirect taxes are levied on goods and services). This leads consumers to spend more on taxes, and hence some people would be reluctant on spending a higher price. Note- To just get an idea as to what the monetary policy instruments in detail are, I recommend checking them out on search engines to understand them better. This is how central banks and governments around the world combat inflation, but we must not forget that inflation is not the only problem for an economy. There can be cases when the economy can go into severe depression or a recession when the demand is low, wages are falling, jobs are lost, and government borrowings increase. During such times, the job of the government and central banks around the world is to generate demand in the economy. The ways of doing that are by lowering the interest rates so that people borrow and deposit money in the banks, the second way is by lowering the tax rates, and increasing the government expenditure. Amid the slowdown in the economy, we see governments coming up with fiscal and credit stimulus and relief packages to help their citizens. Such stimulus packages help citizens with money and hence this is how many poor people get amid the slowdown when many citizens lose their jobs, and they don’t have anything for a living. Of course, many economists argue about the usefulness of such stimulus in the country. An excess fiscal stimulus leads to government expenditure rising (fiscal deficit rises) and may crowd out private investment.

China's supremacy in trade

Currently, China has the lion's share in producing and selling the most manufacturing goods compared to any other country. If we look at China, it is relatively good at everything, right from technology, fashion, textile, chemicals, toys, etc. So, it easier for other nations to completely rely on china and buy everything from them. According to the data published by the United Nations statistical division, in 2018 China ed for about 28% of the global manufacturing output. This data puts China 10 percentage points ahead of that of the United States who was the world’s largest manufacturer until china took it over in 2010. As David Ricardo argued in 1817 that even if China is relatively good and productive at producing everything, it is not possible for China to sell everything, because then the buyer country will not earn anything and will have no money to buy anything from China or any other country in the future. Secondly, it is also about the deficits, (current deficit). If a country simply keeps on importing everything from China or any other country, it will simply give a rise to current deficits, and eventually debt piles up. And as debts pile up, it ultimately puts pressure on the central banks to monetize the debt or increase taxation to finance the deficits. A large and persistent trade deficit leads to international indebtedness. Owing to this even international organizations such as the International Monetary Fund (IMF), and the World Bank are reluctant to offer financial aid. In 2020 when the Covid19 completely disrupted people’s lives and societies around the world, we quickly saw China’s economy back to normalcy with their supply chains recovering at a faster speed and a surge in exports, mainly medical supplies, and work from home equipment’s. However, China as we know relies extensively on the demand from other countries, and hence china needs to ensure that the other countries are functioning well otherwise, china will simply keep on producing while consumption might stay tepid, which will cause a problem to China since they would be producing excess with no proper consumption. Thus, China needs to make sure that other countries are doing well.

Hence, we cannot simply rely on China as far as trade is concerned, as the nation’s debts keep on piling up, and no new jobs are created in the domestic country.

The economics of technology and jobs

Over the past few years, many research papers have been published, many talks have been going on around the world about what state-of-the-art technologies have to do with replacing humans, or making humans obsolete and redundant. The advancement in new technologies is developing tremendous anxiety among people. Will humans continue to have good jobs to earn a living, or will they have to struggle? The fact of the matter is, we cannot bring a hold to technological advancement, considering the way it has been benefiting the masses. Today, Artificial Intelligence, Machine learning, Robotics have completely changed the way companies have been functioning. Even the labor market. Many computers are being used in construction projects to build products and make the work much more effective and efficient. But the sad news is that many laborers still do not know how to access a computer which has become one of the basic skills in any type of job. If they don’t know how to use a computer, then other advanced tools such as Excel file, or Word file is just a dream for them. So, what happens in such cases, either they lose their employment, or they seek a reduction in wages. Now, this is not the case only in the labor market, but in all the sectors. These new technologies as we all know have been helping us in every possible way. Right from climate change to the healthcare sector. Technology is not only helping us to satisfy our needs but is also helping us satisfy our wants. In the times of the covid19 pandemic which led employees to operate from home, students to attend online classes over video meetings, have surged the demand for technology. Clearly, this is one of the reasons why tech companies (technology companies) are booming today and will boom in the post-covid era as well. This is one of the biggest advantages’ technology brings forth. However, the worry is about the jobs. No matter how captivating these advantages are, they always bring a few disadvantages with them. In this case, are the jobs with basic skills, or the wage earners to be specific. My research and many other professional researchers’ study have found that the jobs of proof-

readers, housemaid/servant, travel agents, courier guys, driver, salespeople can be under threat, considering the way we are going about technology. But all these jobs are the basic jobs that do not demand advanced qualifications to get into. While these may be some basic jobs, we also have highly skilled jobs into . Today, we are seeing a rise in people accessing online study programs, or MOOCs, (Massive open online courses) which have proven their quality and high levels of caliber. These are MOOC courses that are being taught by some highly qualified professors and include various capstone projects, assignments, tests which make the programs much more intriguing and practical. The recent data has shown that the students who enroll in these courses, in reality, complete them. Further, the dropout rates from colleges have increased to 8-10% as many students are moving towards MOOC courses. This might leave a professor out of job, and will essentially have to only be concerned with publishing research papers. Even the ants, financial advisors, and surgeons are under threat. Many countries have been working on building robots which can be helpful even in the health care sector as surgeons. A robot can be taught how to operate a patient, and the robot will be able to do it much more effectively, efficiently, and expeditiously. The job of a financial advisor is to take the client’s information and then come up with a financial plan which is based on the advisor’s knowledge. Now, this is the sort of thing that is easier for Artificial intelligence to do, and do it in a much better way. The job of a financial advisor is to keep up with the economic and market data, but again here the advisor will only be able to read a limited number of newspapers and articles, whereas Artificial Intelligence can easily read all the articles, historical data, trends, and have a better understanding of the market data. Hence, there are chances that Artificial intelligence will sur financial advisors as well. Now, this is where the concern arises. The question is what are we going to do about it. As mentioned earlier, we cannot stop the progress of the technological revolution considering the way it has been benefiting us, but we do have the solution to upgrade ourselves, keep learning, and keep acquiring the skills that are required in a particular field/industry to exist.

Impact of immigration on natives

It is naive to think that, as immigrants move to different countries the labour supply goes up, but since the labour demand is not in equilibrium it drives down the wages, which affects the natives and benefits the immigrants. Immigration is a big thing. Our world has a plethora of poor people and would like to earn a lot more if they get an opportunity, wherever it might be. Indeed, if they get a chance to move out of the country to earn more, they will undisputedly go ahead. But what many politicians and media argue is that immigration makes the immigrant better off while it affects the natives by making them worse off. The question is, is that true? Do immigrants make the natives worse off, or that ultimately leads to a long-term benefit? An article published by IZA World of Labor. The article was about, ‘Do immigrant workers depress the wages of native workers?’ In that article, it stated that 30 years of empirical research provides little ing evidence to this question. Most studies for industrialized countries have found no effect on wages on average and only a modest effect on wage differentials between more and less educated immigrant and native worker. The key finding of their research was, immigration has a very small effect on the average wages of native workers. The article estimates that immigration especially of high skilled workers leads to a long term increase in innovation and positive productivity effects. Below are few points on why immigrants may not depress natives’ wages-

Animmigrantmaytakethosejobswhichthenativesareunwillingtotake.Forexample– flippingburgers,cleaning,sweeping,etc.

Immigrantsbringnewskillsandideasthat maybenefitthecountryinthelongterminofinnovatio

Lowskilledimmigrationmightpushupthedemandforlabour,anditslowsdowntheprocessofmechan

Firmstaketheadvantagetoreducethelabourcostbyhiringimmigrantworkersatlowerpay.So,whenth

Immigrantsarenotsimplyworkerstheyarealsoconsumers.Theywillgoforhaircuts,torestaurants,etc skilledpeople.

The effect of immigrants also depends on who the immigrants are. If they are highly skilled and smarter, then they may start their franchise that may create jobs for natives, but if they are low skilled labours then they may compete with the native low-skilled workers. However, as the article states, immigration has a very small effect on the average wages of native workers. Considering that the wage effects are small, it wouldn't have much effect in taking the advantages of native labourers. In fact, productivity and innovation have positive effects in the long term. And hence, it is important to open immigration policies that focus on attracting immigrants with balanced skills or slightly favouring college educated would not probably change the wages in short term, but will help in of productivity and innovation in the longterm.

Government and its fiscal policy