How To Transfer A Flat In Housing Society Or Chs 1o1z28

This document was ed by and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this report form. Report 3b7i

Overview 3e4r5l

& View How To Transfer A Flat In Housing Society Or Chs as PDF for free.

More details w3441

- Words: 14,107

- Pages: 46

How to transfer a flat in housing society or CHS? Shirish S Shanbhag 21 May 2014 15

Here are the guidelines to follow while transferring a flat in a cooperative housing society- CHS to a legal heir or nominee From the days of “ek bangla bane nyara”, a large part of our society, especially in cities, has come to comfortably adopt a lifestyle based on nuclear families with a rise in the demand and ownership of flats and such property. However, more often than not, due to the sheer complicity and technicalities of our legal system, we find ourselves trampled by a load of complicated questions and even cheating and deception. One such area of concern is 'transmission of flats'. Here, we have the procedure for the same simplified for you. Earlier, flats were generally purchased by an individual, usually the male member of the family, who used to be the earning member. However, with the rise in the prices of property, the trends have undergone a change now. These days we find that flats are usually purchased in the t name of husband and wife. In such a case, if percentage of share in purchasing the flat is not stated, it is assumed that both of them have equal shares in the ownership of the flat. In the above scenario, a share certificate is issued in the t name of the husband and wife, as a t ownership. As per existing Bye-laws, the person whose name does not stand first in the share certificate becomes an 'Associate Member'. In case of death of the person named first in the share certificate, the Associate Member retains the right on his/her flat since his/her name exists in the Sale Deed of the flat as a t buyer.

When flats are bought tly, the t owner can make a will bequeathing his/her part of the flat to the other t owner. Thus, in case of death of anyone of them, the one surviving t owner will get an absolute right on the tly owned flat (provided, the due process of the law is followed). Transmission of flats happens in the following two ways: 1. When the flat owner has made a nomination before death. 2. When the flat owner has not made any nomination before death. Nominee: The word nominee means a person who holds or acquire right, property or any other kind of liability incurred on behalf of others. Nominee means a trustee. A nominee holds a property on behalf of other legal heirs. Thus, the simple meaning derived from above proposition is that a nominee cannot be a real owner but, in fact a trustee who has legal control of property that is kept or invested for another person, company or organization. Procedure for nomination: The procedure for nomination by a member of co-operative society is provided in bye laws of the cooperative Housing society, bye law no. 32, which runs as under: “A member of the society may by writing under his hand in the prescribed form, nominate a person or persons to who the whole or part of the shares and /or interest of the in the capital/property of the society shall be transferred in the event of his/her death.” Further no fees shall be charged for recording the first nomination.

1. A may revoke or vary his nomination, at any time, by making an application, in writing under his hand to the to the secretary of the society. 2. Every nomination made, shall be recorded in of nomination “within 7 clear days’’ from the date on which resolution to accept the nomination was recorded in minutes of managing committee. 3. Every fresh nomination shall be changed a fee of Rs100 Transfer of shares/of interest on event of death of member to a nominee: It is clearly provided in section 30 of the Maharashtra co-operative societies act, 1960 (Act no. XXIV of 1961 Mah) that, on the death of a member of society, the society shall transfer the share or interest of the deceased member to person or persons nominated in accordance with the rules and byelaws. Analysis of section 30 A nominee comes into picture only on death of the member. The society shall transfer the shares of the deceased member to nominated person. Whether it is advisable to make a nominee in case of t ownership of flats? The object behind nomination is to avoid confusion in case there are disputes between the heirs and legal representatives and to obviate the necessity of obtaining legal representation and to avoid uncertainties as to with whom the society should deal to get proper discharge. Nomination does not create a new rule of succession. Therefore, it is highly advisable to make a nomination in case of t ownership of a flat. In case of a simultaneous death of both the t owners, the flat is rendered intestate. The due process of law has to be followed to

transmit such a flat in the name of the legatee. An appointed nominee and a will (of a t owner bequeathing his/her ownership in the name of the other t owner) can go a long way in avoiding unnecessary confusion and ambiguities. In a case where both nomination and Will is prepared, the Will will prevail over the nomination paper. Procedure to follow for transmission when nomination is made by the flat owner (1) The form of application for hip in Appendix-15, by the nominee/ nominees [ under Bye-law No. 34] with Rs100 entrance fee. (2) If nominee has no independent income source, an undertaking on Rs100 Non-Judicial Stamp Paper, in Appendix-5 will be furnished by a person who is a close relative and an earning member and who is ready to discharge the liabilities of the prospective nominee-member to the Society. [ under Bye-law No.19(A) (v)] (3) If there are more than one nominee, an indemnity on Rs200 Non-Judicial Stamp Paper is to be submitted by the prospective nominee-member, in Appendix-18. [ under Bye-law No.34 ] (Note: This indemnity is to be given, only if one of the nominees become member of the society. If first named nominee becomes a member of the Society and all other nominees become t associate , this indemnity need not be given.) (4) Undertaking on Rs100 Non-Judicial Stamp Paper to be submitted by the prospective nominee-member, in Appendix-4. [ under Bye-law No.17(b) and 19(A)(iv) ] (5) Copy of the Nomination Form in Appendix-14, of the deceased member. [ under Bye-law no.34 ] (6) Attested Xerox copy of the Death Certificate of the deceased member. [ under Bye-law no.34 ]

(7) Xerox copy of the Share Certificate of the deceased member, with undertaking on the Xerox copy, that original share certificate will be produced by the member, as and when asked by the Secretary for making the name change by the Society. (8) If nominee-member wants to make one of his relatives an associate member, simultaneously with him, he needs to apply by filling the form in Appendix-8, with Rs100 entrance fee for the Associate Member. [ under Byelaw No. 19(B) ] (9) If the nominee already possesses another flat in the same society, then to hold an additional flat, an application in Appendix-28, has to be made by the nominee-member. [ under Bye-law No. 62 ] (10) Nomination to be made by the nominee-member, in Appendix-14, in triplicate. [ under Bye-law No.32 ] (NOTE: This is also applicable, to the case, when no nomination is made, as given below... (1) All forms and papers as stated above are to be submitted in a file to the Society's office. (2) All dues of the Society and the deceased member in arrears and also future dues for the following six months have to be paid by the nominator member at the time of submitting the hip application. (3) All stamp papers are to be purchased in 's name. (4) Entrance fees, as in Sr. No.(1) and (8) have to be paid along with dues, at the time of submitting of the forms to the society. (5) If the Society does not inform you of any objection within 90 days of submitting of your application for your hip, then under Section 22(2) of Maharashtra Co-operative Societies Act, 1960, you become a deemed member of the Society. To confirm your deemed hip, you have to make an appeal to your Deputy Registrar, to take a hearing and an order under section 22(2), to confirm your hip by the society.)

Procedure to follow for transmission when no nomination is made by the flat owner or when no nominee is ready to accept the hip of the society In such a case, if there is a dispute among the relatives of the deceased, the Society will demand Succession Certificate from the the relatives of the deceased. Negligible Court Fee has to be paid for the same, in the light of judgement delivered by the Bombay High Court, in case of Testamentary Petition No595 of 2005, Yallappagauda Shankar Rao v/s Smt. Yallappagauda Manjunatha Rao. When there is no dispute, following papers are to be submitted: (1) Application for hip by an heir of the deceased member, in Appendix-17, with Rs100 entrance fee. [under Bye-law No.35] (2) If the heir does not have an independent source of income, an undertaking by an earning member and relative of the heir, who is ready to pay all Society's due of the heir has to be made on Rs100 Non-judicial Stamp Paper. (2) The heir has to give an indemnity on Rs200 Non-Judicial Stamp Paper, in Appendix-19. [ under Bye-law no.35 ] (3) The heir has to give an undertaking on Rs100 Non-Judicial Stamp Paper, in Appendix-4. [under the bye-law no. 17(b) and 19(A)(iv) ] (4) CHS will display the notice in Appendix-16 in its notice board, send a copy to every member of the Society and will publish it in two local news papers having wide publicity, one in local language and one in English. Any claim from the public has to come within a period of 15 days from the date of publication of the notice. [ under Bye-law no.35 ] (5) Follow points (6) to (10) as mentioned above in the case where nomination is made.

(Note: The heir has to take a Xerox copy of the notice published in all the news papers as proof of publication in the newspapers and among the of the said CHS. These are to be submitted to the Society, as a proof of publication in the papers.) He will then submit his papers to CHS, only after the period stated in the newspaper has expired.

What is CHS and Transmission? Cooperative Housing Society (CHS): According to Section 2(16) of The Maharashtra Cooperative Societies Act “Cooperative Housing Society” means a society the object of which is to provide its with open plots for housing, dwelling houses or flats; or if open plots, the dwelling houses or flats as already acquired to provide its common amenities and services. Transmission: The right which heirs or legatees may have of ing to their successors the inheritance or legacy to which they were entitled, if the owner happen to die without having exercised their rights. Transmission of flats: Transmission in case of flats is possible only for the flats owned by individuals. If flat is held by a body corporate, transmission is impossible, since body corporate has no death. Body Corporate: A body corporate means any entity that has its separate legal existence apart from the persons forming it. It enjoys a completely different legal status apart from its . So, a body corporate shall include: a company, a foreign company, a corporation, a statutory company, a statutory body, an LLP, etc. and such bodies that have separate legal existence. Even after the death of all the partners or directors of a company/firm, the company/firm does not die.

NOMINATION AND SHARES TRANSFER TO NOMINEE AFTER THE DEATH OF MEMBER § A member can give his/her nomination to Secretary of the society under ByeLaws No. 32 and 33.A member can nominate one or more persons to whom the flat/shop/garage and the member’s share in the capital/property of the society must be transferred after the member’s death. The acknowledgement of the nomination by the Secretary shall be deemed to be the acceptance of the nomination by society.

§ A nomination is made by executing nomination form .A specimen of nomination form is given in Bye-Laws Appendix-14. § For first nomination made by member’s society can not take any charge from member.A member may revoke or vary his/her nomination, at any time by making fresh nomination. Every fresh nomination shall be charged a fee of Rs. 100/§ The acknowledgement of the Variation / Fresh in nomination / subsequent nomination by the Secretary shall be deemed to be the cancellation of the earlier nomination. § On receipt of the nomination form, or the letter of revocation of the earlier nomination Secretary should give the acknowledgement for the same. The society can not refuse the nomination maid by member’s § On receipt of the nomination form, or the letter of revocation of the earlier nomination,the same shall be placed before the meeting of the MC held next after the receipt of the nomination form, or the letter of revocation of the earlier nomination, by the Secretary of the society for the recording the same in the minutes of the MC. Every such nomination or revocation thereof shall be entered in the nomination by the Secretary of the society within 7 days of the meeting of the MC,in which it was recorded § Nominee/Nominess is only Trustee of that Property not legal owner of that property after the death of member .If property is transfer to Nominee/Nominess it does not mean that he is legal owner of that property. Legal Heirs can go to Hon. Court and estiblish their right as per different Laws. On received such order from the Court society is bound to transfer the property to that Legal Heirs. hip given by Nomination to Nominee/Nominess is the way on which society can

/ talk the person’s after the death of member regarding his/her property in society. Nominee/Nominess is only Trustee of that Property.

§ In the event of the death of the member, Secretary should send letter to Nominee/Nominees with in 15 days after the death of member asking him/her to change the name in property of society As per nomination / Court order or as perWill. § In the event of the death of the member, Nominee/Nominees shall submit the application for hip,with in six month from death of the member.An application include 1.A specimen form of application to be submitted by the Nomiee is given in Appendix-15 in Bye-Laws 2. Form of Indemnity Bond is given in Appendix-19 in Bye-Laws 3.The form of undertaking to use the flat for the purpose for which it is alloted is given in Appendix-4 in Bye-Laws. 4.True copy of Death Certificate. 5.Nomination form 6. hip Fee § If Nominee/Nominees does not submit the application for hip,with in six month from death of the member Secretary should invite claim or objection by giving notice in 2 large publication NEWS Paper. The cost of this notice should collect from Nominee/Nominees and then transfer the shre of the death member to Nominee/Nominees if no claim or objection come. § Subject to the provision of the Section 30 of MCSAct,1960 Bye-Laws no. 34, 17A ,19 ,on the Death of the member, the society shall transfer the share and interest of the deceased member in the capital /property of the society to Nominee/Nominees and in proportion with the shares and interest held by the deceased member,in case property is purchased by member and associate member tly § Nominee can not create interest in favour of the third parties without establishing the rights of the Legal heirs § If there are more than one Nominee,on the death of a member,such nominee shall make t Application to the society and indicate the name of the Nominee who should be enrolled as member.The other nominess shall be enrolled as t/Associate Member unless the nominees indicate otherwise § The Nominees shall also file an Indemnity Bound in the prescribed form indemnifying the society against any claim made to the shares and interest of the deceased member in the property of the society by any of them in case only one nominee is indicated by the Nominees for hip of the society § To protect the interest of the widows of the by restricting the right of the nominee to deal with the property.

Does a society have to transfer a flat to the nominee? What if there is more than one nominee? If there is more than one nominee, will this be a deterrent for the subsequent flat sale if some of the nominees do not want to allow it? —Kamini Sheth We have assumed that the queries are being raised in respect of a residential flat which is situated in Maharashtra in a society ed under the provisions of the Maharashtra Co-operative Societies Act, 1960, (MCSA) and that at present, you are the owner of the flat and the corresponding shares. As per MCSA, upon your death, the society must transfer your flat and shares in the society to your nominees. In your case, if there are multiple nominees, then the society would be bound to transfer the flat to all of them in accordance with its bye-laws. But, do note that by virtue of the nomination or the transfer of the flat/shares to the nominee, the nominee herself does not become the owner. The purpose of the nomination is to make certain the person with whom the society has to deal with, and not to create interest in the nominee to the exclusion of the beneficiaries or legal heirs of the deceased. Even though you may intend that your flat be transferred to A by drawing up a Will, the nominees (let us say, B and C), will not acquire any interest in the flat per se and they will hold the flat in trust for the legal beneficiary of the same (i.e., A, whom you would have named as a beneficiary in your Will for this purpose). So long as B and C hold the flat as nominees, they won’t be legally entitled to sell/transfer it to any third party, and neither will anyone be able to compel them to sell it. Eventually, the nominees will have to transfer the flat to A as beneficiary under your Will. After this the flat will belong to A. Once the flat belongs to A, she will be legally entitled to transfer it to a third party. At that point of time, B and C will have no say in the sale and will not be able to block such a sale. You may consider creating a private trust under your Will where A, B and C would be the trustees and they would hold the flat in trust for A as the sole beneficiary. A would then be legally entitled to enjoy the use of the flat, and the flat will be held in the name of the three trustees and will be protected from forcible sale. You may provide in your Will that the trust will be dissolved after a particular number of years after your death (trust life), after which the flat will vest with the sole beneficiary, i.e. A. You would have to provide for the eventuality of either of A, B or C either ing away before you or before expiry of the trust life. Even upon having settled the trust, A, as the sole beneficiary, may by consent (assuming A is competent to contract) modify the directions given by you to the trustees under your Will, and sell the flat prior to the trust life.

Nomination in CHS Q.: What is Nomination? A member fills in a Nomination Form and submits to the Society so that upon his death the nominee shall become a member of the Society in respect of his shares and flat. Bye Law No.32 A member of the society may, by writing under his hand, in the prescribed form APPENDIX-14, nominate a person or persons to whom the whole or part of the shares and/or interest of the member in the capital/property of the society shall be transferred in the event of his death. Q.: What is the procedure for Nomination? Nomination form APPENDIX-14 in triplicate is to be submitted to the society. Third copy is acknowledged by the Secretary & returned to the member immediately. Second copy is returned to the member on recording the nomination in the next Managing Committee Meeting. The Original copy remains in the records of the society. Details of each nomination form, is entered date wise in the Nomination . Q.: What are the check points in Nomination form? Fill the Nomination form completely in triplicate, in neat & clear handwriting. Check that all names are written correctly. In case of minor, his date of birth & details of guardian are to be furnished. Sign the Nomination Forms at “Signature of the Nominator Member”. Write share of each nominee in percentage. Total shares of all nominees must be 100% (not <100% nor >100%). Signature of two witnesses should be taken on the Nomination forms, along with their names & addresses.. Witnesses can be anyone, who can confirm the signature of the member. However family as witnesses can be challenged in the court. Nominee himself can not be a witness. Q.: Can a Minor be a Nominee? Yes. A minor can be a nominee. After the death of the member, this minor can become member of the society through his guardian. Q.: Whether Nominee should be a family member only? A nominee can be a family member or relative or friend or any other person. Q.: Is Nomination compulsory? No it can not be. But it is in the interest of the member. Every member should fill Nomination forms so that Society can transfer the shares in the name of Nominee. Q.: Can I change the Nominee? Yes, at any time. Refer Bye Law No.32 A member may revoke or vary his nomination, at any time, by making an application, in writing, under his hand, to the Secretary of the Society.

Q.: If I submit a fresh Nomination form, whether I have to cancel earlier Nomination? A subsequent Nomination automatically cancels the earlier Nomination. Bye Law No.32 The acknowledgement of the variation in nomination/subsequent nomination by the Secretary, shall be-deemed to be the cancellation of earlier nomination. Q.: What is the effective date of Nomination? The Nomination is effective from the date it is acknowledged by the secretary of the society. Bye Law No.32 The acknowledgement of the nomination by the Secretary, shall be deemed to be the acceptance of nomination by the Secretary. Q.: Do I have to pay any charges/fees to file the Nomination? First Nomination is free of cost. For subsequent each Nomination Rs.100 has to be paid. Bye Law No.32No fees shall be charged for recording the first nomination. Every fresh nomination shall be charged a fee of Rs.100/Q.: What are the relevant Bye Laws? Bye Law No.32: A member of the society may, by writing under his hand, in the prescribed form APPENDIX-14, nominate a person or persons to whom the whole or part of the shares and/or interest of the member in the capital/property of the society shall be transferred in the event of his death. The acknowledgement of the nomination by the Secretary, shall be deemed to be the acceptance of nomination by the Secretary. No fees shall be charged for recording the first nomination. A member may revoke or vary his nomination, at any time, by making an application, in writing, under his hand, to the Secretary of the Society. The acknowledgement of the variation in nomination/subsequent nomination by the Secretary, shall be-deemed to be the cancellation of earlier nomination. Every fresh nomination shall be charged a fee of Rs.100/- (as per new amendments in June 2009) Bye Law No.33: On receipt of the nomination form, or the letter or revocation of the earlier nomination, the same shall be placed before the meeting of the Committee held next after the receipt of the nomination form, or the letter of revocation of the earlier nomination, by the Secretary of the Society for recording the same in the minutes of the Committee. Every such nomination or revocation thereof shall be entered in the of nominations by the Secretary of the society within 7 days of the meeting of the committee, in which it was recorded. Q.: What is the procedure in case of death of the member? Bye Law No.34: Subject to the provisions of the Section 30 of MCS Act 1960, bye-law No.17A or 19, on the death of member, the society shall transfer the shares and interest of the deceased member in

the Capital/Property of the society to the Nominee/Nominees and in proportion with the shares and interest held by the deceased member, in case property is purchased by member and associate member tly. In the event of death of the member Nominee/Nominees shall submit the Application APPENDIX-15 for hip, within six months from the death of a member. If there are more than one nominee, on the death of a member, such Nominees shall make t Application APPENDIX-18 to the Society and indicate the name of the Nominee who should be enrolled as member. The other nominees shall be enrolled as t/Associate unless the nominees indicate otherwise. The nominees shall also file an Indemnity Bond in the prescribed form APPENDIX19 indemnifying the society against any claims made to the shares and interest of the deceased member in the Capital/Property of the society by any of them, in case only one nominee is indicated, by the Nominees for hip of the society. Q.: What is the procedure if the member has not filed Nomination? Bye Law No.35: Where a member of the society dies without making a nomination, or no nominee comes forward for transfer, the society shall invite within one month from the information of his death, claims or objections to the proposed transfer of shares and interest of the deceased member in the capital/property of the society, by a public notice, in the prescribed form APPENDIX-16, exhibited on the notice board of the society. It shall also publish such notice in atleast two local newspapers, having wide circulation. The entire expenses of publication of the notice shall be recoverable from the value of shares and Interest of the deceased member in the capital/property of the society. After taking into consideration the claimed or objections received, in response to the said notice, and after making such inquiries as the committee considers proper in the circumstances prevailing, the committee shall decide as to the person, who in its opinion is the heir or legal representative of the deceased member. Such a person will be eligible to be a member of the society subject to the provisions of the bye-laws Nos. 17(a) or 19, provided that he gives an Indemnity Bond APPENDIX-19 along with his application for hip in the prescribed formAPPENDIX-17, indemnifying the society against any claims made to the shares and interest of the deceased in the capital property of the society, at any time in future, by any person. If there are more claimants than one, they shall be asked to make the affidavit APPENDIX18 as to who should become a member of the society and such person, named in the affidavit shall furnish the indemnity bond as indicated above along with application for hip, referred to above. If however, the committee is not able to decide as to the person who is the heir/legal representative of the deceased member or the claimants do not come to the agreement, as to who should become the member of the society, the Committee shall call upon them to produce succession certificate from the Competent Court. If, however, there is no

claimant, the shares and interest of the deceased member in the capital/property of the Society shall vest in the Society. Q.: Can Society ask for Succession Certificate? Yes, Society can ask for Succession Certificate. Q.: What happens if the Nominee / Nominees demand Value of the shares? Bye Law No.36: If there is the single nominee and if he demands payment of the value of ~hares and interest of the deceased member, in the capital/property of the society, the society shall acquire the same and pay him the value thereof as provided under the bye-law No.66, if, however, there are more nominees then one and if they demand payment of the value of the shares and interest of the deceased member in the capital/property of the society, the society shall acquire the same and pay them value thereof as provided under the bye-law referred to above in the proportion mentioned in the nomination from. If no proportion is mentioned in the nomination from, the payment shall be in equal proportion Bye Law No.37: If, in the opinion of the Committee, there is only one heir/legal representative of the deceased member and if he demands payment of the value of the shares and interest of the deceased member in the capital/property of the society, the society may acquire the same and pay him the value thereof as provided under the bye-law No.66 after obtaining the indemnity bond referred to in the bye-law No.35, If, in the opinion of the Committee there are more heir/legal representatives than one and if they demand payment of the value of Shares and interest of the deceased member in the capital/property of the society, the society may acquire the same and pay them value thereof in equal proportion as provided under bye-law No.66, after obtaining the indemnity bond referred to the bye-law No.35, from all the heirs/legal representatives tly. Q.: Does Nominee become owner of the flat? Nomination is not a ‘Will’ and therefore nominee does not become owner of the shares of the flat. The Nominee is only a trustee of the legal heirs. Q.: What happens if the member has filed Nomination & has left “Will” too? Society has to go with Bye Laws & has to transfer the shares in the name of Nominee. However still nominee does not become owner of the flat. The ‘Will’ has to be probated & then Society has to transfer the shares accordingly. For Hindu Succession Act, please refer the following website http://www.legalindia.in/the-hindu-succession-act-1956 http://nitinprane.blogspot.com/2010/10/hindu-succession-act.html

Q.: Agreement is in the name of Mr.X, he nominates his son Mr.A, does this mean that Mrs.Y who is the wife of Mr.X has no rights in the flat? As per Hindu Succession Act, Wife, Sons and Daughters have equal rights (unless and otherwise Mr.X has made any Will). Mrs.Y has to get Succession Certificate from the court. Q.: Does Married Daughter, Mrs.B has any rights in the property of her father? Yes, As per Hindu Succession Act, Married Daughter has equal rights alongwith wife and son. Note – Muslim Succession Law may differ. Q.: Agreement is in the name of Mr.X & Mrs.Y, after death of Mr.X, does Mrs.Y becomes 100% owner of the flat? No, all legal heirs of Mr.X, will have equal rights (Wife + Son + Daughter) in proportion with the shares and interest held by the deceased member, in case property is purchased by member and associate member tly (assumed to be 50% each, if not mentioned or can not be proved) (i.e. 1/3rd of 50% equally by Wife + Son + Daughter) (& 50% remains with Wife as before), (i.e. 2/3rd of Total Property with Wife, 1/6th with Son & 1/6th with Daughter). Note – 1) If Mr.X has paid say 75% & Mrs.Y has paid 25%, then 1/3rd of 75 i.e. 25% + 25% of her own i.e. Total 50% to wife, 25% to Son, Mr.B & 25% to Daughter, Mrs.B. 2) If Mr.X has paid 25%, Mrs.Y has 25% & Loan for the 50% was taken which Mr.X was repaying, then Mr.X’s contribution is 75%. 3) If Mrs.Y (Housewife) has not paid any amount to purchase the property, then all the property is supposed to be of Mr.X. For all the above, Succession Certificate has to be obtained. Q.: Ask your questions?

APPENDIX - 14 [Under the Bye-law No. 32]

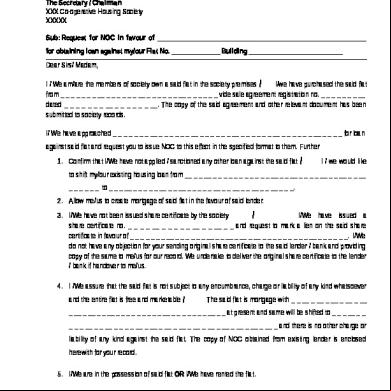

FORM OF NOMINATION TO BE FURNISHED IN TRIPLICATE To, The Secretary ____________________________________ Co-operative Housing Society Ltd., ____________________________________ Sir,

1. l, Shri/Shrimati ______________________________________________ am the member of the ____________________________________ Co-operative Housing Society Ltd., having address at ____________________________________ 2. I hold the share certificate No. ____________ dated ____________ for five fully paid up shares of Rupees fifty each, bearing number from ____________ to ____________ (both inclusive), issued by the said society to me. 3. I also hold the Flat No. ____________ easuring ____________ sq. metres, in the building of the said society, known *numbered as ____________ 4. As provided under Rule 25 of the Maharashtra Co-op. Societies Rules, 1961, l hereby nominate the person/s whose particulars are as given below.

Sr. No.

Name/s of the Nominee/s

Permanent Addresses of the Nominee/s

Relationshi p with the Nominator

Share of each Nominee (Percentag e)

1

2

3

4

5

Date of Birth of Nominee/s if the Nominee/s is a minor 6

(1)

(2)

(3)

(4)

(5)

5. As provided under Section 30 of the Maharashtra Co-operative Societies Act, 1960 and the Byelaws No. 36 of the Society, I state that on my death the Shares mentioned above and my interest in the flat, the details of which are given above, should be transferred to Shri/Shrimati ______________________________________________ the first named nominee, on his/her complying with the provisions of the Bye-laws of the society regarding requirements of ission to hip and on furnishing *Indemnity Bond, alongwith the application for

hip, indemnifying the society against any claims made to the said shares and my interest in the said flat by other nominee/nominees. ___________________________________________________________________________ *Indemnity Bond is not required to be furnished in case of a single nominee. 6. As the nominee at Sr. No. ______ is the minor, I hereby appoint Shri/Shrimati _______________________________________________________ as the guardian/legal representative of the minor to represent the minor nominee in matters connected with this nomination. Place : Date : Signature of the Nominator Member Witnesses : Name and Addresses of Witnesses. (1) Shri/Shrimati ________________________________ Address ____________________________________ ___________________________________________ ___________________________________________ Signature of the Witness (2) Shri/Shrimati ________________________________ Address ____________________________________ ___________________________________________ ___________________________________________ Signature of the Witness Place : The nomination was placed in the meeting of the managing committee of the society held on ________________ for being recorded in its minutes. The nomination has been recorded in the nomination at Sr. No. ___________ Date : Secretary, ______________ Co-op. Housing Society Ltd., Received the duplicate copy of the nomination.

Date : Nominator-Member

APPENDIX - 15 [Under the Bye law No. 34]

the Form of applicaiion for hip by the Nominee/Nominees To, The Secretary ____________________________________ Co-operative Housing Society Ltd., ____________________________________ Sir, l/We Shri/Smt/Messrs ______________________________________ hereby make an application for hip of the ________________________________ Co-operative Housing Society Ltd., ________________________________ and for transfer of shares and interest of Shri/Shrimati ______________________________________ Deceased member of the society, in the capital/property of the society. Shri/Shrimati _____________________________________________ was a member of the society holding ____________ Shares of Rs. Fifty each and Flat No. ________ in the society‘s building. Shri/Shrimati _________________________________________ the deceased member of the society died on ______________ A copy of the death certificate of the said member is enclosed. The late Shri/Shrimati ___________________________________ the deceased member of the society had nominated me/us under Rule 25 of the Maharashtra Co-operative Societies Rules 1961. Being the only nominee/authorised nominees as per nomination filed with the society by the deceased member, l/We am/are entitled to make an application for hip of the society and for transfer of shares and interest of the deceased member in the capital/property of the society to my/our name. l/We have executed the Indemnity Bond in favour of the society indemnifying it against any claim made at any subsequent time by other nominee/nominees to the shares and interest of the deceased member in the capital/property of the society. The said Indemnity Bond is enclosed herewith. [Appendix 18(1)] I/We remit herewith an amount of Rs.100/- as entrance fee.

My particulars for the purpose of consideration of my application for hip of the society are as under : Age : ___________________________________ Occupation : ___________________________________ Monthly income : Rs. ___________________________________ Office Address : ___________________________________ Residential Address : ___________________________________ l give below the particulars of the plot / flat / house owned by me or any of the of my family / person dependent on me in the area of operation of the society.

Sr. No.

Name/s of the Person

Perticulars of the plot / house owned by the applicant or by any of the of his family or a person dependent on him in the area of operation of the society

1

2

3

Location of the plot / flat / house

4

l/We undertake to use the flat for the purpose for which it was allotted to or acquired by the deceased member and that any change of will be made with prior approval of the society. The undertaking in the prescribed form to that effect is enclosed. (Appendix 3). I/We enclose herewith the undertaking and the declaration, in the prescribed forms, in respect of the registration of transfer of the registration of transfer of the flat to my/our name under Section 269AB of the Income-tax Act and about non-holding of immoveable property in excess of 500 sq. mtrs. under the Urban Land (Ceiling and Regulation) Act. (Appendix 25) l/We undertake to discharge the present and future liabilities to the society / As l have no independent source of income, I enclose herewith the undertaking in the prescribed form (Appendix 4) from the person, on whom l am dependent to the effect that he will discharge all the present and future liabilities to the society on my behalf. I/We have gone through the bye-laws of the society and undertake to abide by the same and any modifications that the ing Authority may make in them.

l/We request you to please it me/us as a member of the society and transfer the shares and interest of the deceased member in the capital/property of the society to my/our name. The share certificate held by the deceased member is enclosed herewith. Yours faithfully, Place : _________________ Date : _________________ Note : (1) the expression “a member of a family" means as defined under bye-law No. 3(xxv) (2) The undertaking about registration of the flat is not necessary if the nominee is related to the deceased member within the meaning of Section 2 (41) of the income-tax Act.

APPENDIX - 16 (Under the Bye-law No.35)

The Form of Notice, inviting claims or objections to the transfer of the shares and the interest of the Deceased Member in the Capital/Property of the Society (To be published in two local newspapers having large publication.)

NOTICE Shri/Smt ____________________________________________________ a Member of the ___________________________________ Co-operative Housing Society Ltd., having address at ____________________________________ and holding Flat No. __________ in the building of the society, died on ___________ without making any nomination. The society hereby invites claims or objections from the heir or heirs or other claimants / objector or objections to the transfer of the said shares and interest of the deceased member in the capital / property of the society within a period of _____ days from the publication of this notice, with copies of such documents and other proofs in of his / her / their claims / objections for transfer of shares and interest of the deceased member in the capital / property of

the society. lf no claims / objections are received within the period prescribed above, the society shall be free to deal with the shares and interest of the deceased member in the capital / property of the society in such manner as is provided under the bye-laws of the society. The claims / objections, if any; received by the society for transfer of shares and interest of the deceased member in the capital / property of the society shall be dealt with in the manner provided under bye-laws of the society. A copy of the ed bye-laws of the society is available for inspection by the claimants / objectors, in the office of the society / with the Secretary of the society between ______ A.M. / P.M. to ______ A.M. / P.M. from the date of publication of the notice till the date of expiry of its period. For and on behalf of _________________ Co-op. Housing Society Ltd. Place : Date : Hon. Secretary

APPENDIX - 17 [Under the Bye-law No. 35]

Application for hip by the Heir of the Deceased Member of the Society To, The Secretary ____________________________________ Co-operative Housing Society Ltd., ____________________________________ Sir, I, Shri/Smt ______________________________________ hereby make an application for hip of the ______________________________ Co-operative Housing Society Ltd., having address at _______________________________________ and for transfer of shares and interest of the deceased member or the society in the capital / property of the society. Shri/Smt ___________________________________________ who was a member of the society and holding ________ shares of Rs. Fifty each and the Flat No. ____________ in the society's building, died on ___________ without making a nomination, His / Her death certificate is enclosed. l hereby state that I am the only heir of the said deceased member / there are _______ heirs of the deceased member and all of the heirs have made an affidavit choosing me to make

an application for hip of the society and for transfer of shares and interest of the deceased member in the capital / property of the society to my name. The affidavit in original is enclosed. I have also executed an Indemnity Bond in favour of the society Appendix 18(2), indemnifying it against any claim made by any other person / persons or heir / heirs at any subsequent time in respect of the shares and interest of the deceased member in the capital / property of the society. l remit herewith an amount of Rs.100/- as entrance fee. My particulars for the purpose of consideration of my application for hip of the society are as under : Age : ___________________________________ Occupation : ___________________________________ Monthly income : Rs. ___________________________________ Office Address : ___________________________________ Residential Address : ___________________________________ l give below the particulars of the plot / flat / house owned by me or any of the of my family or person dependent on me in the area of operation of the society.

Sr. No.

Name/s of the Person

Perticulars of the plot / house owned by the applicant or by any of the of his family or a person dependent on him in the area of operation of the society

1

2

3

Location of the plot / flat / house 4

l undertake to use the flat for the purpose for which it was held / acquired by the deceased member and that any change of will be made with the prior approval of the society. The undertaking in the prescribed form to that effect is enclosed. (Appendix 3).

I enclose herewith the undertaking and the declaration in the prescribed forms that I will disclose of the plot / flat / house, owned by me or any of the of my family, or the person dependent on me, the details of which are given above. I enclose herewith the undertaking and the declaration in the prescribed forms about registration of the transfer of the flat to my name under Section 269 AB of the Income-tax Act and about non-holding of immoveable property in excess of 500 sq. mtrs. under the Urban Land (Ceiling and Regulation) Act. l undertake to discharge the present and future liabilities to the society / As l have no independent source of income, I enclose herewith the undertaking in the prescribed form from the person, on whom l am dependent to the effect that he will discharge all the present and future liabilities to the society on my behalf. I have gone through the bye-laws of the society and undertake to abide by the same and any modifications that the ing Authority may make in them. l request you to please it me as a member of the society and to transfer the shares and interest of the deceased member in the capital / property of the society to my name. The share certificate held by the deceased member is enclosed herewith. Yours faithfully, Place : _________________ Date : _________________ Note : (1) the expression “a member of a family" means as defined under bye-law No. 3(xxv) (2) The undertaking about registration of the flat is not necessary if the nominee is related to the deceased member within the meaning of Section 2 (41) of the income-tax Act.

APPENDIX – 18 [Under the Bye-law No.34]

FORM OF INDEMNITY BOND To be given on Stamp Paper of Rs.200 or to be affixed with adhesive stamps of the same denomination. (To be given where there are more nominees than one) I, Shri/Shrimati ____________________________________________ residing at _____________________________________ an Indian inhabitant state as under :

2. Shri/Shrimati _____________________________________________________ residing at _____________________________________________________ was the member of the ________________________ Co-operative Housing Society Ltd. having address at _____________________________________________________________ He/She was holding Share Certificate No. ____________ for five fully paid up shares of Rupees Fifty each, bearing distinctive numbers from _____________ to _____________ (both inculsive). 3. The said Shri/Shrimati __________________________________ was holding the Flat No. __________ on _______ floor, in the building of the society known/numbered as ____________ constructed on the plot of land bearing No. __________________ at ________________________________________________ 4. The said Shri/Shrimati ______________________________________________ had nominated the following persons under Rule 25 of the Maharashtra Co-op. Societies Rules 1961. (i) Shri/Shrimati ____________________________________________ (ii) Shri/Shrimati ____________________________________________ (iii) Shri/Shrimati ____________________________________________ (iv) Shri/Shrimati ____________________________________________ (v) Shri/Shrimati ____________________________________________ 5. I am duly authorised by the above nominees to make an application for hip in the society. 6. The said Shri/Shrimati died on or about _______________________ 7. According to the bye-law N0. 34 of the bye-laws of the said society I am entitled to make an application for hip of the said society and or transfer of the said shares and interest of the said shares and interest of the said deceased member in the said flat to our names. Accordingly, I have made an application for hip of the said society and for transfer of the Shares and the interest of the said deceased/member in the said flat to my name. 8. We hereby indemnify and keep indemnified and harmless the said society and its officebearers against any claim demand, suit or other legal proceedings by other nominee/nominees claiming either lawfully and/or equitably, through the said deceased Shri/Shrimati ___________________________________________ We further declare and undertake to bear all expenses, costs, charges in respect of any such claim, demand, suit and/or legal proceedings which may be filed by other nominee/nominees either lawfully and/or equitably claiming through the said deceased member of the society.

9. We are conscious of the fact that the society will it us as its t/Associate member in place and instead of the said deceased member of the society on the basis of this indemnity and undertaking. Signatures of applicant Place : Date : Signatures of nominees 1) 2) 3) Witnesses : (1) Shri/Shrimati ________________________________ Address ____________________________________ ___________________________________________ ___________________________________________ Signature of the Witness (2) Shri/Shrimati ________________________________ Address ____________________________________ ___________________________________________ ___________________________________________ Signature of the Witness Place : Date :

APPENDIX - 19 [Under the Bye-law No.35]

FORM OF INDEMNITY BOND To be given on Stamp Paper of Rs.200 or to be affixed

with adhesive stamps of the same denomination. (To be given where there is no nomination) 1. Shri/Shrimati ___________________________________________________ of _____________________________ Indian inhabitant, state as under: 2. Shri/Shrimati _____________________________________________ residing at _______________________________________________ who was the member of the ___________________________ co-operative Housing Society Ltd. having address at __________________________________________ died on or about _____________ 3. The said Shri/Shrimati _______________________________ had not made any nomination as provided under Rule 25 of the Maharashtra Co-operative Societies Rule, 1961. 4. The said Shri/Shrimati _________________________________ was holding the share certificate No. ____________ for five fully paid up shares of Rupees Fifty each; bearing distinctive numbers from ______________ to ____________ (both inclusive) 5. The said Shri/Shrimati _____________________________________ was holding the Flat No. ___________ on ______ floor, in the building of the society, known / numbered as _____________________ constructed on the plot of land bearing no. _________________________________ at ______________________________ 6. The said Shri/Shrimati _________________________________ has left behind me as his / her only heir / the following heirs. (i) Shri/Shrimati ____________________________________________ (ii) Shri/Shrimati ____________________________________________ (iii) Shri/Shrimati ____________________________________________ (iv) Shri/Shrimati ____________________________________________ (v) Shri/Shrimati ____________________________________________ l am the only heir of the deceased Shri/Shrimati __________________________________ I inherit his/her shares, and his/her interest in the said flat. According to the bye-law No.35 of the bye-laws of the said society, I am entitled to make an application for hip of the said society and for transfer of the said flat to my name. Accordingly, I have made an application for transfer of the said shares and the interest of the said deceased member in the said flat to my name. OR According to the bye-law No.35 of the bye-laws of the society, all the above heirs have tly made an affidavit and make an application for t / Associate hip of the said society and for transfer of the said shares and the interest of the said deceased member in the said flat

to our names. Accordingly, we have made an application for t / Associate hip of the said society and for transfer of the said shares and the interest of the said deceased member in the said flat to our names. 7. We hereby indemnify and keep indemnified and harmless the said society and its officebearers against any claim demand, suit or other legal proceedings by any other heir/heirs, either lawfully and/or equitably, through the said deceased Shri/Shrimati ___________________________________________ We further declare and undertake to bear all expenses, costs, charges in respect of any such claim, demand, suit and/or legal proceedings which may be filed by any other heir/heirs either lawfully and/or equitably claiming through the said deceased member of the society. 8. We are conscious of the fact that the society will it us as its t/Associate member in place and instead of the said deceased member of the society on the basis of this indemnity and undertaking. Signatures of applicant Place : 1) Date : 2) 3) Witnesses : (1) Shri/Shrimati ________________________________ Address ____________________________________ ___________________________________________ ___________________________________________ Signature of the Witness (2) Shri/Shrimati ________________________________ Address ____________________________________ ___________________________________________ ___________________________________________ Signature of the Witness Place : Date :

1. UnknownDecember 17, 2014 at 6:50 PM Hi I am owner of a flat and I want to file nomination in name of two people who would own equal shares in the flat after my death.Apart from Nomination form do i need to submit any type of idemity bond or declaration in stamp paper about dual nomination.If yes can you give me the format for the same Regards Sunil Pai Reply Replies

1. Nitin RaneDecember 17, 2014 at 11:35 PM Only Nomination Form (APPENDIX-14) is to be submitted to society. You can nominate anybody at your wish, at any proportion (equal to 100%). Reply 2. AnonymousJanuary 5, 2015 at 12:55 AM Dear sir, My mother is 68years Old and having three sons, After her death She wants to give her flat to her 3 sons. So, if she is filing Nomination Form in Appendix 14 along with this does she also needs to submit IDEMINTY BOND along with Nomination. & If she Don't make any will Can Nominee Can Apply for hip???? Right now, A single nomination is there in her flat, she wants to cancel it?? Does we have to wait till society meeting for cancelling of a Nominee????? and meanwhile she is no more then ACCEPTANCE DATE of Cancellation Of Nominee Letter BY SECRETARY will be effective. Kindly guide. Reply Replies

1. Nitin RaneJanuary 5, 2015 at 10:00 PM 1) No indeminity bond from mother. 2) Please refer Bye Law No. 32 a) A member may revoke or vary his nomination, at any time, by making an application, in writing, under his hand, to the Secretary of the Society. b) The acknowledgement of the variation in nomination/subsequent nomination by the Secretary, shall be deemed to be the cancellation of earlier nomination. c) Every fresh nomination shall be charged a fee of Rs. 100/-. 3) Please refer Bye Law No. 33 On receipt of the nomination form, or the letter or revocation of the earlier nomination, the same shall be placed before the meeting of the Committee. held next after the receipt of the nomination form, or the letter of revocation of the earlier nomination, by the Secretary of the Society for recording the same in the minutes of the Committee. Every such nomination or revocation thereof shall be entered in the of nominations by the Secretary of the society within 7 days of the meeting of the Committee, in which it was recorded. 4) Nominee is trustee of the flat. Even if only 1 son is nominee, under Hindu Succession Act, all 3 sons (& daughters, if any) have equal rights on the flat (provided no will is done). Reply 3. jyothi shettyJanuary 20, 2015 at 2:27 PM May i ask you one question : There is one old lady who expired in our Society. She has two legal hier son. One son is staying away and the other son is expired whose wife stay with her daughter in the lady flat. The old lady expired and she has appointed ONLY ONE PERSON - daughter in law (son expired) as a 100% Nominee. For transfer of shares now, the secretary is asking for NOC from legal hiers INDEMNITY BOND from lady

Lady not ready to give NOC (as the other legal hier son is not giving his NOC) Lady now after much persuasion ready to give Indemnity BOND Society secretary saying that they are ready to transfer the shares in her name but she cannot become owner of the flat till all the legal hiers are brought on records of the society. Is this true, under which byelaw Society Secretary say that the lady cannot sell this flat unless the legal hiers are brought on record. Is this true, under which byelaw. Can society as a special case allow sale of flat, after one year. SHETTY Reply Replies

1. Nitin RaneJanuary 27, 2015 at 8:16 PM

Please refer Bye Law No. 34 In case of acquiring hip on the basis of nomination, such member shall hold the flat/unit in ‘Trust' till all the Heirs are brought on record and shall not have the right to ownership and shall not create the third party interest.

Please refer Section 30 of The Maharashtra Co-operative Societies Act (MCS Act) 30. TRANSFER OF INTEREST ON DEATH OF MEMBER (1) On the death of a member of a society, the society shall transfer the share or interest of the deceased member to a person or persons nominated in interest on accordance with the rules or, if no person has been so nominated, to such person as may appear to the committee to be the heir or legal representative of the deceased member Purpose of making a nomination is only to provide for the parties with whom the society must deal on the death of a member and not to create a rule of succession. Nominee is mere a trustee. Succession to the estate of deceased must take its course in accordance with the law of succession governing the deceased and his heirs. Nomination does not alter the succession in the estate of deceased and do not confer exclusive title on the nominee.

Please refer the following case in Bombay High Court (attached herewith). Gopal Vishnu Ghatnekar vs Madhukar Vishnu Ghatnekar on 24 June, 1981 http://www.judis.nic.in/bombay/chejudis.asp

Example : Flat owned by Mrs.X, hip of Society Mrs.X. Mrs.X has two sons (Mr.A & Mr.B). Mr.A & Mr.B are legal heirs. Mr.A staying abroad. Mr.B stays with his wife Mrs.P & daughter Miss D. Mr.B expired. Case-1 : Mrs.X NOMINATES Mrs.P. Mrs.X expired. Mrs.P will become member of the society as Nominee of Mrs.X. Still Mr.A has 50% rights of ownership in the flat. i) Mr.A can release his rights to Mrs.P for consideration of 50% of flat value or even free. Then Mrs.P will become sole owner of the flat. She can then sell the flat at her wish. ii) Mrs.P wants to sell the flat. Mr.A has to give NOC to sell the flat, his name will be entered in the sell agreement. Mrs.P has to give 50% of the sell value (or as decided mutually, it may be even zero) to Mr.A.

Case-2 : Mrs.X MAKES WILL in the name of Mrs.P. Mrs.X expired. Mrs.P will get probate on the will of Mrs.X. Mrs.P becomes sole owner of the flat & member of the society. Mr.A will have no rights of ownership in the flat.

Disclaimer : I am not professional. Get professional advice. Reply 4. Zainab PresswalaJanuary 27, 2015 at 6:51 PM where and who has to sign on the nomination form? Reply Replies

1. Nitin RaneJanuary 27, 2015 at 8:14 PM 1) To be signed by Member above "Signature of the Nominator Member", 2) To be witnessed by 2 persons "Signature of the Witness" 3) 3rd copy to be acknowledged by Secretary of the society at the time of receiving Nomination Form from member. 4) 1st & 2nd copy to be signed by Secretary of the society after noting it in Managing Committee Meeting held next & recording Nomination in Nomination . 5) To be signed by member on 1st copy (acknowledgement) when receiving 2nd copy. 1st copy to be filed for society record, 2nd copy to be given to member after recording Nomination in Nomination , 3rd copy to be given to member at the time of receiving Nomination Form from Member. Reply

5. SunitaFebruary 12, 2015 at 1:17 AM In case the nomination mentions A and B in that order for 50% of the share can the nominees mutually decide among themselves on who will be first on the share certificate in case they apply for t hip of a flat in a case of transfer to nominee. Can they later mutually nominate each other ? Reply Replies

1.

Nitin RaneApril 21, 2015 at 1:15 AM Is there anybody who has legal rights other than A & B ? If only A & B are legal heirs A & B can mutually decide who will be member & who will be associate member, as both have legal rights in the flat. (1st name) Member, (2nd name) Associate Member. Please note that _ Nominee does not become owner. To become owner of flat, consent of all legal heirs is required. He should get such ownership through law of court.

Disclaimer : I am not advocate. Get professional help, if required. Reply

6. pradeep makhijaniMarch 23, 2015 at 12:40 AM nitin sir mother and son are tly member of the society ( mothers name are 1st in share certificate ) now mother want to give full hip to her son. sir what is the remedy ,which form shall she be fill Reply Replies

1. Nitin RaneApril 21, 2015 at 1:07 AM She should make Gift Deed in the name of her son & then transfer the flat alongwith hip to her son. Disclaimer : I am not advocate. Get professional help, if required. Reply 7. AnonymousMarch 23, 2015 at 5:43 PM

Nitin Sir I have a question. I have a flat in the t name with my wife. Now society has distributed the nomination form. Whether both of us have to sign the nomination or alone i can sign. or she has to submit a separate nomination form? Please advice. Regards D bhattacharya Reply

8. Nitin RaneApril 21, 2015 at 1:05 AM Mr.X & Mrs.Y have bought flat tly & are t owners. For convenience, Mr.X has become Member & Mrs.Y has become Associate Member (t Member). Mr.X can file Nomination Form & Mrs.Y can file Nomination Form separately. In case of death of Mr.X, his nominee (may or may not be his wife) will become member in place of Mr.X; In case of death of Mrs.Y, her nominee (may or may not be his husband) will become member in place of Mrs.Y. Disclaimer : I am not advocate. Get professional help, if required. Reply

9. ppJune 2, 2015 at 8:51 PM I want to nominate my wife and daughter. I will up the form (14) in triplicate and submit. BUt i read somewhere if there is more than one nominee i need a indemnity bond. Where do I get that form. Is there a place I can these forms. thanks a lot for your great blog Reply Replies

1. Nitin RaneJune 3, 2015 at 6:12 PM

Please refer (Form-18) APPENDIX – 18 FORM OF INDEMNITY BOND, (given above). If a member nominates more than one nominees – after his/her death (member’s death), 1st nominee (who will become member) along with other nominee/s (who will become associate / t member/s) have to give this Indemnity Bond. Existing member does not have to give Indemnity Bond. Reply 10. AnonymousJune 21, 2015 at 11:31 AM "A" gave nomination of B & C. After death of "A" B & C became member of the Society 20 years back. B & C both died in 2013. Both gave nomination of D & E. My questions Sir, 1) Whether B & C can give further nominations as they themselves were through nomination. 2) Can anyone without obtaining heirship/succession certificate of "A" object to it ? 3) Whether Society is under obligation to transfer the hip to D & E. 4) Whether anyone else claiming to be legal heir of "A" can claim the hip without obtaining any order from the court -- which will be the right court for him --- can he get orders of his heirship from cooperative fora like deputy registrar or coop court ? Regards xyz. Reply 11. AnonymousJuly 13, 2015 at 4:17 PM Received an application for removal of (deceased) name from the share certificate on his death. The flat was purchased in the name of Son and his wife - the names of father and mother were added only for convinience sake for using it as a proof of address. on the death of father an application has been received by the secretary to remove the father name as member on the share certificate. the son , his wife and mother continue to be . what is the protocol to be followed in such case by the secretary of the society? the will of the father clearly says that he has no interest in the property which belongs exclusively to his son and sons wife. Reply

Replies

1. Nitin RaneJuly 29, 2015 at 9:34 AM Father was an associate member. On his death he is ceased to be an associate member & his name has to be removed. Please refer Bye-Law No.58 : The person shall cease to be the associate member of the society, when the original member ceases to be the member of the society or on the death of the associate member or on the acceptance of the resignation of the associate member by the Committee, The Committee shall take further action in the matter as indicated in the Bye-law No. 61. Reply 12. GauravJuly 26, 2015 at 6:24 PM Dear Sir, As per the nomination form - 14 under by-laws No. 32 we have following queries: 1) The form is to be submitted by single member (as the form mentions I & not We). How to submit the form for t ? 2) As the nominee is only Trustee & not the heir, however Form 14 instructs to transfer the shares & interest in the flat to 1st named nominee, which seems to be contradictory.(encl form 14 for ready reference). In case there are more than 1 nominee what happens to their share/interest? 3) In the above case, can the nominee dispose of the flat, after the transfer of shares & interest in his name? What is the precautions society must take? 4) In case of t holding by husband & wife can they nominate one of them in the nomination, along with children? 5) Can a flat owner nominate a Trust? What is the procedure?

Reply Replies

1. Nitin RaneJuly 27, 2015 at 8:58 PM Gaurav has left a new comment on your post "Nomination in CHS": Dear Sir,

As per the nomination form - 14 under by-laws No. 32 we have following queries: 1) The form is to be submitted by single member (as the form mentions I & not We). How to submit the form for t ? Both can submit Form-14 individually. 2) As the nominee is only Trustee & not the heir, however Form 14 instructs to transfer the shares & interest in the flat to 1st named nominee, which seems to be contradictory. (encl form 14 for ready reference). In case there are more than 1 nominee what happens to their share/interest? For society, first one is member & other/s is/are associate member/s. Please refer Form-15 Application for hip by Nominee/Nominees. Please refer Form-18 Indemnity Bond When there are more than one nominees, hip is transferred to first nominee who becomes member, other/s can fill associate hip form & can become associate member/s. 3) In the above case, can the nominee dispose of the flat, after the transfer of shares & interest in his name? It is to be ed always that Nominee/s is/are mere trustee/s on behalf of legal heir/s. Nominee can not sell flat without NOC from other legal heir/s. What is the precautions society must take? Society has to give Notice (Form-16) in at least 2 local wide circulating newspapers & on society notice board & invite claims & objections. Society can ask for succession certificate. 4) In case of t holding by husband & wife can they nominate one of them in the nomination, along with children? Yes, Husband can nominate Wife+Children & Wife can nominate Husband+Children. 5) Can a flat owner nominate a Trust? What is the procedure? Instead he should make a will in favor of Trust. 2. GauravJuly 31, 2015 at 11:32 PM Thank You, Sir

Reply 13. ParthAugust 2, 2015 at 8:13 PM Dear Sir, We are in the process of getting the nominations from our . We have the following situation: 1) One flat has been occupied by the relative of the owner. 2) Two flats have been under the caretaker relative who gives it on rent or keeps it vacant. The main owner for both, situation 1 & 2 is not known to the committee or Society . Also the main owner has not attended any meetings of the Society from the beggining (approx 20 yrs). We have given nomination form to the relative and caretaker relative. The relative has returned the form signed by the owner indicating himself as the nominee and caretaker relative has also indicated one of his family as nominee. The committee is not sure about the authenticity of the signature in nomination form by the owner since committee does not have any KYC details of the owner. We have to the relatives since we do not have any details, no.s of the owner. To avoid any complications in future regarding the nominations can the Society take the following actions: 1)The relatives will be asked to present the owners with KYC details along with witnesses in front of the committee for g. 2) In case the relative refuses to bring the original owner for signature can Society refuse to the nominations. 3) What additional action or precaution to be taken by the Society and which bye-laws reference the society can give to the owners and relative for the action. 4) As we have indicated above the original member has not attended any meeting so far, what action Society can take as per the bye-laws. Reply 14. AnonymousAugust 2, 2015 at 9:59 PM Respected Sir, We have the following question... One shop has been tly owned by mother and daughter. Mother has expired. No will/ nomination made by mother. Now we are asking for the nomination form which daughter has filled making her brother as nominee. As per earlier explanations given by you, we understand daughter is only 50% owner for which her brother is a nominee. Now what happens to her mothers share of 50%? What is the procedure to get the mothers share's nominee or successor? Thanking you and awaiting prompt reply. Reply 15. AnonymousOctober 20, 2015 at 6:53 PM

The nomination form is required to be submitted to the society in triplicate. The society returns one copy to the member after ing the nomination. Is there a provision to give one copy to the nominee? Reply 16. AnonymousDecember 4, 2015 at 2:43 PM Sir In case of multiple nominees, do we have to submit indemity bond to the society, and if so kindly let me know if there is any format for the same Reply Replies

1. Nitin RaneDecember 5, 2015 at 12:14 PM Form No.18 (APPENDIX – 18) is given above for the same. Reply 17. AnonymousJanuary 4, 2016 at 6:42 PM X was the member of society. He ed away. He had made flat share transfer nomination 70% to wife and 30% son. As per his will 100% share should be transferred to his wife after his death. Is NOC required by son in this case? If yes then whether required on stamp paper? Also whether succession certificate needed in this case? Reply Replies

1. Nitin RaneJanuary 7, 2016 at 4:31 PM Legal heir should get probate of deceased member's WILL. Reply 18. UnknownJanuary 6, 2016 at 12:47 PM

in Co Op housing society, more than one nominee we have to fill indemnity, but notary is require or not Reply 19. manjusha burhadeJanuary 6, 2016 at 6:24 PM in Co Op housing society, more than one nominee we have to fill indemnity, but notary is require or not Reply Replies

1. Nitin RaneJanuary 7, 2016 at 4:32 PM Indemnity Bond should be notarised. Reply 20. JITENDRA PARMARFebruary 11, 2016 at 5:55 PM Hi, I stay in co op housing service society in Gujarat...as you know we have nothing to do with ownership issues being a service society. We only have to look after the common properties maintenance and handling services/facilities. are having complete ownership rights. But we issue them share certificates for being ...so are we suppossed to get nomination details from them? Reply 21. AnonymousFebruary 19, 2016 at 1:31 PM Mr.X had a flat in a co-operative society in his name. Mr.X expired and in his nomination have named Mrs.Y(wife) and Mr.A & Mr.B(Both sons) to get equal share in the share certificate for hip/associate hip. Now both the sons want to transfer their share in nomination to the Mother and make her a 100% nominee for the Society share certificate. What type of NOC should the two sons (Mr.A & Mr.B) issue to the society so that the society can include only Mrs.X name as the only member of the society holding 100% rights in the share certificate. Please let us know the format in which the NOC has to be issued to the society. Reply

Replies

1. Nitin RaneFebruary 23, 2016 at 2:33 PM Both

sons

should

make

Release

Deed

in

the

name

of

their

mother.

Take legal opinion, I am not Legal professional. Reply 22. RohitMarch 18, 2016 at 10:00 PM Is it mandatory to have the signature of witnesses? Reply 23. Prasarch 21, 2016 at 3:53 PM Namaskar I have two questions 1) In CHS we have two adjacent flats. One is in my name and my wife name ( t) and the second one in my wife and my mother's name ( t ) My mother expired few years back. I am the only child of my parents. My father is no more. I wish to add my name in second flat in place of my mothers name. Just application to society would do? Do I need to give any indemnity bond? 2) When we bought the second adjacent flat in my wife and mother's name the previous owner did not hand over the share certificate to us at the time of sale and told he would do the same later. But later he tells that he has lost the share certificate. How to get duplicate one? Reply 24. Anil BhatkarMarch 26, 2016 at 12:50 PM Sir, My mother is 80 yrs old with 4 children and can not walk and sign nomination form due to her illness. In this case, what is the procedure as per By-Laws to submit nomination form in the name of 4 children to Society. Reply 25.

UnknownApril 19, 2016 at 2:12 PM Hello, Does Chairman of housing society has right to reject nomination for once filled in triplicate and acknowledged by secretary, nominee becomes trustee? Reply 26. AnonymousApril 24, 2016 at 9:17 PM Hello, I am the nominee in the Maharashtra housing society flat. My mother was single member of the said society. She died without any will but my name was recorded as nominee. According to byelaw as a nominee, I applied for hip of society and managing committee added my name in share certificate and accepted my hip. Now the society is going for the redevelopment. Now the question is as nominee is only working as a trustee, can I sell or transfer this flat or do a deal with builder for redevelopment? If not what is the procedure to become owner of property from trusty? I have a sister and we are the only legal heirs of my mother. If I want to add my sister's name also in society share certificate along with me as t member and then do dealing with builder for redevelopment of society property, what procedure needs to be followed. Reply 27. SANKET POSAMApril 25, 2016 at 10:55 PM Mr. X was the owner of a flat, Mr. Y is the sole nominee, upon Mr. X's death Mr. Y applies for hip and gets shares transferred to his name. Can Mr. Y now make further nomination to Mr. Z and so on. Reply Replies

1. Nitin RaneSeptember 16, 2016 at 2:13 PM Mr. Y is nominee & not became owner. All legal heirs of Mr.X can claim the ownership. Reply 28.

G BMay 1, 2016 at 12:29 PM Hello My mother recently ed away. My father was t holder. No nomination was made. Is succession certificate compulsory. I heard getting succession certificate is very cumbersome procedure. What are the other ways. My mother has uned will. Will that help. Please reply as My family doesn't know what to do now. Reply 29. Himesh LakhaniAugust 30, 2016 at 11:20 AM I am holding a flat in a CHS along with my dad as t holder. Now, while filling up the nomination, do both of us have to submit separate Nomination forms even though the nominee is the same." Reply 30. Nitin RaneAugust 30, 2016 at 1:45 PM It's better, if both t holders fill nomination forms individually. In case of death of Member-1: Member-1's 50% share will be transferred to Nominee. So share certificate will have names of Nominee+Member-2. In case of death of Member-2: Member-2's 50% share will be transferred to Nominee. So share certificate will have names of Member-1+Nominee. In case of death of Both : Member-1's 50% share will be transferred to Nominee. Member-2's 50% share will be transferred to Nominee. So share certificate will have name of Nominee.

If Nomination is filled by both together, it creates confusion to managing committee of society. However in both cases, share of member should be transferred to nominee.

Disclaimer : I am not legal advisor, you can seek legal advise. Reply 31.

Sonu SuvarnaSeptember 7, 2016 at 8:42 PM Hello, I have submitted my nomination form in triplicate to the society in the year 2013 and I have an acknowledgment as received from the society. But the Society has not reverted with a stamped copy of the nomination form. I noted this just recently. Does the fact that I have not been given a copy of the nomination form by the society make my nomination invalid. Please advice. Thank you.

1. Nitin RaneSeptember 16, 2016 at 2:08 PM Please refer Bye-Law No.32 : The acknowledgement of the nomination by the Secretary, shall be deemed to be the acceptance of nomination by the Secretary.

Nominee – Transfer of Shares in Co-operative Housing Society: Maharashtra CHS Act Posted: February 12, 2013 | Author: yazdi | Filed under: Co-operative Societies |51 Comments

Source Courtesy: Advocate Sanjeev Kanchan Transfer of Shares in Co-operative Housing Society: Maharashtra CHS Act Can Society transfer the Share Certificate in the name of the nominee in spite of objections from legal heirs ? By Advocate Sanjeev Kanchan Posted on 10th July 2002 ( Provisions still Valid ) I would like to deal with the above query in detail, since similar problems are faced in many co-operative societies. For instance, a person has been nominated as a legal nominee by the deceased member in the records of a co-operative housing society. The said deceased husband died in Bombay in 1999, leaving behind him his wife and his two adult sons. The sons have filed their objection with the society and requested them not to transfer the share certificate in the name of their mother, although she is the nominee of the flat as per the records of the society.